The automotive retail sales began to grow Y-o-Y from November 2020 and the passenger vehicle sales had Y-o-Y growth of 9%. This restricted the fall in passenger vehicles sales in FY21 to about 2%, compared to the previous year.

The increasing preference for personal mobility in the post-COVID period will boost the growth of automobiles and components such as bearings. Additionally, the Indian automotive bearings market is expected to benefit from the shift of production lines of the global automotive bearings manufacturers to the emerging economies.

Nachi-Fujikoshi, a prominent manufacturer of automotive bearings, has announced its plan to move its production of general-purpose bearings from Japan and Taiwan to Thailand. The move is to reduce production costs for automotive bearings. The recent introduction of production-linked incentive (PLI) schemes for automotive components by the government of India will play a crucial role in attracting global players to set up manufacturing facilities in India.

The growing demand for light-weight and durable bearings from the automotive industry is leading the prominent bearing manufacturers such as SKF India, Schaeffler India, and NRB Bearings to focus on adopting new raw materials, instead of traditional high-grade steel. For instance, SKF India is manufacturing automotive bearings with alloys that are 10%-12% lighter than traditional bearings made from high-grade steel. The vendors are increasing spending on R&D for the development of lightweight technology. In 2019, Schaeffler India spent 1.34% of revenue on R & D.

Overview of Indian automotive bearings market

All automobiles require bearings for the functioning of the moving parts. The major benefits of bearings are enhancement of vehicle performance, bearing heavy loads, and reducing friction. The major application of bearings in the automotive industry is for engines, gearboxes, transmissions, wheels, steering, motors, and pumps. Bearings are also used in wipers, rear view mirrors, and door and bonnet hinges for smooth functioning. Ball bearings, plain bearings, and thrust bearings are the most common bearings used in the automotive industry.

The demand for automobiles in India is increasing the demand for bearings. The reduction of GST rate on ball bearings and roller bearings from 28% to 18% in 2017, contributed positively to the margin expansion of bearing manufacturers. The traditional hatchback requires an average of 60 bearings for various applications, and this number goes higher for sedan and SUV. In 2019 (before COVID-19), the automotive bearing market in India was valued at about INR 7,000 crore. The automotive bearing market is concentrated with top 5 players, namely SKF India, Schaeffler India, NRB Bearings, National Engineering Industries Ltd., and Timken India, accounting about 80% of market share.

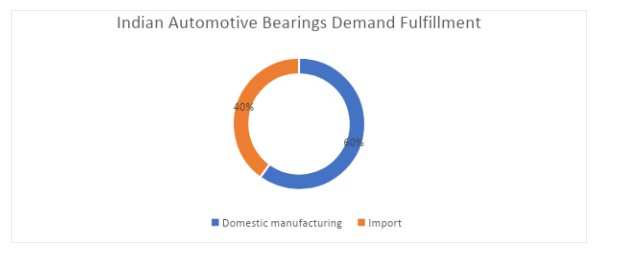

The major demand for the automotive bearings in India is met by the domestic manufacturers. The import of automotive bearings accounts for about 40% of domestic demand, which is continuously decreasing with the expansion of domestic players such as NRB Bearings and National Engineering Industries Ltd.

The domestic subsidiaries of international players such as SKF and Schaeffler are also focused on domestic manufacturing of bearings for the domestic market. In 2019, SKF India announced that it is investing INR 100 crore to INR 150 crore a year in India. In 2018, Schaeffler India announced investment of INR 1000 crore in India over the next three years.

Stringent emission standards shaping developments in automotive bearings

The implementation of Bharat Stage VI emission norms in 2020 has added more focus on the reduction of vehicle weight. This led the bearing manufacturers to focus on using new technologies to comply with the changing emission norms as bearings add significant weight to the vehicle. The prominent raw material used for manufacturing bearings are high grade steel.

The prominent bearing manufacturers are working on adopting new raw materials such as light weight steel alloys or ceramics. The adoption of light weight steel alloys, along with new technologies for forging, will allow bearing manufacturers to satisfy the demand for lightweight and durable bearings in modern vehicles.

Digitalization and inorganic growth adoption

The bearing manufacturers are adopting digital transformation as an essential part of their strategy to keep up with the increasing demand. For instance, National Engineering Industries Ltd. digitalized its supply chain and inventory management, and the company implemented predictive maintenance using data analytics. The digital transformation allowed the company to weather the COVID-19 impact and was able to implement massive cost-reduction strategies during the first half of 2020.

We will be developing more bearings for the EV sector, such as smart and high-speed bearings.Rohit Saboo, President and CEO, National Engineering Industries Ltd

The company announced that it is aiming to fully digitalize its manufacturing and non-manufacturing operations in the coming years. These developments are crucial for the growth of the automotive bearings market in India. The company is also expanding internationally to expand its product portfolio and acquire new customers. In January 2020, National Engineering Industries Ltd. acquired Slovakia-based international bearing manufacturer, Kinex Bearings.

Transition to EVs: boon or bane?

The major factor that may impact positively or negatively on the automotive bearings market in India is the gradual transition from ICE-based vehicle to electric vehicles (EVs) in the coming years. In India, the cumulative EV sales in all vehicle segments is to cross 100 million units from 0.5 million units in March 2020, according to a CEEW-CEF study. The shift towards EVs is seen as a challenge and as an opportunity for the automotive bearings market.

The challenge is that the number of bearings in EVs will be fewer than in its counterpart due to the elimination of the engine and its parts. On an average, the number of bearings will fall to about 40 per vehicle, depending on the EV configuration. However, there will be opportunity to develop high-quality bearings in terms of tolerance and heat management for high-speed electric motors in EVs. The requirement of smart and high-speed bearings in EVs will be a major margin enabler for the bearing manufacturers, who are continuously facing pricing pressure on conventional bearings used in ICE-based vehicles.

However, an interesting market dynamics is visible in the EV development. The prominent domestic bearing manufacturers such as NRB Bearings and National Engineering Industries Ltd. have the major presence in bearings used in engines, while international players such as SKF has major presence in wheel bearings and motor bearings. Globally, only 4% of SKF products go into combustion engines.

Also, Schaeffler is engaged in the development of full electric drive lines across the world. Hence, transition to EVs will be more positive for the international players such as SKF and Schaeffler. For the domestic bearing manufacturers, the next 3-4 years will be very crucial to develop and build manufacturing facilities of smart and high-speed bearings for EVs as the Indian automotive industry gradually shifts from ICE-based vehicle to EVs.

Confirming this possibility, Rohit Saboo, president and CEO, National Engineering Industries Ltd, has said that “We will be developing more bearings for the EV sector, such as smart and high-speed bearings.”

The prominent domestic manufacturers are working on producing the bearings for EVs. Over this transition towards EVs, one thing is certain that the domestic manufacturing of bearings will continue to increase, and with the Indian government’s Atmanirbhar Bharat initiative, the same can be visible in the automotive bearings market also.