New Delhi:

From supply constraints to sluggish demand in the domestic market, a double whammy for the auto sector is all set to weigh on the December quarter earnings of most listed firms. Initial projections show that at least a dozen auto and auto ancillary companies are likely to report about a 25% decline in Q3 margins due to severe semiconductor shortages that dented production, weak consumer sentiment, particularly in rural regions, and raw material headwinds.Throughout the October-December period, operational performance of the automakes and suppliers remained muted on account of double-digit volume decline and high margins in the base quarter. Additionally, subdued festive sales trimmed growth prospects and brokerages are largely projecting single-digit top-line expansion for most of the auto universe. Moreover, companies such as Mahindra & Mahindra (M&M), Hero MotoCorp, and Bajaj Auto stare at up to 400 bps drop in earnings before interest, tax, depreciation, and amortization (EBITDA) margin on erratic sales, analysts have warned.

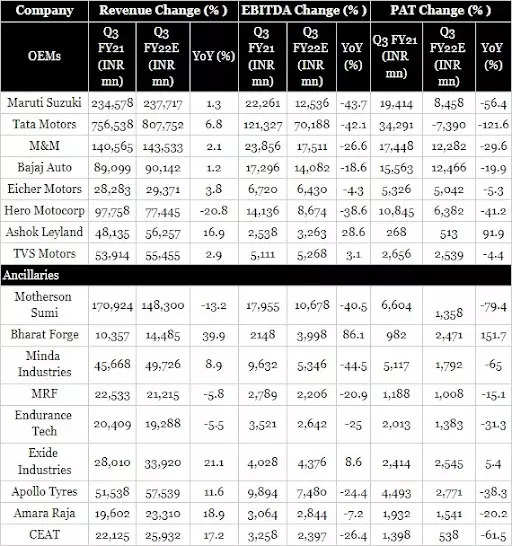

“We expect the OEM industry’s EBITDA (ex-Tata Motors) to decelerate 26% YoY on account of raw material cost inflation, though partially offset by operating leverage and price hikes. Ancillary industry’s EBITDA is likely to decelerate 25% YoY with substantial outperformance expected from Bharat Forge (+86% YoY),” Elara Capital said in a note.

Meanwhile, the brokerage expects revenue of its OEM coverage universe likely to remain flat at -0.3% YoY, while those for ancillaries may grow +1% YoY.

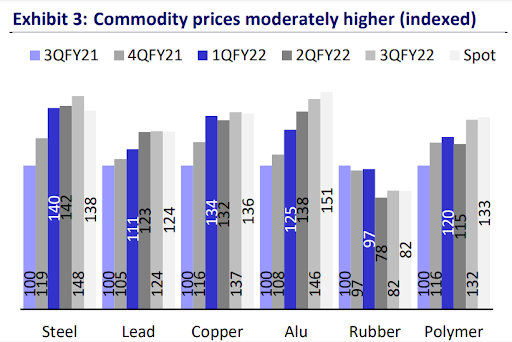

Margin recovery was seen until the first quarter of the ongoing financial year 2021-2022, Motilal Oswal said. Following this, there is pressure on profitability for the second consecutive quarter on a YoY basis majorly on the back of an upswing in commodity prices.

Notably, the OEMs have hiked prices within the range of 1.5%-3% in Q3 across-the-board, to partially cushion the impact on margins. “On a YoY basis, only Ashok Leyland and TVS Motors would report moderate improvement in margins,” it added.

Analysts at Motilal Oswal noted that the volume evolution during the quarter under review was a mixed bag, partly impacted by weak demand and partly by supply-side issues – which restricted the wholesale of PVs, premium motorcycles, and M&HCVs. Demand for two-wheelers and tractors failed to pick up during the festive season, they pointed out. Based on analyst assessment, top two-wheeler players like Hero MotoCorp, Bajaj Auto, and TVS will report a massive contraction in EBITDA margins because of negative operating leverage.

During the last quarter, wholesale volumes grew YoY for CVs by 7% and three-wheelers 15%, while volumes for PVs, two-wheelers, and tractors sank 4.5%, 20%, and 12%, respectively. The CV segment has outperformed, led by a sequential recovery in fleet movement and improved demand from construction and mining activities.

Quarterly volumes of listed auto OEMs

| OEMs | 3QFY22 | 3QFY21 | YoY (%) |

| Maruti Suzuki | 430,668 | 495,897 | -13.2 |

| M&M | 214,134 | 226,428 | -5.4 |

| Tata Motors | 199,633 | 158,215 | 26.2 |

| Hero MotoCorp | 1,292,136 | 1,846,941 | -30 |

| Bajaj Auto | 1,182,835 | 1,306,810 | -9.5 |

| TVS Motor | 878,659 | 989,517 | -11.2 |

| Royal Enfield | 169,526 | 199,668 | -15.1 |

| Ashok Leyland | 34,077 | 33,410 | 2 |

Kotak Institutional Equities (KIE) sees revenues for the auto component companies, under its coverage, increasing by 2% YoY in Q3 FY22 while EBITDA may drop by 23% YoY. A sharp recovery in CV demand, strong demand in the replacement segment, and higher average selling prices (ASPs) on account of price pass-through due to raw material inflation will aid the positive trend in the top line.

“Battery companies may benefit from the replacement segment. For tyre companies, revenues may grow by 7-8% YoY led by strong growth in the replacement segment and price increases taken during the quarter,” it added.

At the bourses, the Nifty Auto index grew 3.2% in Q3 FY21, thus underperforming the benchmark Nifty50 index which dipped by 1% during the same period.

While prices of major commodities such as aluminium, lead, and copper have remained firm at higher levels, steel and precious metal prices have declined in the last quarter. Brokerages are of the view that price rally should ease off and commodity pressure will be reduced in the coming quarters.

Analysts, however, caution that amid the looming threat of the Omicron variant of the Covid-19 virus the sector may have to witness a few rocking months. “Current issues of supply chain constraints and rising Covid cases are dynamic, but we see them leading to subdued demand and weak profitability in Q4 FY22,” analysts at Nirmal Bang said.

Also Read: