By

Ashim SharmaAround 35 million cars are running on Indian roads now. Over 25 million of them are running out of warranty and most of their owners find little or no incentive to visit OEM authorized service centres for their needs. The reasons may be the perception of higher service costs at dealerships or the hassle to find an authorized service centre at a convenient location. The customers look for reputed multi-brand aftermarket service providers close to them. An added boost for the aftermarket has been longer retention of cars as well as large proliferation of second-hand cars on account of the rise of personal mobility in the face of the Covid-19 pandemic.

Over the past decade, OEMs in India have improved their service networks considerably – both in availability and efficiency, and have managed to grab a pie of these out of warranty vehicles. However, despite great efforts, the service retention ratio for most OEMs in India remains at 40%. This means that 60% of the 25 million out of warranty vehicles still rely on the unorganized service centres to meet their service and repair needs.

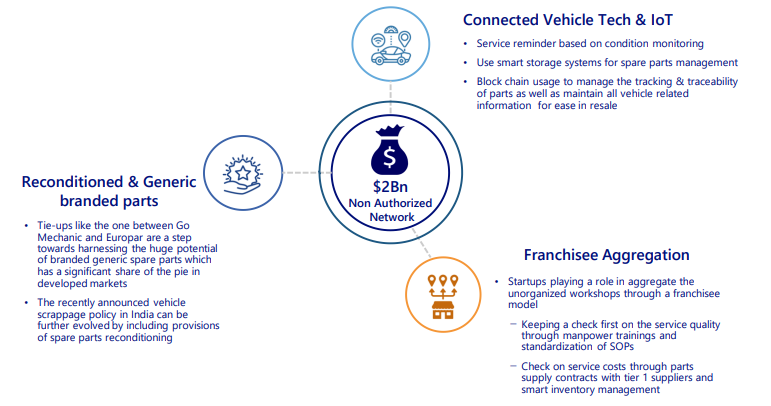

Assuming that an average car spends INR 10,000 in a year on service and repairs, these 16 million-cars-strong unauthorized markets stand at a massive INR 15,800 crore or USD 2 billion a year.

unorganized service Network

There are an estimated 300,000 unorganized service and repair workshops in India. These are spread across the length and breadth of the country – in metro cities, tier 2/3 cities, highways and villages. Most of these unorganized workshops might not have state of the art infrastructure and facilities like in an OEM-authorized workshop. They are still able to serve customers’ regular servicing and repair needs. While they are at a disadvantage in terms of infrastructure, spare parts availability, quality of trained manpower and ability to handle complex jobs such as those related to vehicle electronics, customers choose them due to their cost-effective servicing, availability at every nook and corner across the country and their ability to handle multi-brand cars at the same workshop.

In order to capture this aftermarket opportunity, there have been continuous efforts on both sides of the divide to innovate and to provide the customers the best of both worlds – spare parts and service cost, quality, infrastructure and turnaround time.

OEM innovations in aftermarket

OEMs don’t want to lose their share of the huge aftermarket opportunity. For the traditional dealerships, vehicle repair and servicing is one of the most profitable lines of business. The authorized OEM car servicing industry has been making considerable efforts to retain as many customers as they can.

Initially the focus of such innovations was on improving transparency, turnaround time, service costs and on building more trust between the customers and the dealers. Of late it has shifted to more advanced business improvement parameters such as incorporation of big data analytics to continuously monitor vehicle health through sensors data, adoption of smart storage systems for spare parts management, implementation of telematics and IoT, and experimenting with block chain usage to manage the tracking and traceability of parts across the supply chain and also offering multi-year service packages which can be renewed / extended.

There have been business model innovations to capture the unorganized service network. An example is the Gurugram-based company, GoMechanic, backed by global PE firms such as Tiger Global. It intends to aggregate the unorganized workshops through a franchisee model. To make them more attractive for the customers they are keeping a check on the service quality, through manpower training and standardization of SOPs and on service costs through parts supply contracts with tier-1 suppliers and smart inventory management.

But Go Mechanic is not alone in the market. There are other companies such as PitStop and Mahindra First Choice (Multi-brand).

All of them are innovating in technology and business models to capture the huge potential that lies in the unorganized car servicing market in India.

Similarly, GOpreuner, a recent initiative, is promoting self-employment programmes in Tier-2 & Tier-3 cities and also conducting training programmes.

Several startups are utilizing the block chain technology to maintain all vehicle-related information including title, service providers, prior damage, maintenance etc. Their range of services are being tailored for users, OEMs, producers and distributors of spare parts, insurance companies as well as fleet management services. All these are intended to make the spares and service business more efficient and also create transparency about the vehicle history in the used car market.

A few other recent trends also suggest a convergence of the organized and unorganized service industries in India. Though at a nascent stage and sporadic, such collaborations might hold the key to unlock the huge potential in the aftermarket service industry. One such collaboration is the tie-up between GoMechanic and Revolt Intellicorp, an electric motorcycle manufacturer in India. Through this tie-up, GoMechanic will act as exclusive service partner for all revolt motorcycles in India.

Another one is the tie-up between GoMechanic and Eurorepar, the independent part manufacturing company within the PSA group. Unorganized market aggregators are also tying up with the tier-1part suppliers for their inventory needs. Through these tie-ups it is evident that in the long run, both the organized and the unorganized markets have a lot to learn and contribute to each other’ success. While OEMs can leverage the huge reach and lean cost structure of the unorganized players, these smaller players and aggregators have a lot to gain in the form of technical knowhow, manpower training and OEM brand equity. In addition, tie-ups like the one with Europar are a step towards harnessing the huge potential of branded generic spare parts which has a significant share of the pie in developed markets.

The case for reconditioned parts

In the developed countries, reconditioned or remanufactured parts have been accepted widely since long. They have proven to be very effective in keeping the parts cost down for users, OEMs and workshops, simultaneously helping the automotive industry in boosting the circular economy. As per the European Remanufacturing Council, this is a Euro 30 billion industry in Europe alone.

The recently-announced vehicle scrappage policy in India can be further evolved by including provisions of spare parts reconditioning. Once a vehicle comes for disassembly, good auto components can be removed, reconditioned, reassembled, and obsolete parts can be junked. Then quality tests can be conducted before these parts are equated as new and put to fresh use either in the organized or unorganized market. However, a big lacuna in achieving this goal is to have proper certification and testing procedures in place and a central agency certifying the authenticity of such parts. If this is achieved, the cost of spare parts will go down for users, along with the risk of using spurious parts for older vehicles.

Future of car servicing industry

The Indian car market has witnessed a shift towards premium cars and SUVs and the customer preferences are continuously evolving in favour of safer and feature-laden cars. But the fact remains that a large chunk of the Indian car buyers are still price conscious. A large section of buyers also base their buying decision on the service cost and network availability, especially in the smaller towns and cities as well as rural areas of India.

This is perhaps one of the biggest ‘chicken and egg’ questions that OEMs in India (OEMs with lower volumes and new entrants) are continuously trying to solve – how to maintain a fine balance between service network expansion and sales growth. Analysis shows that there is a strong correlation between OEM market share and their service network. Market leaders have a strong network of more than 5,000- plus service centres. Smaller OEMs have a service network of just ~300 service stations across India.

While addressing the aftermarket needs for ICE vehicles, OEMs have to also prepare their service network in-line with requirements specific to electric mobility. EV parts will significantly change the traditional TOB (tyre, oil, battery) revenue model for ICE spare parts. From a warehouse perspective, routine spare part kit management will also differ from ICE to EVs and shortage of critical parts such as battery for EV, will pose a challenge since transporting batteries by air freight is regulated by design and performance attributes.

Moreover, long duration storage of parts such as EV batteries may result in leakage and loss of charge, leading to increased battery management cost. If we consider the parking lot and store-yard perspective, additional investment into charging infrastructure facilities will be required. Hence OEMs will also need to plan their future investment into EV spare part management very judiciously.

This question becomes even more pertinent for global OEMs that have either announced, or are on the verge of announcing their India entry plans. To keep their cost structure lean initially, and to make sure the availability of service stations closer to the customer, the new entrants can leverage the aftermarket network either through self-franchising or tying up with aggregator companies. While traditional tier 1 suppliers are definitely set to gain with the expansion of the OEM service network in the unorganized market, global independent parts manufacturers can also leverage this opportunity by supplying their parts to the unorganized market through new age aggregators like GoMechanic and PitStop.

The automotive industry has witnessed a lot of innovations across the value chain in the recent past. We have seen new technology and business models dramatically changing the way traditional auto businesses are run. It would not be a farfetched conclusion to say that vehicle servicing and aftermarket is going to be the next target of such innovations where traditional players and new entrants will collaborate with each other and use innovative business models and technology to provide the best after sales experience to the customer.

(Disclaimer: Ashim Sharma is Partner and Group Head at NRI Consulting & Solutions India. NRI’s Yogesh Shivani (Senior Manager) made significant contributions in this article. Views are personal)

Also Read: