Though prices of a handful of raw materials have started to slide, industry experts are skeptical about any significant change in the situation in the coming months.

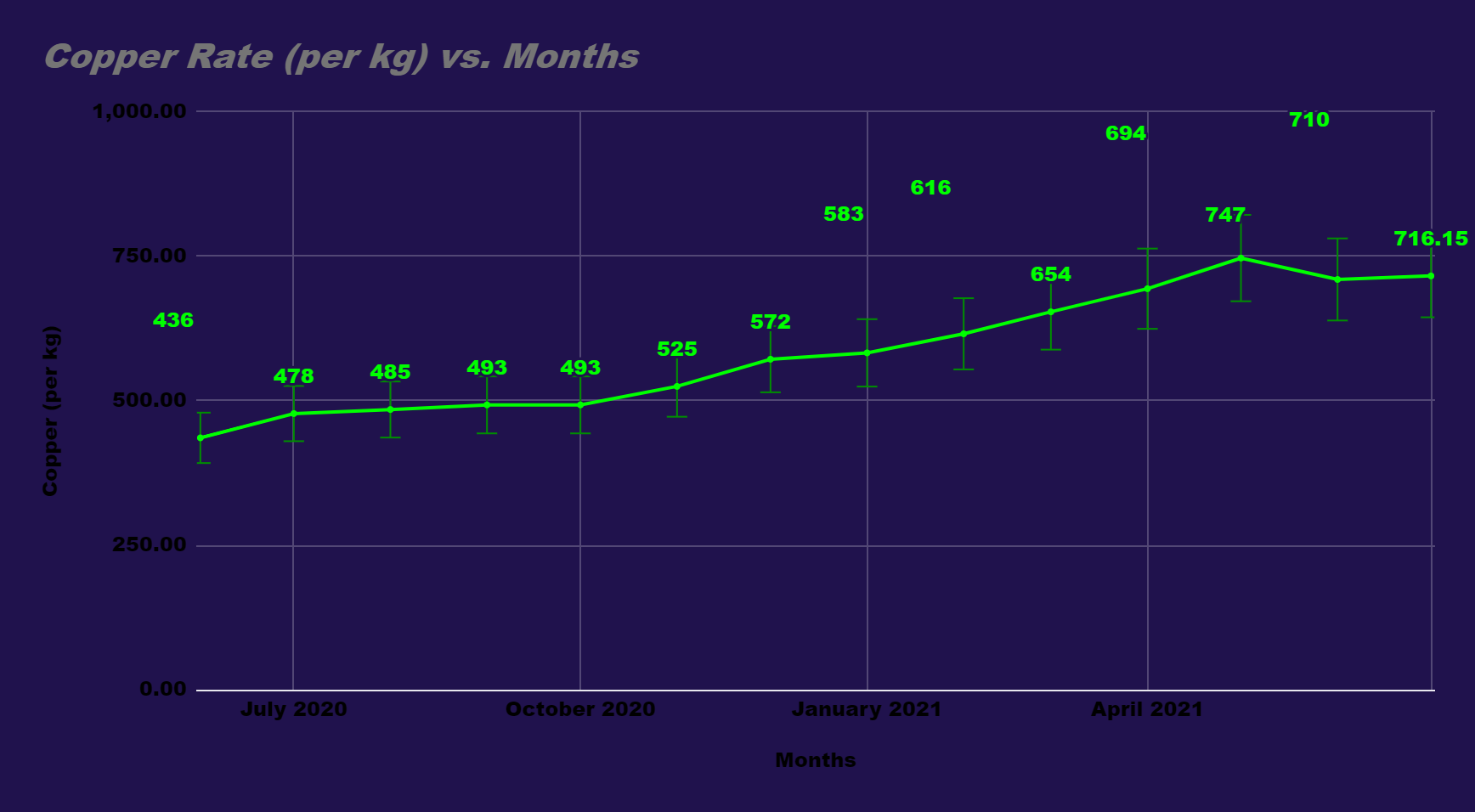

Prices of copper, often used as a gauge of global economic health, slid in June and traded below USD 9,100/tonne as China steps to cool off rising prices and stronger dollar. In a rare move, China announced a plan to sell state reserves of copper, aluminium and zinc, in an effort to curb a strong price rally in commodities.

The global decline in base metal price mirrored in Indian futures markets as well. In the Multi Commodity Exchange of India (MCX) copper price corrected 7.29% in the middle of June. Since the beginning of July, prices are trapped tight in the range of INR 730 and INR 716

Notably, the non-ferrous metal has fallen over 11% after hitting an all-time high of INR 797.5 on May 10.

Similarly prices of palladium and rhodium dropped over 11% and 36% respectively in July.

As per SIAM’s data the price of copper has reduced from about USD 10,200 per tonne in May 2021 to just about USD 9,600 per tonne in June 2021. However, about one year ago in June 2020 the prices of copper were about USD 5,800 per tonne.

“Copper prices are still about 66% more than what it was a year ago. Companies are already stretched due to very high commodity prices, as the prices of steel, which is a major material for vehicle manufacturing, continued to rise in June 2021. We hope that the commodity prices get moderated sooner than later, in the overall interest of the Auto Industry,” Rajesh Menon, director general of SIAM, told ETAuto.

As commodity prices continue to sustain their red-hot bull run since the beginning of the pandemic, its cascading effect on steel-dominated industries, such as automotive, is becoming more pronounced across the supply chain.

According to Shashank Srivastava, senior executive director, Maruti Suzuki, there has been a dramatic increase in material costs for the past 12-14 months especially steel and precious metals. The country’s largest carmaker pointed out that steel prices have increased from INR 38 per kg to INR 68 per kg while Rhodium has gone up from INR 19,000 per gram to about INR 66,000 per gram.

“Only a small part of this increase has been passed on to the consumers so far. We have decided to increase the prices across models and a small change in material costs is unlikely to change this situation,” Srivastava told ETAuto.

Hot Rolled Coil (HRC) and Cold Rolled Coil (CRC) are the two varieties of flat steel widely used in industries such as auto, appliances and construction. Hence, any rise in steel prices impacts the prices of vehicles, consumer goods, and the construction costs.

Additionally, Rhodium and palladium are used in the catalysers and their demand has gone up manifold due to the introduction of stricter emission norms across the world.

Only a small part of commodity price increase has been passed on to the consumers so far. We have decided to increase the prices across models and a small change in material costs is unlikely to change this situation.Shashank Srivastava, senior executive director, Maruti Suzuki

Raw material costs constitute a significant percentage of the cost of automotive OEM, which makes forecasts particularly important. The variety of commodity inputs for auto companies have increased with development of products such as advanced batteries, biofuels and synthetic chemicals. These products have subsequently created new and growing markets for commodities such as cobalt, lithium, nickel and waste oil.

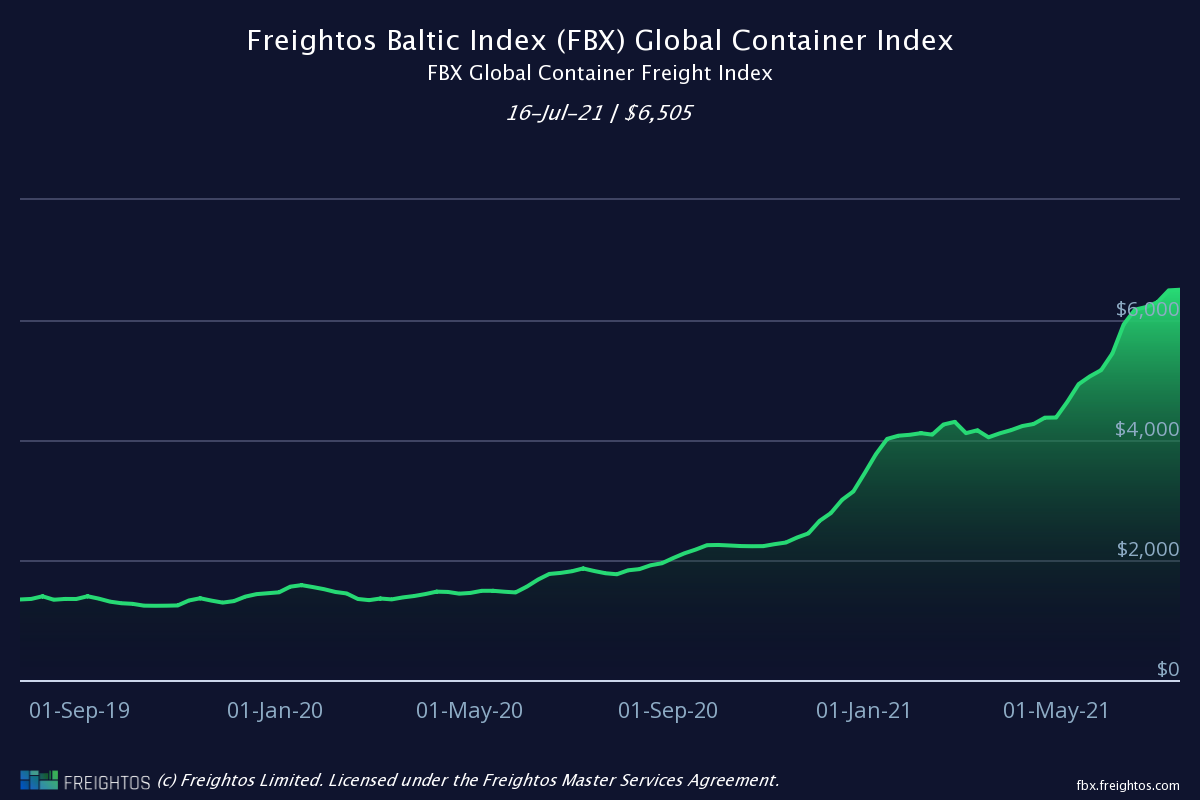

Expressing similar views, Deepak Jain, President, ACMA, said it’s very premature to conclude anything on such short-term fluctuations. “In the short term we see the situation to remain volatile especially because of the supply-side problem due to shortage of chips the input cost will remain high. The increasing logistics cost will continue to put the industry under pressure,” he said. The container shortage situation may be eased toward Q2 but it may not have a very big positive impact as India’s logistics cost remains high, Jain added.

With input costs going up, companies such as Maruti Suzuki India, Honda and Tata Motors have already announced that they would increase the prices of their product portfolio in the September quarter. Besides, soaring bulk shipping costs are further worsening the condition.

“Our input costs keep going up and up and a few of us can raise prices as fast as these costs are rising. As of now we can’t keep up with it. On the flip side, outsourcing of lower material adds higher freight costs, with often fluctuating currency exchange making the situation worse,” said one industry expert on condition of anonymity.

Soaring shipping freight rates

Shipping freight rates have been consistently increasing since July 2020 and have reached such levels where automakers have been finding it almost impossible for sustaining normal trade operations. Due to realignment of global trade route patterns after COVID, the companies are also seeing delay in container arrivals resulting in shortages.

As manufacturing picks up pace following the second wave of COVID-19 in Q2, SIAM DG said, it is important that availability of containers normalises.

“Q1 cannot be compared presently, as most of the companies had shut operations and therefore the impact of shortages, if it continues, may be felt in the coming few months. With the intervention of the Government, discussions are happening with shipping liners for increasing the availability of containers. We sincerely hope that this shortage of containers is temporary,” Menon said.

Outlook

In April, the World Bank commodity price outlook report indicated that 2021 will be a broad upswing for all commodities in general, after which there will be a tapering down in 2022.

Aluminium prices are projected to increase by about 29% in 2021, before falling 7% in 2022. Copper prices are projected to average 38% higher in 2021 compared to last year. Precious metals prices are forecast to fall in 2022 as investment demand recedes.