New Delhi: Broadly the tale of 3 Cs summarizes the past one year of the Indian automobile industry – cars, chip crunch and COVID-19. In the first quarter of FY22, Maruti Suzuki, Hyundai, Mahindra and other major car makers began warning shareholders of revenues falling to far below expectations. And the reason wasn’t the pandemic alone, which had already depressed sales during the second wave, but also the chip crunch.

These global issues that showed noticeable tightening in the operations of OEMs from January, 2021 pushed the Indian automakers by mid-year to a tricky spot. Manufacturers were not able to produce some of the highest selling models for want of the microchips needed to keep vehicles rolling off the production lines on time.

Microprocessors or chips are semiconductors that help power multiple functions in a vehicle such as releasing airbags, audio/video entertainment, navigation, collision detection system and switching on air-conditioning remotely.

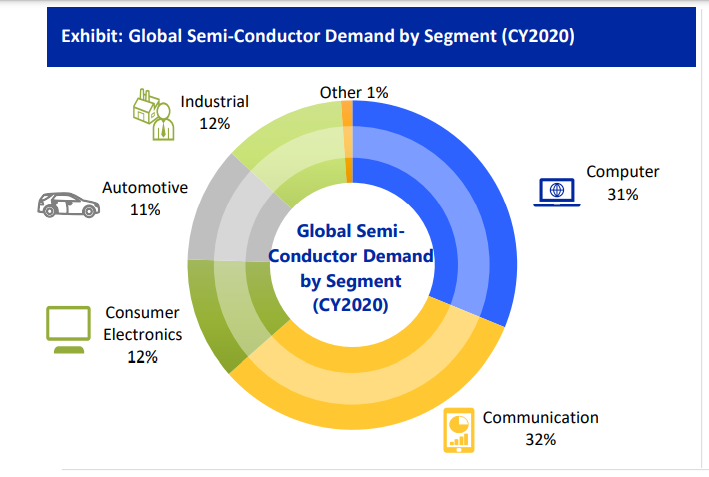

Stronger-than-expected demand recovery across industries, especially for computers and communication devices, along with supply disruption at a few chip manufacturing locations globally aggravated chip shortage.

According to Goldman Sachs, the disruption of the global chip supply chain had affected as many as 169 industries.

Now, the turmoil in the semiconductor space has caught two critical industries of the ‘Make in India’ dream – telecom and automobile- in a perfect storm. Despite high order book and high demand, ICRA expects that the Indian passenger vehicles industry will lose about 500,000 units of sales in the ongoing fiscal. The current scenario indicates that the shortage will continue at least through the first half of 2022.

PLI scheme comes to the rescue?

It is in this background that the Union Cabinet’s approval of incentives under the production-linked incentive (PLI) scheme worth INR 76,000 crore (USD 10 billion at current rates) for the development of semiconductors and display manufacturing ecosystems for the next six years to make India a global electronics hub gains significance.

Interested industry players have an opportunity to seek 25% incentives on capital expenditure for establishing a unit of Compound Semiconductor Wafer Fabrication (Fab), assembly, testing, and packaging facility.

How the auto industry was mauled?

For the past five months in a row, India’s largest automaker with over 50% market share is massively cutting its production on account of the severe shortage of microchips. The picture is no different for its peers as well. The latest data of industry body SIAM shows that the domestic auto industry has lost above 26% of passenger vehicle production between April and November.

The situation worsened during the festive season when passenger vehicle retail across India crashed nearly 26% from the same time the previous year, according to the Federation of Automobile Dealers Associations (FADA), an autonomous body. Auto retailers were feeling the pressure as inventory dropped drastically due to supply chain setbacks.

While the waiting period of new models such as Nissan Magnite and Mahindra XUV700 were in the range of 7-8 months, it was up to 10-12 months for other popular models like Thar, Ertiga and Creta during the 42 days of the recent festive season. FADA President Vinkesh Gulati said that the industry had witnessed the worst festive period in a decade mostly owing to the semiconductor shortage. “We could not cater to customers’ needs as SUVs, compact-SUVs, and luxury categories witnessed huge shortages,” he said in a statement last month.

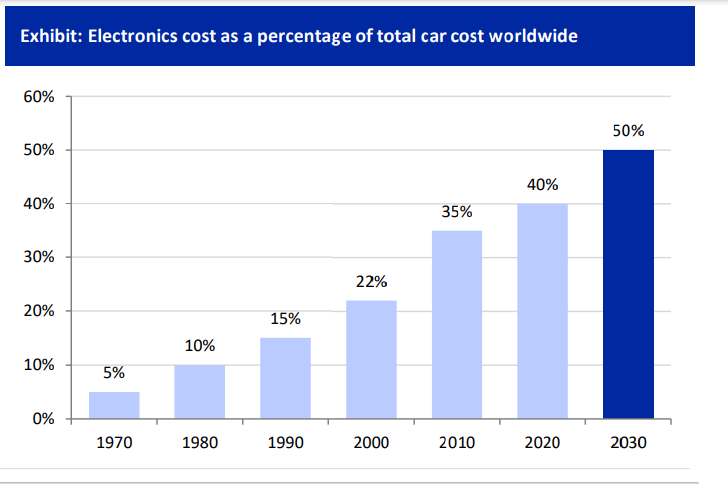

Of the industries that depend on semiconductors for their manufacturing, computer and communications hold the largest share of 31% and 32% respectively. The automotive industry constitutes only about 11% of the overall semiconductor demand worldwide. But the cost share of electronic components in relation to the total value of today’s average new automobile will grow from the present 40% to 50% by 2030, according to rating agency ICRA.

For India, electronic components form the third largest share in the country’s import basket after crude oil and gold. India doesn’t have any operational wafer fabrication plant and depends entirely on imports. The country imported electronic components worth INR 1.15 lakh crore in 2019-20, out of which, 37% came from China, as the data from Directorate General of Commercial Intelligence and Statistics shows.

Industry response to the new scheme

Manufacturing semiconductors is a very high tech and capital-intensive process and with the recent announcement of the incentive scheme India seems to have taken the first step. Backed by the ‘China Plus One’ sentiment, the industry players see this as a golden opportunity to present India as an electronic manufacturing hub globally.

“This strategic and path-breaking move shall lay foundation to a much needed indigenous and integrated electronic design and manufacturing ecosystem – bedrock of any developed economy in the digital and Industry 4.0 era. I am confident, this will now set-in-motion a longer-term process to transform India into an Innovation driven economy with focus on high-end capability, skills and value-creation, here in India,” Baba Kalyani, chairman and managing director, Bharat Forge Ltd, said.

Sanjay Gupta, managing director, NXP India, said approval of the PLI scheme for semiconductor will pave the path for the industry to broaden the horizon of research, manufacturing and export. “In the long term issues like sudden surge in demand for semiconductors will also be addressed. This move will also make the Indian manufacturers globally competitive to attract investment in the areas of core competency and cutting-edge technology,” he added.

Undoubtedly, the scheme is a shot in the arm for the ailing industries but how fast the recovery action will take is a pertinent question. Like automobiles, semiconductor chipsets are used across a wide range of smartphones, laptops, computers, smart home appliances like lights, fans and many other things. In short, the scarcity has flummoxed sectors ranging from consumer electronics, medical equipment to telecom. They all need chips on priority.

With such a large list, diversion of funds and preference of chip making firms and startups will play a critical role in deciding the recovery of dependent industries.

Also Read: