New Delhi:

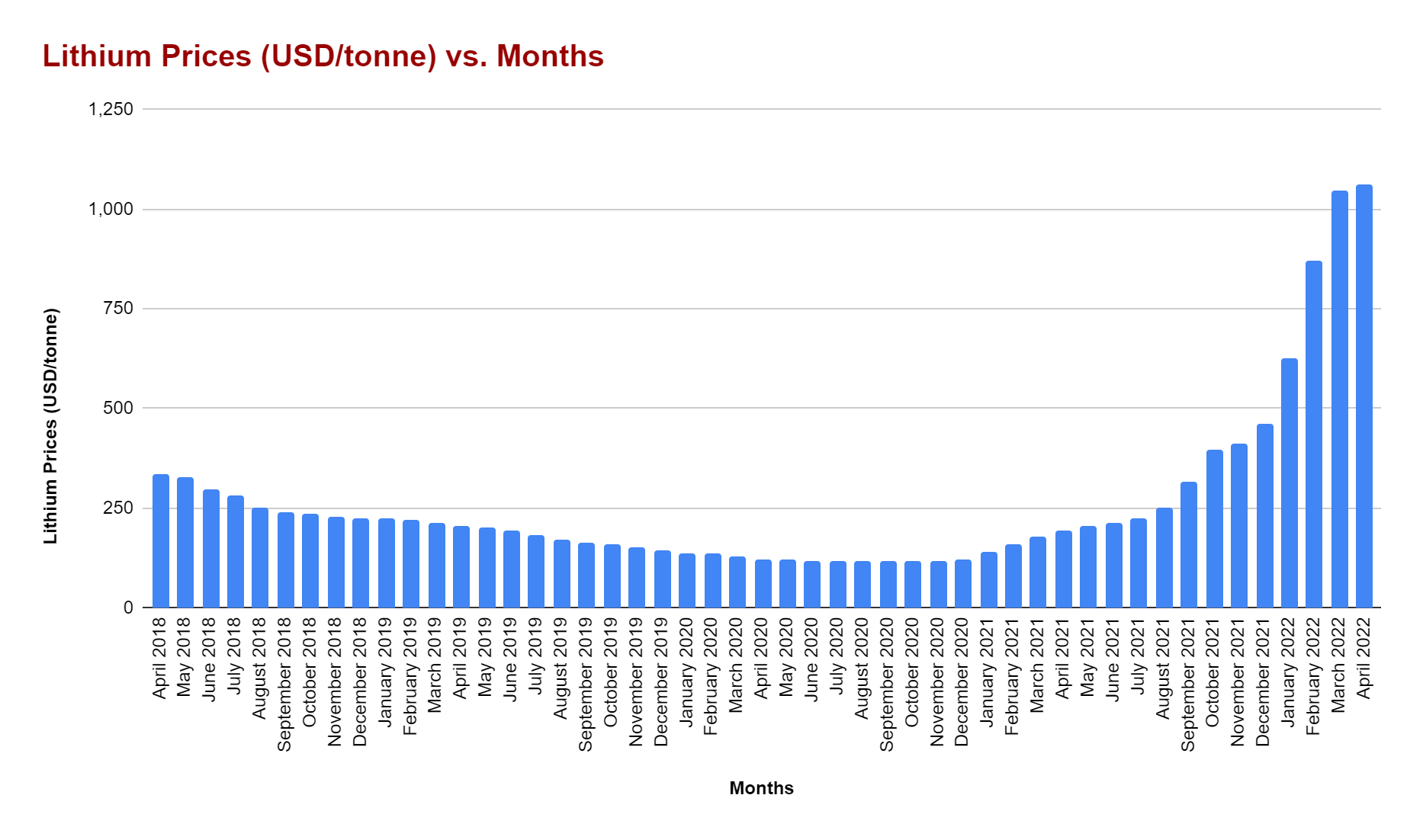

Supply crunch, semiconductor shortages, and abrupt price increases of key commodities in the wake of COVID-19 disruptions are crippling the automotive industry around the world. Added to these woes is the impending supply-demand imbalance of the key battery metal, lithium.The recent buoyancy of over 442% in the lithium prices is primarily driven by the high demand for it from the electric vehicle manufacturers. The reason behind this sudden jump is an exponential rise in metal content inside the battery. Metals accounted for 40% of battery cost in 2015. It has risen to 80% this year, as per consultancy Benchmark Minerals.

Almost all major marques ranging from Tesla to Rivian have started feeling the heat. “Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years,” Robert Scaringe, CEO of all-new EV manufacturer headquartered right outside of Detroit, said last month.

This ‘insane’ price level has not gone unnoticed even by the largest EV manufacturer Elon Musk, who co-founded and leads Tesla. During his latest earnings call Musk tweeted, “There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”

Lithium is not a rare mineral, and an ample amount of it is present in the world. It is the 33rd most abundant element in nature and is distributed widely in trace amounts in soils, rocks, seawater, surface and ground.

However, extraction of the metal is time consuming and plans to produce more have prompted protests and raised barriers to entry for investors.

Looming deficit

Global electric vehicles makers and suppliers are struggling to get enough supplies of lithium to meet the booming demand. Many worry that escalating prices might slow down the push toward making cheaper EV batteries, key to more widespread adoption of emissions-free vehicles. By the end of 2021, several mining experts forecasted a lithium market deficit during 2022 – 2030.

“”I think we have already reached a crisis moment. This year demand will outstrip supply by probably another 50,000 tonnes. The automakers are going to face extreme hardships in terms of actually producing the models they have promised,” lithium and mining expert Joe Lowry, who is popularly known as Mr. Lithium, recently said in an interview with ETAuto.

On March 8, another prominent Morgan Stanley analyst Adam Jonas stated in a note to investors that he sees ‘an ever-widening gap’ between appropriate supplies of lithium battery metals and ambitious EV production targets.

Lack of timely investments

Currently, Australia is the world’s biggest lithium miner, with production from hard rock mines. Argentina, Chile and China are majorly extracting it from salt lakes. These four economies control 90% of overall lithium extraction globally.

According to the Department of Industry Australia, total global output is estimated at 485,000 tonnes, measured as lithium carbonate equivalent (LCE) in 2021, and is forecast to increase to 615,000 tonnes in 2022 and 821,000 tonnes in 2023. At this stage, supply from mine and brine operations is falling short of matching demand growth, the department pointed out adding that “project development is underway, but will take time to fill the supply gap.”

Highlighting the dearth of investments, Lowry said that economies had failed to create adequate supply chains for the white metal, making the bold commitments in EV manufacturing unsustainable.

“One can build a giga factory in two years and cathode capacity in even less time but it takes up to 10 years to take up a lithium project online. It is high time that automakers have to make sure that new lithium projects are invested in,” he noted.

Price hikes

Amid fuel price instability and the push for green energy, demand for lithium is only expected to grow. EV makers are already grappling with hikes in raw material costs. Skyrocketed commodity cost has begun to squeeze margins, and many have raised vehicle prices in response.

During the conference call last month, Musk highlighted that Tesla has updated its pricing for the Model 3 and Model Y, raising the prices of the long-range versions by USD 1,000. Earlier this year Australian lithium miner Allkem and one of the top producers earlier said it expects pricing in the half-year to June to jump to around USD 20,000 a tonne at point of loading, up about 80% from the half-year to December 2021.

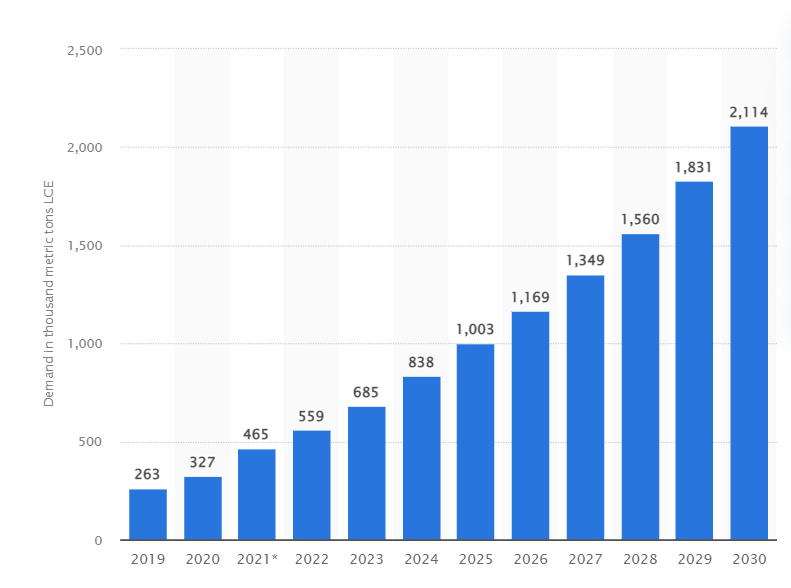

Till the end of this decade, battery demand for electric vehicles will be a strong driver of lithium consumption. In 2030, the global demand for lithium is expected to surpass two million metric tons of LCE, more than doubling the demand forecast for 2025.

Projection of worldwide lithium demand from 2019 to 2030

A look at aggressive plans show that the US wants half of all car sales to be EVs by 2030. The EU has also proposed banning internal combustion engine car sales altogether by 2035. Besides, auto giants like Volkswagen, Ford, and Toyota have all announced ambitious targets to ramp up EV production and phase out fossil fuel cars.

In countries like India where the electric revolution has just begun, a plethora of EV wannabes are coming into picture to join the pristine hub of alternative energy sources. However, seeing the present volatility of the market and supply deficit, investors are potentially undermining the great EV push as there won’t be enough lithium to go around in coming days.

Watch Now: