New Delhi: Domestic replacement tyre prices are all set to go up across categories during March-April due to the higher prices for the commodities used for manufacturing tyres. This will be the third price increase by the companies after the lockdown.

Ceat, Apollo Tyres and Michelin have announced their intentions about an impending 3%-8% price hike. JK Tyre and others may do so soon.

The manufacturers have attributed the latest price increases to rising commodity costs. But this trend largely went unnoticed in the first two quarters when the raw material costs, which comprise over two-thirds of the total cost of producing a tyre, were hovering at the lowest levels. Tyres manufactured in India have a ratio of 40% natural rubber and 50% of synthetics (petrol derivatives). The remaining 10% consists of miscellaneous inputs like steel.

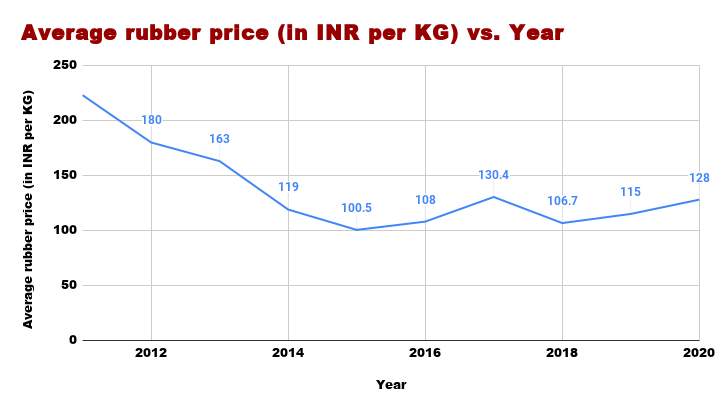

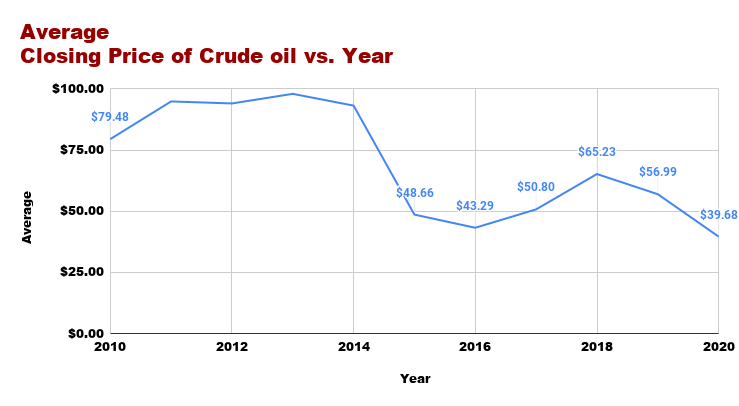

What’s important to note is that, in the past with every rise in commodity prices tyre companies increased prices. Data from the listed tyre companies that account for 75%-80% of the INR 60,000 crore automobile tyre sector show 76.5% jump in their revenue in the past one decade. This was mainly owing to the sharp drop in raw material prices. Crude oil and natural rubber prices have crashed almost 50% and 32%, respectively in the last 10 years. Despite this, the manufacturers have never made any significant reduction in tyre prices in all these years.

Dealers’ dilemma

According to ETAuto’s surveys of dealers from six cities, JK Tyre, MRF, Ceat, Goodyear and Apollo Tyres have, on an average, raised prices between 10% and 15% in the last six months from the previous year, depending on the tyre brand.

Interestingly, tyre majors jacked up prices by 5% to 8% in the first quarter of the current financial year when both the natural and the synthetic rubber prices were largely stable at lower levels. Then the tyre companies did not announce price hikes directly to the customers rather they did it through the backdoor.

Marred by the Coronavirus pandemic and the restriction on Chinese imports, tyre companies in the country were facing some serious manufacturing hurdles. Soon after their resumption of operations after the lockdown, almost every tyre company slashed all the schemes and discounts they used to provide to the retailers, the tyre dealers from Maharashtra, Haryana and Orissa said.

In June 2020, the government imposed restrictions on tyre import from China to promote domestic production. “Since July, we have been getting limited supplies from the companies. To fulfill requirements, small dealers started buying from the big ones at higher prices which ultimately spiked the cost for the customers,” one of the tyre dealers said on condition of anonymity.

For the large tyre retailers, the person cited above said, the supply waiting period has increased by at least 10 days. “We are now receiving deliveries in almost 15-20 days after placing the order against the 2-day delivery time in the pre-COVID period,” he added.

Another tyre dealer from the eastern region said that officially companies are not giving any discount, whatever discount we are providing is completely from our margin. And this is happening when the industry is witnessing lower demand largely on account of extended replacement cycles.

While the lack of demand is eroding the margins of dealers, the companies profit from this along with higher realisation and benign input costs, he said.

“With the import restrictions, the market is facing serious shortage of supplies in certain tyre categories particularly in SUVs and commercial vehicles. When any requirement for such tyres comes, we have to sell from the old stock at almost half the price,” he said.

Data from the listed tyre companies that account for 75%-80% of the INR 60,000 crore automobile tyre sector show 76.5% jump in their revenue in the past one decade. This was mainly owing to the sharp drop in raw material prices.~

Even prices of the most common categories of tyres have been rising since June last year as their domestic production cost has been higher than their imported counterparts. For instance, the current market price of 15-inch car radial tyre is INR 4,500 whereas the price of an imported tyre was only INR 3,500.

Additionally, fleet operators and transporters are also facing serious challenges in recouping their operating expenses as 30% of their operating cost is on tyres and the rest on fuel.

“Frequent price hikes are hurting the trucking industry the most as the cargo industry is a price sensitive business. Even the slightest spike in input cost shoots up transportation cost,” S P Singh, convenor, All India Tyre Dealers Federation (AITDF), said.

Domestic tyre industry derives close to 60% of its volume from the replacement market and 28% from auto companies. The balance volume comes from exports. The availability of a replacement tyre depends on multiple factors such as volume, production costs, type of vehicle, and whether the tyre will be profitable. Therefore, in some cases, there could be only one tyre manufacturer with a replacement tyre that is suitable for that vehicle.

Moreover, the greater variety of sizes has forced distributors and retailers to manage more stock which drives up their inventory holding costs. These costs are passed on to the end-user.