By Kaushik Narayan

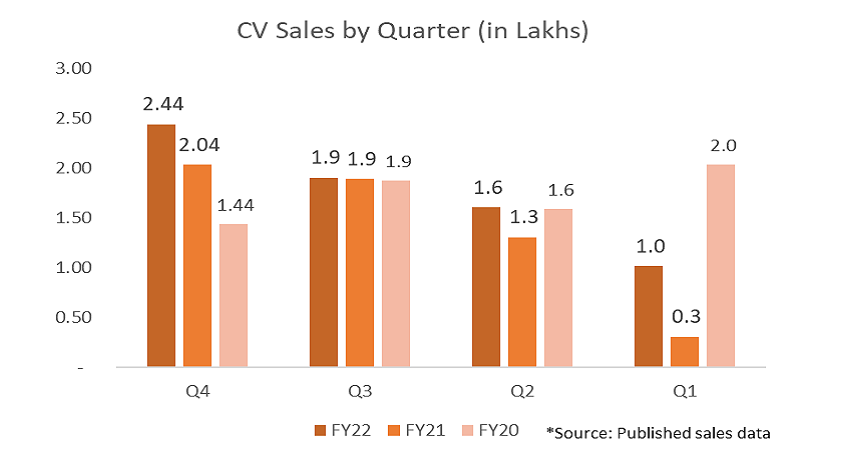

The top 5 commercial vehicle (CV) manufacturers sold 7 lakh units in the financial year 2021-22 showing a healthy growth of 26% against FY21. More importantly, the sales were flat against the pre-pandemic year FY20. This was also a remarkable turnaround for the industry despite facing challenges like the impact of Corona wave 2, shortage of semiconductors, rising input costs and diesel prices.

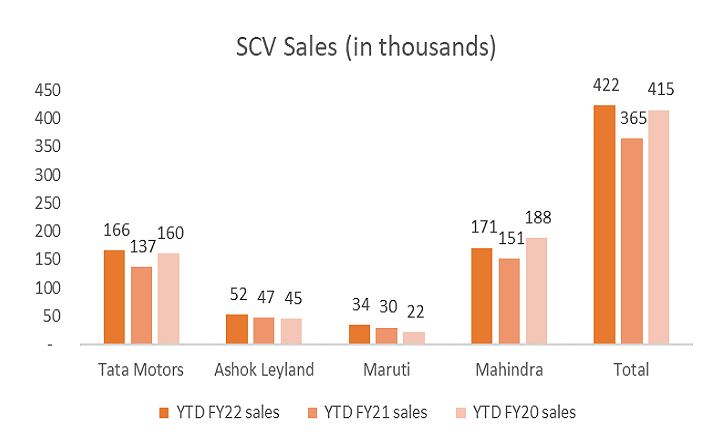

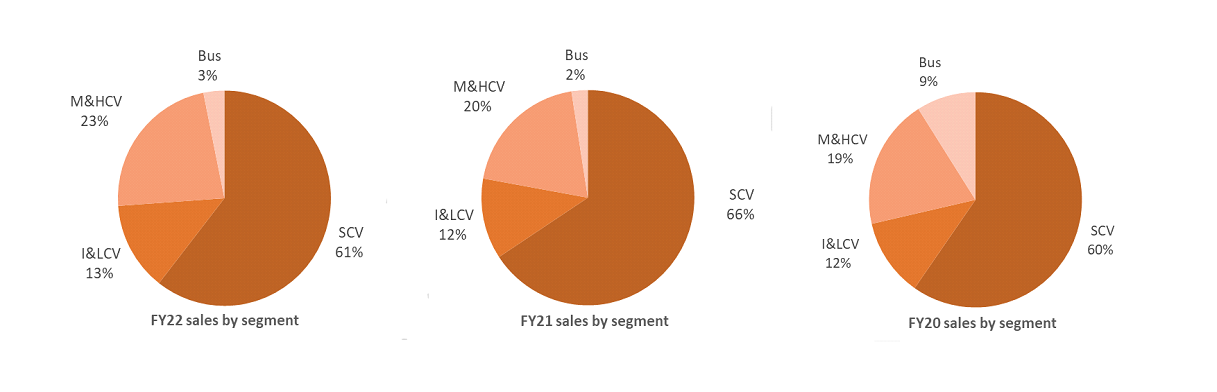

Small Commercial Vehicles (SCVs) made up 61% of overall sales with an annual volume of 4.22 lakh units, followed by M&HCVs at 1.6 lakh units, I&LCVs at 93,000 units, and buses, which continued to struggle, at only 22,000 units. The contribution of M&HCVs and I&LCVs to overall sales rose significantly this year compared to last year.

SCV sales

Last year was very challenging for the SCV segment. While Mahindra & Mahindra continued to be the largest player in this segment, it had to grapple with semiconductor shortages for most of Q2 and Q3 which impacted its overall volumes. In the meantime, Tata Motors was able to bridge the gap in this segment with the market leader coming a close second. Ashok Leyland and Maruti also finished the year strong, growing against both FY21 and FY20.

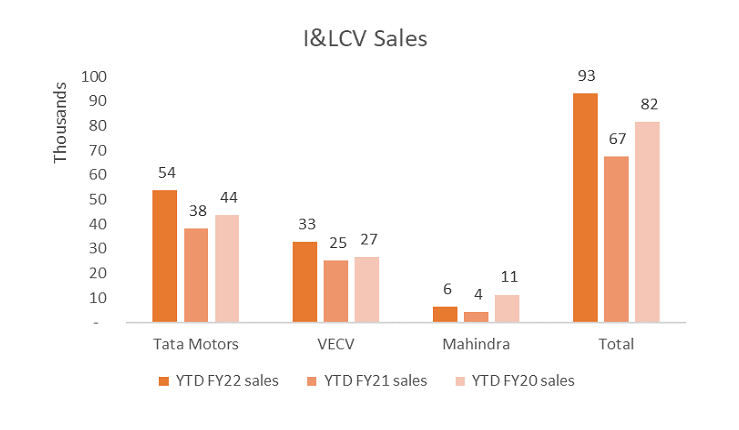

I&LCV Segment

The Intermediate and Light Commercial Vehicle (I&LCV) segment was one of the stars last year. Sales of the segment grew at a very healthy rate of 38% vs FY21 and more importantly, over 14% vs FY20. Tata Motors was the market leader and had an excellent year in this segment. It was followed by VECV which also had a strong performance growing against both last year and the year before. Mahindra had a challenging year in this segment due to the delay in the launch of certain BS-VI variants.

M&HCV segment

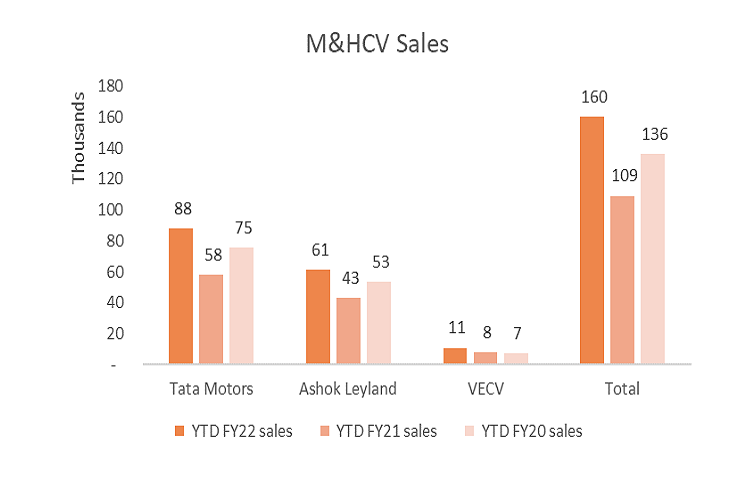

The Medium & Heavy Commercial Vehicle (M&HCV) segment also sparkled last year. Sales of the segment grew over 47% vs FY21 and an impressive 18% vs. pre pandemic year FY20. Tata Motors, Ashok Leyland and VECV, all had an excellent year last year. Tata Motors was the market leader followed by Ashok Leyland. VECV has leveraged the BS6 transition to establish itself as a strong player in this segment.

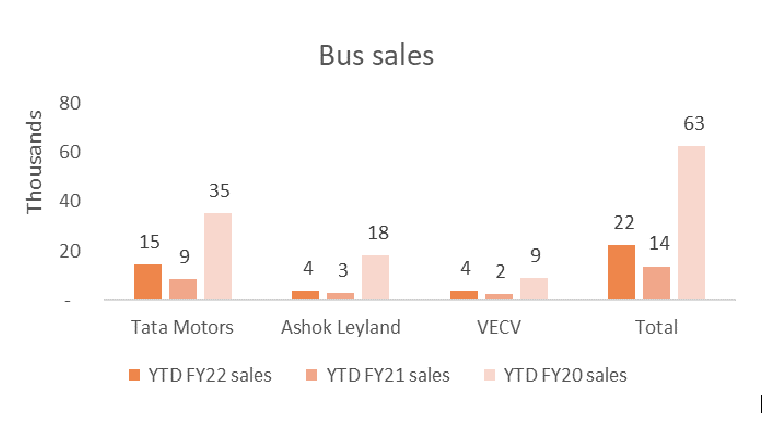

Bus sales

The bus segment continued to be impacted significantly by the pandemic. With schools continuing to operate online for a major part of the year and many corporates continuing to encourage employees in working from home, both the school and the staff transportation segments had significantly lower than normal activity. At the same time, the tourist segment, night service and route permit bus segments faced an uphill battle with very low occupancy for most of the year.

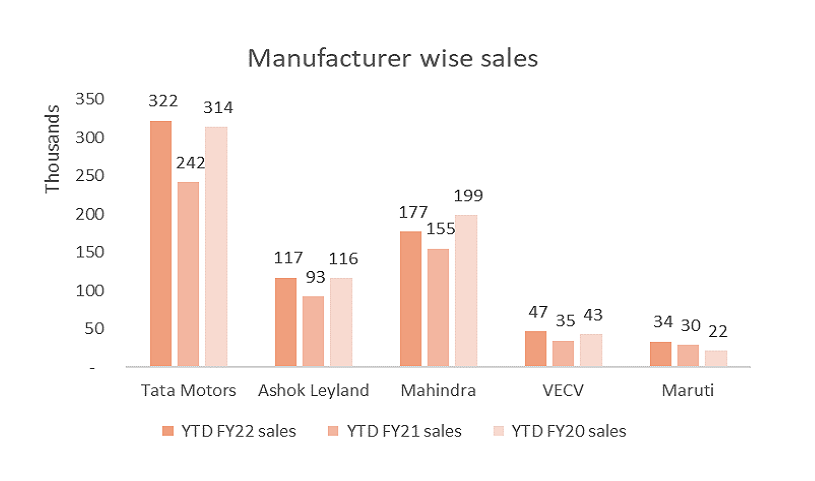

Manufacturer-wise performance

Tata Motors continued their dominance in the CV industry in FY22. The company sold over 46% of CVs in India last fiscal. Mahindra, the second largest player in the segment, was deeply affected by semi-conductor issues which impacted its sales for almost 2 quarters. It was followed by Ashok Leyland, VECV and Maruti in that order. All players with the exception of Mahindra showed impressive growth against both FY21 and FY20. The truck & tipper variants had a stellar year leading the industry to post an impressive growth against the pre-pandemic year of FY20 despite the fact that the bus variants had a de-growth of (65%) vs FY20.

CV Industry upside for FY23

1. Momentum: CV sales for FY22 was a story of 3 quarters. While Q1 was significantly impacted by Covid Wave 2, Q2 and Q3 were quarters of recovery where the industry matched the volumes from the pre-pandemic year. Q4 was a breakout quarter for the industry with healthy growth over both FY21 and FY 20. It is also interesting to note that the industry was down in Q4 FY19 due to the transition from BS4 to BS6. The Q4 performance provides a very healthy platform for the industry to go back in a healthy growth cycle in the next few years.

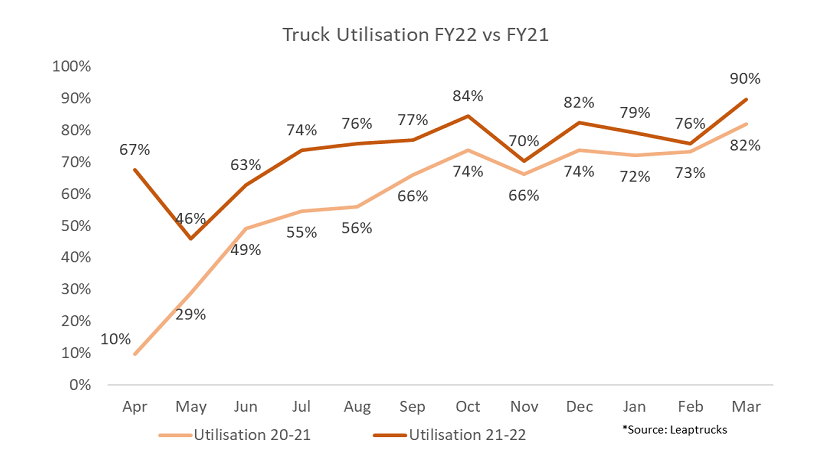

2. Rising truck utilisation: Truck utilisation also finished at a previously unseen high of over 90%. Utilisation this year has consistently stayed well over the levels seen last year. Almost all segments across the industry have benefited from higher loads in the last quarter of the year. This has a direct impact on operator profitability and sentiments of operators as they look to make purchase decisions in the upcoming year.

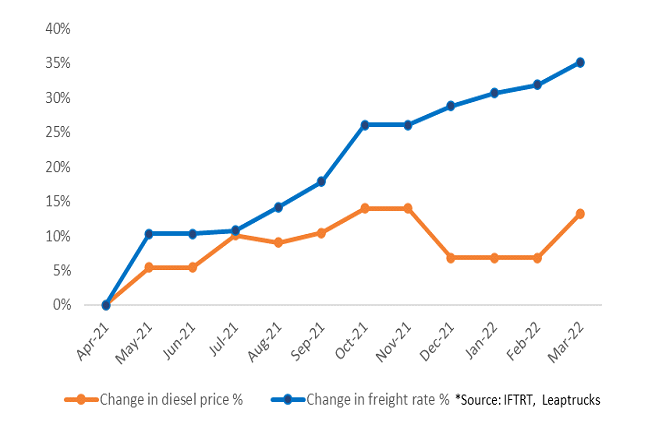

3. Rising freight rates: Rising truck utilisation has helped significantly improve freight rates over the past year. Rates for market load vehicles have increased by over 30% while diesel prices in the same timeframe have risen by only 10%. We have also seen that freight rates are also moving real-time to adjust to changes in diesel prices which has helped keep operators profitable.

4. Improving segmental mix: M&HCVs and I&LCVs took up a larger portion of the total sale of CVs in FY22 comprising almost 36% of the overall market size. SCVs went back to their pre-pandemic contribution dropping down to 61% of CV sales. Bus contribution continued to be down to 3% of overall industry volume vs. a pre-pandemic contribution of around 9%. The change in mix to pre-pandemic levels clearly indicates demand returning across a broader range of sectors within the CV industry.

5. BS-VI technology establishment: Over the last 2 years, over 12.5L BS6 CVs have been sold in the country. This has given the ecosystem time to adjust to the new technology in Diesel, Petrol and CNG variants. All OEMs have significantly improved the reliability of the trucks to be better than the BS4 variants in emission norms, safety features and driver comfort. Now, operators are also more confident of operating more technologically advanced CVs with lower emissions, longer life and good fuel efficiency.

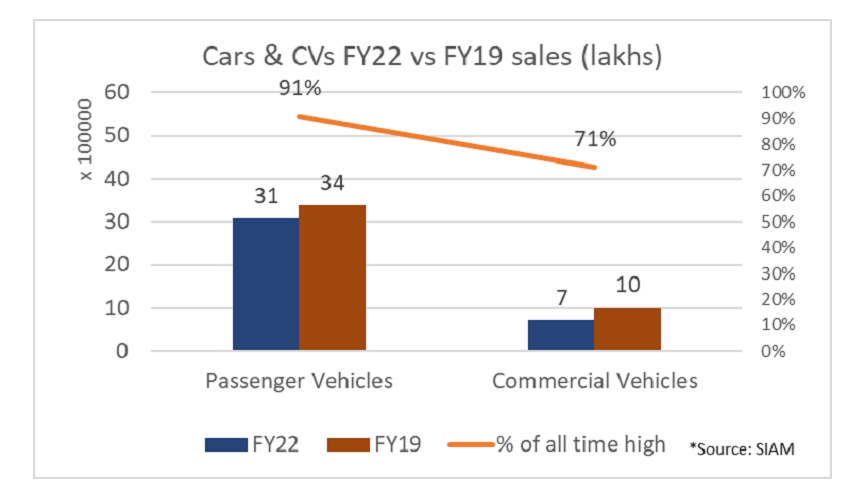

6. Strong upside: The entire automobile industry had a breakout year with every product category having its best year in terms of volumes in FY19. Despite the semiconductor supply issues, the Passenger car industry had an excellent year in FY21 finishing the year just 9% shy of the all-time high sales. In contrast, the CV industry was 29% shy of its all time high despite strong momentum. We believe that the CV industry has a strong potential upside for growth in comparison to the Passenger car industry in FY23.

7. The surging bus segment: The passenger bus segment is coming off of two very bad years. March saw a surge in volumes driven by the school segment. The momentum is expected to continue in the April to June quarter driven by schools with the staff, tourist, night service and route permit segments driving volumes for the rest of the year.

Challenges in the coming year

1. Geopolitical uncertainty: Continued geopolitical uncertainty, war and economic sanctions have a widespread impact in the highly interconnected world that we live in today. A prolonged war will impact supply and in turn prices of oil, gas, rare metals, grains etc. which will in turn impact the Indian Economy in general and the CV industry in particular.

2. Next Covid wave: As cases rise, state governments have started getting back to enforcement of masking and social distancing. With a majority of the population doubly vaccinated and vaccines being approved for kids, we anticipate a lower impact of any new waves on the economy.

3. High diesel prices: Bank of America Research expects Brent crude prices to remain over $100 for the rest of the year. The war in Ukraine, diminishing reserves and sanctions on Russia will continue to keep prices high. However, both the Indian Foreign Minister and Finance Minister continue to stay strong on securing some crude supplies at lower than market rate which should provide some relief.

4. Input costs: While the steel output across the country has increased, demand remains high in both domestic and export markets leading to high prices. Higher prices for other metals like aluminium, copper etc., for semiconductors and many other components that go into CVs. This coupled by high fuel costs which will also increase logistics costs for components will lead to margin pressure at the OEMs and higher prices for new vehicles for customers.

5. Inflation: Inflation has been trending higher than the Government’s stated target. Rising fuel costs will add pressure on consumer staples and food. However, if the Government is able to manage inflation at current or lower levels, the economy should continue to remain strong.

6. Semiconductor availability: Semiconductor availability has had a significant impact on Mahindra’s SCV sales last year. While they recovered strongly in Q4, it highlighted the risk in case of supply issues. We anticipated supply issues to continue this year and next which may intermittently affect supply of vehicles.

7. Discounts: While all OEMs have seen strong growth, discounts continue to remain high. Installed capacity continues to remain high in comparison to existing demand. Continued growth will help OEMs in reducing discounts and improving margins.

8. Passenger bus supplies: While the challenges in the bus segment in the past 2 years have been related to demand, the situation will be reversed this year. A very large number of buses were built by body-builders across the country and only a few were built by OEMs. The pandemic has led to many of these units either downsizing significantly or shutting down completely. This will cause challenges in supply of buses, especially in the school segment.

Outlook for 2022-23

In summary, the fundamentals remain strong in the CV ecosystems. To begin with, operators remain profitable and truck utilisation is at an all-time high. In addition, freight rates are moving in line with Diesel price increases almost real-time. And finally, the CV industry prospects look as bright as the India growth story projected for 2022-23.

We expect the CV industry to carry forward the growth momentum from Q4 FY22 into FY23. The CV industry is poised to have a break-out year and showcase a stellar growth between 23% and 34% in FY23.

(Disclaimer: Kaushik Narayan is the CEO of Leaptrucks, the largest platform for used trucks in India. Views are personal)