By Anuj Monga and Pranav Nair

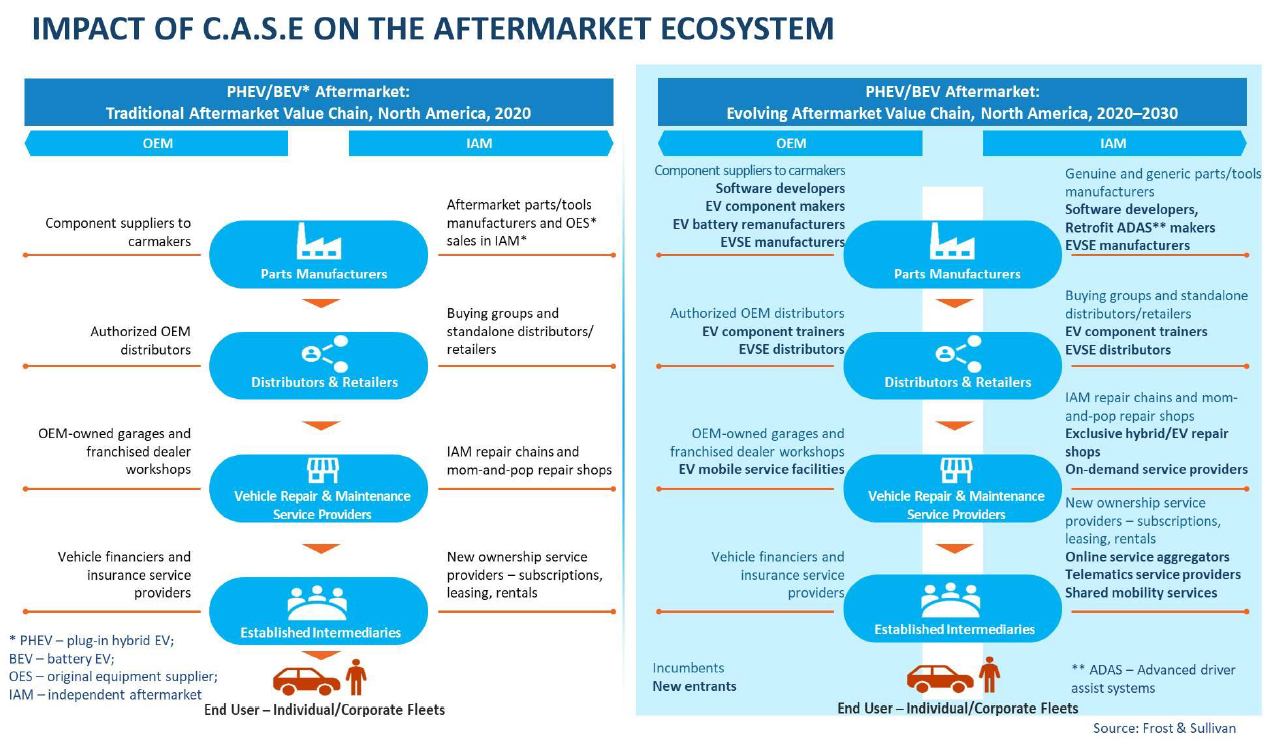

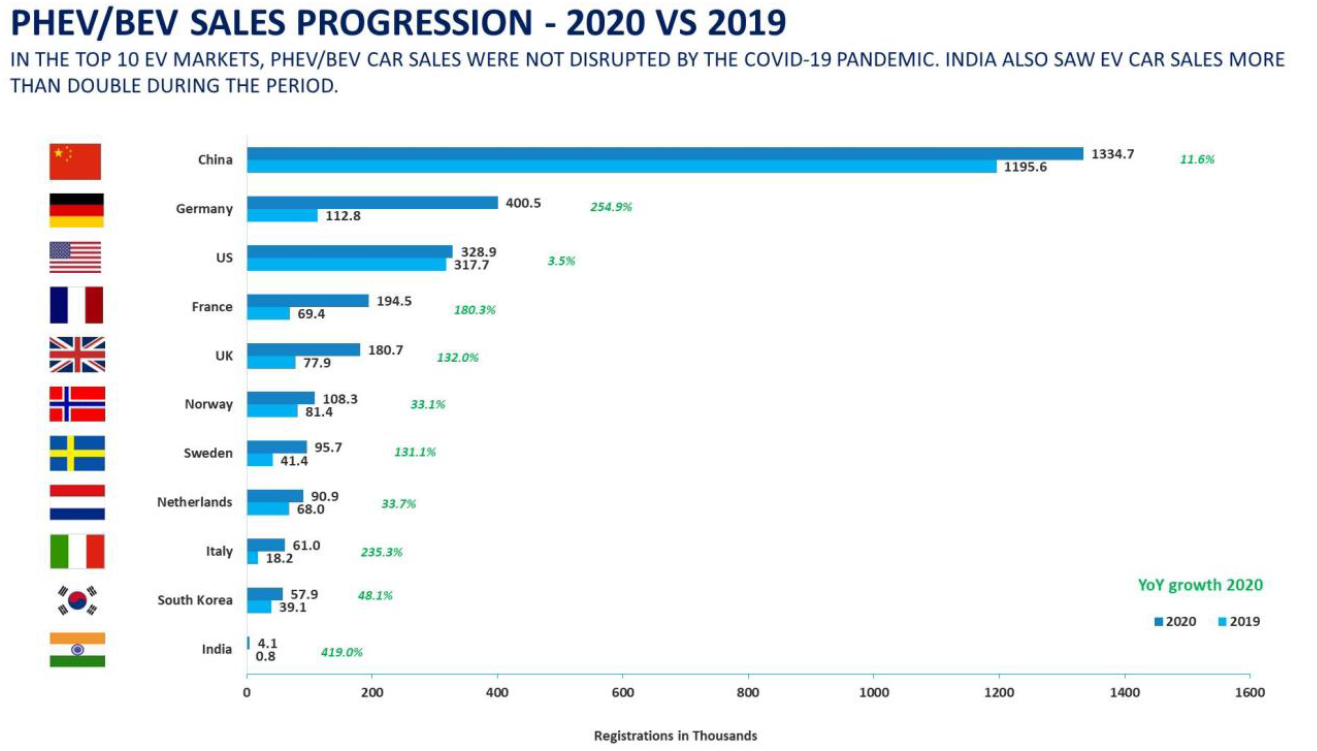

A new automotive ecosystem is emerging globally as a result of connected, autonomous, shared and electric (CASE) mega trends, transforming the aftermarket in the process. Traditional revenue streams generated by internal combustion engine (ICE) vehicles are set to dry up; however, electrification will unleash a flood of new growth opportunities associated with servicing plug-in hybrids (PHEVs) and battery electric vehicles (BEVs). As new pockets of demand emerge, existing companies and recent entrants in the aftermarket will be compelled to design appropriate electrification-led business models.

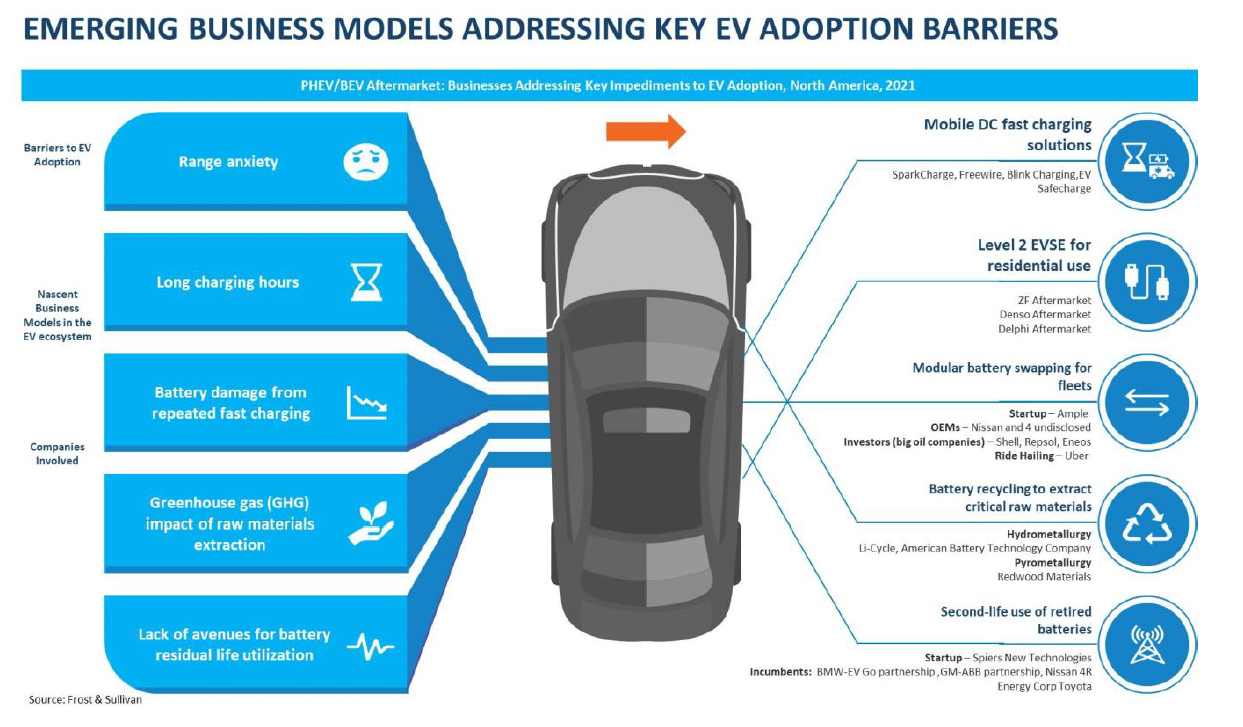

One of the biggest restraints to the increased adoption of electric vehicles across most markets is the concern about battery range. This has been making the deal look like a trade-off between a traditional powertrain vehicle and an electric vehicle. It has, therefore, become imperative to address this challenge, leading to market participants exploring various business models.

Some of the most prevalent models include providing efficient mobile or at-home charging solutions. This creates room for a variety of participants to enter the space and operate with their own value propositions.

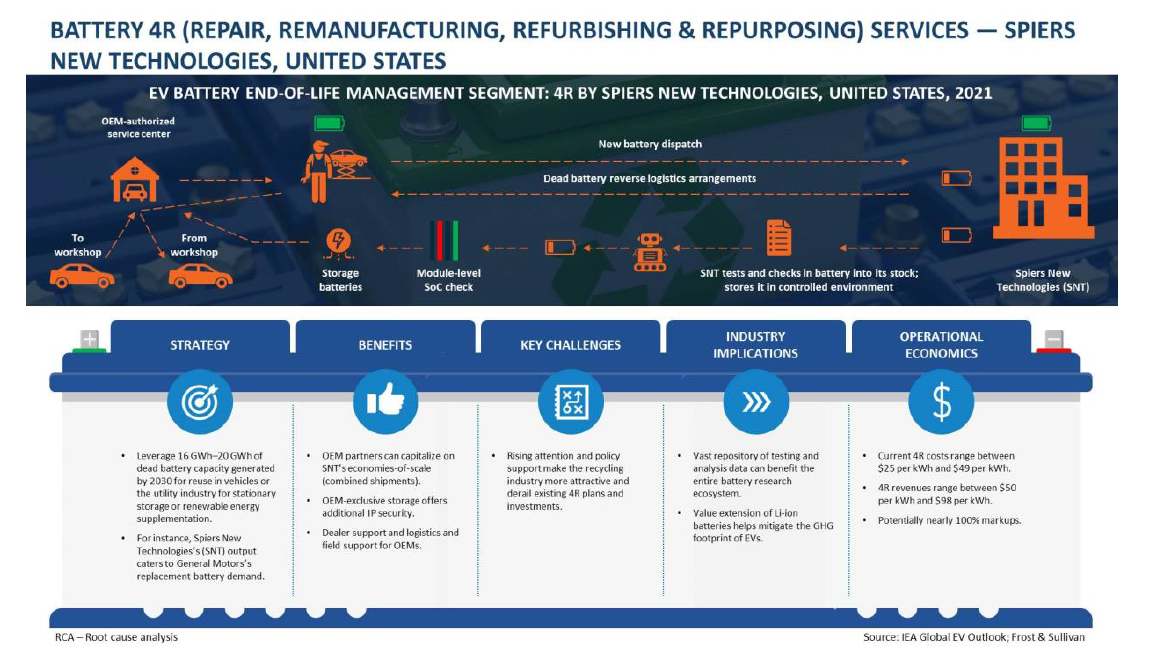

Some of the other business models around end-of-life battery management have emerged as a necessity because regulatory mandates compel market participants to ensure the safe disposal of dead batteries.

Four major demand pockets

Our latest research identifies four key areas of demand: battery end-of-life management, battery swapping for fleets, mobile DC charging, and Level 2 Electric Vehicle Supply Equipment (EVSE) retail that will offer healthy growth potential.

Battery end-of-life management that focuses on reusing and recycling, and modular battery swapping for ride-hailing fleets will require huge upfront investments to scale operations.

However, app-based, on-demand DC fast charging (FC) and direct-to-consumer sales of Level 2 EVSE that address range anxiety will constitute more low-hanging fruit, offering more easily realisable goals for stakeholders.

Revenue and growth opportunities

According to our estimation, the revenue opportunity size in North America alone could be USD2.1 billion for Level 2 EVSE retail, USD 972 million for battery end-of-life management, USD 975 million for mobile DC charging and USD 347 million for battery swapping by the end of 2030.

In India, while the opportunity could be relatively smaller, it will, nonetheless, represent an opportunity worth tapping as concerns surrounding India’s high fuel import bill, deteriorating air quality levels and spiraling fuel costs gradually nudge personal mobility preferences toward electric or hybrid options. Sensing this, OEMs are diversifying their EV portfolios and the choice of models available for the consumers, catalysing EV adoption.

Based on trends, we expect battery end-of-life management and mobile DC charging to be major focus areas for independent aftermarket (IAM) participants.

In 2020, approximately 13,302 EVs were sold in India compared to 375,000 in North America. A cumulative retired lithium-ion battery capacity of 19.4 GWh is anticipated in North America by 2030. We see participants adopting one of the two approaches for end-of-life management of this capacity. Each of them will require different levels of scale and investments.

The first will be battery recycling to extract critical raw materials from dead batteries and introduce them into new battery supply chains. The second will be battery reuse as part of second life use in both automotive and non-automotive applications.

In India, the potential for deployment of retired EV battery capacity for non-automotive purposes gains further significance when viewed against the backdrop of the country’s renewable energy ambitions of installing nearly 450 GW capacity by 2030. This scale of deployment will create a demand for cost-effective stationary storage solutions, which the EV-retired batteries can provide.

As part of its sustainability initiatives, Tata Chemicals is already active in the lithium-ion battery recycling space, with its current focus predominantly on batteries extracted from consumer electronics products. The company plans to tap into retired EVs as a battery source for its operations once EVs go mainstream, generating sufficient volumes.

Most of the current business of Gravita India Ltd, the market leader in India’s battery recycling space, comes from recycling lead-acid batteries. It is now eyeing the EV battery recycling opportunity and expects it to be a viable revenue stream by the end of the decade.

All signs point to the fact that public direct current fast-charging (DCFC) infrastructure will be unable to keep pace with the dramatic growth in PHEV/BEV vehicle parc. This will present significant and lucrative business opportunities for providers of B2C mobile DCFC—charging-as-a-service, with off-peak charging keeping charge replenishment costs low.

Almost 70%-80% of the charging needs of PHEVs/BEVs are likely to be addressed through residential charging. Consequently, we believe that sales of Level 2 EVSE will offer a profitable business opportunity spurring residential consumers to shift to faster-charging equipment such as Level 2.

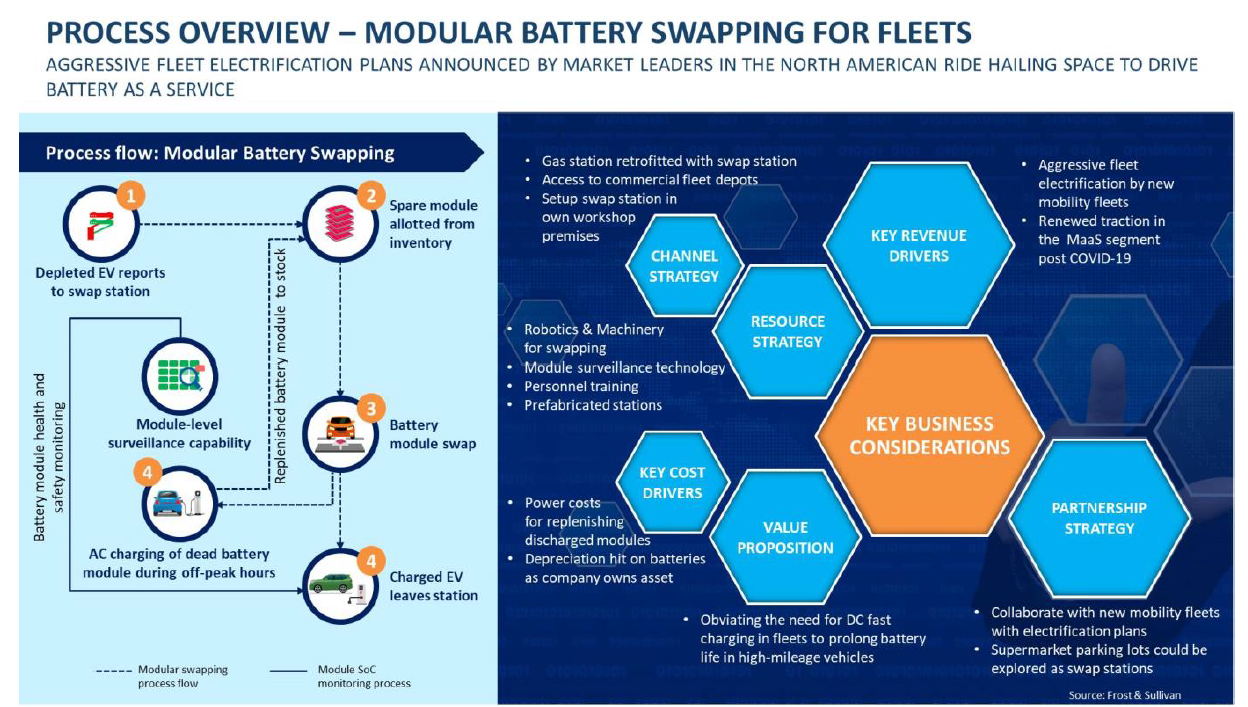

Battery swapping for fleet applications will be another prospective growth area. Shared mobility operators are heavy annual vehicle miles traveled (VMT) generators, averaging over 30,000 miles annually. Heavy usage, coupled with the adverse impact of repeated DCFC on battery life, will underline the appeal of modular battery swapping as a viable fast-charging solution for fleet needs.

A 2018 NITI Aayog study on shared mobility trends in India forecast an approximately 27% potential reduction in the cumulative vehicle kilometers traveled in a high-sharing scenario (a scenario where there is high adoption of shared mobility solutions like Uber and Ola), compared to the business-as-usual scenario (a scenario where the adoption levels will remain as they are today) by 2034.

Meanwhile, ride-hailing players such as Ola and Uber are pursuing aggressive fleet electrification plans as the environmental, social and corporate governance theme gains wider currency. Therefore, as urban mobility turns increasingly toward shared and electric, battery swapping is anticipated to find favour among drivers of shared EVs, offering service providers the benefit of scale.

Another area where we are seeing OEM interest is in totaled vehicle battery refurbishment, which involves the retrieval of usable EV batteries from total loss vehicles. This offers growth opportunities and minimizes the stress on a battery waste management ecosystem that is only now gradually taking shape.

Five growth areas

Aftermarket participants will also need to re-examine their strategies vis-a-vis the replacement of EV components. Indications are that the expertise required for producing EV components that integrate with vehicle control systems will be the preserve of the OE channel, while the IAM channel will turn its attention to remanufacturing for failed parts that are not covered by warranties.

In line with this, Frost & Sullivan’s research highlights five major opportunity areas for aftermarket replacement. They are:-

- The failure of e-compressors in PHEVs/BEVs will create opportunities for replacement with new/remanufactured parts.

- The replacement of integrated starter generators (ISGs) in PHEVs.

- The replacement of power electronics components like integrated inverters and DC-DC converters, whose long-term reliability is compromised by the heat and wear-and-tear associated with high switching frequencies in EVs.

- Battery replacement—Repeated charging causes a substantial deterioration in the energy storage capacity of EV batteries. A 25%-30% drop in original battery capacity renders them unusable in automotive applications, resulting in replacement with refurbished batteries with higher capacities.

- The replacement demand for drive motors and reducers.

The bottom line

We will see an array of new demand pockets and business opportunities emerging for incumbents and new entrants in the aftermarket value chain owing to the adoption of PHEVs and BEVs.

The possibilities for the aftermarket to flourish and grow in a new era of electrified vehicles are real and enormous. They include the consumer readiness to convert conventional ICEs to hybrid/EV variants through do-it- yourself (DIY) and do-it-for-me (DIFM) modes, mobile servicing for private EVs, dealership infrastructure upgrades to ensure preparedness for EV sales, and servicing and smart solutions focused on tyre life optimisation technology for EV fleets.

What the aftermarket stakeholders need to do is to identify and leverage these embryonic opportunities with targeted, electrification-led strategies.

(Disclaimer: Anuj Monga, Associate Director, Mobility Practice, Frost & Sullivan, has written this article with contributions from Pranav Nair, Senior Research Analyst, Mobility Practice, Frost & Sullivan. Views are personal.)

Also Read: