New Delhi:

India’s largest automotive battery maker Exide Industries is all set to invest INR 6,000 crore to establish a lithium-ion cell manufacturing plant in the country in collaboration with China’s SVOLT Energy Technology.Exide Industries is in an advanced stage of finalizing a land parcel in Karnataka to set up a turnkey plant, the company’s senior executives said on a recent call.

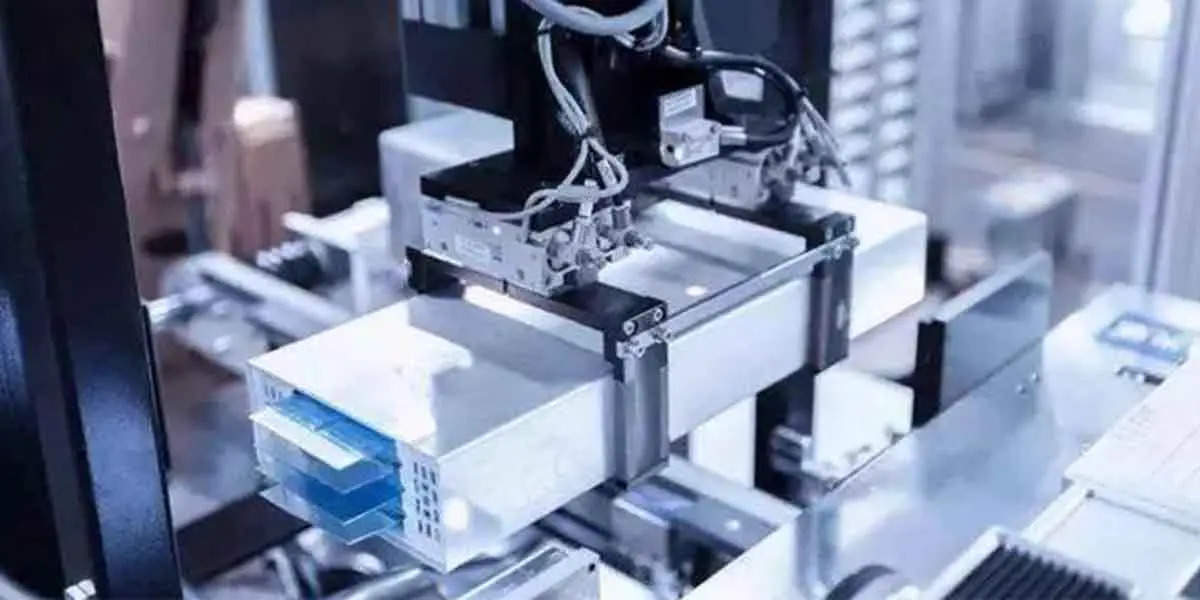

The construction of the multi-gigawatt-scale greenfield Li-ion cell facility will be done in two-phases with phase one capex planned at INR 2,500 crore, the company executives said. Targeted to start over the next 3-4 four years, the plant would have an initial annual production capacity of 6 gigawatt hours (GWh), with a goal to increase to 12 GWh in 8-10 years.

Exide plans to manufacture cells across two popular chemistries- -Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP) for the cylindrical, pouch and prismatic cell formats. Reaping the benefits of being an ‘early-bird’ in this space, the Kolkata-based battery maker is currently in discussion with more than 100 OEMs for supply of lithium-Ion battery packs.

In December 2021, Exide Industries entered into a technical collaboration with the Jiangsu-headquartered high-tech lithium-ion producing company SVOLT. Under this agreement, SVOLT will grant Exide an irrevocable right and license to use, exploit and commercialize necessary technology and know-how owned by it for lithium-ion cell manufacturing in India.

“With SVOLT‘s strong technical expertise, R&D capabilities and rich experience in manufacturing lithium-ion batteries, Exide plans to set-up a multi-gigawatt lithium-ion cell manufacturing facility. This strategic partnership is in line with Exide’s commitment to provide best-in-class batteries and energy storage solutions for automotive and industrial applications,” Subir Chakraborty, MD & CEO, Exide, said.

This upcoming facility will complement the existing 1.5 GWh assembly facility of Nexcharge, a joint venture between Exide Industries and Leclanche SA, in Gujarat. The plant is the largest in India for the production of Li-ion battery packs and modules and has six fully automated manufacturing lines and testing labs. According to the company, Nexcharge has received orders worth INR 260 crore to be executed over 18 months across the industrial and automotive segments.

Exide, the market leader in most of the application segments of lead-acid batteries, expects lithium-ion battery demand in India to reach 90 GWh by 2030. The company caters to all segments of the auto industry including two-wheelers, three-wheelers, four-wheelers, commercial vehicles and tractors.

Underlining the pace of the domestic electric vehicle (EV) industry, the company expects that EV adoption will take time to pan out in India, due to lack of infrastructure. “Electric two-wheelers will require an auxiliary lead acid battery to power other components,” the management said. They expect lead-acid to continue to thrive in the energy storage space in the short to medium term.

“We remain concerned about two-wheeler lead acid battery prospects once the industry transitions to Li-ion battery-based EV. While the company has partnered with SVOLT to set up a Li-ion cells unit, the industry construct could change. Making the battery pack and BMS in-house by OEM could emerge as a trend while competition could intensify for the outsourcing model too,” brokerage firm Emkay Global said in a latest note. Notably, the company derives 15% of its revenue from the two-wheeler lead-acid battery sales.

PLI scheme: A lost opportunity

Exide Industries lost out on the Production Linked Incentive (PLI) scheme as it failed to meet the eligibility criteria under the Request for Proposal (RFP). It was among the 10 companies that submitted their bids under the Advanced Chemistry Cell (ACC) Battery Storage Programme in India, released by the Ministry of Heavy Industries on October 22, 2021.

As per the ministry the selected companies would have to set up the manufacturing facilities within two years. The incentive will be disbursed thereafter over a period of five years on sale of batteries manufactured in India.

The battery maker stands to lose incentives worth INR 250 crore. However, this will not have a significant impact on its expansion plan, the company management said.

For the year ended March 31, 2022, the company posted a significant jump in its consolidated net profit to INR 4,357 crore. It was INR 803 crore in FY21. Revenue from operations stood at INR 12,789 crore in the last financial year, as against INR 10,359 crore in 2020-21.

Also Read: