Fuel cell electric vehicles (FCEVs) run on hydrogen and are considered more efficient than conventional internal combustion engine vehicles and produce zero tailpipe emissions and only emit water vapor and air.

Fuel cells are electrochemical devices to convert chemical energy into electrical energy. They offer over 40% higher electrical efficiency than the conventional ones.

Six years down the road, the subject is yet to see any major acceleration in terms of adoption.

In 2020, the investment in hydrogen fell on a lower level of fuel-cell bus deployments. Hydrogen received nearly USD1.5 billion in investments in 2020, 20% less than the year before. Fuel-cell bus sales drove the decline, falling from USD865 million in 2019 to approximately USD400 million in 2020.

While the projection also paints a bleak picture. According to Bloomberg NEF, fuel cell vehicles (FCVs) will represent less than 1% of the global passenger vehicle fleet in 2040.

Even achieving this requires a thousand-fold scale up from the 20,000 passenger FCVs on the road today, and a dramatic reduction in the cost of producing green hydrogen.

Hydrogen’s higher energy and power density makes FCVs better suited for applications involving heavier loads and/or daily long-distance travel.

As a result FCVs can achieve higher adoption rates in heavy trucks and buses. By 2040, FCVs may account for 1.5% of the medium-duty truck sales, 3.9% of heavy-duty and 6.5% of municipal bus global annual sales. However, Hydrogen investment is expected to grow in the coming years, driven by increasing policy support.

The development of hydrogen as an automotive fuel has gained momentum worldwide. Hydrogen-fuelled cars and buses are already in use in the US, Japan, South Korea, China, and Germany. Japan has announced plans to run fuel cell buses and cars for the Tokyo 2020 Olympics to promote the use of hydrogen. These countries are making investments towards cleaner production technology and expanding the network of hydrogen refuelling infrastructure.

According to a report by Deloitte, the TCO of FCEVs is forecasted to be less than that of BEVs by 2026, and less than that of ICE vehicles around 2027. “Overall, we estimate that the TCO of FCEVs will decline by almost 50% in the next 10 years. This is driven by several factors. From an acquisition cost perspective, fuel cell systems are forecasted to decrease in cost by almost 50% in the next 10 years.”

The adoption of technology will be geographically limited, with higher adoption rates in the US (California), China, parts of Europe, Japan and South Korea. These are all regions with active plans for the deployment of hydrogen refuelling infrastructure.

India

India has been toying with the idea of hydrogen fuel for more than two decades, but not much has progressed.

A hydrogen fuel cell bus has been launched in India by Tata Motors in collaboration with the Indian Space Research Organization (ISRO) and Indian Oil (IOCL). Further, Hyundai also seeks to launch its first fuel cell SUV in India and plans to build the required infrastructure for it in and around Delhi-NCR area. It has further shown interest in introducing hydrogen-powered trucks in India if the Government demonstrates a positive stance in the promotion of hydrogen

Recently, the Ministry of Road Transport and Highways has notified amendments to the Central Motor Vehicles Rules, 2020, wherein it has issued standards for safety evaluation of the vehicles propelled by hydrogen fuel cells. The suppliers and manufacturers of such hydrogen fuel cells vehicles now have standards available to test the vehicles, which are at par with the international standards. MoRTH has also issued specifications for Hydrogen Enriched Compressed Natural Gas (H-CNG) for use of 18% mix of hydrogen for automotive purposes as per the Bureau of Indian Standards. The objective is to promote the adoption of such eco-friendly and energy-efficient hydrogen fuel-cell vehicles and H-CNG.

India has been toying with the idea of hydrogen fuel for more than two decades, but not much has progressed.BNEF

The Ministry of New and Renewable Energy has been supporting various hydrogen projects in academic institutions, research organisations and the industry for its research and development such as internal combustion engines running on hydrogen and establishment of two hydrogen refuelling stations at Indian Oil R&D centre, Faridabad, and National Institute of Solar Energy, Gurugram.

Similarly, an expression of interest has been recently issued by NTPC Vidyut Vvyapar Nigam Limited, a wholly-owned subsidiary of NTPC, to provide ten hydrogen fuel cell-based buses and cars in Leh and Delhi. It intends also to develop storage and dispensation facilities as a part of its pilot projects. Further, Indian Oil has floated a tender to purchase 15 hydrogen fuel cell-fitted buses that produce their own electricity.

Truck and buses more apt for fuel cell

EVs and fuel cell vehicles will reduce road CO2 emissions by 2.57Gt a year by 2040 and are set for much larger reductions thereafter. But the total emissions will still be 6% higher in that year than they were in 2019. More stringent fuel economy regulations for commercial trucks and other policy measures will be needed to bend the curve faster.

FCEVs and the hydrogen infrastructure to fuel them are in the early stages of implementation. The US Department of Energy leads research efforts to make hydrogen-powered vehicles an affordable, environmentally friendly, and safe transportation option

Hydrogen-fuelled cars

Currently, there are only 3 models active in the market – Hyundai Nexo (most sold in 2019), Toyota Mirai, and Honda Clarity. Hyundai Tucson is awaiting an upgrade and there will be a new Tucson and Clarity in the market next year. About 25+ models will be available, together accounting for about 1-1.5% of global passenger car (PC) sales by the end of this decade.

In order to promote the technology, Toyota and the Japanese energy company Eneos have entered into a partnership to advance hydrogen mobility. The core of the cooperation is the expansion of Toyota’s future project Woven City into a hydrogen-based model city.

In 2020, the investment in hydrogen fell on a lower level of fuel-cell bus deployments. Hydrogen received nearly USD1.5 billion in investments in 2020, 20% less than the year before. Fuel-cell bus sales drove the decline, falling from USD865 million in 2019 to approximately USD400 million in 2020.BNEF

The goal for the model Woven City at the foot of Mount Fuji is CO2 neutrality not only in everyday mobility, but in the entire life of the people and in the urban infrastructure itself, says Toyota. Residents should “live in harmony with nature and technology – smart, connected and sustainable”.

Passenger FCV sales grew slightly, from USD555 million in 2019 to USD592 million in 2020. Hydrogen refueling stations saw a small rise in investment, with USD272 million in 2020 compared to USD268 million in 2019. Electrolysis investments registered a rise from USD168 million in 2019 to USD189 million in 2020, thanks to growing global interest in green hydrogen production.

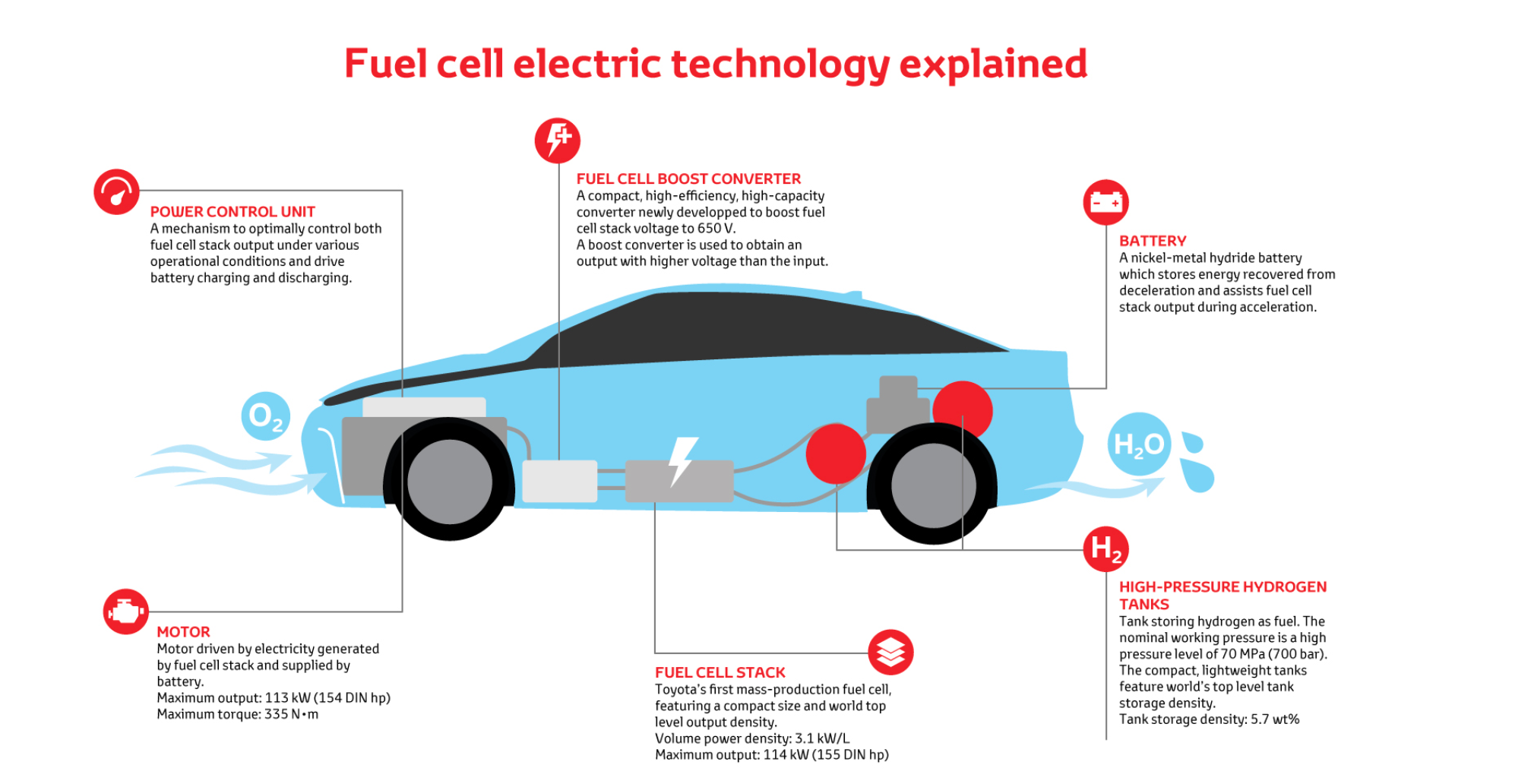

Proton exchange membrane, or PEM, is currently the only type of fuel cell found viable for usage in mobility due to its high power density and other advantages related to low weight and volume compared to other types. It operates at low temperatures of about 80 degrees Celsius, which makes it suitable for mobility applications and other uses that require an initial high demand of power, which is of high density.

Cost, infrastructure, and safety are some of the most important barriers for the growth in FCEV sales. Companies across the value chain and governments are working closely towards reducing the cost of the vehicle, hydrogen production and retail pricing, increasing the number of refueling stations and improving safety, and we can expect FCEVs to have price parity with traditional internal combustion engine (ICE) vehicles by 2030.