New Delhi:

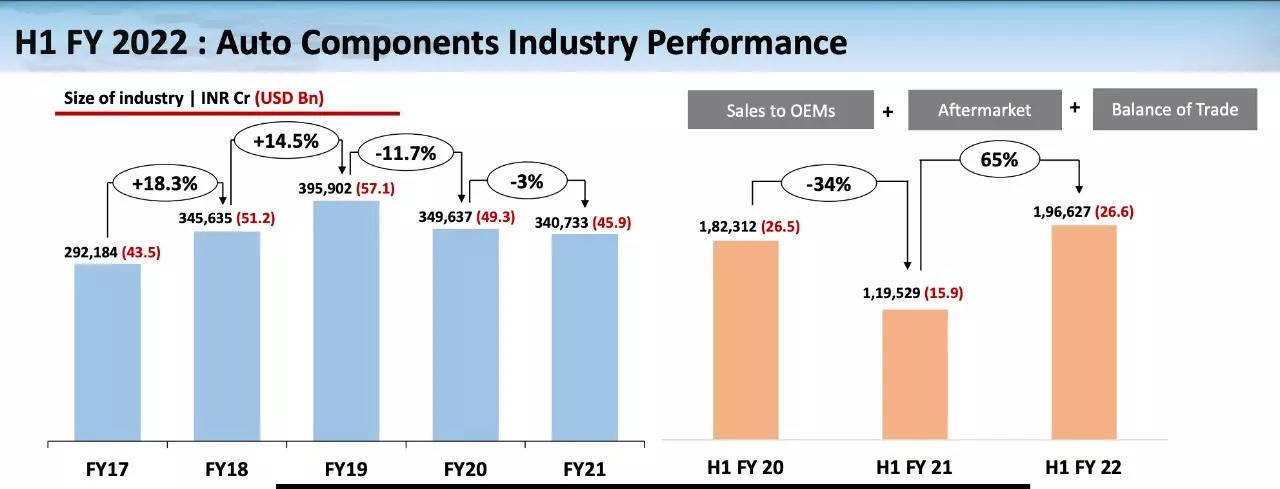

In the automotive value chain, the component makers are emerging as the dark horse. The segment seems to be on its way to achieving the previous peak revenue of the financial year 2018-19 in this financial year ending on March 31, 2022.India’s auto component Inc has mopped up revenue of USD 26.6 billion in the first half of the year with a rise of almost 67% compared to the same period in the previous year. By the end of this fiscal year, if no major negative disruption erupts, auto component makers are most likely to reach closer to the peak business of USD 57.1 billion in the previous financial year.

Traditionally, the component industry works in tandem with the performance of the vehicle industry. But this time it is going to be not so. The sales of the passenger vehicle segment (Cars, SUVs, and Vans) in the first eight months of FY22 (April-November 2021) were only at 1.8 million as against 3.4 million in the complete FY19.

Similarly in the two-wheeler segment, about 9.1 million units were sold in April – November 2021, which is not even half of the peak 21 million dispatched in FY19. Three-wheeler and CV segments remain the worst among the lot.

It is also to be noted that FY19, despite achieving peak volume YoY growth rate for most segments, was the slowest, burdened with policy complexities like GST, Demonetisation, etc.

Now, it becomes obvious that the silver lining of the component industry emerges from markets beyond the local.

Factors of advantage

So, what has worked in favour of the component makers?

The most prominent factor that drove the business up was the reduced production interruptions during the second wave unlike the Covid 19 first wave when the country went into a complete lockdown.

The manufacturers moved to exports as in the international market production had limped back to almost normal creating good demand.

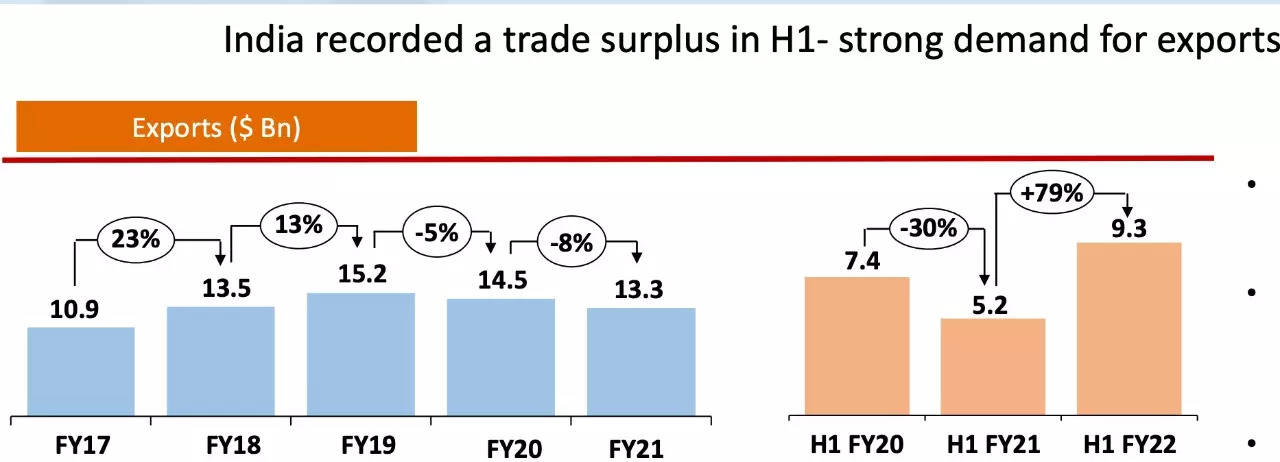

If all goes well, the auto parts industry may hit an all-time high revenue from exports in FY22. With a total offshore dispatch of USD 9.3 billion, a YoY 79% growth in the H1 of the current fiscal year, the industry registered USD 600 million trade surplus in H1 FY22. In FY19 the exports of auto parts were at USD 15.2 billion.

Yet, the full potential was not utilized because of the constraints such as container back log, and acute shortage of semiconductors which seems to be improving.

With the world struggling with the third wave, an increasing impact on China may further expand India’s opportunities in the international market. India has got adequate time due to the comparatively delayed entry of the third wave.

The demand for luxury and high-end vehicles in the local market also pushed the overall valuation of the industry. The other reason for increase in the component cost has been the massive increase in the prices of raw materials. It has also led to multiple price hikes by the vehicle manufacturers.

While demand from the conventional vehicle industry remained subdued, demand for electronics and electrical parts from the electric vehicle sector provided additional business.

The demand push from the after-sales service for the auto parts rose by 25% in H1. After the unlocking of state economies, aftermarket saw more stable demand.

Relatively higher mobility of CVs, trucks, and buses is likely to have a positive impact going ahead. In the first half, the aftermarket revenue for the component industry stood at USD 5.3 billion which is expected to remain stable or upward. Demand for repair and maintenance will remain the focus. Valuation may reach the peak, but the bottom line may not be that impressive.

Also Read: