According to the ‘Electric Vehicle Outlook 2020’ report by BNEF, the share of e-bus remains unchanged from last year, and the share of e-buses in the global bus fleet will be about 67% by 2040. Electric buses will not fully take over the market. Diesel and eventually hydrogen fuel cell buses will round out the rest of the fleet.

The Electric Vehicle Outlook is BloombergNEF’s annual long-term forecast of how electrification, shared mobility and autonomous driving will impact road transport from now out to 2040.

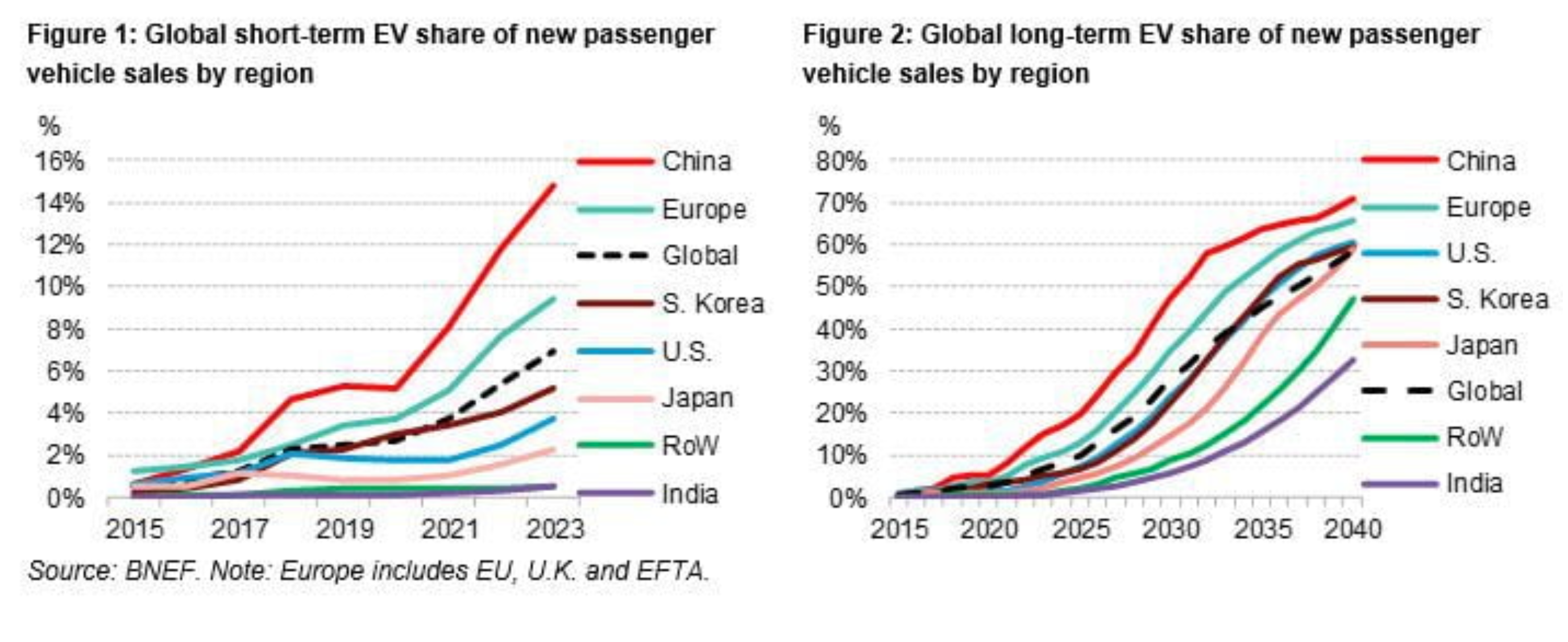

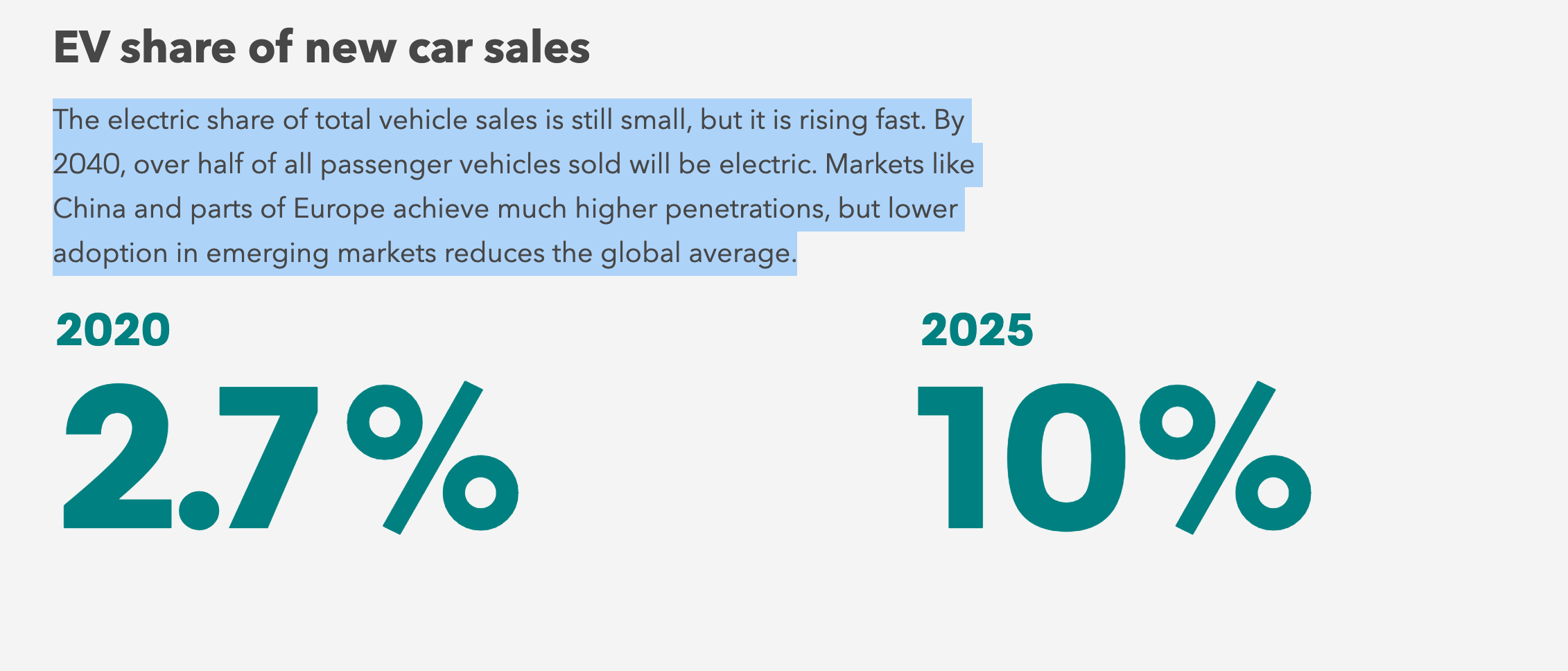

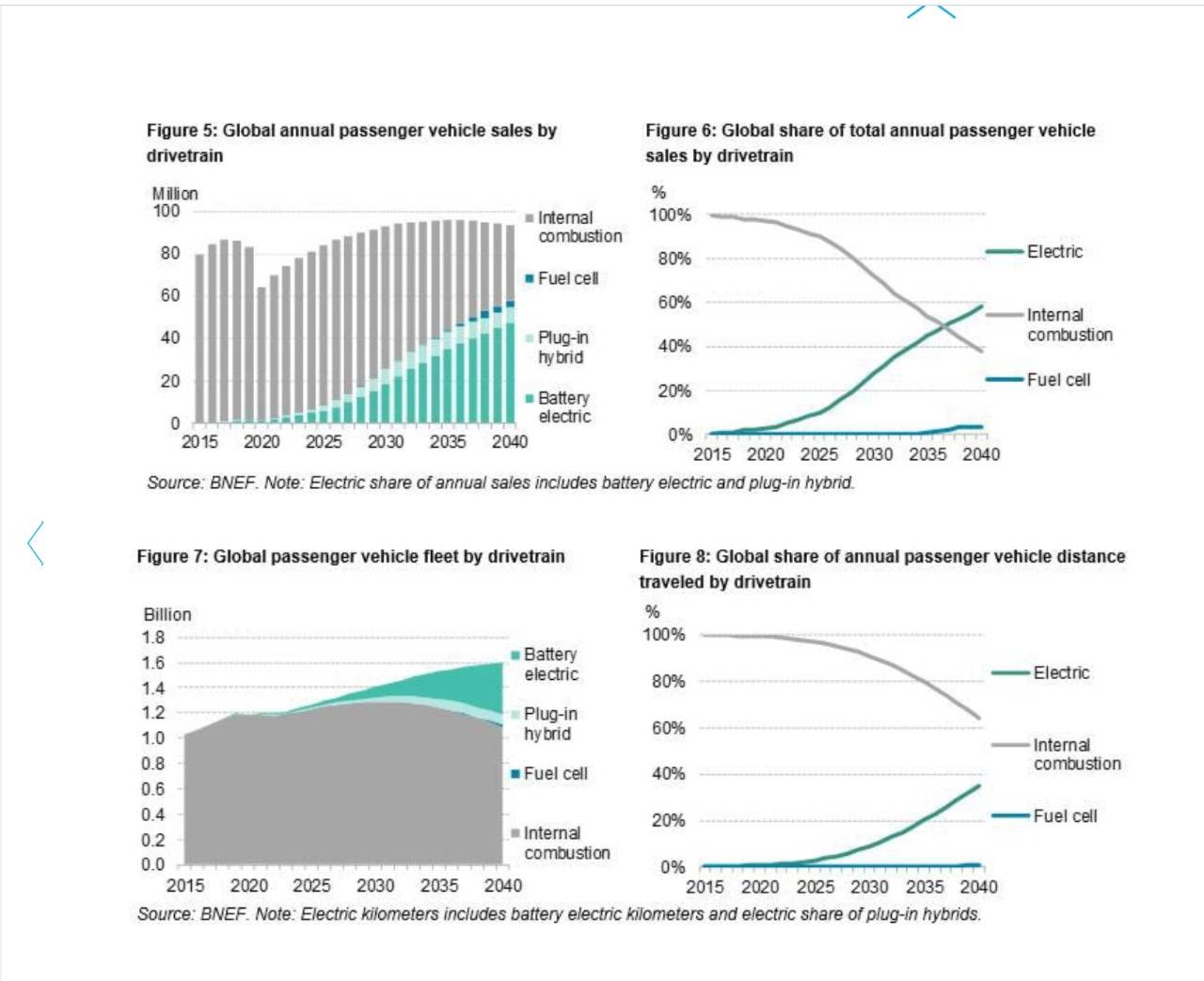

EVs’ share of global sales was relatively flat in 2020 at around 3%, but they continue rising and will hit 7% in 2023 with sales of around 5.4 million. Some automakers delay EV launches in North America, but the timelines in Europe and China remain largely unchanged. Delay in launches by leading manufacturers is seen in India also.

By 2025, EVs hit 10% of global passenger vehicle sales, rising to 28% in 2030 and 58% in 2040 the report pointed out. Price parity between EVs and internal combustion vehicles is reached by the mid-2020s in most segments, but there is a wide variation between geographies. For instance, small vehicles in India and Japan do not hit parity until after 2030 due to very low average purchase prices in these segments, the report mentioned.

Industry experts believe that price factor coupled with infrastructure limitation will not be able to give desired demand boost to EVs in India and the country will see about 8% new EV car sales by 2030.

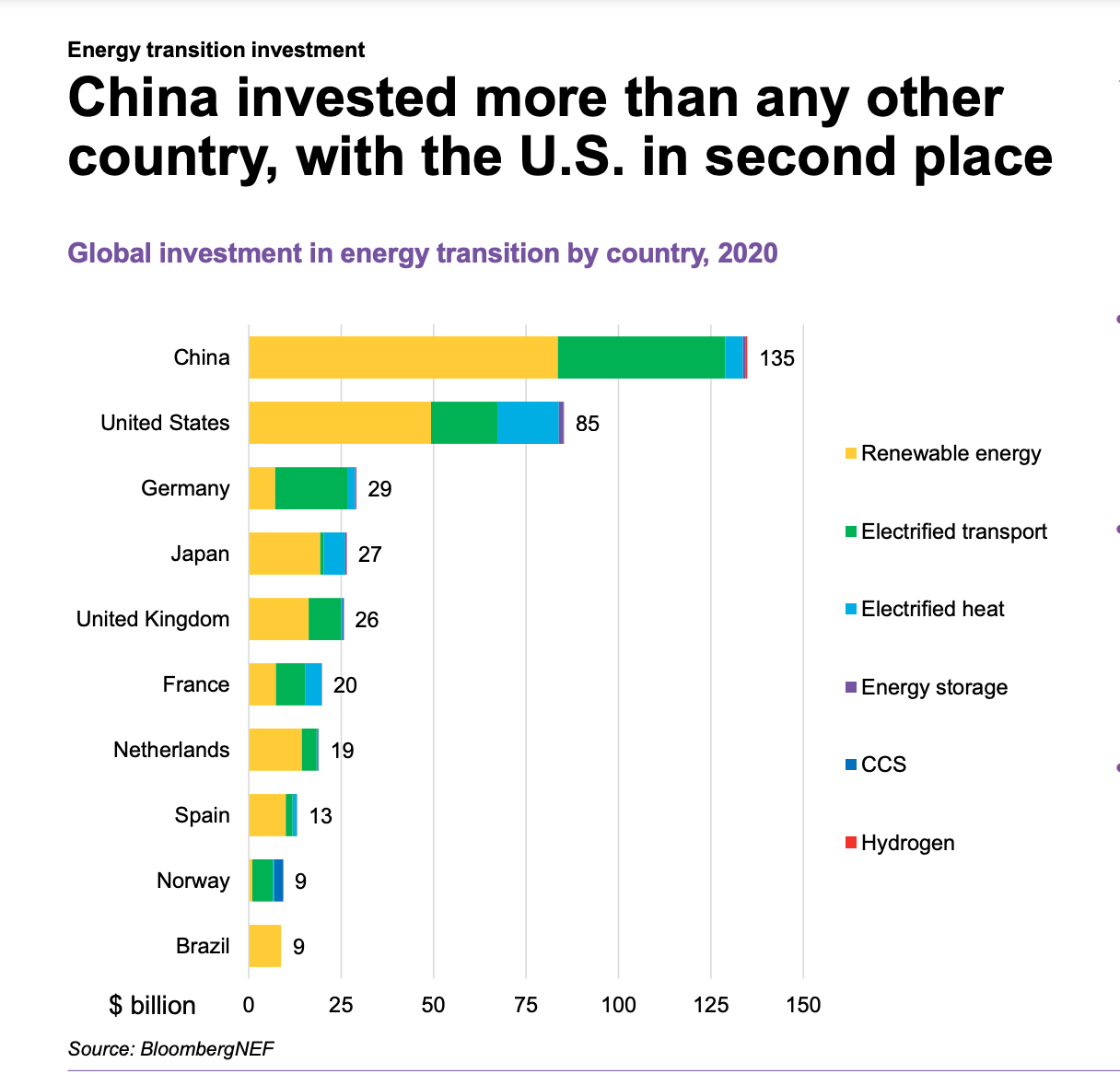

Cumulative investments, as per the report, in all types of charging hardware and installations, will reach USD500 billion globally by 2040. China will account for 50% of global cumulative investment in 2025 but by 2040 it will expand almost evenly between China, Europe, the US, and the rest of the world.

The tussle between Europe and China continues

China, the long-standing number one electric car market, was pushed to number two position by Europe with a 137% year-on-year increase in electric car sales to 1.4 million in 2020. Sales in China grew only moderately by 12% to 1.34 million.

There are now over 10 million electric vehicles on the road globally, and adoption will continue to accelerate in 2021. Driving this will be generous subsidies, tighter fuel economy/CO2 regulations, fleet purchases, and a growing number of competitive models. Around 4.4 million passenger EVs (including battery-electric and plug-in hybrids) are expected to be sold globally this year, up about 60% from 2020. After a close finish in 2020, the race between China and Europe is heating up.

Sales in Europe spiked in 2020 as automakers rushed to meet their vehicle CO2 requirements. The targets stay the same in 2021, but automakers are no longer able to exempt their worst 5% of vehicles from the calculations and have used up some of their banked credits. This means even higher EV adoption is coming across the Continent. EVs should be around 14%-18% of light-duty vehicle sales in 2021 at around 1.9 million.

EV adoption is set to rise quickly again in China this year with around 1.7 million passenger EV sales (1.8 million including commercial EVs), up from 1.2 million in 2020. There will still be an oversupply of New Energy Vehicle credits, but the fuel economy targets are getting tighter and city regulations will continue to be major drivers of adoption.

The North American EV sales should be a little over 500,000. This is far behind Europe and China, but 2021 marks a dramatic change on the policy front in the US. The Biden administration’s appointments and statements so far show strong ambitions on EVs and charging infrastructure.

Investment

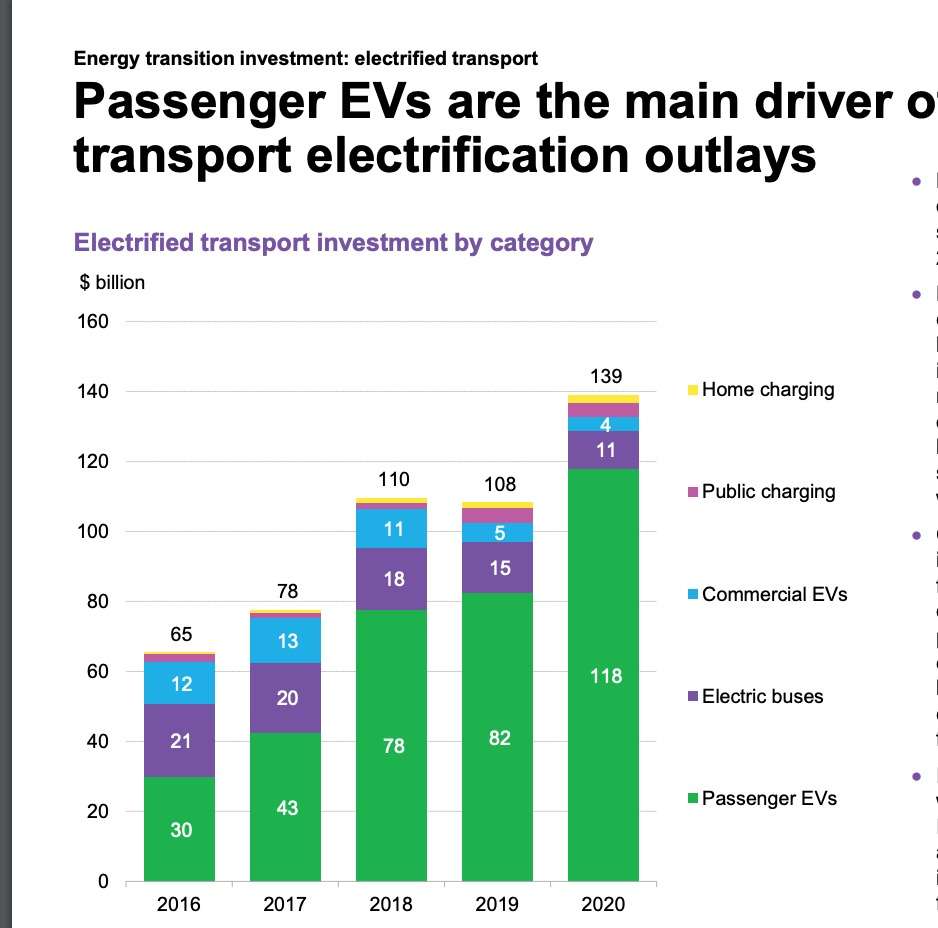

Global investment in electric transport surged 28% in 2020 year on year to USD139 billion. The world invested more than USD500 billion in 2020 in energy transition sectors such as renewable energy, electric vehicles and charging, and electric heat, according to the figures from BNEF.

The biggest deals included USD2.8 billion raised by Chinese battery maker Contemporary Amperex Technology (CATL), USD846 million by the US fuel cell company Plug Power, and USD777 million by the Chinese PV manufacturer JA Solar Technology.

Within the automotive segments, passenger EVs have emerged as the main driver of transport electrification outlays, as per the report.

“Passenger EVs were responsible for the bulk of outlays on electrified transport globally. In 2020, the size of the market increased four times compared to 2016, reaching an estimated USD118 billion,” the report said.

On the other hand, commercial EV investment declined from USD 12 billion in 2016 to USD 4 billion in 2020 due to the decline in upfront costs of the vehicles – driven by falling battery prices – and changes in predominant duty cycles of vehicles sold in the developed economies. The study points out that the market is shifting from long-haul heavy-duty commercial vehicles to cheaper medium- and light-duty commercial vehicles for regional and local deliveries of consumer goods.

Simplified pack designs introduced for battery electric vehicle platforms also help. By 2030, pack prices reach $61/kWh, but high levels of investment will be needed to keep prices falling.

New EV battery chemistries are being adopted faster than. Around 2023, lithium nickel manganese cobalt aluminum oxide (NMCA) will start to enter the EV market. This provides higher energy densities and a longer cycle life than the equivalent NMC or NCA material.

By 2024, battery pack prices will go below USD100/kWh on a volume-weighted average basis, driven in part by the introduction of new cell chemistries and manufacturing equipment and techniquesBloombergNEF

Indian Scenario

India’s journey to electrification got a new lease of life in December 2020, when the world’s leading electric car manufacturer Tesla confirmed its entry. Soon after this announcement OLA Electric Mobility Pvt Ltd, the subsidiary of the Indian ride-hailing startup Ola, also announced USD330 million investment plan on the world’s largest electric scooter plant in Hosur, Tamil Nadu, with a capacity to produce 2 million units a year. With this facility, the company aims to capture 15% of the global e-scooter market by 2022.

Another promising player in this space is Hero MotoCorp-backed Ather Energy. In February 2021, Ather shifted its USD86.5 million factory from Bengaluru (Karnataka) to Hosur (Tamil Nadu) and turned it into a smart manufacturing plant with a production capacity of 1,10,000 e-scooters and also 1,20,000 battery packs per annum.

Despite such major moves, India’s share of investment in e-mobility is extremely low due to scalability and infrastructure constraints, and it is largely confined to the two-wheeler segment.

Charging infrastructure

Charging infrastructure, which forms the backbone of the EV ecosystem, and adoption of EVs is a classic chicken and egg scenario. The moot point is do charging networks help drive EV adoption, or does greater EV adoption boost a comprehensive public charging infrastructure?

This is still arguable and no one clearly knows where the original assumption stands. However, on the monetary front charging infrastructure investment is equivalent to a small fraction of what is spent on a new vehicle. The annual investments also vary as government spending increases and drops when networks are completed.

“About 290 million charging points are needed globally by 2040 to support the growing EV fleet. Home charging is by far the largest category, but around 12 million public charging points are needed as the number of EV owners with access to home charging options saturates,” the report estimates.

Almost 1 million public charging points are already installed globally. This is rising much faster in Europe and China than elsewhere.

EVs’ share of global sales was relatively flat in 2020 at around 3%, but they continue rising and will hit 7% in 2023 with sales of around 5.4 million.BNEF

Cumulative investment in all types of charging hardware and installation reaches $500 billion globally by 2040. China accounts for 50% of global cumulative investment in 2025, but by 2040 it is split evenly between China, Europe, the U.S and the Rest of the World.

Last year, the investment in public charging hit USD4.1 billion, while home charging brought in USD2.1 billion.

According to BNEF, the ratio of EV to public charging points varies widely today but converges at around 40-50 for Europe and the US by 2040. China has a comparatively lower ratio due to its high-density housing stock and more emphasis on rapid charging.

Besides, companies globally are adopting many new battery chemistries in addition to the conventional lithium-ion to reduce the overall acquisition cost and the charging time.

The BNEF report suggests that by 2023, lithium nickel will start to enter the EV market. Lithium nickel battery provides higher energy densities and has longer cycle life than its equivalent counterparts lithium nickel manganese cobalt oxide (NMC) and lithium nickel cobalt aluminum oxide battery (NCA)

“By 2024, battery pack prices will go below USD100/kWh on a volume-weighted average basis, driven in part by the introduction of new cell chemistries and manufacturing equipment and techniques,” the BNEF report says.

Cumulative investments, as per the report, in all types of charging hardware and installations will reach USD500 billion globally by 2040. China will account for 50% of global cumulative investment in 2025 but by 2040 it will expand almost evenly between China, Europe, the US and the rest of the world.

500 EV models by 2022

Automakers are accelerating their EV launch plans, partly to comply with increasingly stringent regulations in Europe and China. COVID-19 will delay some of these, but by 2022 there will be over 500 different EV models available globally. Consumer choice and competitive pricing will be key to attracting new buyers to the market.

BNEF in one of its recent studies found that electric sedans and sport utility vehicles will be as cheap to make as combustion vehicles from 2026.

According to Julia Poliscanova, senior director for vehicles and e-mobility at Transport and Environment, EVs will be a reality for all new buyers within six years. “They will be cheaper than combustion engines for everyone, from the man with a van in Berlin to the family living in the Romanian countryside,” Poliscanova said in a statement.

A drop in the cost of batteries and the use of production lines dedicated to making electric vehicles will make them cheaper to buy, on average, even before subsidies, the study points out.