Electric vehicle prices are set to rise in India as the cost of raw materials like nickel, copper, cobalt and manganese are shooting up while an impending demand supply mismatch in global lithium ion cell production has begun to pinch manufacturers.

A clutch of companies ETAuto spoke to said while they were looking at ways to contain the costs some of it will need to be passed on to the consumers. It would be the first price hike for this new age sector. The cost of raw materials used in the cathode — lithium, cobalt and nickel — and other key components including the electrolyte have risen. The impact has been stronger in the second half of the year with Chinese firms announcing a price increase of upto 20 percent. In EVs, wherever China treads, the world follows.

“There is definitely pressure from the input cost side. Cell prices have gone up by almost 40 percent. The increase is more in LFP as Tesla has announced that they will use only LFP in their low range products and whenever Tesla does something the impact is felt all across the industry,” says Samrath Kochar, CEO, Trontek. “It is impossible for EV prices to go down in the near future. It will only go up. The trend that prices were continually falling is over.”

Some have already started to raise prices. Late last month, Revolt Motors hiked prices of its flagship RV400 electric bike by Rs 18,000 citing raw material cost pressure. Similarly, Hero Lectro, the e-bicycle brand from the house of Hero Cycles, also increased prices of Rs 5000 across the board.

“While the price revision of our product line has been necessitated by external market factors such as increasing freight and input materials cost, it also ensures that our quality continues to meet customer expectations and global benchmarks,” said Hero Lectro CEO Aditya Munjal.

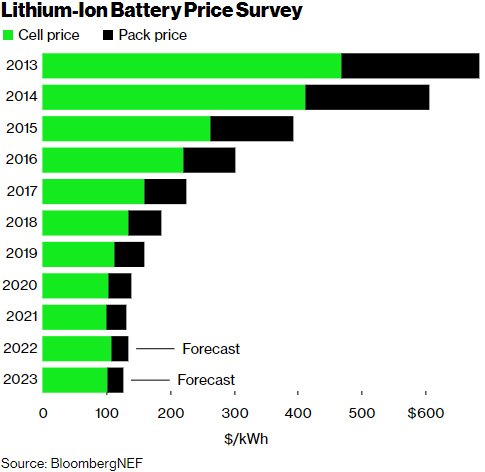

According to Bloomberg NEF, lithium ion battery pack prices fell sharply from $ 1220 per KWh (kilo-watt hour) to just $ 140 in 2020. This year though, the fall has been a modest 6 percent at $ 132 per KWh and Bloomberg estimates a marginal rise in price to $ 135 per KWh in 2022. Battery prices are now likely to fall below the magical $ 100 per KWh when they achieve price parity with their fossil fuel counterparts, only by 2024.

“Chinese lithium prices continue upward trend amid pre-winter restocking,” says Ravi Bhatia, President and CEO, JATO Dynamics India. “Lithium prices in China have also continued to rise due to re-stocking ahead of winter demand. New recommendations on battery energy density by the Chinese government could also drive up demand for nickel-cobalt-manganese (NCM) batteries in the domestic market.”

Besides the current rise in cost of raw materials which is also due to the global boom in commodity prices, the bigger concern is a shortage of lithium ion cells. India does not produce any cell today which is a core element of the battery pack, which in turn is a core part of the electric vehicle itself–cell accounts for 75 percent of the cost of a battery pack which accounts for 40-50 percent cost of an EV. Globally, lithium ion cell production capacity stands at 350 GWh today and is expected to cross 500 GWh by the end of next year. While companies like CATL, LG Chem, Panasonic etc are expanding aggressively, demand for electric vehicles may yet far exceed fresh capacity buildup.

“Battery prices had been falling due to technology intervention and increase in demand due to scale. Earlier there was lower demand and high supply. Now it is the other way round,” says Kochar of Trontek. “Right now there is no real shortage of cells but prices have gone up. But what I am hearing is that the situation will become similar to semiconductor chips in ICE. We may be staring at a shortage next year.”

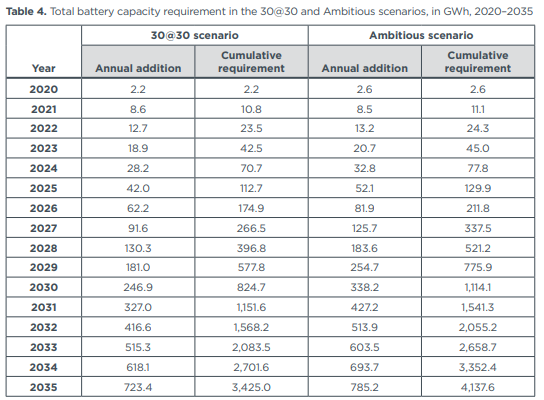

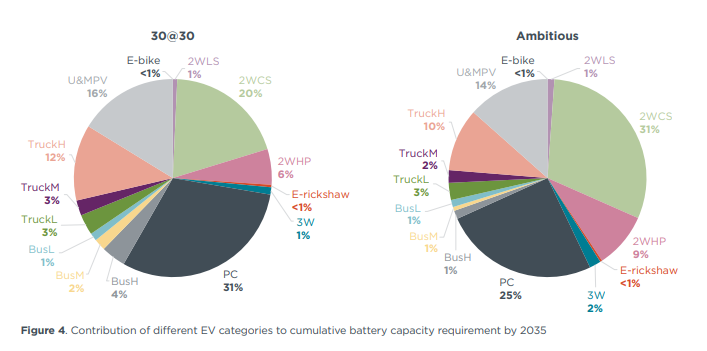

This would put domestic manufacturers in a particularly difficult spot as just like semiconductor chips, India does not produce any lithium ion cells of its own and is completely dependent on imports from countries like Taiwan, China and South Korea. According to a working paper by ICCT from February 2021, India would need between 3400-4100 GWh battery capacity by 2035. That is ten times the global capacity of today. For India, it would be imperative that lithium cell manufacturing takes off in a big way. The required investment in this area alone is estimated to the tune of $ 7-8 billion over the next 5 years, and at least $ 50-70 billion in the next 10 years. The challenge to localise is massive.

“There are two ways to look at it. First the scale of localisation of the components similar to petrol scooters like plastic and steel parts, where costs are currently higher in electric two wheelers due to low volumes however will eventually even out. Few materials like for permanent magnets, semiconductors, lithium, cobalt and copper will therefore govern the cost differentials and will need to be managed strategically,” says Sohinder Gill, CEO Hero Electric. “There is no clear long term cost trend of such materials except the short term price volatility due to demand supply equations. We believe that we are in for a long haul and would factor such cyclic cost variations in our manufacturing.”

Vivekananda Hellekere, the CEO and co-founder of Bounce which recently launched its first electric scooter Infinity, believes the pressure on cost will not be from just the cells but also in many components in electronics. The typical electric motor for example, uses magnets, which are rare, in a big way. Hellekere is however hopeful that technology intervention in the next few years will help to somewhat mitigate the risk of shortages and arbitrary cost pressures.

“There are a lot of investments taking place in new battery chemistries but in the short to medium term prices will go up,” he says. “That is at the back end but even in the front end with electric motors, I believe the prices will go up. With the kind of demand we are witnessing for motors, there will be an absolute stress on magnets. So what we are doing is investing in reluctance motors which do not use magnets. Those are the kind of investments we are making to ensure we are somewhat insulated which in turn should give us an edge over others in pricing.”

Also Read: