By Ashim Sharma

In line with our ‘Nine game changers’ in the next decade for the Indian automotive sector, the industry is being shaped by electronics which is one of the fastest growing automotive component segments.

Multiple factors are driving the growth of electronics in vehicles. Government safety norms, consumer demand for safer vehicles, and adoption of telematics systems are growth drivers for this market. As the mid and small-segment carmakers and two-wheeler companies also are starting to provide advanced features, demand for electronics is expected to remain robust in the near future. The major applications include safety, ADAS, infotainment, body electronics and powertrain. The shift is further catalysed by electrification.

Estimates suggest that 60% of this demand is expected to come from safety, ADAS and infotainment alone. This has created opportunities for electronic components such as micro controllers, actuators, processors, sensors, etc. and assembled components such as ECUs (vehicle as well as system levels) like Body Control Module, in battery management systems or vehicle ECUs.

In addition, the Electronic Manufacturing Services (EMS) space is also fast emerging on the back of these changes, coupled with favorable government policies to facilitate large-scale manufacturing, development of supply chain ecosystem and new manufacturing clusters in India. (e.g. through the PLI scheme).

The domestic EMS industry is expected to comprise 14% share in the global EMS industry by 2025 by growing up to USD 152 billion (ECLINA estimates) and therefore is an important pillar of the game changing electronics segment of the Indian automotive sector.

The domestic EMS industry is expected to comprise 14% share in the global EMS industry by 2025 by growing up to USD 152 billion~

Three key factors

With many factors in place to promote electronics manufacturing in the country, it is important to assess the role of a company aspiring to enter the electronics business. It can potentially be a combination of 3 key factors: Value chain integration, Business model and Synergies with the current business.

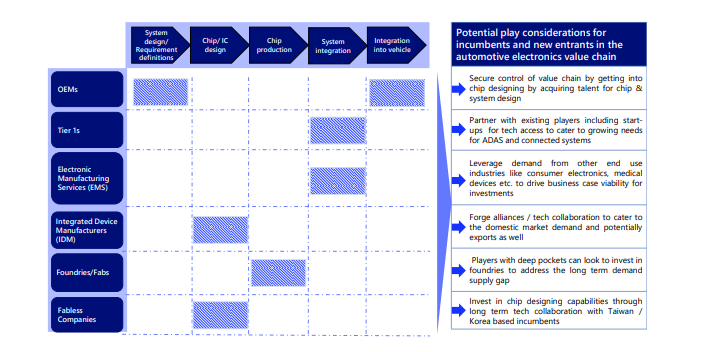

Value chain integration: While the whole value chain is available, strategies of players to enter various segments should be driven by considerations peculiar to the identified opportunity at different stages of the value chain.

The required scale of operations is an important consideration e.g. for manufacturing sensors. In order to achieve economies of scale, players need to widen their customer portfolio beyond the automotive industry i.e. to other industries like white goods and consumer electronics.

Scale of investment required is also a consideration peculiar to various stages of the electronics value chain; semiconductors being one such area demanding high scale of investment. Another crucial consideration is the rate of technological advancements which is quite fast for certain electronics components.

Entrants therefore need a robust strategy supplemented with significant investments in research and development as well as necessary cross industry linkages in order to keep up with the rapid rate of technological advancements.

Business model / ways to play: While the opportunities abound for the players to capitalise on, the route to entry will be crucial to decide for the players. The traditional participants will most likely wrestle for more control over the value chain and the new entrants without much automotive presence can carve out lucrative opportunities, with their readiness to infuse capital for technology access and manufacturing setups.

Another case in point is that of extending control over the value chain and examples like Ford investing in Velodyne, an automotive Lidar company, to ensure supply of LIDARs for the systems that go in their vehicles, currently largely supplied by Tier 1 players.

In addition, regroupings in the supply chain would also be necessitated by the investment and scale requirements. For instance, the OEMs, with the on-going chip shortage might look at addressing supply vulnerabilities by moving backward into chip designing.

However, to overcome the high capital infusion requirements, consortiums of OEMs or Tier 1 suppliers from automotive and / or other end use industries to jointly invest in foundries for semiconductor manufacturing to share the long-term investment risks associated with the venture.

Similarly, technology companies like Google and Microsoft are increasingly forging alliances with automotive OEMs and Tier ones.

The Tier ones, traditionally not into electronics manufacturing and desiring a share of the pie with the influx of ADAS and connected technologies, will need access to technology from the global leaders or startups which will necessitate long-term JVs or tech alliances with players in this field. Swift moves in this direction could help gain a sustainable competitive advantage.

Given the capital intensive nature of some of these opportunities, a prudent way for some of the new entrants in the space would be to cater to the demand through a multi shore manufacturing model for products with substantial value add. For example, power electronics for EVs like converters and inverters wherein the components could be imported and assembly, testing and packaging to be done locally. With the volumes picking up, a case for setting up a dedicated manufacturing facility could be explored.

The EMS space could see potentially new entrants outside of automotive leveraging scale of operations and cross industry linkages serving to various other growing end use industries apart from automotive like consumer electronics, smartphones and medical devices, thus justifying viability of investments in the PCB Assembly setups. The EMS space in India, which is largely unorganized with ~ 300 players in the market, presents an opportunity for non-related players with access to capital and technology (e.g. possibility of sourcing rigid PCBs for automotive applications from Japanese PCB manufacturers).

Synergies with current business: For the new entrants without prior background of electronics or even automotive, the need is to look inwards to understand their core competencies and identify synergies that could be explored in the electronics ecosystem. The core competencies need to be assessed rigorously through a three-factor lens of being unique, sustainable and viable in the long term for the new opportunities to assess the capability gap that exists between the current and aspired state.

For instance, a precision manufacturing company serving automotive customers (domestic and exports) would find itself well placed to leverage the manufacturing and quality competencies along with the customer relationships to offer electronics components by gaining access to manufacturing processes and system design capabilities, augmented through strategic partnerships / alliances. A more logical diversification for the existing automotive display companies like those making instrument clusters would be to move into HMI products like the Heads Up Display.

Therefore, a multi factor framework that takes into account the value chain integration, business models/ ways to play and synergies with the current business should be used to decide what part of the value chain of electronics individual players can enter into.

The ever-evolving consumer landscape and government regulations would drive the need for automotive electronics to open up opportunities for value creation for the incumbents and new entrants. It will be important for the entrants in this space to carry out detailed exercises for assessing their integration in the current or evolving value chain, attractiveness of potential business models and synergies with the current line of businesses that could potentially be leveraged.

(Disclaimer: Ashim Sharma is partner and group head at NRI Consulting & Solutions. Views expressed are personal.)