As electric vehicles become mainstream in the next few years there is likely to be a mad scramble for lithium ion reserves, which forms the basis of all EV batteries today. With China having a definitive head start in this, India finds itself in a difficult spot– its current dependence on Gulf countries for imported oil potentially being replaced by lithium controlled by China.

The country’s biggest electronic asset management firm – Attero Recycling has a solution. It believes India can emerge as a hub for global recycling – importing end of lifecycle batteries from other parts of the world to begin with, recycling them to provide raw material for local battery manufacturing. Its projection is within 10 years, recycling could provide 100 percent of India’s requirement for battery materials including precious metals like cobalt, nickel, graphite and manganese besides lithium.

“Within the next 10 years, we should be able to meet 100% of India’s demand for battery materials, which include cobalt, lithium, nickel, graphite and manganese,” says Nitin Gupta, CEO and co-founder, Attero Recycling. “To get that done the capacity or infrastructure for recycling lithium ion batteries has to scale up. In the interim, we will need to import end of life lithium ion batteries from outside to meet that demand. But after just four years, there will be no need to import as the local generation of end of life batteries will be good enough to meet new battery demand.”

Lithium ion batteries have become the mainstay for all sorts of electronic gadgets like smartphones, laptops, tablets or stationary storage devices for solar panels and telecom towers. The onset of electric vehicles will expand demand for lithium ion batteries manifold but also open up the market for end of life recycling that companies like Attero are trying to tap. Besides providing raw material supply, it also takes care of ecological concerns.

“What happens to all the end of life batteries? They’re hazardous in nature and somebody needs to recycle them in an environmentally friendly manner,” Gupta added. “Then almost 40 to 50% of the cost of a vehicle today is the cost of battery, out of which almost 30% is the cost of metals, which includes cobalt, nickel, lithium and graphite. Each of these metals have significant ESG issues (environmental social issues), as well as supply security issues.”

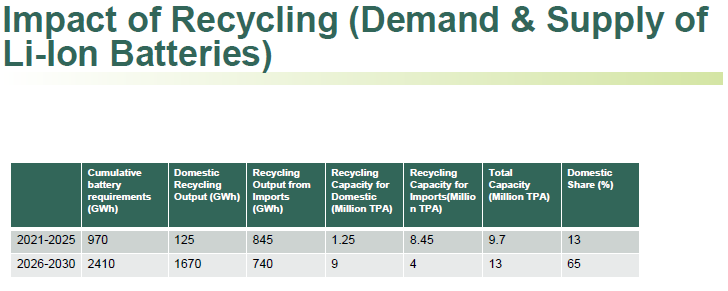

As per the company’s projections, India’s cumulative lithium ion battery requirement is likely to be around 970 GWh in 2021-25, which is expected to more than double to 2410 GWh over the next five years (see table). Estimates for domestic recycling output indicate a significant jump from 125 GWh to 1670 GWh while recycling capacity will go up from 1.25 million tonnes per annum to 9 MTPA.

“Given the fact that we do not manufacture our own cells, we are just replacing Saudi Arabia with China. And even if we manufacture our own battery cells, courtesy the government’s 50 Gwh PLI scheme for advanced cell chemistries, we still need to figure out how we source lithium and cobalt for manufacturing,” he added. “Today, 97 percent of the world’s lithium supply is being controlled by China. They dont have the mines but have the capacity to refine that much lithium. So from a geopolitical standpoint it’s very important for a country like India to figure out all data sources to battery materials.”

It is a genuine concern that is being increasingly raised in many different quarters. At the recently concluded ETAuto EV Conclave 2022, Switch Mobility vice chairman and CEO, Andy Palmer also cautioned that India needs to chart its own course and be mindful of geopolitical undertones.

“It is the location of the battery Giga factories that will determine the location of the future car industry. If you’re going to invest, and India must invest, then invest in technology that drives you forward and not one that ties you geopolitically to China,” Palmer had said on Wednesday. “India deserves to be a pioneer in New Energy vehicles, and needs to boldly innovate. Rather than borrow hand me down technologies.”

Should recycling take off, the potential is big. Attero believes the industry could be worth upwards of $ 50 billion by 2030. By then India’s EV market is projected at $ 206 billion and 80 percent of the lithium ion battery market would be comprised of EV batteries, up from about 35 percent today. Sensing this upcoming demand, Attero is investing Rs 300 crore to expand its lithium ion recycling capacity 11 fold from 1000 tonnes to 11,000 tonnes per annum with an aim of capturing 22 percent of this market by October. It is also more than doubling its overall e waste management capacity to 300,000 tonnes per annum by the end of this year and is in the process of adding 156,000 tonne capacity. For 2030, the company has set a target to produce 200 GWh equivalent of Lithium through urban mining.

“We will continue to expand multi fold every year over the next few years,” Gupta says. “Our plans are to maintain a very dominant position and make sure that we become a prominent player in the battery material supply chain.”

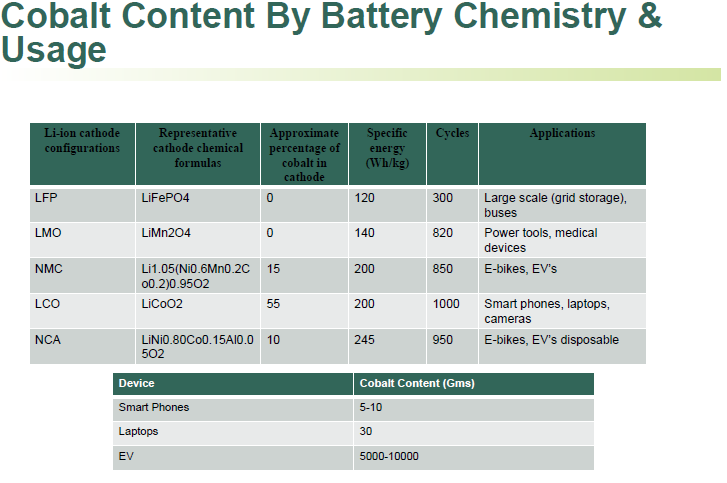

The ecological and human rights concerns around mining of these precious metals also makes recycling important. Almost 70% of world’s cobalt today is mined in the Democratic Republic of Congo in central Africa, where child labour and exploitative labour practices is rampant. On top of that, given the increase in demand for cobalt and known reserves of the metal, there may be an acute shortage of it by the end of this decade. Similarly half of the world’s lithium is currently mined in a triangular region around Argentina, Bolivia and Chile in South America, which is also considered as one the planet’s driest regions. Extracting one tonne of lithium requires 500,000 gallons of water which causes a lot of social and ecological issues in the region.

“Recycling lithium ion batteries, extracting cobalt and putting them back in the circular economy is not only an environmentally good thing to do, but it is also more driven by supply security at this point in time. So whether you take lithium, cobalt or any other battery materials, there are significant ESG and supply security issues around them,” Gupta added.

Also Read: