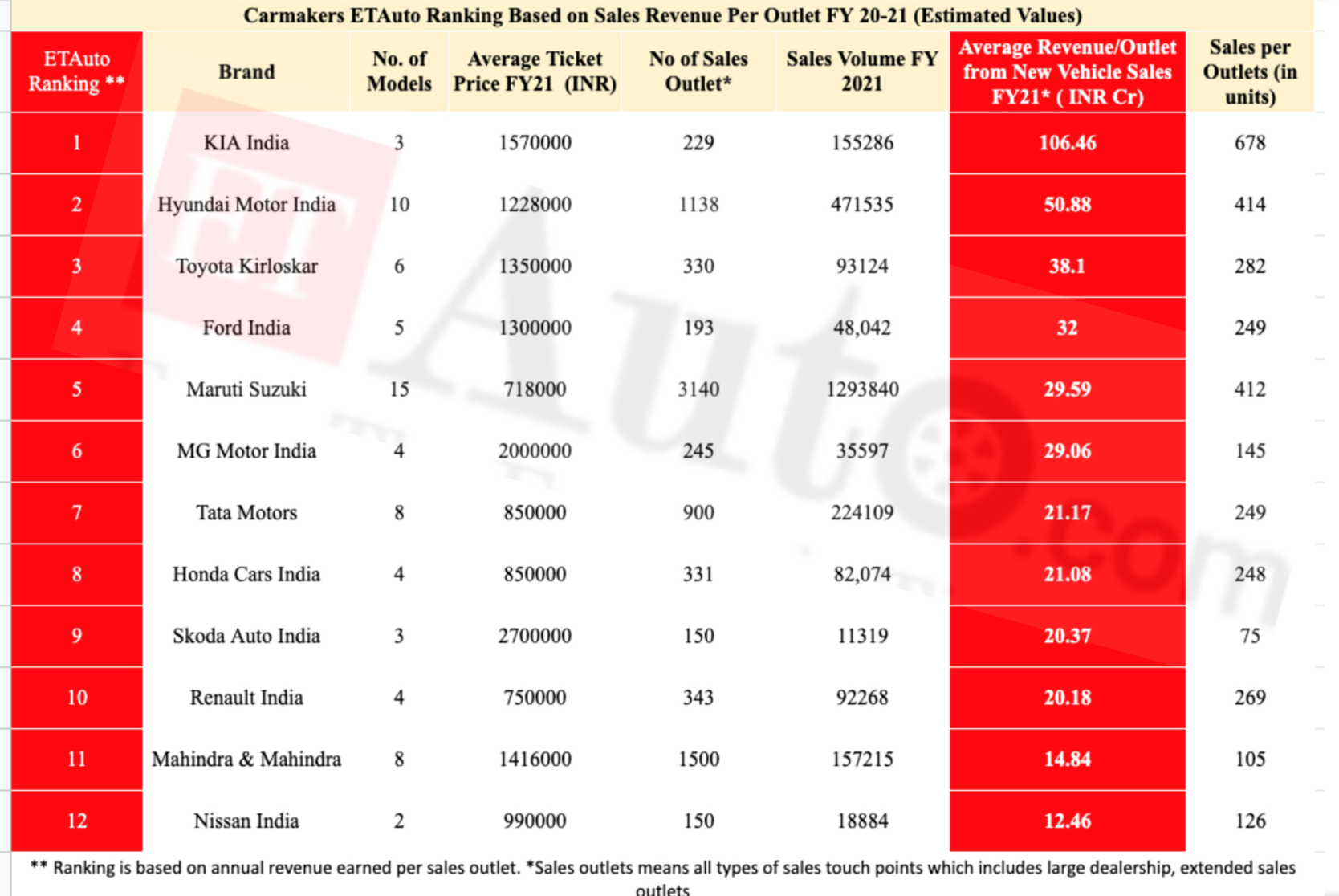

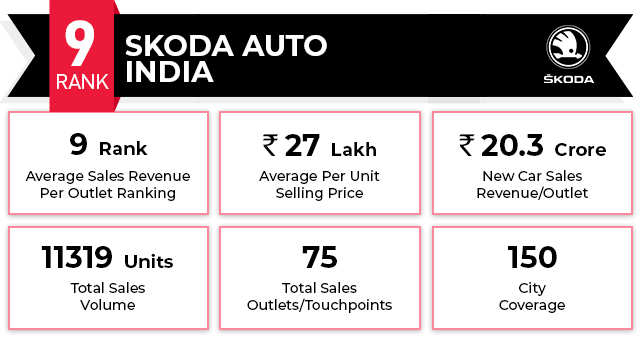

Volkswagen Group-owned carmaker Skoda Auto India, with highest per unit selling price of INR 27 lakh, looks to expand its network in the next two years. Each outlet of the carmaker sells on an average 75 units compared to the overall industry average of 275. To better the situation, it is launching the entry level SUV Kushaq and the new model of Octavia in the next one month. ETAuto during the release of this report spoke to Zac Hollis, brand director, ŠKODA AUTO India, on the retail and network plans: Edited Excerpts.

Q. What are the three focus areas for your dealer partners in a post-COVID world?

The priority at the moment is the health and welfare of our teams. During these uncertain times, this is not only about physical welfare but also emotional stability. We all know the best way to stop the spread of this disease and to remain healthy is to follow the government guidelines on washing hands, wearing masks and social distancing. These we have been emphasising to our dealer teams. We have also arranged virtual meetings with our company doctors to support this further and also to answer questions regarding vaccines and other health concerns.

On the emotional side it is important to use the time while at home fruitfully and to work on personal development. This we have been ensuring with activities ranging from on line events, quizzes to virtual training sessions.

Post COVID, of course we see a very bright future for the Skoda brand and for our network partners. We will immediately focus on making sure our dealer partners have the resources in place for a three-fold expansion in business, and the sales teams are well trained to meet the needs of the Kushaq customers. We will also continue with the branch expansion plan to be closer to our customers and maximise the sales potential of the great new products that are coming.

Q. Is the smaller setup becoming the norm going forward; what percentage of sales outlets will be large, small, sub-outlets and mobile outlets?

Expanding our reach pan India has been an important pillar of our India 2.0 Expansion plan. We will increase the number of outlets from 65 to 200 over the next 2 years. As we speak, we are at 105. Our recently-launched branch concept enables us to have a cost effective format for the smaller cities in India while still maintaining the brand standards and customer experience.

Q. What is the total number of dealership outlets you have right now — in terms of 3S, only sales, only service- please provide the breakup. What were their numbers in FY20?

At the end of 2020 we reached the milestone of 100 sales outlets and 60 service outlets. The plan for the end of this year is to expand to 150 sales outlets. With our Compact Service proposal we will reach 125 service centres. Getting closer to our customers is a core part of our preparation for India 2.0

It is found in general that the older carmakers having deeper penetration in smaller towns and rural areas will have less investment and operating cost per outlet than the new car brands having most of its outlets in big cities.

Note: All the data is an estimation based on the information received from various sources and extrapolated by ETAuto research.

Sales Outlet: Sales Outlet means all kinds of physical outlets/dealerships/touchpoints from where cars were sold.

Average Sales Revenue: This is based on the ballpark average selling price per unit multiplied by total units sold in a year divided by the number of outlets.

Average Selling Price Per Unit : This is an estimated price derived from the price range and the calculation done by ETAuto. It may differ slightly from the exact price.

Corrigendum: Due to a typographical error Ford’s per sales outlet revenue was computed as INR 3 crore instead of INR 32 crore thus impacted the accuracy of the Ranking. The same has been amended. We deeply regret the inconvenience.

More on Skoda

Also Read