There is one glaring peculiarity about the electric two wheeler market in India that not many are paying much attention to–the overwhelming dominance of scooters.

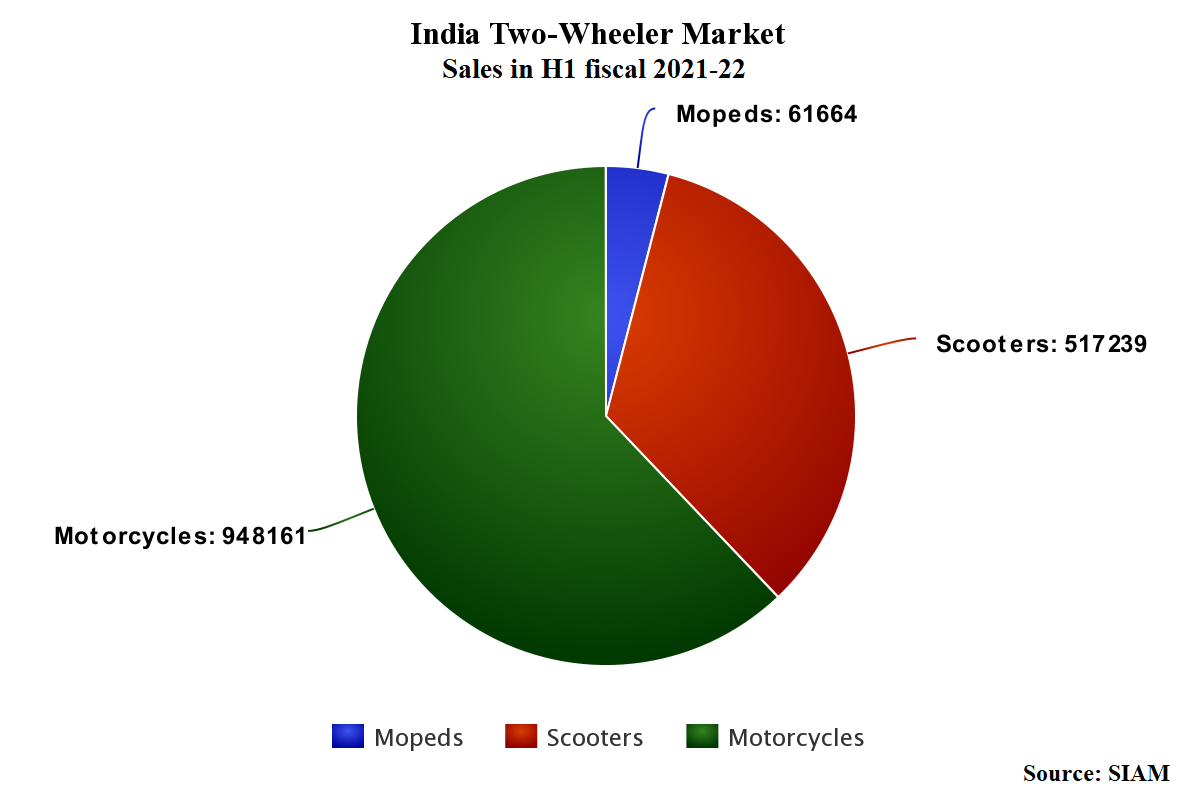

Unlike the conventional two wheeler market where motorcycles dominate with over 60 percent share, scooters have cornered the lion’s share of the nascent electric market with over 90 percent share. It is easy to see why it is so. While there are over two dozen companies–big and small, that have ventured into manufacture and sale of electric scooters, only a handful are into motorcycles.

From Bhavish Aggarwal’s Ola Electric to Ather Energy, Hero Electric, Okinawa and Ampere Electric, most manufacturers are only offering scooters. Even legacy firms like TVS Motor and Bajaj Auto that have a motorcycle heavy portfolio in the traditional category, are yet to launch any motorcycle in the electric segment though they have one scooter each there. Similarly, market-leader Hero MotoCorp will also foray into the electric segment later this fiscal with a scooter. The only companies that make electric motorcycles today are Revolt Motors, Tork Motorcycles, Evolet India, WardWizard and Ultraviolette Automotive.

The dichotomy between conventional and electric two wheeler markets is stark.

“Scooter is really the low hanging fruit for electric vehicles. Most scooter users dont travel more than 15 kilometers in a day so the vehicles are more conservative. The battery requirement in a scooter is small which makes them more competitive in price,” says Hemant Kabra, director RR Global and founder and managing director, Bgauss. “Motorcycles on the other hand need more power which means a bigger electric motor as well as battery which pushes up the cost. In times to come, motorcycles will take off in EVs too but India’s is a value conscious market so scooters will remain the mainstay.”

If it does, it will mean a big departure from the current scenario. Due to their unisex appeal and greater practicality in terms of storage space, demand for scooters has grown in India in the last decade to stabilise at around 30 percent of the market. Motorcycles still command the bigger share. In the electric vehicle space globally too, it is the scooters that dominate.

“It is partly a technical issue. Scooters with their lower ground clearance and flat footboard lend themselves more easily to the electric powertrain where the battery can be placed along the floor,” says industry veteran Arun Malhotra. “In a motorcycle, integrating the electric motor and the battery while maintaining the stability of the vehicle is more complicated.”

Narayan Subramaniam the founder and CEO of Bangalore based startup Ultraviolette agrees the industry has thus far suffered from technological deficiencies but those can be and are being fixed.

“There are a couple of reasons we see a lot more scooter companies in the EV space today. The technological capability is at a very nascent stage across the board for higher-performance electric vehicles. Building this capability requires several years of in-depth research, development and Testing on multiple fronts – power electronics, thermal management, battery management & safety systems,” he says. “Then, there are several options on commodity battery and drivetrain components for lower performance requirements. Hence, time to market can be faster for scooters.”

Another reason could be that most EVs in India right now are merely versions of what is available in the rest of the world–especially in China and other East Asian markets. As the industry evolves and more research and development moves in-house, companies will offer more motorcycles. Not everybody agrees that scooters will continue to dominate.

“Presently most of the manufacturers are using imported kits so bulk of the availability is in scooters. However, as soon as we start seeing local R&D catch up in India, especially from big players like Hero and Bajaj, we will see bikes gaining share,” said Puneet Gupta, director IHS Markit. “India is a young country so bikes will always be preferred even though I feel scooter is a better option as the battery, which is very expensive, is relatively less theft prone in scooters, as it can be hidden under seats.”

Rahul Sharma, the CEO of Revolt Motors that sells one of the few electric motorcycles on offer–the RV 400, is convinced that in future bikes will command the same share in EVs as today. Last month, Sharma even took a dig at scooters mocking them as “old school” in a video that he tweeted on the occasion of World EV day.

We are all set to revv up your swag. So you can choose what’s really cool!

Watch out for this space for more on the World EV Day, 9th Sep, 12:00noon.#WorldEVday #RideTheChange #JoinTheReVolt@rahulsharma pic.twitter.com/ImPq0fiPsf— Revolt Motors (@RevoltMotorsIN) September 7, 2021

“Motorcycles command 60-65 percent of two wheeler sales in the country today and scooters account for the rest. I am sure in future it will be the same in the electric segment as well,” he told ETAuto. “We will essentially cater to the same set of customers who are buying motorcycles today. That is 65 percent of the market. For me, it is a no brainer this is the segment where the bulk of the demand will be. Even the shared mobility or delivery segment today mostly use motorcycles and they will continue to prefer them over scooters.”

Given the lack of options, companies are also looking at it from a global perspective. Subramaniam’s Ultraviolette for example has received significant interest from overseas markets too for its upcoming maiden offering.

“The ICE 2 wheeler industry has evolved over the past few decades to what we see today – higher numbers in terms of motorcycles than scooters. Now coming to electric vehicles, the need for motorcycles is strong. However, today, very few companies in India and international markets have the battery or drivetrain technology to cater to higher power & performance requirements,” he says.

“Targeting low-performance EV segments may be the industry’s short-term approach but we have developed core EV technology in India for 200-600cc equivalent performance. This gives us a long-term competitive edge in the electric motorcycle space,” he adds. “Based on our experience, we believe that there is a lot of consumer interest for electric motorcycles in the country and there is substantial opportunity for this category to grow in the overall EV two- wheeler segment.”

With most companies focussed on the scooter segment, this is also a market that is less cluttered and competitive. Fewer players could mean there is more to gain here.

“We want more players to come and I am sure they will but if they dont, I am not complaining,” says Sharma of Revolt. “Right now the demand far outstrips the supply and I cannot keep up. This industry as a whole and the segment with it will double every year for many years.”

The relative lack of interest of pure play motorcycle makers like Bajaj Auto or Royal Enfield is also telling. Enfield’s Siddhartha Lal recently said the market was still not ripe for electric motorcycles. That may be a bluff but if it is not then it runs the risk of missing out on an opportunity, leaving it for others to exploit. Little known Komaki Electric Vehicles for example, is gearing up to launch what it calls India’s first electric cruiser motorcycle in January next year.

“There is no reason we will not see electric motorcycles. It is just a matter of time. A lot will depend on pricing, performance and choices,” says Ravi Bhatia, president and director, Jato Dynamics. “Bike makers may come together to commonise battery and charging points. Given the youthful demographics, I do see motorcycles continuing to have a higher share in the market.”

Fresh off the press, India’s largest scooter maker Honda Motorcycle and Scooter India is also planning to enter the electric segment with its own scooter next fiscal. That shouldn’t come as a surprise but the bikes should follow soon.

Also Read: