New Delhi: The Indian automobile industry, along with the entire world, has marked a historic change so far in this fiscal year (FY21). Seven months down the line, the industry has witnessed a sequential recovery. Several automakers have reported double-digit growth in their wholesales compared with that in the same period last year. However, since this growth is on last year’s low base, the industry still stands far away from the normal volumes.

The passenger vehicle industry has been under severe pressure over the past two years, as the sales declined by 1% in FY19 and 18% in FY20. However, as a direct impact of an extended festive season, October was exciting in a special way for the vehicle manufacturers. Last year all the major festivals like Diwali were in October. This year Diwali is in November, indicating continuity in the sales momentum.

Industry veterans say that the Indian hinterland played a significant role and marked stronger demand than their urban counterparts due to the lower impact of the Coronavirus in the rural areas, good Kharif crop and the evenly spread monsoon. The excitement of the new launches could have also brought in good sales numbers.

According to the wholesales data released by the Society of Indian Automobile Manufacturer (SIAM) on November 11, the PV segment clocked 11,90,260 units in FY21 so far, as compared to 16,05,041 units in the same period last year, marking a decline of 25.8%.

The SIAM numbers pertain to wholesale and not retail as the auto industry in India reports only the dispatches or wholesale numbers.

Winners and losers

The once popular sedans are losing out of the customer demand and SUVs are comparatively ranking the trends. The weak buying sentiment was even reflected on the high-end of the spectrum – the luxury cars.

Meanwhile, rural and small car contributions to the total PV sales have increased to 62% of the total volume in H1 FY21 from 58.1% in H1 of the previous fiscal.

The undisputed leader of the Indian car market, Maruti Suzuki India Limited (MSIL), and the second largest carmaker Hyundai Motor India (HMI) have emerged as the biggest gainers, on account of the demand for personal mobility, preference for small cars during a sluggish economy, and reliance on trusted brands.

Maruti Suzuki’s rural sales grew by 12% in H1 FY21 while the rural contribution to the overall sales went up to 41% in the same period. Its stellar sales performance in an otherwise weak Indian automobile market is reflected in its share price also.

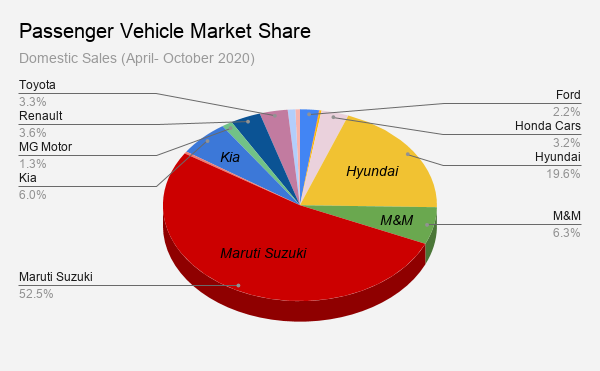

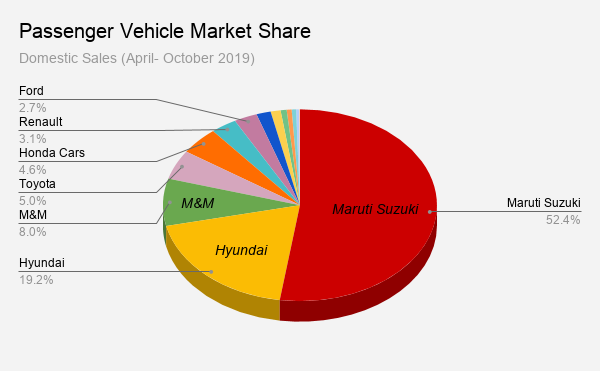

The maker of the Alto and WagonR dispatched only 5,87,345 units during this fiscal year so far (April-October 2020) as against 8,02,643 units in the same period last year. However, the automaker’s market share remained the same at 52% in both the years, thereby indicating a low buying sentiment across the segment.

Meanwhile, it also depicts that while some companies have lost market share, others must have gained to rise up the ladder. The report card of the Indian auto OEMs, being judged by the market share, is in favour of the segment leaders and the new entrants. The ones which were losing out in the Indian market are further marginalised.

The South Korean automaker Kia Motors which debuted in the Indian auto market in August 2019 with its Seltos SUV, has stormed into the list of top five carmakers in the country in terms of market share in FY21 so far, leaving behind established players like Toyota Kirloskar Motors and Honda Cars India when many carmakers are struggling to tackle the slowdown.

The SAIC-owned MG Motor, which also began operations in the Indian market during the same time as Kia in June 2019, has not garnered as much interest. However, it has managed to hop into the list of Top 10 PV makers this fiscal.

In another development, Mahindra and Mahindra (M&M) continued to be the country’s third largest auto-maker, despite a market share drop of 2% during this fiscal year as compared to FY20.

*Source: SIAM (Tata Motors shares the sales data on quarterly basis)

Except for the market leaders, most automakers have grown at the cost of the Indian vehicle makers who are not upgrading their product portfolios. Also, they were aided by the falling fortunes of brands like Skoda, Nissan, Fiat, and Volkswagen, which recorded below 1% market share and are diminishing in the Indian market with reduced sales.

Meanwhile, the French carmaker Renault India rode over the Japanese carmaker Honda Cars India with its recently-launched Triber.

Going forward, this year may witness some automakers recording the highest-ever market share, while others may be laid out.

COVID-19 journey so far

India went into lockdown on March 25 and began the fiscal year under lockdown, which resulted in a historic zero sales month of April, followed by no production, supply chain challenges and labour shortage. While the nation-wide lockdown continued for almost two months, the restrictions started to ease from May 4. Consequently, most of the automakers began to operate production plants in single shifts by the end of May. While some of them had COVID-19 cases among the workforce, others went ahead to operate in two shifts. Gradually, production came to be normal. However, the partial lockdown restrictions in certain states aggravated supply chain issues.

During August-October, sales started to get back with the gradual relaxing of the lockdown, easing of the supply chain, and return of migrant labour. Segment leaders outperformed, others claimed to reach their pre-COVID level demand and started to make aggressive production plans while dispatching in good numbers to dealers, solely riding on high expectations from the festive season. Analysts noted that the festivals like Onam and Ganesh Chaturthi in September in the southern and western markets made up for the inauspicious period of Shraadh and Adhik Maas in North India.

Going forward, the industry is hopeful of November sales. However, the resurgence of Coronavirus cases across the country is clouding the outlook for FY 21 on the whole. Industry veterans are also shying away from commenting on consumer demand in January 2021 and thereafter.