By Amit Panday

New Delhi: Commercial vehicle sales, the barometer of economic activities, are expected to recover this fiscal with a year-on-year growth of around 30-50% after witnessing steep decline for two years in a row, Nitin Seth, chief operating officer, Ashok Leyland Ltd said at the ET Auto panel discussion – ‘Recap FY21 and Mission FY22’ – on Wednesday.

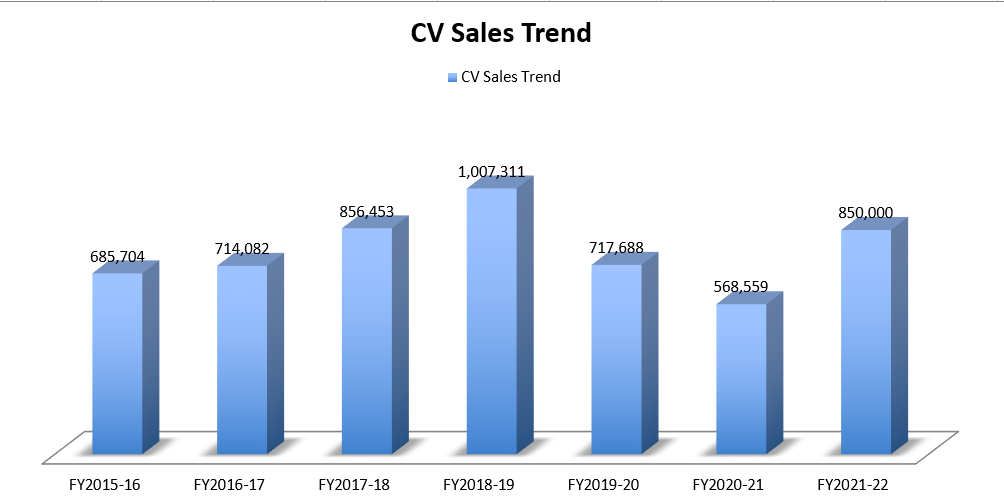

While commercial vehicle (CV) sales, which saw a peak of over one million units in FY2019, had fallen 29% in FY2020 on account of new regulatory norms and the economic slowdown, the pandemic-induced crisis in the following year resulted in volumes crashing yet again by 21% YoY to almost half a million units.

“I am of the view that commercial vehicles will see a growth in the region of 30%-50% this fiscal. We should do quite well across light, medium and heavy trucks (LCVs and MHCVs) as well as the bus segment. But we believe that the LCVs would fare best (among all CV categories) this year,” Seth said.

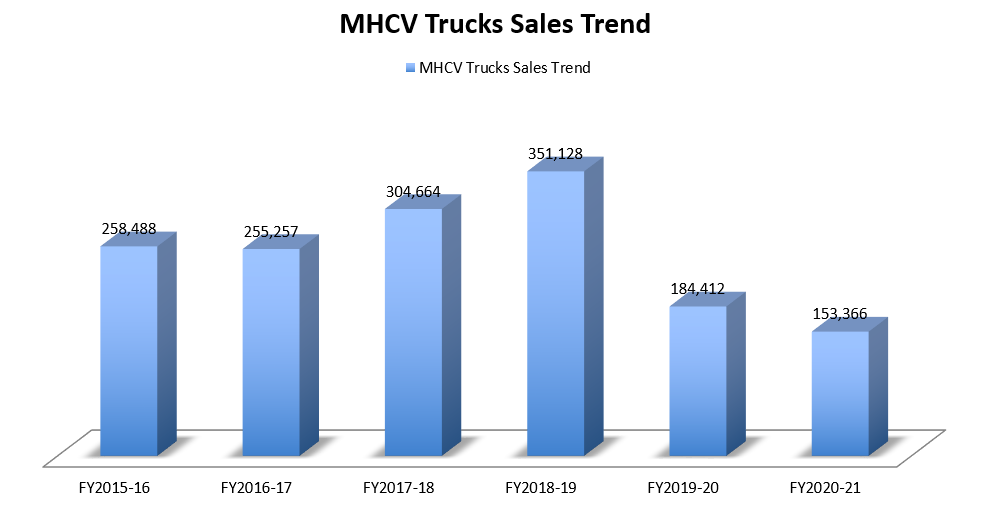

“Meanwhile, MHCVs are highly dependent on GDP growth. With a GDP growth of 11% – 11.5%, we expect the construction and manufacturing activities to pick up. This augurs well for the MHCV demand as tipper and long haul truck volumes would come back,” he added.

Seth’s expectations are aligned with Crisil’s CV forecast for FY22. The ratings agency forecasts CV sales of 7.5 lakh – 8.5 lakh units this fiscal and will depend upon economic revival on the back of government spending, replacement demand for trucks and increased consumption leading to more last mile requirements.

“Despite the 11% GDP growth, real growth would be only 2 or 3 percentage points higher than what it was in FY20. This also means that we will have almost 2 years of negligible growth. It is also important to monitor how the fiscal deficit is going to pan out in FY22 because that will have implications on the government’s ability to spend, which will directly impact the CV segment,” said Ajay Srinivasan, director, Crisil Research.

Seth, however, warned that the anticipated growth is subject to timely control of rising covid-19 cases and price hikes due to the mounting input costs.

“If rising covid-19 cases lead to FY21 like lockdowns, it might disrupt the supply chains, especially in Maharashtra. Some of the most critical parts are produced and supplied from the Pune – Nashik – Kolhapur belt. If some components don’t come on time, the production lines will stop across the plants,” he warned.

Adding further he said, “Increase in vehicle prices could become the biggest roadblock as the price of raw materials such as steel, commodities and precious metals continues to rise. We have already taken price hikes twice in the last 6 months and another is expected this month. These hikes will lead to reduced demand.”

He said that the steel companies are talking about another price increase in July.

Meanwhile, MHCVs are highly dependent on GDP growth. With a GDP growth of 11% – 11.5%, we expect the construction and manufacturing activities to pick up. This augurs well for the MHCV demand as tipper and long haul truck volumes would come backNitin Seth, Chief Operating Officer, Ashok Leyland

Green shoots of recovery seen in buses

The senior company official is also hopeful that the state road transport undertakings (STUs) will open up the bus acquisitions for public transport this fiscal. The bus segment was worst hit last fiscal as people avoided public transport and preferred personal mobility amid covid-19 scare. According to the data released by the Society of Indian Automobile Manufacturers (Siam), the bus sales in medium and heavy categories crashed 82% and 49% YoY in the domestic market and export volumes respectively.

“The bus segment was a total washout last year. I am very hopeful that the STUs, which deferred their (bus) purchases last year will come back, some of the STUs have already awarded us tenders and we are sure that they will take deliveries of their buses this year, given the current covid-19 wave does not persist,” Seth said.

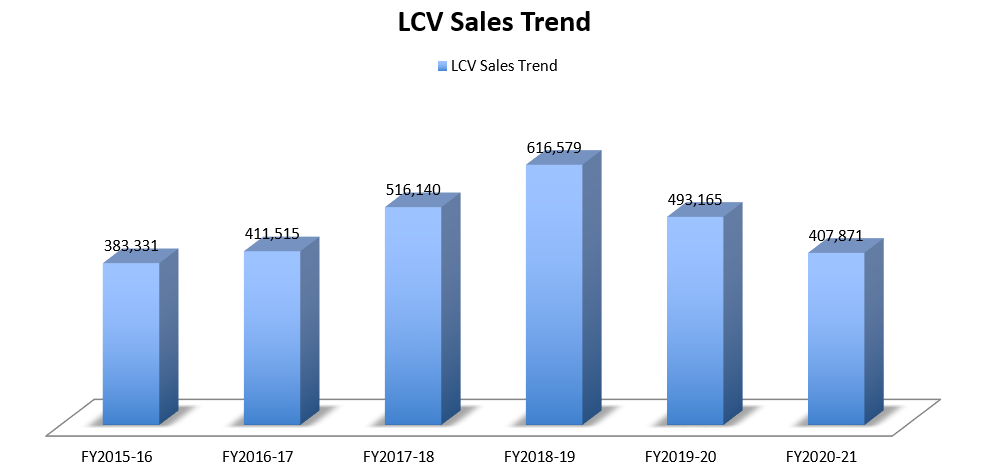

Meanwhile, as the economy recovered from the covid-19 shock last fiscal, the demand for medium and heavy trucks picked up resulting in a YoY decline of 17% to 153,366 units. The goods carriers in the LCV category were even better placed with YoY volumes dropping by nearly 12% to nearly 4 lakh units.

“The recovery in the CV segment last year was not even across categories. MHCVs recovered quite well in H2 FY21 as demand for tipper trucks picked up on increased government spending on infrastructure projects. Similarly, the intermediate commercial vehicles (ICVs) picked up due to short haul requirements and e-commerce,” he said.

LCVs fastest to recover

Seth added that the LCVs recorded the fastest recovery in the past 9 months driven by increase in consumption as the consumers stayed home along with a sharp uptick in the ecommerce activities.

“We were worried about a drop in LCV sales due to the price hike under BSVI norms. However, it saw the fastest recovery after India lifted the lockdown last year,” he said.

Seth forecasts that the LCV volumes will recover the peak volumes of around 6 lakh units sold in FY2019 in another 1-2 years time.

“The LCV sales were at 4 lakh units in FY21. It will touch its peak levels in a year or 2 as these vehicles will continue to serve the requirements of last mile delivery of goods,” he said, hoping that the rate of interest on the LCV loans remain low.

Scrappage policy to drive MHCV replacement sales

The senior executive, who is bullish about the positive implications of the recently introduced vehicle scrappage guidelines, expects that it would benefit the MHCVs but not the LCV segment.

“The LCV boom began after 2004, so there are fewer LCVs older than 15 years on the roads today. But there is a large fleet of MHCVs 15 years or more plying on the roads. The customers are expected to replace their old low tonnage trucks with the modern, higher tonnage models,” he said.