New Delhi: After recording the highest-ever sales of about 9 lakh units in the past two decades, the risk of slowing growth rate looms large over the Indian tractor industry owing to the sporadic lockdowns, supply chain constraints and chances of deteriorating farm income.

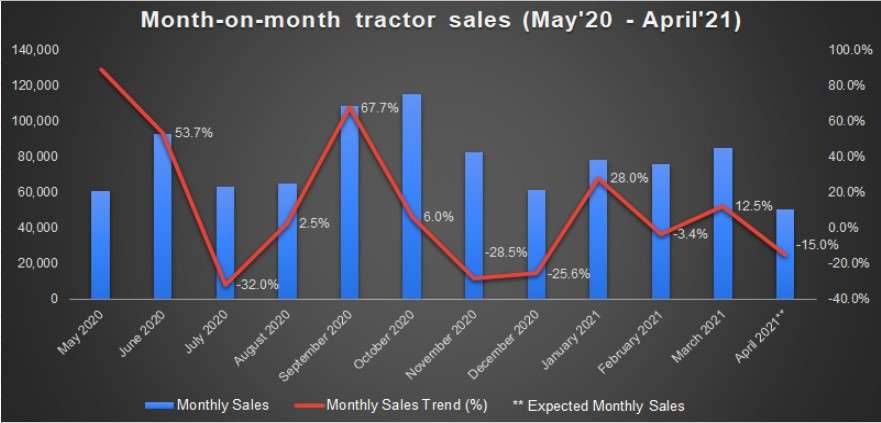

Unlike the first wave, the rate of increase in fresh cases in rural areas is substantially higher this time. Seeing the alarming increase in the number of COVID-19 infections in the hinterland, industry watchers expect tractor sales to witness double digit drop on a month-on-month (m-o-m) basis for the first time this year.

According to a recent report by brokerage firm East India Securities the tractor industry is going to report about 10%-15% decline in sales in April 2021 due to regional lockdowns and restricted movements in several states. It further stated that dealers are uncertain about the coming months as well because everything depends on the lockdown situation.

“Dealers will try to match FY21 sales numbers in FY22, but won’t be able to break the two decades high records. Last year, everything was good including crop prices, water facility, reverse migration of labour, and good monsoon. This year, a lot of uncertainty is there in everything. Although crop prices are stable, most of the dealers are not confident of their sustenance,” Amit Hiranandani, Senior Analyst of East India Securities, said.

As the Coronavirus cases keep increasing with no signs of ebbing, several states have clamped stringent restrictions, including night curfew. Even lockdown is in their efforts to curb the spread of the virus.

About 70% of the tractor sales happen in 10 states including Maharashtra, Uttar Pradesh and Madhya Pradesh, where the COVID-cases are highest. All these states have either opted for partial-to-full lockdown and night curfew or other restrictions to curb the spread of the virus.

On Friday, India’s active COVID-19 cases crossed 24 lakh mark with 3.3 lakh new infections and a record 2,263 fatalities.

From the past week there has been drastic drop in sales and footfalls in the dealerships as customers have become more cautious and selective.

With the arrival of festivals such as Gudi Padwa and Chaitra Navratri in April dealers were expecting bumper sales this month, but customer traffic quickly dwindled as it became clear that the virus is spreading rapidly.

“Concerns of infection completely dented the festive fervour this year. Hardly any sales were reported from the festive season nor any demand from the rabi harvest. There’s obvious fear that the escalating Coronavirus cases and the lockdown extension might sweep away the chances of retail offtake during Akshaya Tritiya festival as well,” one of the Swaraj Tractor dealers of Raipur region said.

Supply logjam

Besides lockdown, the industry has also been hit by supply logjam just in the middle of the harvesting season. This is a boom time for tractor sales, but the sector is scrambling to keep up production because of the disruptions all along its supply chain, including the short supply of tyres.

According to an ETAuto survey, dealers of all major farm equipment brands complained of tight inventories. Most of them are told that manufacturing is really delayed because they can’t get raw materials to finish up the machines.

“The biggest problem is getting inventory. Citing raw material crunch, companies are fulfilling only 20%-30% of our requirements. In the absence of new models, customers will scout for used tractors or postpone their purchase which is another bad news for us in these tough times,” a dealer of a top tractor company said on condition of anonymity.

Almost all dealers in Maharashtra have the stock for 15-20 days, he pointed out. “Lockdown is not the issue and even if it gets lifted, the sales crunch will continue as there isn’t enough production. In case the state government will go for a third round of restrictions, we won’t be able to sell a single unit next month,” the dealer mentioned above said. Notably, the Maharashtra government has announced new restrictions from April 22 which will continue till 7 am on May 1.

I don’t foresee any bad signs in the purchase of rabi produce in major agriculture states as of now. This coupled with a normal forecast of monsoon indicates that the domestic tractor industry may post a 7%-9% growth in 2021-22.TR Kesavan, President TMA

Farm income under risk

Moreover, the overlapping of lockdown at the time of the rabi harvest has derailed the farming preparations and there’s a looming fear that it could possibly squeeze farm income. The months of March and April in India are the time rabi crops like wheat, gram, tomatoes, mustard etc. are ready for harvest.

“The harvesting season is barely days away but the ongoing lockdown has disrupted all farm plans. On the other hand there’s also a nagging concern that once the lockdown is lifted the crash in prices would severely impact the income of millions of farmers,” an industry veteran, who did not wish to be named, said.

On an average, farmers can earn up to INR 6 lakh- INR 7 lakh profit on these crops but now it seems they may not be able to sell perishable crops to the agricultural markets on time, causing a big threat to their income due to ongoing local lockdowns, the person cited above pointed out adding this may dwindle the prospects of new vehicle buying in the coming months.

Adding to the headwinds is tractor prices which got 2-4% hike in the beggining of this month. “At a time when source of income is under stress, farmers will not be willing to pay higher prices and they will chose to defer such big-ticket purchase for few months,” the industry veteran said.

Outlook

Drawing parallels between last year and the current situations, TR Kesavan, President of Tractor & Mechanisation Association (TMA), is hopeful that procurement season will not face any major problems despite logistical hurdles including a shortage of labour.

“I don’t foresee any bad signs in the purchase of rabi produce in major agriculture states as of now. This coupled with a normal forecast of monsoon indicates that the domestic tractor industry may post a 7%-9% growth in 2021-22,” he added.

Kesavan, however, underlined that the discrepancies in the supply chain activities are the only negative that could bring the industry’s performance under stress in Q1. It is to note that tractor sales in Q1 accounts for 30%-35% of the overall annual sales.

“I’m denying the fact that the commodity crisis has become a serious problem but as other segments of the auto industry, tractor players haven’t reached the verge of plant shutdowns due to raw material shortages,” he said.