By Dev Ashish Aneja & Abhishek Bansal

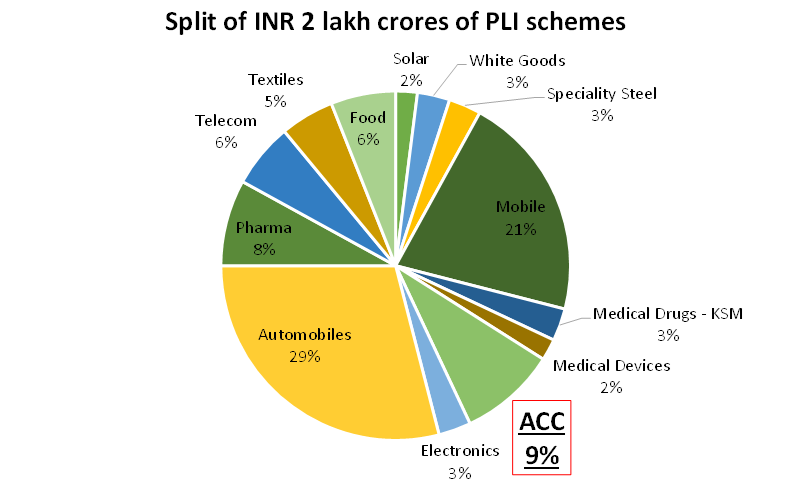

Production Linked Incentive (PLI) scheme of the Union government covers 13 sectors, including Advanced Cell Chemistries with a focus on e-mobility. The scheme, with the cumulative incentives worth INR 2 lakh crore, is aimed at enhancing India’s manufacturing capabilities and export competitiveness manyfold.

The PLI scheme for advanced cell chemistries has the potential to make India the fourth largest production hub for lithium-ion cells mainly for the e-mobility ecosystem including electric vehicles (EVs).

Three-pronged approach

The Union government is following a three-pronged approach to enhance localization within the e-mobility ecosystem.

Demand side incentives: FAME II with an outlay of INR 10,000 crore aims to take care of the demand creation and charging infrastructure. There have been recent amendments in this scheme which make it even more robust and lucrative. Local content above a certain threshold (minimum 50% for 2W) is needed to avail these incentives.

Fiscal incentives: The phased increase in basic customs duty on parts of EVs: This is a subset of the phased manufacturing programme. The goal of this approach is to promote domestic manufacturing of electric vehicles by increasing basic customs duty on imported components by up-to 15%.

Supply side incentives: About 11 states have already announced their dedicated EV policies and most of these are focusing on supply side incentives for manufacturers. Over and above this, we have the Production Linked Incentive scheme (PLI) for Advanced Cell Chemistries (ACC). Storage has always been the bottleneck and with this policy, we should soon be able to have futuristic and cost-efficient batteries available to support applications of mobility and stationary storage.

PLI-ACC scheme

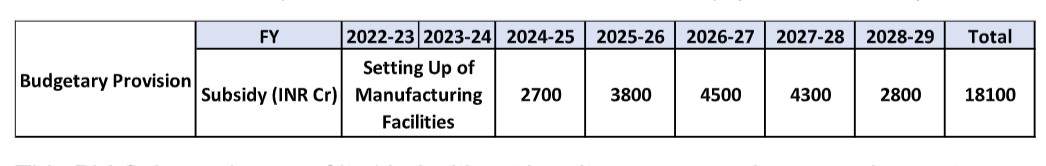

On May 12, 2021, the Union Cabinet approved the implementation of the PLI Scheme for Advanced Cell Chemistries. Estimated financial outlay for this scheme is INR 18,100 crores. The department of heavy industries officially notified the policy on June 9, 2021 with information around the scheme parameters and allocation of incentives. Detailed RFP document with the scheme guidelines is yet to be officially released.

Table below presents the year-wise break up of financial outlay (INR 18,100 crore).

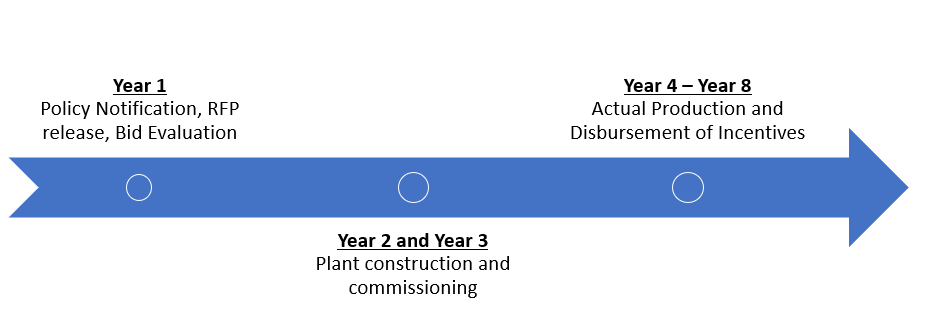

This PLI Scheme is one of its kind with a tripartite agreement between the center, state, and the bidder. This is an 8-year technology agnostic programme with the first year being the tendering year followed by 2 years of plant construction and commissioning and subsequent 5 years of actual production and incentive disbursement.

The scheme envisages setting up of 5-20 GwH capacities by the respective beneficiary companies with a cumulative capacity of 50 GwH. Additionally, this scheme does have a provision for incentivizing niche technologies of up to 5GwH. These would be a few select newage futuristic technologies which are not yet ready for giga scale, but have the potential to turn into giga scale in the next 5-10 years.

Global Li-ion manufacturing

Until 2018, global cell capacity was 175 GwH. As of 2020, this grew to 3X (525 GwH). Most of the global capacity of 500+ GwH is present across four countries: China, USA, South Korea, and Poland.

Global li-ion production is expected to be 1500 GwH by 2024-25, a CAGR of over 25%. China and Europe will be the largest contributors to these capacity increases followed by the US. Over 500 GwH of new capacities have already been announced in Europe.

India has the potential to become the fourth largest production hub for lithium-ion cells with the recently approved production linked incentive scheme for advanced cell chemistries.

Indian Scenario

On a conservative basis, the annual battery demand is forecasted to be 70-80GWh by 2028, of which two third will be for electric mobility applications and the balance will be for stationary applications. This demand is going to increase exponentially in the coming years owing to the increase in population, industrialization, and urbanization in the country. A lot of industries use these batteries as a backup source for their power requirement. The International Energy Agency’s (IEA) India Energy Outlook 2021 projects that India could have up to 200 GW of battery storage capacity by 2040.

Nitin Gadkari, Minister of Micro, Small and Medium Enterprises of India has urged MSMEs to avail concessional finance and install solar rooftops. This will not just help companies optimize on their annual spend but also drive the market for battery cells.

In the last 10 years, the cell cost has dropped from USD1,100/kWh in 2010 to USD137/kWh in 2020. Bloomberg NEF (BNEF) further projects that these costs will decline a further 55% to US$58/kWh by 2030. Large cell manufacturing countries of 2030 such as India will stand to gain from these falling prices owing to extensive R&D, economies of scale, government push and incentives.

PLI-ACC Scheme, the evaluation parameters

Eligible bidders need to have a minimum net worth of INR 225 crore per GwH. Bidders will be evaluated on three parameters:

1. Scale of operations(5-20 GwH, the higher the better)

2. Local value addition (minimum 25% over the initial 2 years, at the mother unit level and minimum 60% over 5 years) – bidders who propose a higher local value addition in the earlier years stand to gain

3. Subsidy sought per Kwh(lower the better, can go up- to 20% of cell price, net of GST)

Beneficiary firms will eventually receive incentives based on their cell performance on the parameters of energy density and cycle life. Policy incentivizes energy densities from 50 wh/kg all the way upto 350 wh/kg and cycle life from 1000 to 10,000+. Lower energy densities need to be compensated by a higher cycle life and vice versa to avail the incentives.

The conclusion

The policy is extremely flexible by design. For example, mobility applications naturally require a much higher energy density to have a higher driving range; however, these electric vehicles are okay to have cells with a lower cycle life (say 1500 cycles) viz a viz. a stationary storage project whose life cycle is 20-25 years and higher cycle life becomes vital. These stationary storage projects are okay to have a lower energy density. In lieu of this, the PLI ACC scheme is technology agnostic, allowing for all possible chemistries to avail the incentives provided they meet the cell performance parameters.

Localisation targets of 60% are possible. A basic cell assembly and finishing can result in 30% local value addition. Over and above this, there are a handful of Indian companies working on manufacturing anode in the country which can further add another 15% of value. The need of the hour is to eventually localize the cathode which makes up to 35% of cell value and this is where the cell chemistry resides.

There is already a lot of traction from cell players internationally who are willing to enter India with their ecosystem partners including cathode players. Also, some of the chemistries we are facilitating are nickel and cobalt-free and are rather extremely rich in elements which are abundant in India.

Considering all these, we believe that the PLI incentive would easily lower the cost of cell to a sub $100 mark for a 5GwH facility in the near term. All this should make India one of the global leaders in this market. Also, given that this PLI is backed by sovereign guarantee, this makes it much more robust.

We firmly believe that the ACC scheme will play a vital role in the fields of telecommunication, consumer electronics and electric vehicles (EVs) in the coming years. This scheme will give the much-needed impetus to several industries and promote cleaner energy in the country. It would also lead to huge savings in foreign exchange s as a result of reduction in oil imports and thus making the INR stronger.

(Disclaimer: Dev Ashish Aneja, AVP and Sector Lead, and Abhishek Bansal, Investment Specialist, are part of Automobile and Electric Mobility Sector of Invest India, the National Investment Promotion and Facilitation Agency of Government of India. Views mentioned are personal.)