New Delhi: While the automobile industry in India has witnessed several lows since the Covid pandemic last year, the tractor industry has been holding on to its position. The segment is gradually growing supported by the resilience in the rural economy helped by bountiful monsoons and good yield from the farms, and exports.

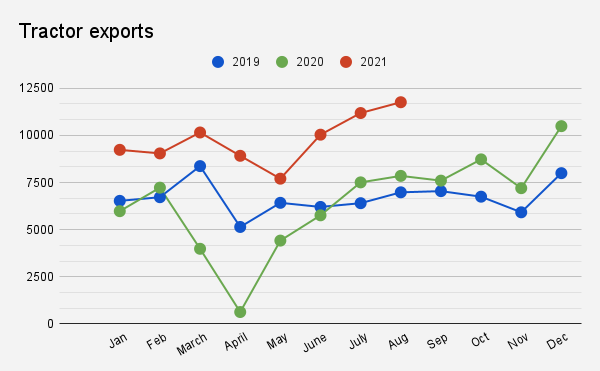

India’s tractor industry gets 10% of its revenues from exports. In the past 18 months, tractor exports have reached a crescendo and in August 2021, India exported 11,760 tractors, marking one of the highest monthly sales.

Gaurav Saxena, President and CEO- International Business, Sonalika Tractors, said at the ETAuto Farm Equipment Summit on Thursday, “For the last one year and half, the trend of surge in tractor exports has been seen in Europe and America where our volumes and demand has gone beyond expectations.”

In the current scenario, the total volumes for the tractor industry is about 2 million units, including domestic sales and exports. Other than India and Europe, the US, Brazil, Turkey, Thailand account for major volumes.

Source: Tractor & Mechanization Association

According to Saxena, one of the reasons for the growth in exports is the government’s support for agriculture in those countries where farm mechanisation and food security have larger interest.

Sonalika Tractors has assembly plants outside India and has been into tractor exports for the past 10 years. Explaining the importance of exports in business, Saxena said, “If something happens in the Indian market, another country’s sales can support the business. So it is always good to have an export business and not have over-dependence on one market.”

For a cyclical industry like this, export gives the manufacturers a healthy cushion to offset any unforeseen shock in the domestic market.

Saxena said, another reason for the growth in exports could be attributed to the particular range of tractors. In India the demand for tractors ranges up to 60 horsepower (HP) and the major demand comes from 30-60 HP tractors. However for exports, demand ranges below 30 HP and above 60 HP.

“Initially, we did not have the range for tractors which is suitable outside India. Now we have a strong product lineup below 30 HP and above 60 HP as well, going up to 120 HP. Likewise, many manufacturers have developed the competencies and product range which are suitable for the markets outside,” he said.

The Indian farms are becoming smaller because the population is growing and families have divided the farms among them. But outside India, farms are huge and follow corporate farming. So people are using bigger machines. Thus they need better technology, more comfortable cabins and AC-fitted tractors. Such products have given us good growth, he said.

In 5 years, I expect that this market of exports should grow up to almost 2 lakh tractors which is almost double the present levelsGaurav Saxena, President and CEO- International Business, Sonalika Tractors

Saxena expects the exports for this year from India to be around 1.25 lakh tractors. “This demand should grow with advancement in technology. In 5 years, I expect that this market of exports should grow up to almost 2 lakh tractors which is almost double the present levels,” he said.

Giving a component supplier’s perspective, Suresh KV, president and CEO, ZF India, said that it has components for higher HP tractors. “Initially, we struggled to apply these to the Indian market but now we are seeing that this is also slowly changing. We are going to supply 1 lakh to 2 lakh tractors per annum over the next 3-4 years to European countries. Then we can look at indigenizing our products in India to support the Indian OEMs in their export initiatives,” he said.

Technology and electrification

Saxena highlighted that there is a lot of interest in electric and robotic tractors. But in India, electrification in the farm sector will take more time than the auto industry because the terrain is very different for the tractor usage.

“We are focused on working for electric and robotic tractors for countries outside India. In the coming years, the demand for e-tractors or agricultural machinery is bound to grow. A lot of companies are working on this from India as ultimately it has to come to all markets,” he said.

Tractors use purpose-specific modern machinery called implements. Some of these include rotavator, cultivator plough, harrow, trailer, among others.

According to Saxena, tractors are of no use without implements. “We are making all primary and secondary implements in India and cater to exports of these implements which are getting good response,” he said.

ZF, which has a technical centre in Hyderabad, has been active in electrical applications for automotive as well as the farm equipment segment. “We are in an advanced stage where we can soon apply electric drives into the tractor segment. As and when manufacturers in India are ready to use them, ZF will create a business case to apply them in the Indian market also,” Suresh said.

“Adopting the right products and adapting them into the Indian market is an absolute need. The electric drives cannot be plugged and played in from Europe to the price sensitive Indian market. This also calls for a high level of localisation, so it will be a 2-3 year journey but we will definitely pitch in when required,” he said.

Challenges

According to Saxena, the increase in raw material cost is a huge challenge for the tractor industry. In some export markets, the logistics costs have also gone up 10 times because of unavailability of containers. So the price of the end-product is very high for the farmer who is a rural buyer. This is putting a lot of pressure on the bottomline of every company.

About chip shortage which has affected a larger portion of the auto industry, he said that it is an issue in some markets like Europe or Tier-4 markets of the US. “But other than this, we are not facing a problem similar to that the auto industry is going through,” he said.

According to Suresh, taking calculative risk while expanding capacity is essential, so that excess capacity does not convert to cost. “We must also be careful on prices. We should not be making all technological changes so that the products do not become unaffordable to the farmers.”

Also Read: