By Ashim Sharma

In line with our ‘Nine game changers in the next decade for the Indian automotive industry’, Connected Vehicles is a key focus area. Digital migration has been considered as one of the upbeats among the many gloom-ridden events during Covid-19. As the country went under lockdown, digital connectivity bound people together. This digitisation also appended the evolving connected vehicle ecosystem in the country. With the increased focus on driver experience, comfort, safety, and vehicle efficiency, the shift to digitisation will fuel the surge in the connected cars market in India making it reach USD 18 billion to 22 billion by 2030 at a CAGR of 25%.

Emergence of new revenue streams

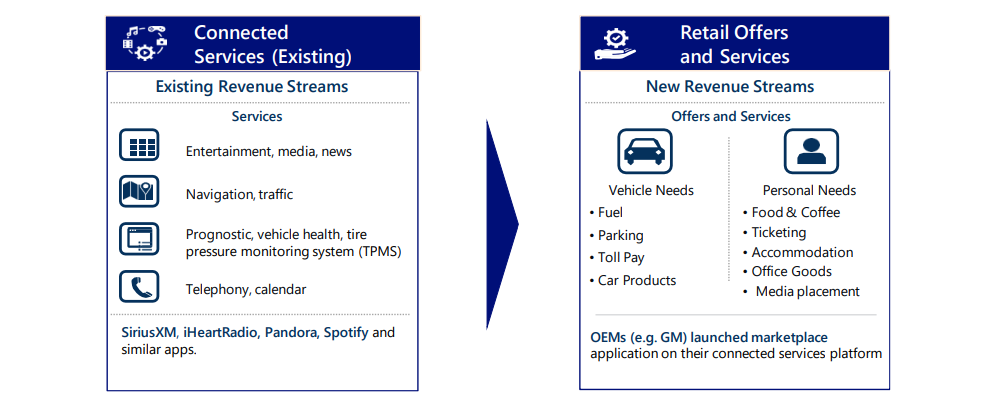

Earlier connected technology was only synonymous with features like vehicle tracking, e-call, roadside assistance, and smartphone mirroring. The technology has evolved to include features like automatic collision notifications, vehicle monitoring, service scheduling, vehicle health reports, driving analysis, geo-based services, cloud storage, and many more.

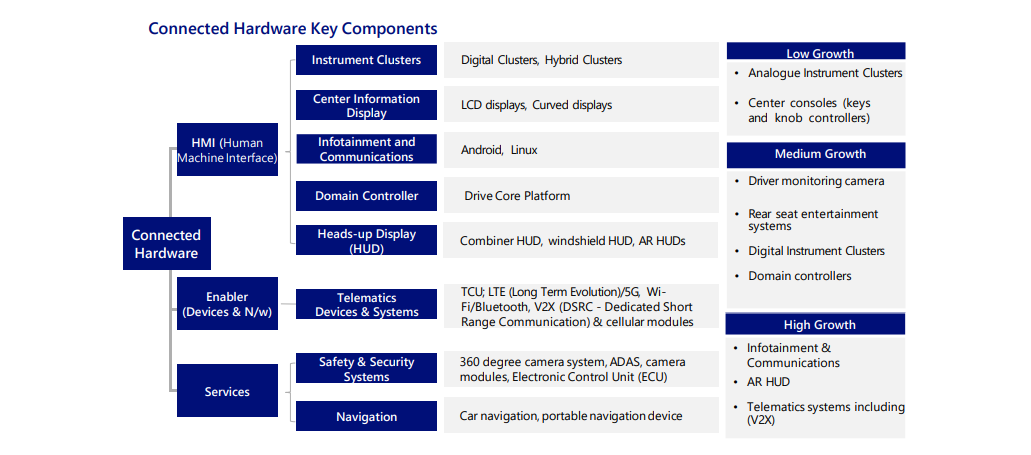

Connected vehicle ecosystem calls for the interaction of the vehicle with other vehicles (V2V), pedestrians (V2P), cloud (V2C), energy grids (V2G), and road infra (V2I). This functional demand will require technological transformation on the vehicles’ side, creating additional demand in the automotive allied industries for HMI devices, telematics, security, and navigation applications.

In the years to come, we will see devices like analogue instrument clusters and centre consoles decelerate, while the growth of infotainment, communication, HUD, and telematics devices accelerate

The global OEMs are partnering with value chain players to latch onto this promising market opportunity and to address vehicle and consumer needs, generating additional revenue from the same vehicle sale. Connected technology serves in media, entertainment, navigation, traffic, tyre pressure, vehicle health, and scheduler. With the technological advancement in this field, connected technology might be able to provide for vehicular needs like fuel, parking, toll payment, and drivers’ needs like food, ticketing, accommodation, office goods, and media placements.

Similarly, the possibility of more auxiliary revenue models like mass-scale deployment of OEM-based e-wallets cannot be ruled out in the near future as the technology and digitisation ramp up. Prevalent in-vehicle payment use case involves fuel purchases, take away orders, and making online reservations, and in the future can potentially be augmented in mobility and parking services with an OEM-based e-wallet.

For commercial vehicle fleet providers, connectivity and telematics-based solutions provide multiple benefits in the form of real-time delivery, scheduling, and quality control. The resultant web of connectivity provides assistance to Logistics Service Providers (LSPs), truck drivers, OEMs, and the after sales service and Insurance providers with multiple useful solutions for all participants of the ecosystem.

For the LSP companies, connected technology will be able to deliver drivers’ feedback, fleet management, route optimization, theft protection, repair payments, and warehouse management.

For trucks, connected technology will provide reliable traffic information, workshop location, fuel station, restaurant and police station locations and maintenance requirements. On the after sales network, information on preventive maintenance notification, emergency medical services, payments for repairs, insurance, damage reports, and driving feedback will be available with the help of connected vehicle technology.

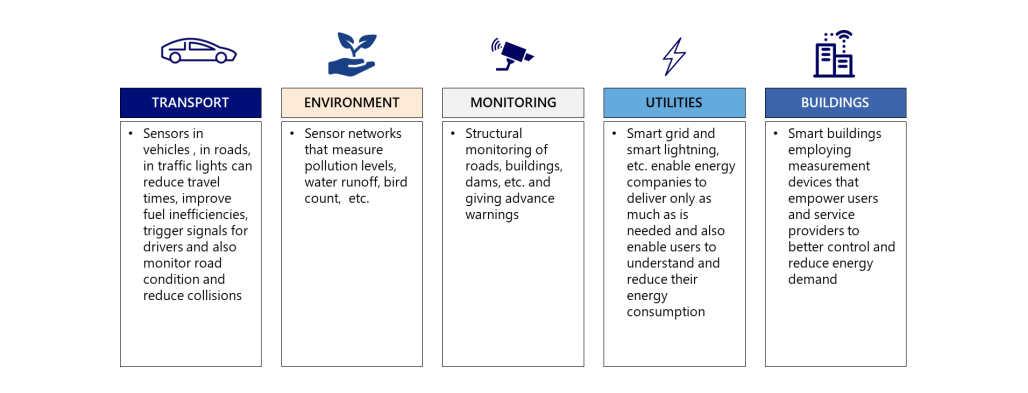

With the increased acceptability of connected vehicle technology, its confluence with the elements of smart city will reap benefits across the ecosystem. An amalgamated use of relevant sensors, greater network connectivity, and advanced devices can aid environment monitoring, utilities, and buildings directly or indirectly. In addition to the better driving experience, connected technology can be maneuvered to measure pollution levels, water runoff, structural monitoring of buildings, bridges, provide smart and efficient electricity and reduce energy wastage in the city.

Challenges to overcome

Compared to some of the developed countries, India lagged behind in infrastructure and technological advancements and hence also saw a delayed introduction of the connected car services. In its initial phase, connected services were used for Fleet Management Services in commercial vehicles. But in recent years, with the proliferation of smartphones and internet connectivity, connected services have been augmented to entertainment-based services. Along with smartphones, OEMs are slowly migrating towards embedded TCU solutions to provide higher functionality and security to drivers with advanced functions like entertainment, remote control, car data, and improved integration with the car security system.

While the opportunity looks exciting for connected vehicles, multiple challenges like longer product development cycle, network connectivity, unavailability of bandwidth and frequency and fear on the lines of data security and privacy are holding back large scale adoption of the technology in India.

It is expected that the connected vehicle technology will make advancements and maturity in the coming years and will continue to add premium features. But for that to happen, we would need the combined efforts of the government, automobile manufacturers, and after sales service providers. In addition, the focus would need to be on delivering useful solutions for creating a favorable demand for the technology by the country’s population

Time for action

Connected vehicle technologies will create multiple revenue streams and revenue opportunities for OEMs throughout the ownership experience of the vehicle unlike the current revenue streams of vehicle purchase and maintenance. The recurrent use of connected services will boost revenues for OEMs and the partnering ecosystem. However, for that it is vital to ensure that the infrastructure and data security framework in the country keep pace.

Meanwhile OEMs must forge tie-ups and work with partners in the ecosystem to ensure seamless delivery of these services. If done right, it will certainly usher in a new era for OEMs and the data obtained will also open up possibilities of analytics for continuously improving the products, efficiency in processes and enhancing the customer experience.

(Disclaimer: Ashim Sharma is Partner & Group Head at NRI Consulting & Solutions India. NRI’s Yogesh Shivani (Senior Manager), and Himanshu (Senior Consultant) made significant contributions to this study. Views expressed are their own.)

Also Read: