The first claimed electric car Reva by Chetan Maini was a two-seater launched in 2001, when the concept of an electric car was way ahead of its time. With an innovative powertrain, lack of cost parity with ICE vehicles, no government support on EVs, and zero awareness, the tiny car failed to gain traction. Between 2001 and 2010, the company sold only 3,500 Reva cars. Then the auto major Mahindra & Mahindra took a controlling stake in the company.

Two decades since the first e-car launch, the EV industry has come a long way with innovative technologies on all fronts. But the adoption of electric passenger cars in India is yet to take off. Inadequate charging infrastructure (especially on highways), range anxiety, weak consumer aspiration, high cost of acquisition compared to ICE vehicles are still the roadblocks.

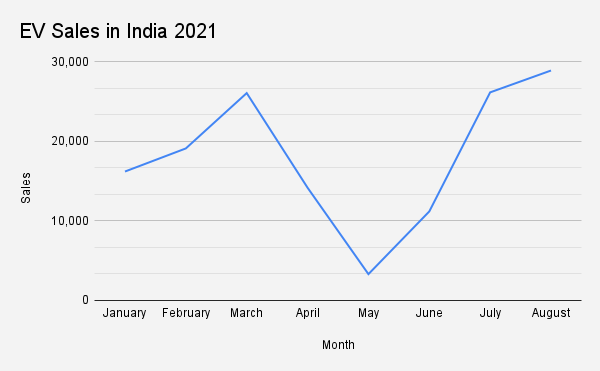

In the Indian car market EVs account for less than 2% of the annual car sales. The auto industry sold about 28,919 EVs in August.

Are Indian automakers leading the EV revolution in the country?

The Indian automobile industry is dominated by the Japanese carmakers, Maruti Suzuki, Toyota, Honda Cars, and Nissan. However, none of them have shared plans to enter the EV segment. South Korea’s Hyundai offers Kona EV, but it is priced above INR 20 lakh bracket, a little far away from the common man’s affordability basket. Meanwhile, the company said it is working on a mass-market EV for India.

According to Puneet Gupta, director, IHS Markit, the Indian subsidiaries of the Japanese car makers are not going for EVs because even globally, their parent companies are working at the most on hybrids or hydrogen vehicles, not EVs.

Owing to poor demand, India is still a low priority EV market for global automakers, he added.

Maruti Suzuki which had plans to launch a WagonR EV in India has not given any specific timeline. The car was to be introduced for the fleet segment, which is almost 1/7th of the personal vehicle market in India.

Recently, the company chairman R C Bhargava said it will not enter EVs in the short term and will enter “only when it is feasible” to sell reasonable numbers.

Currently, the leader in the personal EV space Tata Motors offers two models, Tata Nexon EV and Tata Tigor, starting from a price range of INR 12 lakh and going up to INR 17 lakh (ex-showroom).

Tata Motors also has a Group advantage, where it can get support from Tata Power for charging solutions, Tata Chemicals for Battery cells, Tata AutoCop Systems for other auto components, an industry veteran observed.

Tata Motors Chairman N Chandrasekaran in the annual report for FY21 said that the company would launch 10 new battery-electric vehicles in India by 2025. This might also imply that by the time other mass market car makers will bring about their first EV offering for the customers, Tata would be offering the benefit of choice with an extensive product lineup of 10 models.

Mahindra & Mahindra has also been in the space for almost a decade but could not make a mark with its e20 (based on Reva) or the e-Verito. However it has plans to launch eKUV100 and eXUV300 in the market in 2-3 years. The company is also working on bringing about the “born-electric” platform by the next 4-5 years.

For four wheelers there is no catalyst like Ola Electric in the two-wheeler space. Though Tata Motors is doing a great job for EVs, it is yet to be an impactful disruptor, Gupta of HIS said.

Brajesh Chhibber, Partner, McKinsey & Company said, “The Indian car market is dominated by value oriented products which are price sensitive. There is more activity from e-2W, e-3Ws side because of affordability. For e-cars, OEMs are required to clock in battery, motor and other parts which are very costly and give a minimum range to vehicles.”

“So the moment that is done and the battery is sizable, the cost structure of the vehicle goes haywire, compared to what the customers are used to. As for e-2Ws, the battery is very small with probably 1/10th the size of the car battery and will be able to give the appropriate range of around 80-100 km,” he added.

Almost every manufacturer has electric products in the works. No one is sitting on the sidelines. It’s just how fast they are ramping up production and strategising their approachBrajesh Chhibber, Partner, McKinsey & Company

Chhibber explained that to design a new vehicle OEMs take about 3 to 5 years depending on the maturity of the design and development capabilities. “Almost every manufacturer has electric products in the works. No one is sitting on the sidelines. It’s just how fast they are ramping up production and strategising their approach,” he said.

Giving yet another perspective, Ravi Bhatia, president and director, JATO Dynamics, said that one OEM launching EVs could also be happening to meet the advanced fuel efficiency and carbon emission targets or the Corporate Average Fuel Economy (CAFE-II) norms.

India will roll out the second round of CAFE regulations in April 2022. Under these regulations, which came into force from April 1, 2017, the average corporate CO2 emission must be less than 130 gm per km till 2022 and below 113 gm per km thereafter.

Government’s push to EVs

The Union Government has been pushing for EV adoption. It offers subsidies under the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME-India I ) schemes. The state governments also offer cash incentives for EV adoption under their EV policies.

The government think-tank Niti Aayog recently said the government should provide incentives on electric vehicle (EV) purchase over and above the existing subsidy under the upcoming Faster Adoption and Manufacturing of Hybrid and EV (FAME-II) scheme.

According to a McKinsey report titled ‘Electromobility’s impact on powertrain machinery’, the electrification of powertrains leads to shifting demand for components and, consequently, a change in the machine tools required during manufacturing. Transmission is the part of the powertrain most affected by these changes.

The number of key components will significantly decline with the shift from ICE to battery electric vehicles (BEV) powertrains. Since plug-in hybrid electric vehicles (PHEVs) and mild hybrid EVs have both ICE and BEV components, there will still be a need for ICE components, but on a much smaller scale, it added.

The challenge is that the government is too fast in pushing EVs while the OEMs are too slow. The onus of bringing in cost parity for electric cars for easy adoption is on both the government and the OEMs, an industry veteran said.

According to Gupta of IHS Markit, building a new platform from scratch can take up to 4-5 years, and building on an existing platform can take sound 2.5 years.

“A lot also depends on the investments, and battery chemistry which is changing very fast. So most OEMs are in the wait-and-watch mode because the entire process of testing and building can take a lot of time,” he said.

Three years down the line, once the FAME-II policy is launched in India in 2024, the passenger car segment can be expected to reach an inflection point by 2025Puneet Gupta, director, IHS Markit

In terms of percentage, when compared to four-wheelers, EV incentives offered by the government are exceptionally high for 2Ws. “Maybe the government wants to push 2Ws and 3Ws first as 70% of the oil consumption is by them and to address the bigger part of the challenge,” Gupta said.

Consumption in e-cars will go up in the coming years if we address the persisting challenges. Three years down the line, once the FAME-II policy is launched in India in 2024, the passenger car segment can be expected to reach an inflection point by 2025, Gupta added.

Giving an example from a research on EV demand in global markets, Ravi Bhatia said that in markets like China and Europe, government policy is driving demand for EVs. “As and when the government stops the subsidy, the demand falls back in these markets,” he said.

Secondly, he reiterated that the EV ecosystem in our country is immature which is largely hampering the demand for electric four-wheelers. “Inflection will occur when EVs achieve a cost parity with the ICE cars. I can see that happening in the next decade,” Bhatia said.

EV ecosystem in our country is immature which is largely hampering the demand for electric four-wheelersRavi Bhatia, president and director, JATO Dynamics

According to Chhibber of McKinsey, “In terms of affordability, we can expect the inflection point by 2025 when the battery cost will come below a particular level and customer demand will start growing. India’s auto industry is likely to have 20%-25% of new vehicle sales of e-4Ws by 2030.”

“Secondly, the whole notion of the ecosystem is a challenge. E-4Ws take a lot of time to charge, unlike 2Ws which have a small battery or portable battery which can be charged anywhere,” he added.

Are luxury carmakers winning the game?

India’s largest luxury carmaker Mercedes-Benz India said at the launch of its premium electric SUV EQC that it is aiming to get the first-mover advantage by bringing India’s first luxury EV. “It is not a volume model, but is for early-adopters who want to own a luxury EV”, the company’s MD and CEO told ETAuto then.

Volvo is also set to launch its SUV XC40 Recharge in India in the second half of this year.

Luxury EV models in India

While the luxury car market is heading fast towards electrification in India, the segment is still at a nascent stage compared to its performance in the other countries like the US, China or Europe.

Tesla Inc also has moved closer to making its official debut in India after it received approval to make or import four models in the country.

The Silicon Valley-based company had urged the government to lower the import duty on EVs to 40% from 100%. Tesla also has plans to set up its manufacturing unit in Karnataka once it succeeds with the imported cars.

Currently, India levies 100% tax on the imported passenger four wheelers of price more than USD 40,000 (INR 30 lakh) inclusive of insurance and shipping expenses. Cars less than USD 40,000 are subject to 60% import tax.

Sharing his view on the same, Bhatia said that the government has to be technology agnostic for allowing the import duty cut. If it allows it for Tesla, it will have to allow it for its peers as well. “Even if Tesla enters, it will be limited to millionaires and billionaires.”