By Avik Chattopadhyay

By Avik ChattopadhyayThe Spark

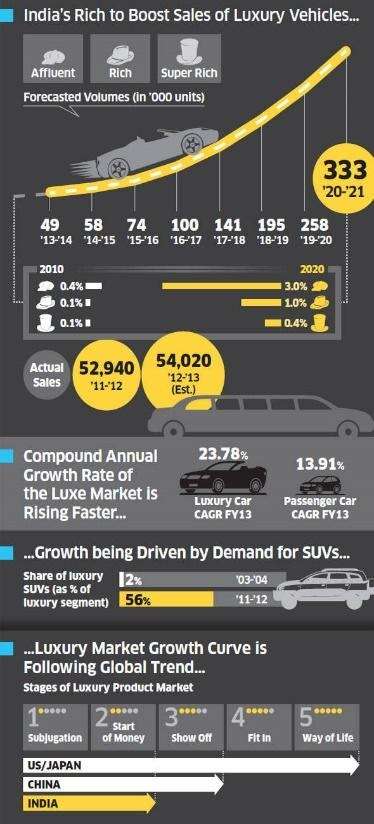

In the midst of the pandemic an ex-colleague of mine from PSA, Sophie Bastide, chatted with me on how the luxury car segment in India was doing. Being a market research specialist, she was intrigued as to why so few luxury cars were sold in India when we had so many ‘rich people’. She reminded me of our market projections way back in 2012that the market would be close to 50,000 units by 2015 given the growth trend then and Peugeot must explore the 508 sedan and RCZ coupe as part of its India entry strategy!

A few days ago, another friend of mine, Subhash Chandra, an analytics expert, shared some data about the emerging rich in India and how the pandemic has only slowed their growth but not halted it. The latest MRUC India Readership Survey report shows that under the ‘New Consumer Classification System’, category A is growing the fastest over the last two years, standing at close to 150 million people right now. This drives the India growth story!

And then I came across this interview of the CEO of a luxury car brand in India in The Economic Times stating that the market will rebound by 25% in 2021. That would take it back to the 2011 numbers, when I had worked on my projections!

A Stagnant pie

All these discussions and data points converged into the one single outcome that the luxury car market in India is grossly underperforming and not representative of the potential the market holds.

Even if we totally overlook 2020, the overall pie has remained the same over the last 5 years. The brands just keep fighting within the same pie, happy to take away numbers from one another.

I dug out an ET infographic of 2012 that predicted the luxury car market. There was direct correlation shown between the rising number of the “rich” and the rising number of luxury vehicles till 2019-20.

While the former has more or less happened, the latter has been a plateau. What could be the reason behind the same? Are the projections wrong? Does increasing affordability not have a directly proportional impact on purchase of luxury products? Or are what the brands offer not just enticing and exciting enough? Or, has the affluent class in India mentally evolved to a stage where possessing mere objects of desire no longer demonstrate status and success?

It was time to dig around a bit more before arriving at hypotheses.

Reality check

While doing desk research, I also reached out to some owners and network partners.

How many “rich”?

The Knight Frank “India Wealth Report 2021” says that while we have 113 billionaires ($) and 6884 UHNIs (Ultra High Net-worth Individuals), it is the 350,000 HNIs that are the foundation of this special pyramid. Earning roughly INR 40 lakh (INR 4 million) a year, they are only 1% of the total population and their number will double in the next 5 years. In addition, the report projects that the UHNIs will grow 63% by 2025.

The Hurun Research report of 2021 says that India has close to 250,000 millionaires ($), that is individuals who earn more than INR 7 crore (INR 70 million) a year.

So, there are enough people who can afford a vehicle costing INR40 lakh (INR 4 million) and upwards, at least one in their lifetime.

The Euromonitor February 2021 report on luxury goods in India states that those sectors or companies that have adapted to changing times and altered or modified traditional product offerings into those relevant for tomorrow will come out of the pandemic much stronger. The report mentions automotive and hospitality as the two sectors that have got hit the most and will take the longest to get back into shape.

For luxury vehicles 2020 was a terrible year. Only 21,000 new ones were driven out of the showrooms. This was a 40% drop over 2019. However, close to 60,000 used ones sell a year and it is growing at 15-20% annually, but for 2020. Mercedes-Benz itself clocks around 200 units a month through their used-vehicle programme.

And here is a snapshot of how the new car segment has done over the last 10 years.

If you were in my place in 2012 doing projections and feeding them to Sophie in Paris, going by the growth from 2009 to 2011you too might have projected 50,000 units by the next 4 years!

The owners

I reached out to three types – (1) UHNIs who can afford to possess anything they want and (2) HNI professionals who have bought their first luxury vehicle and (3) self-employed HNIs who have bought one purely to show off. I deliberately limited the scope to luxury vehicles within INR 1 crore.

The first type was quite dismissive of the typical product and service issues. For them, the reason to choose a particular brand was either by habit or a CEO of one of the luxury brands was a friend.

The second type was the most vocal as they had typically researched and chosen a particular brand for a mix of emotional and performance reasons. They were literally traumatised by the service and customer care. Some even contemplated switching over to a mainstream brand the moment the loan period was over.

The third type, like the first one, really had no emotional attachment with their vehicle as long as it was a “luxury” one. They showed scant brand loyalty and the only criterion for purchase was being the latest in the market.

The roads and traffic

Meanwhile the condition of our roads and traffic management are critical issues…but for all types of vehicles. They can affect not only the sales of luxury brands like Audi 3 but also the premium brands like Toyota Fortuner.

On the other hand, bad road conditions could be a trigger for increased sales. of luxury SUVs for better on-road comfort. But that also does not happen, maybe because there are factors beyond the road and traffic conditions that affect car sales.

If bad road conditions become a deterrent to buying an expensive vehicle, it is your challenge as a brand to make your vehicle more affordable, through leasing and buy-back options. If a customer has to pay only 40% of the sticker price of a luxury vehicle over 3-4 years of owning one and return it for another, the brand would have broken a huge mental barrier.

The diagnosis

If I am to put down all these in points, here are the key reasons for the current situation:

Product, product, product

- The performance of a luxury brand is purely based on new product launches and not on any brand affinity, loyalty, or repeat purchase.

- Most luxury brands have not communicated beyond their products; they have not worked on building any long-term brand affinity and advocacy; they believe only their badge will help them sell without good after-sales service; this has actually created a bad image for any luxury brand in general.

- Even on the product, there have been instances when brands have cut corners to keep prices down, either by bringing products that are clearly not relevant or up to the level of expected quality; the Audi A3 is a clear case of cutting corners to provide a ‘cheaper’ Audi which failed miserably primarily due to the negative word of mouth of the owners; another example is of the first generation Mercedes-Benz GLA which was just not relevant for the Indian market as the rear seat could not accommodate two ‘Indian’ sized adults comfortably.

The timeline of luxury brands coming to India; Tesla not mentioned.(source: ET)

Sell, sell, sell

- There is little brand loyalty in this segment and customers easily switch from one brand to another every 3-5 years based on ‘popularity’.

- The focus is more on finding new customers than building better relationships with the existing ones, as if they are already dismissed as a lost cause; one respondent laughed and shared that while she gets a wonderful calendar from a mainstream automaker every year, she is yet to get any recognition of her mere existence from the luxury brand she fondly acquired!

- Most loyalty programmes are also purely sales focused, to sell a new accessory, a new adventure or a new product in exchange of your existing one; one leading industrialist joked that he has not got even one message about his satisfaction with the product performance as they fear it is bound to be negative!

- There are very few initiatives undertaken beyond the number focus and they are genuinely appreciated by the respective brand owners, a case in point being the “Merc from Home” initiative.

- Most luxury brands carry neutral or negative word of mouth from owners; no real active brand advocacy; all that happens is a justification for purchase to the outside world while in their own ‘community’ they share sob stories.

- While no one denies the high taxation structure in India and the inconsistent regulations (like on alloy wheels), but that cannot be taken as an excuse not to bring about solutions to make the brand more accessible to a larger number of people.

- While manufacturing locally is an obvious answer to better affordability which some have ably adopted, the costs still remain disproportionately high as the products are not defined and designed specific to India and in larger volumes.

- The pandemic has forced some to launch leasing and buy-back offers to make up for lost numbers, thereby making them more accessible.

- The cost of ownership of a luxury brand is very high and service standards are not of the highest level, even falling below that of the mass market brands like Maruti Suzuki and Hyundai; even minor aspects like maintaining a single database across all dealerships is glossed over, almost implying there is no ‘integrated dealership management system’ outside of simple XL worksheets.

Conservative outlook towards India

- Overall, how do they evaluate and treat the Indian market – as an add-on or one that needs specific focus; it has been the chicken-and-egg situation for them all this while, with most brands waiting for the others to expand the market.

- While there have been many instances of luxury brands tailor-making vehicles for the Chinese market, there have been none for the Indian one; in fact, the Chinese portfolio is seen as the basket from where products can be picked for India.

- Investments have been made in manufacturing and assembly capacities and not so much in India-specific R&D.

- Most luxury brands have not communicated beyond their products; they have not worked on building any long-term brand affinity and advocacy; they believe only their badge will help them sell.

- Most importantly, they have not attempted at expanding the pie; they have been catering to the same profile of people to sell their products; they have not tried to think outside their little box and proactively look at the growing number of HNIs and the neo-rich.

The way forward

Three things need to be done, apart from the fundamental shift in mindset towards India not as an “also present” market but as a “must succeed” one.

Grow the pie

- This is a major shift in the basic strategy of defining who your target customer is. If we are talking about 350,000 HNIs and 250,000 millionaires, one just cannot be happy with a target of going back to 2018 numbers.

- There are many in this country who do not buy a luxury brand not because they cannot afford, but because either they do not want to ‘show off’ or have no emotional affinity with any. They would enjoy a much richer relationship with brands like Toyota, Honda and Hyundai.

- The challenge is not to have a share of the purse but of the mind.

- The new rich do not necessarily want to be seen as flashy, ostentatious and irresponsible. Therefore, the vehicle they use should be an extension of this trait. All the communication from all the luxury brands is all about hedonism and showing off which does not work at all with this new rich Indians and in fact puts them off.

- Target those who buy vehicle brands in the INR 20lakh-INR 30 lakh price band and communicate with them. They will help you expand your pie.

- Make your product offer compelling by offering only leasing and buy-back solutions; even if one wants to go in for an outright purchase, suggest it is more prudent and responsible to opt for the former solutions.

Brand, brand, brand

- To make yourself relevant to the new rich Indian, come down from your high pedestal and share the stories of your own struggles and legacy; become more “human” and less “godly”.

- I was surprised that most of the owners I spoke to did not have a clear idea of what exactly the brand they bought stands for, because they were never spoken to on those lines; it is well beyond time to do so now; during the pandemic I did see a couple of luxury brands like Mercedes-Benz and Volvo taking this line which is a positive sign.

- Each salesperson at the dealership has to be a brand-person first and a product expert after that; proper training can surely ensure that.

- Most importantly, the leadership has to be brand-led and not merely product and sales-led; the success of a high-involvement item like an automobile is very much driven by how the man or woman at the top believes and behaves.

Your existing customer is your greatest asset

- Invest in them and the dividends will be invaluable; they are currently your biggest detractors and it is your duty to convert them gradually into your biggest brand advocates

- Celebrity actors and cricketers are passé; go for everyday achievers and share their stories with their community to build greater affinity.

- Celebrate each of your existing customers on your website and social media platforms.

- Allow them to provide you direct and frank feedback through insight and feedback groups based on product, age, profession, location, interests and causes.

- There are already 315,000-odd Indians who have bought your brands at some point of time; connect with them, get to know more about them, how many have remained, how many have moved out, how many have switched brands, how many wish they had never taken this decision.

To build a bigger pie, sometime in your life you need to take the bitter pill!

The condition of our roads and traffic management are a critical issue…but for all types of vehicles.

If they affect the Audi Q3 sales, then why not the Toyota Fortuner?

Also, bad road conditions could have seen greater sales of luxury SUVs which is also not the case, as it is to do with factors more than the road and traffic conditions.

If bad road conditions become a deterrent to buy an expensive vehicle, it is your challenge as a brand to make your vehicle more affordable, through leasing and buy-back options. If a customer had to pay only 40% of the sticker price of a luxury vehicle over 3-4 years of owning one and return it for another, the brand would have broken a huge mental barrier.

(The author is co-creator of Expereal India. Also, he is former head of marketing, product planning and PR at Volkswagen India.)

(DISCLAIMER: The views expressed are solely of the author and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)