Tata Motors is building a range of affordable electric cars as it remains committed to its electrification strategy, and the results are clearly showing. It has embarked upon this journey with a sort of vengeance not only to catch up but to go ahead of its rivals.

The company has also established itself as the frontrunner in the EV space, a journey it started 3 years ago, with the R&D support from Jaguar Land Rover. The EV version of its Nexon has helped it to fast- track penetration in the personal EV space, something which the competition has not been able to do successfully.

On the other hand companies like Mahindra have tried and failed in the EV personal segment category. Others like Maruti Suzuki still need to launch an EV, and Hyundai with its Kona, and MG Motor with its electric ZS are priced above INR 20 lakh, something the discerning Indian customers consider as too high,

The Nexon EV has leapfrogged to one of India’s top electric vehicle models with its accessible pricing (keeping the premium within 20% of an equivalent ICE car), higher range to overcome range-anxiety and providing the ease of home chargingShailesh Chandra, President, Passenger vehicles business, Tata Motors

What has worked for Tata Motors

Tata Motors has entered the market with Tigor EV as a fleet offering and expanded to personal segment with Nexon EV to make EVs aspirational. In order to achieve significant adoption of EVs in India, it was essential to address the personal segment, which is 7-8 times larger than the fleet segment. “The Nexon EV, has leapfrogged to one of India’s top electric vehicle models with its accessible pricing (keeping the premium within 20% of an equivalent ICE car), higher range to overcome range-anxiety and providing the ease of home charging,” Shailesh Chandra, president, passenger vehicles business, Tata Motors, said.

Tata Motors has priced its electric cars at 15-20% premium to conventional petrol/diesel engine vehicles. “That the price premium is competitive between conventional engines and electric variant gives an added advantage to Tata Motors,” Mitul Shah, head of research at Reliance Securities, said.

The Nexon EV’s current price is around 15% premium over its diesel counterparts in the segment and 29% premium over gasoline cars in the segment, Chandra said. The Nexon has clocked 4000 units in sales in 10 months since launch.

Tata Motors closed FY21 with total passenger vehicle sales of 222,025 units, up 69%, the highest growth in 8 years. Its market share of the PV business doubled from 4.8 % in FY20 to 9% in FY21. EVs still account for just 2% of the sales of passenger car sales from the Tata Motors stable in 20-21, up from 1% in FY20. It’s still a long way to go.

A decent performance of its cars and assurances such as an 8 year (or 1.6 lakh km) warranty on battery and motor means that Tata Motors has managed a head start over rivals. It is now believed that the company is working on a range of electric vehicles that will hit the market soon. It plans to launch 10 new battery-electric vehicles by 2025 in India, its chairman, N Chandrasekaran, said in the annual report for FY21.

“Consumers are keen to buy EVs in the price range of INR 5 lakh to INR 15 lakh with a ROI of 3 years. Tata Motors is the closest to the price range of INR 15 lakh – INR 20 lakh. Its Evs have a range of 250-300 km and a ROI of 4 years. Another fact that has helped the Tata Motors EV is the ease of its charging with a 15 ampere switch in the comfort of your home”, Rajeev Singh, Partner at Deloitte India, said.

Mahindra’s last mile mobility game plan

While Mahindra has failed to crack the personal EV segment, the UV major is seeing larger traction in the last mile mobility with its three- wheelers and smaller four-wheelers for goods and people transport with products like Treo range and the eAlfa.

“The cost of ownership is at parity today. The range anxiety is really gone because it allows for the range that people want and it is very easy to charge as we see greater movement to electric from the conventional engines in the last mile mobility”, Rajesh Jejurikar, executive director, M&M, said.

Experts say by launching an electric variant in the personal space of the existing not so successful models has not worked for Mahindra.

The EV strategy involved taking an existing vehicle and putting an electric platform on it. “We have done that with the eVerito. Both eKUV100 and the eXUV300 will be in the market in 2022. We hope to retain the price of the eKUV100 at the announced price of Rs 8.26 lakh”, Jejurikar added.

For January-December 2020, Tata Motors sold 2602 Nexons, followed by MG Motors at 1243 ZS. Mahindra’s e Verito sold 9 units during the same period. Market share for the same period stood at 63% for Tata Motors, followed by MG Motor at 30%. Mahindra’s market share was at 0.2%.

Mahindra is all focused on its third phase, which is the born electric platform. This will take three to five years before it is introduced in India and the company has hired a very senior leader in Detroit to lead this initiative.

In the passenger vehicle segment, we are readying an all-electric SUV strategy and we will launch 2 new products by the end of 2022. We expect a higher penetration in EVs in personal segment by 2025 and that’s when our new products built on born EV platforms will be launched in the Indian market, Jejurikar said.

The auto major has merged Mahindra Electric into Mahindra and in this situation will not need an external investment in the business.

Mahindra Electric Mobility has announced that Mahesh Babu, CEO and MD of Mahindra Electric Mobility (MEML), is stepping down to pursue interests outside the company.

Consequently Suman Mishra, senior vice president, business transformation, Insight and Analytics, automotive sector, will take over as chief executive of MEML and chief executive (designate ) of last mile mobility business with effect from August 14.

The restructuring is aimed at providing the M&M vertical complete ownership of the value chain to drive growth and execution. It will also enable the EV Tech Centre with the depth of resources and synergy with M&M’s larger ecosystem of product development capability in MRV, North America, and Europe while exploring partnerships and alliances.

Tata Motors EV journey

From the time Tata Motors applied for the EESL contract and emerged as the lead bidder, it has been a journey full of learning, Chandra said.

In 2006, although Tata Motors European Technical Centre (TMETC) started development of EV technology, it has not been commercially viable owing to high battery prices. Back then India had no demand of electric vehicles. It steered ahead in the EV game, from developing skill sets to an image make-over to driving demand in the personal segment.

“Even if the technology is simpler than IC engine, selecting the right set of aggregates and packing them in an efficient manner to build a vehicle which can give an optimal range and performance requires a special skill set. We had leveraged work done by TMETC, to build our EVs. In addition, we got our design critiqued from JLR,” Chandra said.

While EVs have been present in India for over one and half decades, it was perceived as non-aspirational, expensive, low performance, slow moving machines which can only be used sometime for leisure driving. In addition, EVs were perceived as not “green” when well-to-wheel emissions are considered. “We learnt that in order to bring EVs into the consideration of the potential buyers, these myths have to be broken,” he added.

Adoption of EVs has been low given the apprehensions about technology. Thus creating awareness of the importance of EVs for India as well as commercial advantages of using EVs were important to accelerate adoption.

“We realised that to achieve significant adoption of EVs in India, it is essential to address the personal segment, which is 7-8 times larger than the fleet segment. It was important to ensure that customers do not perceive EVs as a non-aspirational product primarily meant for commercial use. We believe EV adoption was throttled because of 5 major barriers — unavailability of options, range anxiety, unavailability of charging infra, unavailability of financing from banks and economic viability vis-à-vis its ICE vehicles,” Chandra added.

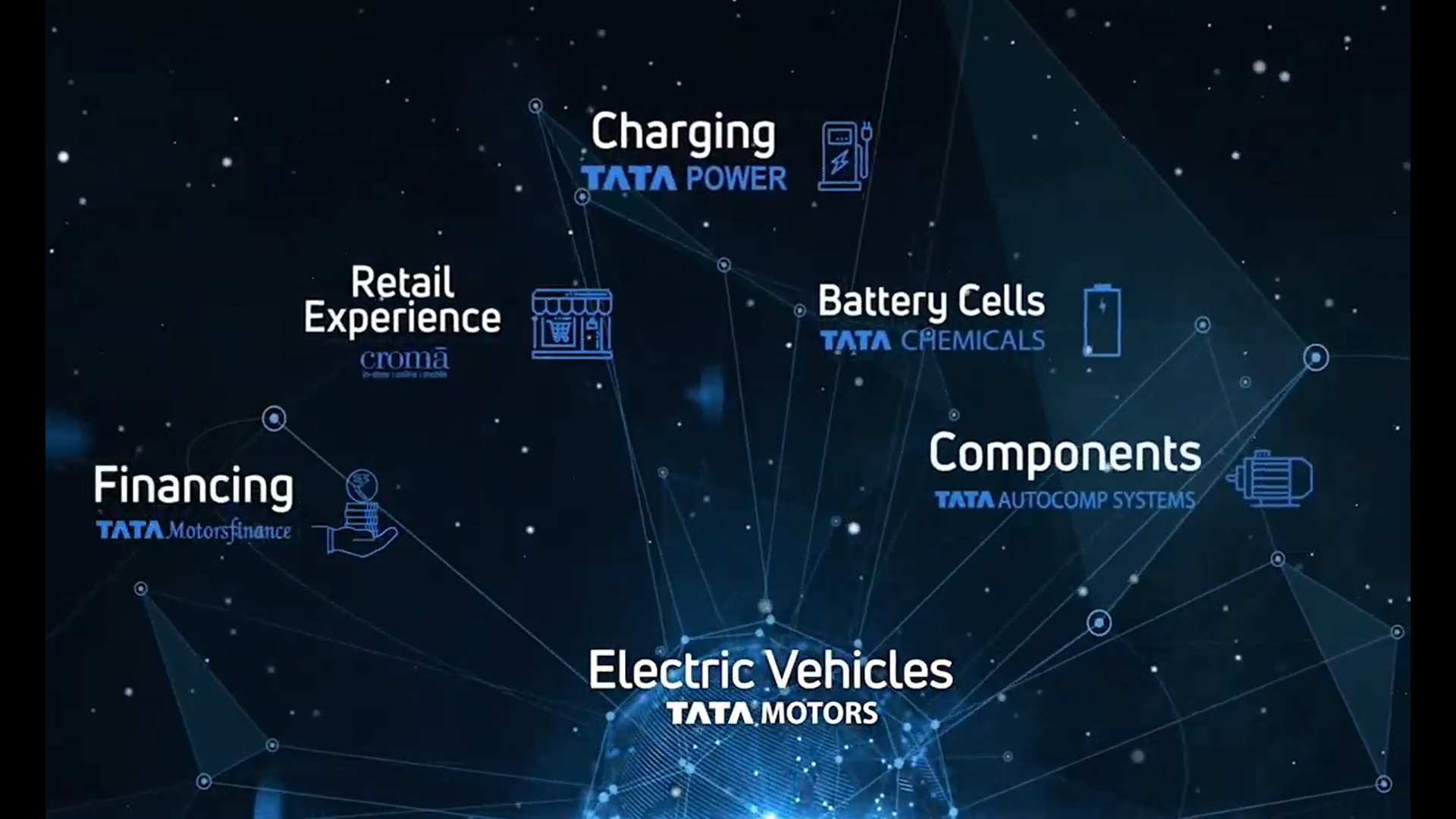

Leveraging group company synergies

In order to make EVs mainstream in India Tata Motors established a supportive ecosystem for EVs, called the Tata uniEVerse, comprising Tata Group companies. It partnered with Tata Power to provide end-to-end charging solutions at home, workplace and for captive and public charging. Under this partnership, the company has installed fast charging stations in key metros like Mumbai, Delhi, Pune, Bengaluru and Hyderabad. Chargers have also been installed on key intercity highways, at Tata Motors dealerships, and over 456 charging points have been installed in 92 cities, and this is expected to go up to 2500 in a year or two. In addition, free home-charging solutions are offered with every Nexon EV sold.

“Tata Chemicals will manufacture lithium-ion battery cells, and battery recycling. We are also working on storage solutions for used batteries”, Chandra said.

The EV industry in India is at a nascent stage and poised to grow fast in the future with the launch of more accessible EVs, growing charging infrastructure, reducing price gap between conventional and electric cars, and inherent benefits in operating and maintenance costs.

As the total cost of ownership (TCO) for EVs vis-à-vis ICE vehicles reaches a point where the EV TCO is visibly much lower than conventional vehicles, there will be rapid mass adoption. This equation will increasingly favour EVs as battery costs decrease and ICE vehicle costs increase due to stringent upcoming regulations to reduce emissions, and fuel costs rise. Also in the next 2-3 years there will be expansion of charging infrastructure, especially on highways, that will provide greater peace of mind to the consumers and support increase in penetration of EVs thus hitting the critical mass.

The drive ahead

EVs are likely to see better adoption in segments with a 200-plus km range cars. The opportunities lie in democratising the adoption of EVs by making them available to every segment of the Indian automotive customer through rapid localisation of all components, and the rollout of the fast charging network.

While on the one hand the regulation, in the form of stringent emission norms, will make the case for EVs stronger, on the other hand the declining cost of battery will enable the price gap with the conventional vehicles to narrow down.

In the next three years, it is expected that more than 20 EV models will get launched. Also, the falling battery prices and stringent emission norms being enforced in the next two years may trigger an inflexion point for accelerated penetration of EVs.