The situation is dire. According to data from the Central Electricity Authority of India, nearly 80 percent of the country’s coal-fired plants were in the critical stage with stocks that may last less than five days. This despite the fact that production of coal is at record levels–Coal India Ltd produced nearly 250 million tonnes in the first half of this fiscal, nearly 6 percent more than last year. The shortage is a result of high demand for electricity which has created a demand supply mismatch.

In turn, the question that has emerged is whether the power sector has the capacity to add automobiles to its list of consumers. It may sound like a logical concern but nothing can be more misplaced.

Even when electric vehicles become mainstream, the demand for power would only be a fraction of the country’s overall capacity. Currently, India has an installed power capacity of 382 Gigawatt (GW) of which thermal power accounts for 234 GW. There is at least 27 GW of fresh thermal power capacity on the anvil in the next 5-6 years. In the renewables space–solar and wind, capacity addition will be substantially more.

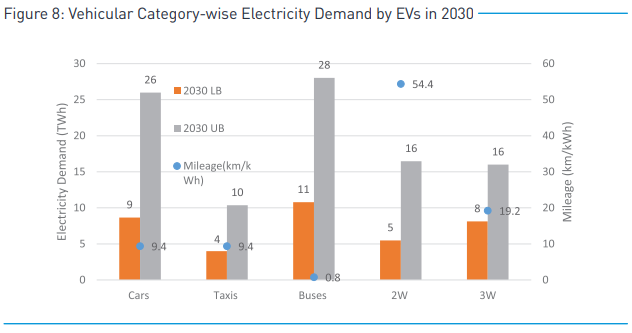

According to a 2019 report by Brookings India, even in an optimistic scenario of 100 percent EV sales by 2030, electricity demand from the sector would be to the tune of 97 terawatt-hour (TWh). In a more realistic scenario where EVs would account for 33 percent of overall sales, electricity demand would be 37 TWh. During the same time, Brookings estimates India’s electricity production by 2030 to grow to 2074 TWh in a modest scenario and 2785 TWh in an ambitious scenario. EVs would account for not less than 1.3 percent and no more than 4.8 percent of overall electricity demand in the best and worst case scenarios.

“Any increase in power consumption due to EVs will not be overnight but gradual. To say that there will be a shortage of electricity due to widespread use of electric vehicles will be misplaced,” said Sudhir Kumar, associate director, CARE Ratings. “India is adding fresh capacity to produce power as well both in the renewable space where we plan to have a capacity of 450 GW by the end of this decade as also in the thermal power sector.”

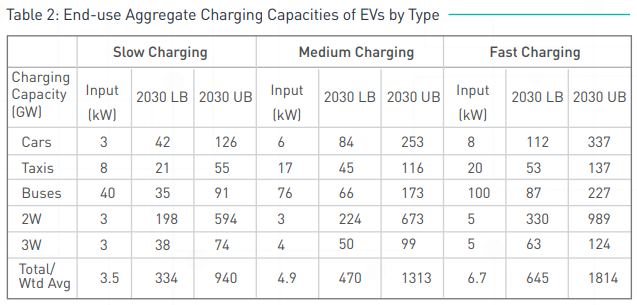

There is a concern though. Widespread use of EVs would put a different kind of pressure on the national grid with varying and more intense peaks. Tackling that is a bigger challenge and requires greater flexibility in the grid. Brookings estimates the EVs’ aggregate charging (or power input) capacity under different scenarios of EV penetration and slow, medium and fast charging to be between 334 GW and 1,814 GW. Even at 334 GW, EVs will constitute almost a quarter of aggregate load capacities of electricity devices and equipment across all end-use sectors of the country.

“EVs could add up to 50 per cent to peak demand and 3 percentage points to peak demand growth between 2017 and 2030. The key challenge for the grid with EVs will, therefore, not be aggregate electricity units but rather ‘when’ and ‘where’ the demand is generated,” the report had said. “Issues of supply capacity being concentrated at local distribution transformer or even substation level with significant EV population will have to be looked at before any large-scale roll out. EVs are unlike any other conventional load that the grid has been used to. Their disproportionately large impact on peak demand compared to electricity units requires significant peaking and distribution capacity head-room that risks severe underutilisation and, therefore, unviability.”

If the grid is not upgraded, EVs can really destabilise it. Sample this. The normal grid loads have an annual aggregate load capacity to effective capacity used factor of nearly five; with EVs, this can vary between 80 and 160. It will bring volatility to instantaneous demand.

“There are no two ways about it. The grid has to be smart and flexible,” said Dr Sandeep Pai, senior research lead, Centre for Strategic and International Studies–a Washington based think tank. “It will require distribution companies to make investments but without that there is no other way. With slow and fast chargers all around and many vehicles getting plugged in at homes, the peaks in power demand will be of a different nature. The traditional grid is ill equipped to take that and will collapse and it will not be for lack of power.”

Infact, there is a silver lining to this as well. With a plant load factor hovering between 55 and 60 percent, thermal power plants are inefficient right now and need higher consumption. Electric vehicles are a new category that can do just that.

With a plant load factor hovering between 55 and 60 percent, thermal power plants are inefficient right now and need higher consumption. Electric vehicles are a new category that can do just that~

According to an EY report electric mobility is expected to help the power and utilities sector to realize net cost and revenue benefits from both the demand and the supply side.

“The realization of this economic value will depend on effective implementation of an ecosystem to improve EV

adoption along with measures to maintain grid absorption. This complex cross-sectoral implementation plan would also need to be assessed for and mitigated against risks, the most prominent of which are the incapability of the grid to absorb mass EV charging and customer perceptions around electric mobility,” the report said.

With innovative use of time of day tariff, it also offers the scope for proper utilization of renewable power.

“EVs charging in the afternoon or late nights can absorb RE peak power with base-load functioning to meet the rest of the demand. This will, in turn, reduce the net load dipping in the current scenario and help maintain a leveled load curve,” the EY report added. “A leveled load curve would result in cost savings for the entire value chain with higher utilization of base-load capacity (lower fixed cost/unit) and lower requirement for expensive peaking capacity.”

“I would not go so far to say EVs will definitely help in improving the plant load factor of the power sector but I would not disagree that there is potential,” said Kumar of Care Ratings. “Time of day tariff can be a very useful tool in shaping consumer behaviour. We know that solar power is generated best during the day so by offering say 30 percent lower tariff at that time, consumers can be encouraged to charge their vehicles at that time. At other times when there is low renewable support, tariff could be higher to disincentivize people from charging their vehicles. This is the template that European countries are also adopting.”

Clearly, India has and will have enough power for any number of electric vehicles on the road. All that needs to be sorted is how effectively the power is transmitted and distributed.

Read More: