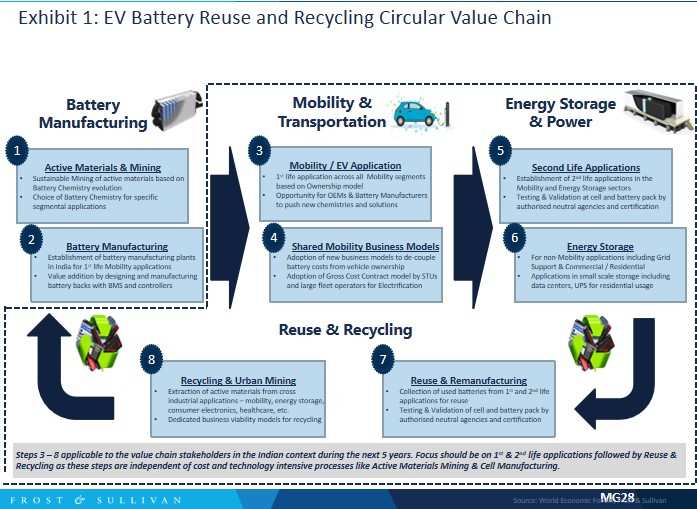

In pursuit of more sustainable business models, the battery and vehicle manufacturers have been pushing forward EV battery recycling and reuse. This is being reinforced by progressive government regulations, such as the recent updates to battery reuse and recycling regulations in Europe.

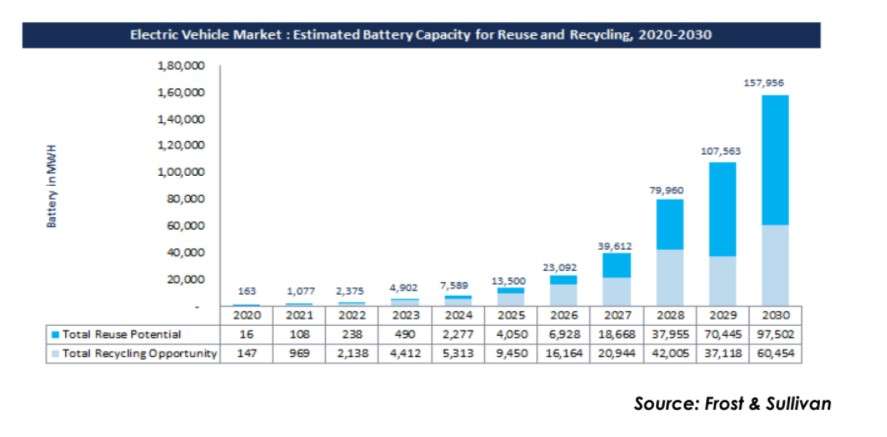

Trends reveal that recycling will be favoured over the next 2-3 years. However, in the long-term, second life use applications will gain momentum due to technological advances, regulatory clarity, and proven business models.

Simultaneously, EV and battery manufacturers are exploring the potential of second life battery pack applications. Most of them are developing battery packs that offer 80% usability of total capacity at the end of their first life.

The EV battery reuse and recycle market is not yet economically viable. However, based on the trend of rising EV sales volumes, the global market is anticipated to become self-sustaining by 2030-35 with the establishment of a circular value chain. By 2030, the market size for reuse and recycling is likely to reach 157 MWH (assuming that the first life of the battery is 10 years and second life is five years until it reaches end-of-life).

Among the potential applications that EV manufacturers and energy storage companies have identified for battery second life include vehicle propulsion, electricity trading, EV charging, grid stability, and renewable energy storage. Not only is implementation relatively easy in these areas, but there is also the prospect of higher returns on investment.

The new trends

Future recycling trends are likely to impact the battery reuse and recycling market landscape over the short, medium and long-term. These trends, for instance, are set to have a positive impact in the next 6-10 years (medium term) and 10-plus years (long term). The trend drivers will be defined by advanced testing techniques to recover alternative cathode materials, monetary incentives to reclaim materials, and highly productive systems that promote reagent use.

The market is currently dominated by expensive and highly combustible materials like lithium and cobalt. Continued dependence on these materials will have a deleterious impact on long-term market prospects. Accordingly, initiatives aimed at developing new, cost-competitive materials with enhanced safety profiles are picking up momentum.

Global best practices of particular importance to India include: investments by battery manufacturers in recycling, the establishment of a nodal agency to monitor usage, push by OEMs to create end-user awareness, and certification requirements for logistics players.~

In the quest for low-cost and high-performance battery chemistries, solid state batteries have been gaining attention. Solid state lithium-ion batteries replace the ‘wet’ liquid electrolyte found in traditional batteries with a ‘dry’ conductive solid material and are being touted for their superior safety and performance attributes.

If the three above mentioned technology trends will shape the battery reuse and recycle market in the coming years, so will the competitive strategies. On the one hand, such strategies will take the form of entering into strategic partnerships with recycling companies and establishing dedicated small-scale recycling plants with specialised procedures. On a larger scale, they will assume the form of forging global alliances to ensure energy security, much like the Japanese-Bolivian alliance, where the former offers comprehensive economic aid in lieu of being supplied with lithium and rare-earth metals.

Regulatory environment

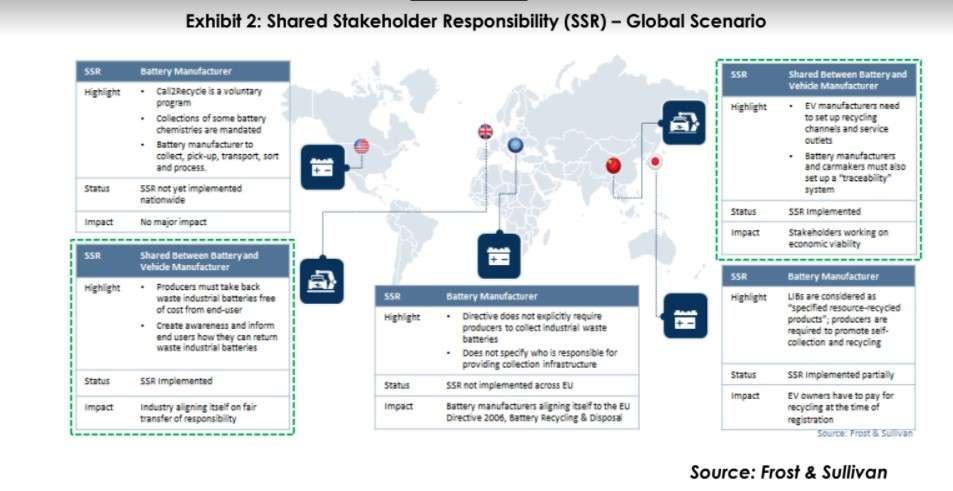

Currently, there are no uniform regulations governing lithium-based EV battery reuse and recycling. China, Europe and Japan have clear regulatory frameworks for lithium battery recycling. In contrast, regulations for recycling are still under development in India, with the proposed policy providing incentives to set up recycling facilities and also making it mandatory for producers to collect used batteries.

Battery collection targets also vary globally. Here again, Europe, China, and Japan have taken the lead with robust battery collection systems for battery recycling. While India has Battery Waste Management Rules, the decision on collection targets proposed for lithium ion and EV batteries is still pending. For lead acid, the collection target set from 2001 onwards in India covers 50% of the new batteries sold during the first year of the implementation of the rules, 60% in the second year and 90% from the third year.

Developments in the Indian market

The Indian market needs to focus on a range of initiatives that will provide additional support and build a robust framework for ecosystem development. Among these include the establishment of a government-appointed neutral/third party agency to facilitate recycling. The task of such an agency will be to monitor the movement of battery packs across the value chain and align with the Ministry of Environment and Forests (MoEF) and/or Central Pollution Control Board (CPCB), while working closely with the state PCBs. The agency will also be responsible for sharing quarterly and annual reports on the status of battery packs with all the stakeholders.

Backed by government subsidies and incentives in the initial stages, the second area of focus will need to encourage higher investments in second life applications. Collaboration between OEMs and battery manufacturers will help expedite second life applications in energy storage and grid support even as cross-industry collaboration –across healthcare, energy, and logistics sectors, among others – will boost the economic viability of second life applications.

Among the potential applications that EV manufacturers and energy storage companies have identified for battery second life include vehicle propulsion, electricity trading, EV charging, grid stability, and renewable energy storage.~

The implementation of global best practices in Extended Producer Responsibility (EPR) will also be crucial. Global best practices of particular importance to India include: investments by battery manufacturers in recycling, the establishment of a nodal agency to monitor usage, push by OEMs to create end-user awareness, and certification requirements for logistics players.

Government guidance and support on business viability will be key to the evolution of the Indian EV battery reuse and recycling market. Within this ambit, the government will need to draw up policies that cover the entire battery recycling value chain; offer strong support in the form of subsidies, incentives, allocation of resources, and speedy resolution of bureaucratic formalities; and promote safe and proper practices by assimilating the informal sector into recycling channels.

Looking to the future

According to Frost & Sullivan’s recent research into the ‘Evolution of Electric Vehicle Battery Reuse and Recycling’, globally, an estimated total of 60,000 MWHof battery capacity will be available for recycling and 97,000 MWH for reuse by the end of 2030.

While this bodes well for the battery recycling and reuse market, other factors will also need to be considered if the market is to realise its full potential. To begin with, clear guidelines and standards will be crucial. Here, due emphasis will need to be placed on Design for Environment (DfE) to mitigate environmental impacts and on systematic processes to promote seamless battery reuse, refurbishing, and recycling.

Secondly, government support for recycling companies will be crucial in the initial stages till scale is achieved and business models can become self-sustaining. Simultaneously, participants should explore cross-sectoral collaboration to strengthen nascent business models focused on lithium ion battery reuse and recycling.

Thirdly, battery manufacturers stand to make gains from having a recycling unit or a preferred partner for recycling. Defining clear roles and responsibilities for battery manufacturers, recyclers, government authorities and EV manufacturers within a Shared Stakeholder Responsibility (SSR) framework will create new monetisation opportunities, while accelerating economic and environmental gains.

Fourthly, incorporating tenets of traceability and collaboration across the value chain will strengthen battery retrieval processes. Here, encouraging customer awareness in terms of returning battery packs to authorised centers or boosting policy compliance linked to reuse and recycling will be essential. As an extension of this, integrating the informal sector into the stakeholder ecosystem through monetary incentives and subsidies, awareness and training will also be highly beneficial.

And finally, devising a supportive ecosystem anchored in authorised/certified channel partners to test and validate batteries for second life use will fast-track market development.

In essence then, building a collaborative EV battery reuse and recycling ecosystem will set the foundation for a smart, safe and sustainable future.

(Disclaimer: The author is Industry Manager – Mobility Practice, Frost & Sullivan. Views expressed are personal)