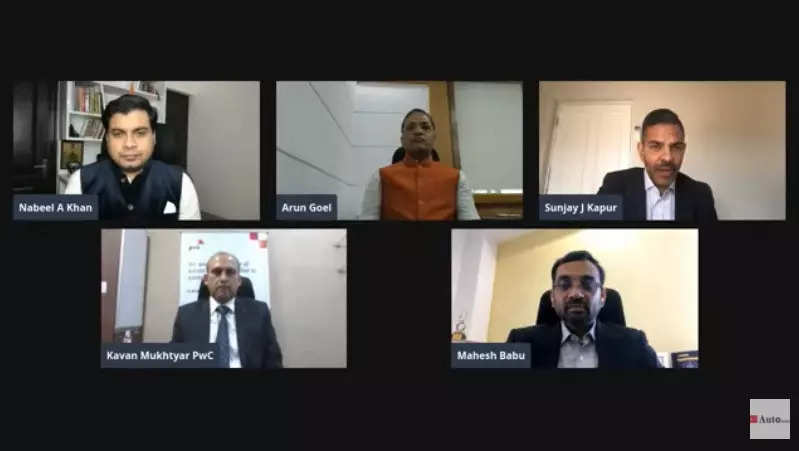

New Delhi: The Indian automotive industry is a great success story, however its production is not up to the expectations. The objective of the Production Linked Incentive (PLI) scheme for the automotive sector is to encourage component players to invest in cleaner and advanced technologies and make the industry competitive on the global front. It will also help bridge the cost disparity and encourage domestic manufacturing. The scheme will act as a catalyst for the domestic weak supply chains to bring about structural changes inevitable in the world scenario, says Arun Goel, Secretary, Department of Heavy Industries (DHI).

“High technology and high value items are imported while exports are inadequate. The global trade in the auto industry is about USD 1.5 trillion. India exports automobiles worth USD 12 billion and components worth USD 15 billion. But we import components worth USD 17 billion and globally we are exporting USD 27 billion which is less than 2%,” Goel said at an ETAuto panel discussion. He highlighted the need to develop high value items in India to reduce imports and increase India’s pie size in the global trade to become an exporter in the long term.

Electricals and electronic parts

Globally, Advanced Automotive Technologies (AAT) production accounts for 18% of overall component production and is likely to grow to 30%, while the Indian auto industry’s share in AAT stands at 3%, he said.

“This is also the reason why India is at number 11 in terms of value creation. The size of pie of AAT is going to increase exponentially with the electrification trend,” he said. Giving an example, he added that AAT like auto electricals and auto electronic components are part of all vehicles, whether ICE or EVs, so when the vehicle prices go up, the majority of value addition will be on account of these.

Investment does not happen overnight. Automotive is a complex industry and there are lots of pre-approvals required. So anything that we start today will gain revenues at least 2 years from today and if we do not move today the share of imports in the Indian auto sector will grow manifold because the world is changing at a fast paceArun Goel, Secretary, Department of Heavy Industries

As an outcome of the scheme, the government is expecting approximately INR 45,000 crore of investments to come in 5 years from the Indian auto industry. The incremental production on this account is going to be worth INR 2,31,500 crore along with generating additional 7.6 lakh jobs from the entire Indian auto industry.

There are two main components for EVs: the battery, for which the government has brought about the PLI and ACC (Advanced Chemistry Cells) scheme, and the powertrain, for which the industry has the auto component incentives. On the demand side the industry has the FAME policy and on the production side it has the PLI scheme. In a way we have covered the entire circle, Goel said. Localisatioin is the key: ACMA

According to Sanjay J Kapur, President, ACMA, the benefits of the scheme are not just for the Tier-I but will go across the value chain. MSMEs form 65% of the auto component body’s membership so they are cognizant of that fact as well.

“OEMs are now looking for system suppliers, not only for components manufacturers. The days of investing just 1% of revenue in technology are gone. We will have to own our technology moving forward. The same is with electronics; there’s a huge opportunity to localise its production through collaboration to match the growing demand,” he said. If required, as an industry, we should collaborate with other industries in the country to localise components, he added.

If required, the auto industry should collaborate with other industries in the country to localise components. Prices are not going to take us very far; it is the technology that will. If we do not localise, by 2025, as a country we will import close to USD 250 billion worth of electronicsSanjay J Kapur, President, ACMA

“Prices are not going to take us very far; it is the technology that will. If we do not localise, by 2025, as a country we will import close to USD 250 billion worth of electronics,” Kapur said.

Benefits for ICE vehicles?

The DHI secretary Arun Goel said five years before COVID-19 there were investments of about USD 34.5 trillion for the ICE vehicles. “We have immense capacity but because of COVID, capacity utilisation has come down and it is underutilised. On the ICE side, we are very low in terms of value because we are a mass market, low value, and low technology production hub. If on the ICE side, we have to increase our share, we need to do what we have not been doing so far and that is AAT,” he said.

According to him, the investment in capacity expansion on the EV side is negligible as of now. “It does not happen overnight. Auto is a complex industry and there are lots of pre-approvals required. So anything that we start today will gain revenues at least 2 years from today and if we do not move today the share of imports in the Indian auto sector will grow manifold because the world is changing at a fast pace.”

Mahesh Babu, chief executive officer – India, Switch Mobility, said that EV is going to be benefitted more than ICE in the auto PLI scheme, when it is linked with the ACC PLI for advanced emission batteries.

“In 2020, the global auto industry declined but EVs went up by 41%. Evidently a huge demand shift is happening. I think the auto PLI scheme will scale electric mobility at a larger scale. However, the scheme has a clear specification for auto OEMs, component suppliers, new entrants and the existing players. It is a very well thought out policy and it has been consulted with auto industries across. It is important that the industry co-operates and co-creates the future of consumers with the government. The government shall continue to consider industry as a partner and the customers must work to democratise zero carbon emissions in India,” he said.

Nothing can match the efficiency of EVs today to drive a person or goods to 1 km. The focus of commercialisation, scaling up and bringing India to a global scale, is going to be in the EV space in the next decade, Babu added.

He stated that Switch Mobility is also looking at exporting components and parts from India to create a value addition of about 70% from India to the Switch’s global contribution. “If we are not utilising the opportunity, we have to blame ourselves.”

Kavan Mukhtyar, Partner – Management Consulting, PwC India, said that the policy is with the future in focus and the government has given a clear signal to the industry that we need to embrace change. “The scheme is not just about EVs, but clean, sustainable and safe mobility. There will be benefits for even the ICE vehicles. For instance, in the auto component segment, automotive electronics may be eligible for the benefits. Looking at input statistics, India has been importing a lot of auto electronics because volumes for these components are much lower here and probably did not make sense to design here. But with this policy intervention, it is something which companies will look at which can be localised and that will kickstart the process of design, manufacturing capabilities in AAT in India which will make the country future ready.”

There are parts of the industry, especially the traditional or metal industry which might not be able to take immediate advantage, but it is a signal for change and one must look at it with an open mind, he added.

Secondly, Mukhtyar said that the automotive component supply chain globally is very tier-ised. And even in developed markets like Germany, you still have family-owned businesses which are thriving. They may not get direct benefits from the scheme but when one is part of the tier and demand uptake happens because of bigger players who are investing further, then that is how it results into healthy development of our supply chains. I think the whole industry will have to be ready to invest in new technology but whoever has the appetite to go ahead and take that risk and believe in investing in new technology will benefit first.

Why was Auto PLI allocation reduced from INR 570bn to INR 259bn?

The DHI Secretary said that the government consulted the auto industry bodies, identified their requirements and then calculated the total amount. List of components has been arrived at in consultation of the industry participants mainly targeting AAT components which are currently not manufactured in India. The discovery suggested that there is a cost disparity of around 15%-20%, depending on which sector it is, because of which fresh investments in AAT are not coming in the auto industry. “In the scheme, the government has given fully what the industry asked for, because the incentives range from 8% to 18%. We studied 15 OEMs and 75 auto component companies. So when we tabulated the requirement it came out to be INR 25,938. Not even a single penny has been cut.”

The PLI scheme is a well thought out policy and it has been consulted with auto industries across. It is important that the industry co-operates and co-creates the future of consumers with the government. The government shall continue to consider industry as a partner and the customers must work to democratise zero carbon emissions in IndiaMahesh Babu, chief executive officer – India, Switch Mobility

He also added that for the PLI scheme, the government has made an exception that benefits under the Advanced Chemical Cell PLI (INR 181 billion) and FAME schemes (INR 100billion) can be combined and players can avail multiple incentives. “The government has taken a holistic approach considering the battery, powertrain and entire vehicle. With this, there is no other country in the world which is giving a better base for manufacturing EVs than in India. Now the time is for the industry to make the investment and walk the talk.

Kavan Mukhtyar said PLI is all about getting big investments in areas where India is currently technologically weak. So going by that theme, by design large companies are slated to get direct benefit but the good thing in the automotive world is that the supply chain and the structure is such that everybody who is part of that chain is benefitted as well. However, it is a harsh reality that if someone is not doing any value addition, their business is going to be impacted. So there is definitely going to be some consolidation of weak performers and this is the time for them to look back and reflect on how they can redesign their business for the future.

Even if OEMs are not direct beneficiaries, they will play an important role in this. Right now very little manufacturing is happening. I think OEMs will also have to take a fresh look at the scheme and see how they can benefit from this beyond EVs, and into the supply chains. Many of them have their international purchase offices in India and a lot of their supply chains from smaller companies are also present here. So they need to look if some of their local programmes can be brought to India. Of Course a very high cost disability is expected in the initial plan, but this scheme can help bridge that and encourage more investments which will result in more localisation, Mukhtyar added.

Startups and drone industry

Talking about the benefits for startups in the auto PLI scheme, Arun Goel said that every scheme cannot be meant for everyone. The Government of India has already launched various schemes where startups are going to be direct beneficiaries. Looking back, the Indian auto industry has grown over the years. Not everybody is born Tier-I. You start with Tier-III, become tier-II and then tier-I. To ensure there are no leakages in the scheme, the incentive payout is at the last stage but that does not mean it will benefit only Tier-I, because Tier-I is dependent on Tier-II, III.

“Yes, a startup cannot do huge production immediately. The ones who are into R&D and product development can collaborate to go into production on a larger scale; pooling of resources is required. Today, bigger players are good and established in manufacturing but not everybody is investing in R&D and those who are not can coordinate with startups which will bring in engineering and product development. Manufacturers can encash on that and both of them can get benefits of the scheme. So for the EV sector, we have PLI on ACC where we have kept 500 mw purely for niche technologies, which is entirely for startups,” he said while stating that hand-holding and collaboration within the ecosystem is required.

For the drone industry, local value addition is currently at 40% and the rest 60% is the imported content. “Incentive pay out will be 20% of the local value addition, which is more than the current turnover or size of the drone industry. As of date, turnover of the drone industry is less than the pay out of INR 1.2billion as the industry is in a nascent stage. Details will be provided by the Ministry of Civil Aviation soon,” Goel said.

Also Watch: