Before the global pandemic struck, auto OEMs were accustomed to steady budget increases as technology transformed business processes, models, and strategies. COVID-19 totally changed their approach to technology, future mobility and corresponding investments.

The pandemic also exposed the major supply chain weaknesses, including demand surges and drops, commodity shortages, reduced productivity, delivery delays and storage and product handling issues. Consequently, COVID-19 became an eye-opener for the adoption of resilient in-house supply chain and management solutions. And so, the stakeholders of the automotive industry rushed to make local arrangements.

“In 2021 a lot of investments have gone into digitisation across the value chain. A major part of the investments was on product development for electric vehicles and tweaking the manufacturing setup accordingly. Investments have also gone into the development cycles of the products for the forthcoming safety and emission regulations,” Ashim Sharma, partner and group head – business performance improvement consulting, Nomura Research Institute, said.

In a year of market oscillation, auto OEMs recorded USD 13 billion (~INR 99,000 crore) investment in India across all deal types, the most prominent being for electric mobility. Combining both the legacy players and the startups, almost half of the gross investments (~ INR 48,400 crore) was on electrical architecture development.

While OEMs and startups focused more on electric and future mobility in the short-to-medium term, suppliers spent more on technological upgrades and software resources.

After a period of pandemic-induced slowdown that resulted in subdued spending, market watchers say that consumer sentiments started looking up from January, 2021. This prompted company leaders to expedite spending.

During this period, automotive industries also witnessed disruption in the supply chain of microchips. This crisis continues, and an unavoidable concern should be raised on whether the semiconductor crunch will influence or reverse the R&D and the tech spending strategies in the coming months.

Here are some trends that drove the course of investments this year:

Investments got electrified: Spending towards future-mobility technologies continued throughout the pandemic. Research shows that about 48% (~INR 48,400 crore) of the total investments was in green and future mobility and related infrastructure development, especially in the aftermath of the COVID crisis.

This is due to the massive number of battery-operated electric propulsion technology developments and system integration around automation, connectivity, electrification, and smart mobility (ACES) features. Out of ACES, e-mobility has emerged as the main feature of investment according to ETAuto Research, particularly around battery technology and management systems, e-motors, and power electronics.

Electrification also got a major boost with the advent of new age companies. About 90% of startups in the auto industry are working and developing products related to EVs.

This, however, draws a sharp contrast to the early days of 2020 when e-mobility space was highlighted as one of the most negatively impacted areas due to COVID-19.

Software was at the core: Although businesses made substantial cuts in spending in almost every category, there were increasing technology budgets for most of the automakers (OEMs) and tier-1 suppliers. In the R&D areas of spending, companies have been allocating substantial budgets on software and software-related feature development. Overall, the investment trend highlights that the focus has been shifting in the automotive industry, both from the OEM and the supplier perspectives. Stakeholders have been placing software development at the forefront due to its important role in the vehicle of the future.

Vehicle navigation software, multi-operating infotainment systems, built-in cybersecurity and autonomous ADAS solutions have been among the focus areas drawing the attention of the automakers.

Automation is another area where companies diverted their software budget. Workforce shortages required organisations to look for opportunities to automate processes, shop floors and to reduce human involvement.

Startups made a mark: The non-incumbents, according to the Research, have made over INR 15,615 crore of investments on future-mobility in the last 12 months. Though the quantum is small, the startup community rallied to fight the Coronavirus crisis in the best way it knew—with innovations and updated technologies. These venture capital-backed newcomers were the ones who responded to the crisis with the fast adoption of digital technologies.

Although current volumes are limited, EVs are expected to grow in a big way. With the government focus on green mobility, it is reasonable to expect the influx of startups in this area and they form over 32% of investments in this space.

Comparatively, traditional automotive companies accounted for 67.7%, or roughly INR 32,800 crore of the total investment on electric mobility this year.

Supply-chain disruption pushed in-house capabilities: A more perceptible impact of the pandemic has been on the supply chain front. Supply chain concerns were radical not only because of COVID-19 but also because of geopolitical tensions, microchip shortages, and even the blockage of the Suez Canal.

OEMs have been aware of the fact that supply-side uncertainties may hinder sustainability-related innovation adoption. Therefore they started investing in new plants, production lines, and accelerated spending on electric vehicles, batteries and alternative energy.

Despite the recent market choppiness, the demand continues to grow very fast. Apart from startups, the attempt by incumbent companies to spend their way out of a post-recession recovery – by pouring money into under-invested infrastructure – and a growing commitment to decarbonisation are fuelling a robust demand in passenger vehicles not seen in years.

For instance, after a gap of over 15 years, India’s largest carmaker Maruti Suzuki India announced its plan to spent INR 18,000 crore in a greenfield factory in Haryana with a peak annual capacity of 10 lakh units

Similarly, the Indian wing of Fiat Chrysler Automobiles (FCA) showed its intention to spend INR 1,900 crore in expanding its product line to manufacture four new SUVs under the Jeep brand.

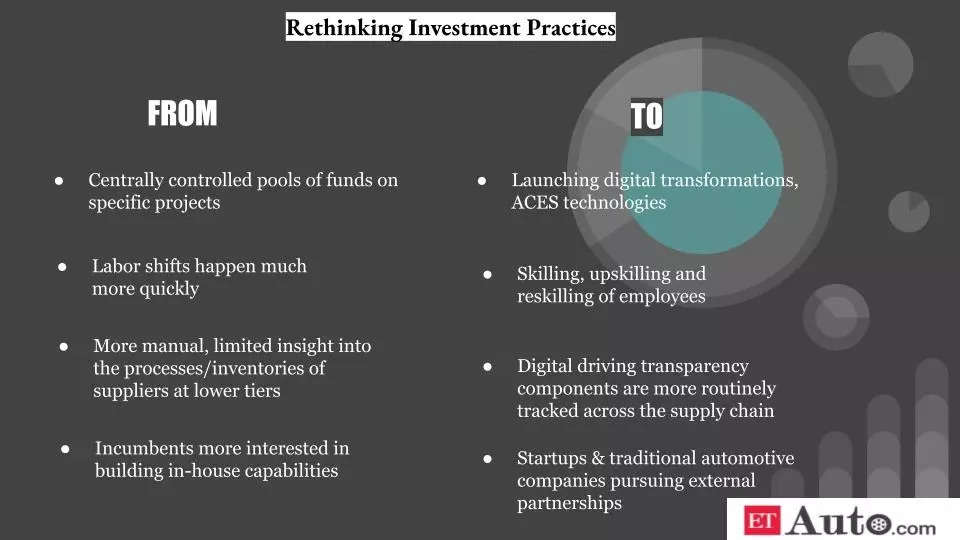

Conclusion: In the past year the mobility investors underscored the growing pace of change as the COVID-19 crisis added a new layer of complexity to an already challenging situation. This suggests a short window of time for all mobility stakeholders, including incumbents, tech giants, and investors, to prepare their businesses for disruption. It is therefore necessary to understand where the market is moving and why, and then move your capital accordingly.

(Disclaimer – The numbers may slightly differ from the actuals as these numbers represent only companies survey by ETAuto)

NOTE: The second part of ‘Investments in time of COVID-19’ segment will appear on Wednesday. Stay Tuned!