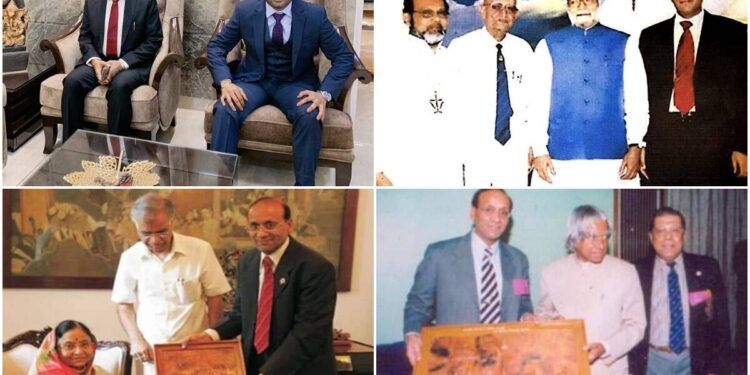

Dr. Suresh Kumar Agarwal & Chandan Agarwal

Dr. Suresh Kumar Agarwal & Chandan Agarwal

Dr. Suresh Kumar Agarwal and his Chartered Accountant son, Chandan Agarwal, share their knowledge and experience on identifying and investing in multibagger stocks. “Hunt for stocks when the growth is high, but the valuation is low” is the mantra of Agarwal Family Office, a Private Investment Group in Kolkata.

Dr. Suresh Kumar Agrawal, explains, “If the valuation is high and growth is also high, it is speculative. When growth is high and valuation is low, that’s when you get a multibagger. This will work in an equity market anywhere in the world and at any point of time.” Instead of wasting energy in figuring out the market, one should try to focus on which stocks to buy next, recommends Dr. Agarwal. However, this requires the skill to pick the right stock and the patience to hold on to it till it matures into a multibagger. To accomplish this, one needs to follow a sound investment philosophy.

“There is no one particular way of making money in the equities market. Everybody will have a different way. And that’s the fun of the market,” remarks Chandan Agarwal.

Dr. Suresh Kumar Agarwal is a multifacted personality, who is an ace investor during the day, and offers free health service to the community in the evenings. He is a Homoeopathic Doctor, besides also having completed studies in Spirituality and Buddhism, Management, Law, etc. He currently holds two Ph.D. degrees besides several Honorary Awards from around the world, and penned over 55 books on Health. He runs a Charitable Clinic in his free time, and sponsors the education of over 100 school children each year.

Chandan Agarwal, his son, is a graduate of the Cambridge University, U.K., and in the footsteps of his father, has completed three Master degrees, one each in Management, Commerce and Naturopathy and Yoga, besides being a practicing Chartered Accountant.

The Agarwal Family Office holds investments in dometic equities, international equities, private equity, real estate, and debt instruments.

Recently, at a retail investors’ conference, the father-son duo listed out the 10 commandments, which have helped them build wealth in Equities over the years.

- Don’t speculate, invest

While investors look for a change in value, speculators look for a change in price. Speculating may feel like fun, but he pointed out that no one can amass wealth by being a “100 percent speculator”. Dr. Agarwal remarked, “To seriously accumulate a lot of wealth, investing is very important.” In other words, it’s a bad idea to start your investing journey with speculation.

- It’s pointless to predict the market

There are millions of investors out there, trying to outsmart the market by trying to time the market, but it is impossible to predict how a particular stock will react for the next few years. Dr. Agrawal noted, “Don’t waste your energy in trying to figure out the market; use all the energy to figure out which stocks to buy next.”

3. Believe in the magic of compounding

Once you have the right stock, sit tight and let the power of compounding work its magic. Dr. Agarwal said, “Don’t try to time the buying and selling. The whole market is only about compounding.” To drive the point home, he explained how if an amount doubles in five years, it goes up four times in 10 years, 8 times in 15 years and 16 times in 20 years.

- Appreciate the value of stocks

Today, we all know the price of everything, but the value of nothing. For investors who want to be successful, this habit has to change. Dr. Suresh Kumar Agarwal advised, “If you dedicate yourself to understanding the value of stocks within your circle of competence, you will start winning.”

- Invest in what you understand

Before you invest, research the company to know if it has sound future prospects. “You cannot understand the future value of the company unless you understand the business today,” Chandan Agarwal commented. Taking the example of Warren Buffett’s investment process, he said investors should opt for a business they understand, with favourable long-term economics and a capable, trustworthy management.

- Gauge the capability of the management

Engage with the company’s competitors, former employees or auditors to gauge if the management running the company is competent and has integrity. “Terrific management competence and solid integrity will lead to a fantastic investment universe. And if you don’t have any one of them, you are in some kind of trap,” he cautioned.

- Quality and growth are equally important

True wealth creation can happen only in the presence of high quality and high growth. “If something doesn’t have quality, it won’t sustain,” he emphasised.

- Pay a fair price

While you may not always be able to buy a stock cheap, make sure to not overpay. “Always look for a margin of safety, which is the gap between value and price,” counsels the investment guru. He explained, “If the fair price is Rs 20, you may pay Rs 20 or Rs 25. But if you pay Rs 50 or Rs 100, you’re locking yourself into underperformance for several years.”

- Have a vision, courage and patience

Investing in the stock market makes you no less than a visionary as you are essentially buying into the future of a company. Agarwal stated, “Compounding will work only for those who have patience. With compounding for 20-30 years, even one or two stocks can make you very rich.”

- Read and research

Staying updated is key to learning about new opportunities. Giving the example of Tesla, Chandan Agarwal remarked that things have progressed over the last three decades. He said, “There are new opportunities, new businesses, new management, new ways of looking at things; you have to keep reading. I don’t think there is any alternative to that to keep making money in the stock market and equities.”

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.