Three weeks of a hawk-eyed study of the economic trends, data, and industry leaders’ projections and analogies culminates in an uncanny outcome.

It portends many misses for the sector including the aspiration to build India and to create an over 5 million ICE (Internal Combustion Engine) passenger vehicles market. In a most optimistic view, the peak volume of the traditionally-powered passenger vehicle will be achieved by FY30, and that too below 4.9 million. And eventually, the offspring, the electric passenger vehicles, will hold the baton and inch closer to their adulthood.

The ambitious target of 5 million ICE passenger vehicles market by FY20 lost its way as a very distant goal because of the faltering demand owing to the spiralling acquisition costs, weakening economy, declining job opportunities and capital -intensive regulations like the mandate to leapfrog to BSVI from BSIV in a short span.

In the past few years, the Indian automobile industry witnessed the maximum number of regulatory changes in areas of emission control and safety.

The ICE industry continued to be stifled by the rising raw material costs, and impact of the Covid-19 pandemic which wrecked the supply chain system along with other damages.

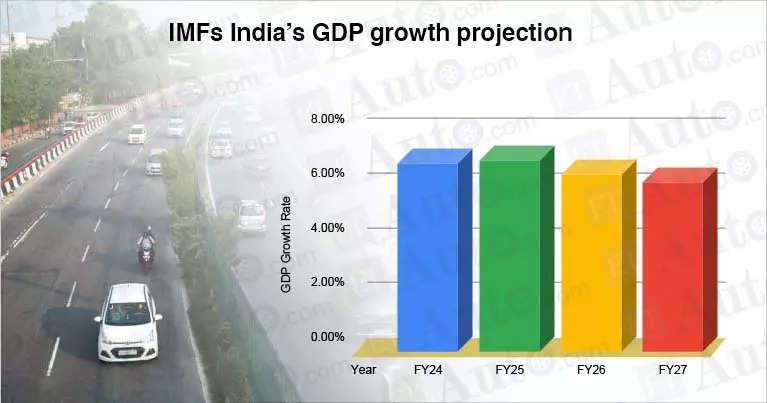

According to ETAuto Research, for the ICE passenger vehicles market to grow from 3.069 million units in FY22 to 5 million, it will have to maintain a compounded annual growth rate (CAGR) of 6.29 % till financial year 2030. It may look achievable but the fast-growing electrification will erode ICE share. Thus, it is unlikely for the ICE PVs to maintain such a high CAGR.

Our research estimates that the electric passenger vehicles is projected to be at least 80,000 units in FY23, an over 100% jump will maintain a CAGR of 40% to 45% till 2030. This would mean that almost 8.5 lakh electric cars will be sold in India by 2030. “India’s electric car market will more than double to 80,000 units in fiscal 2022-23,” Rajeev Chaba of MG Motors had said in an ETAuto discussion session.

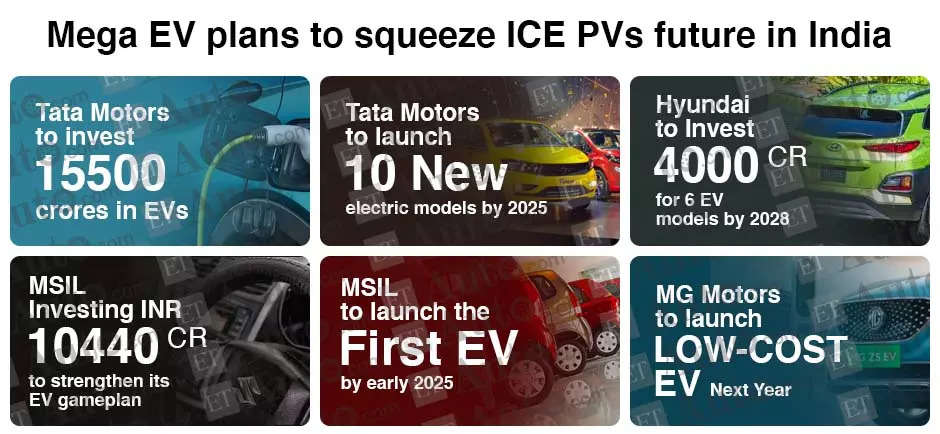

Top carmakers like Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra has announced a combined investment of INR 33000 crore for electric cars programmes.

Top four Indian carmakers to invest INR 33000 crore on EVs in the next five to six years~

Government of India’s think tank Niti Aayog projects that India is poised to grow at 7-8% over the next decade and be the third largest economy by 2030. Extrapolating on the projections by IMF and other institutions we estimate India’s GDP to have a CAGR of 6.4% to 6.8% till FY30.

The passenger vehicle sales to be the same as in a normal situation. Needless to say, the projections are valid until there are no major disruptions and Covid-19 like crises.

In our view the overall passenger vehicle market in India would be around 5.7 million units by FY30 with a CAGR of 8% between FY22 and FY30.

In FY22, Tata Motors achieved 5.15% electric penetration in PV volume against an industry average of about 2.3%. As the product offensive increases with Hyundai, Maruti, and others getting ready to roll out a range of products, including some in the affordable segment, the penetration will spike up from next year.

“Next year we will be launching another electric car priced in the range of INR 10 lakh to INR 15 lakh,” Chaba said recently adding that EVs will contribute 25% of his company’s total car sales in India, at around 30,000 units by next year,”

On the back of the strong demand and aggressive product plans by various OEMs in the country and no major disruption and challenge arising, our estimation of electrification in the passenger vehicles segment is 14% to 15%. This means by financial year 2030 from 7.9 lakh to 8.5 lakh electric passenger vehicles will be sold. That means the ICE passenger vehicles market will limit itself to 4.8 million- 4.9 million units.

Echoing a similar pattern, Ravi Bhatia, President and Director, JATO Dynamics India, said. “The most optimistic forecast by 2029 is below 5 million. Our assessment is closer to 4.7 million. The ICE will continue to dominate with 85%-90% share even in 2029.”

The most optimistic forecast by 2029 is below 5 million PVsRavi Bhatia, JATO Dynamics

The country’s largest carmaker, Maruti Suzuki India’s senior executive director (sales & marketing) Shashank Srivastava, said, “It really depends on the adoption curve of EVs. That is obviously different for different vehicle segments and usage (like fleet). But current projections look like ICE may exceed 5 million and then decline as EV adoption increases.”

Passenger vehicle in FY23

Considering positive factors like easing the situation of the semiconductor shortage (if no major crisis emerges) , faster delivery of the heavy backlog and moderation in the raw material prices and no major hike in the lending rate passenger vehicle will witness an early double-digit year-on-year growth.

The ETAuto Research projects a year-on-year growth of about 12%-14% in FY23 for the ICE passenger vehicle segment to reach a volume of 3.4 million to 3.5 million units. We expect that the market may bounce back if the economy stabilizes better as it had slipped to a decade low in the last fiscal year.

“We estimate the passenger vehicle to be somewhere between 3.36 million to 3.52 million,” Shashank Srivastava said, indicating a robust demand scenario.

Rakesh Srivastava MD, Nissan India, estimates that “the Indian PV market would grow around 15% in FY23. The key growth would be a rise in personal mobility and GDP growth of 8.2% and a return of normalcy after the Covid situation aided by the countermeasures of the industry to manage some part of the supply chain problems by innovating and creating challenges.”

Note: The projection is subject to India’s GDP CAGR of 6.5% and no major geo-political disruption while crude price remains range boud at under or around USD 100 a barrel.

Also Read: