New Delhi: Union Budget 2021 was very crucial and important in many ways. It is the first budget of the decade and also very crucial as it comes after an unprecedented pandemic. It is also the milestone for crossing to and defining the new era. The expectation from Monday’s Union Budget speech was very high, especially as Finance Minister Nirmala Sitharaman had promised to deliver a “first of its kind” and historic budget.

The biggest pain point of the economy is the lack of liquidity and demand. The budget had to address these issues to give maximum liquidity at the hands of the people to boost demand. The impact of the weak demand and the shrinking market became evident after the Economic Survey said that the country will experience a current account surplus for the first time after 17 years.

The automotive industry is placed at the centre of the country’s economic activities. It suffered massive sluggishness in the past three years after the introduction of GST, the new safety norms, insurance regulations, axle and emission norms. These led to a massive increase in acquisition cost. The industry was sanguinely waiting for direct announcements to reduce acquisition cost and improve consumer sentiment by providing buyers with more liquid cash.

We at ETAuto are trying to list the hits and misses in the budget speech 2021 based on the information available so far:

Hits

1. Announcement of Voluntary Vehicle Scrappage Policy: “We are separately announcing a voluntary vehicle scrapping policy, to phase out old and unfit vehicles. This will help in encouraging fuel-efficient, environment-friendly vehicles, thereby reducing vehicular pollution and oil import bill. Vehicles would undergo fitness tests in automated fitness centres after 20 years in case of personal vehicles, and after 15 years in case of commercial vehicles. Details of the scheme will be separately shared by the Ministry:” Finance Minister Nirmala Sitharaman.

The announcement comes after a wait of over a decade. If incentivised properly, this will certainly spur demand for passenger and commercial vehicles. However, this will have efficacy only if the roadworthiness test of the vehicles are made mandatory after a definite period. However, it can be understood well only after the details are made available.

2. INR 18000 crore to Support Acquisition of over 20,000 buses: “We will work towards raising the share of public transport in urban areas through expansion of metro rail network and augmentation of city bus service. A new scheme will be launched at a cost of INR18,000 crore to support augmentation of public bus transport services. The scheme will facilitate deployment of innovative PPP models to enable private sector players to finance, acquire, operate and maintain over 20,000 buses. The scheme will boost the automobile sector, provide a fillip to economic growth, create employment opportunities for our youth and enhance ease of mobility for urban residents:” Finance Minister Nirmala Sitharaman.

This will certainly boost the demand for the ailing commercial vehicle industry and M&HCV segment. A total of 702 km of the conventional metro is operational and another 1,016 km of metro and RRTS is under construction in 27 cities. Two new

Technologies, ‘MetroLite’ and ‘MetroNeo’, will be deployed to provide metro rail systems at much less cost with the same experience, convenience and safety in Tier-2 cities and peripheral areas of Tier-1 cities. This will boost the last mile connectivity and LCV segment.

If incentivised properly, voluntary scrappage policy will certainly spur demand for passenger and commercial vehicles. However, this will have efficacy only if the roadworthiness test of the vehicles is made mandatory after a definite period.~

3. Infrastructure Allocation and 100% tax exempted for investment in Indian infrastructure projects: “I am also providing an enhanced outlay of INR118,101 lakh crore for the Ministry of Road Transport and Highways, of which INR1,08,230 crore is for the capital, the highest ever:” Finance Minister Nirmala Sitharaman.

Additionally, the highway infra work proposed includes building 8,500 km of highways by March 2022, and 3,500 km corridor in Tamil Nadu, 1,100 km in Kerala at an investment of INR 65,000 crore, and 675 km in West Bengal at a cost of INR 95,000 cr 1,300 km in Assam in the next 3 years. This will help in boosting the construction equipment sales and heavy truck and tipper industry and eventually also result in better demand from the rural and wage-earning community in the country.

4. MSME and Startups: “We have taken a number of steps to support the MSME sector. In this Budget, I have provided INR 15,700 crore to this sector, more than double of this year’s BE:” Finance Minister Nirmala Sitharaman.

5. Allocation of Rs 50,000 crore for National Research Foundation: “In my Budget Speech of July 2019, I had announced the National Research Foundation. We have now worked out the modalities and the NRF outlay will be of INR 50,000 crores, over 5 years. It will ensure that the overall 24 research ecosystem of the country is strengthened with a focus on identified national-priority thrust areas. This may help the sector in terms of encouraging R&D:” Finance Minister Nirmala Sitharaman.

Misses

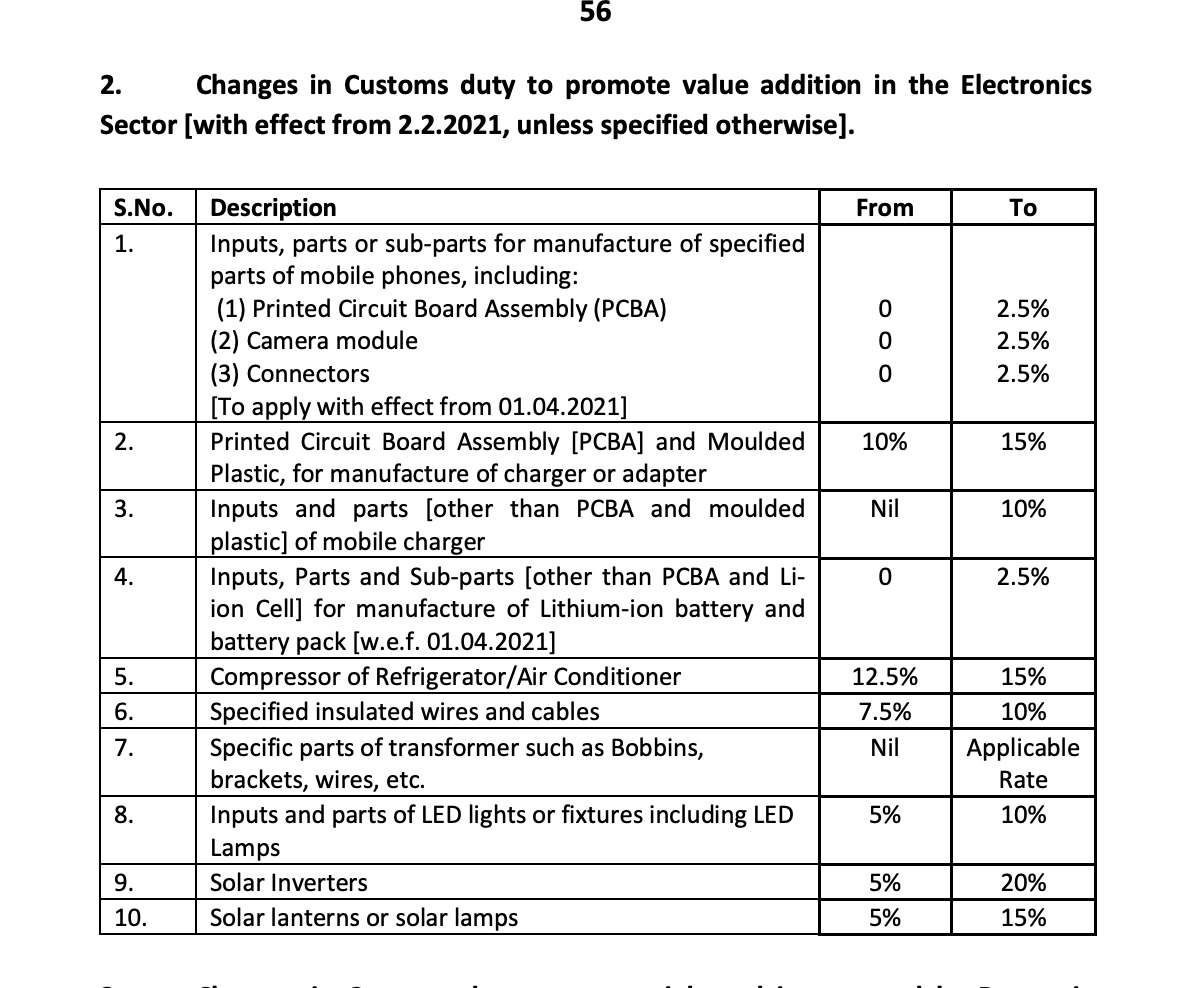

1. Custom Duty Hike on Auto Parts: “There is immense potential in manufacturing heavy capital equipment domestically. We will comprehensively review the rate structure in due course. However, we are revising duty rates on certain items immediately. We propose to withdraw exemptions on tunnel boring machines. It will attract a customs duty of 7.5%; and its parts a duty of 2.5%. We are raising customs duty on certain auto parts to 15% to bring them on par with the general rate on auto parts. We are proposing certain changes to benefit MSMEs. We are increasing duty from 10% to 15% on steel screws and plastic builder wares:” Finance Minister Nirmala Sitharaman.

However if this is done to encourage localization, revoking of anti-dumping duty on imports of the (a) Straight Length Bars and Rods of alloy-steel, originating in or exported from the People’s Republic of China doesn’t make sense.

It was disappointing to see no major direct allocation/announcement for the promotion of the EV. Various state governments have rolled out their incentive scheme for investment and incentives for buying EVs.~

2. No Rationalisation of GST on Automobiles: The sector needed an urgent boost especially for the commuter two-wheeler and entry-level cars by way of reducing GST from the highest 28%. All the automobile products are currently taxed at the levels of luxury items.

3. Surging Fuel Price: Fuel (petrol and diesel) currently attracts a total of almost 70% tax including cess, state and central GST which is playing a spoilsport for the overall economy and demand for automobile products. Contrary, the FM said “Consequent to the imposition of Agriculture Infrastructure and Development Cess (AIDC) on petrol and diesel, the Basic excise duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced on them so that overall consumer does not bear any additional burden.

Consequently, unbranded petrol and diesel will attract basic excise duty of INR1.4, and INR1.8 per litre, respectively. The SAED on unbranded petrol and diesel shall be INR11 and INR 8 per litre, respectively. Similar changes have also been made for branded petrol and diesel. Refer to part C for Agriculture Infrastructure and Development Cess rates on these items”

4. No Relief on Personal Income Tax: The finance minister did not make any major announcement to provide any relief to the salaried people. They are probably the biggest spenders in the local market hence very pertinent to provide liquidity which remains missing in the first budget after the pandemic.

5. No Direct Announcement for EVs: It was disappointing to see no major direct allocation/announcement for the promotion of the EV. Various state governments have rolled out their incentive scheme for investment and incentive for buying EVs. The sector was expecting significant investment or policies in terms of charging infrastructure. There is also no clarity on the inverted duty structure of batteries. A lithium-ion battery fitted in an EV attracts 12% GST, the same as an EV, but it would attract 18% GST when sold separately. Also the absence of any mention on FAME in the budget is a big miss for the EV sector.