By Naynish Kulkarni

The Indian automotive industry is revving up to reach pre-pandemic sales levels after building a solid foundation in FY21 despite semiconductor shortage hampering production. Domestic sales increased from 2.7 million units in FY21 to 3.1 million units in FY22, mainly due to an increase in personal mobility demand, especially in the compact SUV segment. Sales are expected to improve considerably in FY23 as demand for personal mobility returns strongly, and the short supply of components, especially semiconductors, eases.

PV segment – Current scenario, outlook

Domestic sales grew at a modest CAGR of 2.9% from FY17 to FY20. The industry went through one of the toughest times in FY21. However, there was a spurt in economic recovery during FY22, and car sales picked up. The industry saw a V-shaped recovery. The semiconductor shortage persisted and impacted supplies accordingly. OEMs were also cautious about rationalizing dispatches during FY22.

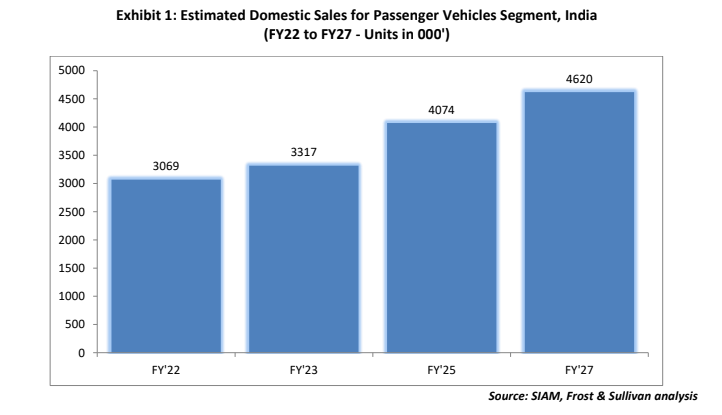

In FY 22 domestic sales grew by 13.2% to 3,069,499 units compared to 2,711,467 in FY21. The passenger vehicle continues to see high demand and long waiting periods as semiconductor availability remains a challenge, even though supplies have slightly improved.

The passenger vehicle market is estimated to grow at a CAGR of 8.5% between FY22 and FY27 due to a lower base in FY20, new digital trends, and a push for personal mobility with higher demand for comfort and safety.

Besides these factors, Frost & Sullivan attributes passenger vehicle industry growth in India to other factors such as strong demand for compact SUVs and premium hatchbacks, competitively-priced seven-seaters, and increasing customer preference for premium features and advanced safety.

Domestic market: Segmental analysis

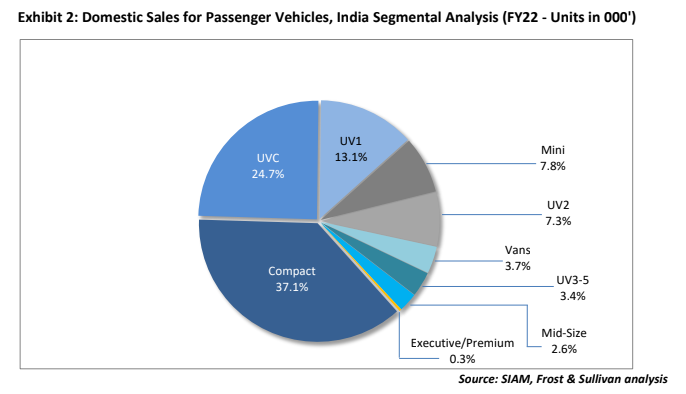

The contribution of the mini segment to overall sales stood at 7.8% in FY22. Once a popular segment, sales declined by 10.7% compared to FY21. A rise in demand for compact models (premium hatchbacks and compact sedans) and compact SUVs (Utility Vehicle and Compact UVC segment) is hitting the mini segment directly.

Compact hatchbacks formed the largest segment with 37.1% sales of cars to the decreasing popularity of the mini segment among the first-time car owners and the gradual shift to the compact segment.

The increasing affordability of compact and mid-size SUVs is limiting the opportunity for mid-size segment (sedan) growth, which witnessed a decline in the past several years. OEMs are providing limited or no models in the mid-size (sedan) segment. Customers are inclined toward SUVs that have better ground clearance, numerous feature options, and sporty styling.

The UVC is the most lucrative among all passenger vehicle segments. It attracted compact segment buyers and mini segment car customers. The segment grew by 32.2% in the past three years. In FY22, the segment contributed 24.7% of the total passenger vehicles sold in the country. Competitive pricing of the models in this segment has been well received by the masses. Further, customers can choose from over 15 models in the segment.

The UV1 segment grew by 15.2% in the past three years. This segment had a direct impact on the mid-size (sedan) and executive sedan segments as customers shifted to the UV1 segment. UV1 segment models successfully managed to bring the look and feel of a bigger SUV at a lower price tag along with an extensive feature list. OEMs operating in this segment provide various drivetrain (engine and transmission) options as well.

The UV2 segment grew by 28.0% in the past three years. It contributes 7.3% of the total passenger vehicles sold in India. UV2s look and feel like proper SUVs/MPVs and provide better comfort and various seating combinations. Also, the recently launched models, like Mahindra XUV 7OO, provide level 1/2 ADAS features.

Preferences for alternative fuels, EVs

With gasoline and diesel prices soaring in India, the market for alternative fuels like CNG is witnessing a growth curve. Also, the significant price increase for diesel vehicles due to BS-VI implementation and performance of petrol vehicles has offset the advantage diesel had over the lighter fuel. Most manufacturers discontinued the diesel engine option from their portfolio in March 2020.

Apart from Maruti Suzuki and Hyundai, Tata Motors has also introduced the CNG option into their popular compact segment models. However, looking at the growing demand for compact SUVs, vehicle manufacturers plan to introduce CNG as an option for their models in this segment. In the medium to long term, the regulatory drive to ban older diesel vehicles and push for CNG in the commercial taxi segment will restrain diesel vehicle demand. Current CNG penetration is ~8% of the total vehicles sold and is estimated to touch ~15% to 18% over the next 3-4 years.

Electric Passenger Vehicle Segment

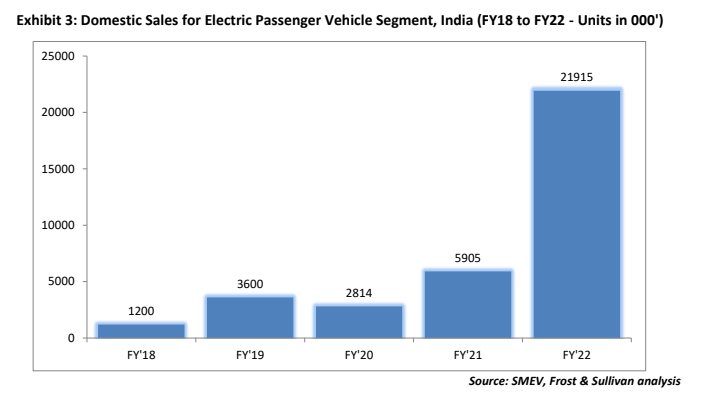

The electric passenger vehicle market has grown more than 106.7% in the past five years. Currently, Tata Motors is the market leader in the electric vehicle segment with a share of 87%. The electric four-wheeler market is limited to only four market players (Tata, Mahindra, Hyundai, and MG Motors). However, a mix of factors, including the supply chain disruption caused by COVID-19, has discouraged some players from launching new models in FY22.

The electric passenger vehicle segment witnessed robust, year-over-year growth of 271.1% in FY22. More OEMs plan to introduce EVs over the next 1-3 years. The country is flying high on the support extended by the government through FAME I and FAME II schemes and the interest shown by private players to build charging infrastructure. There have been continued and expanded policy interventions at the state and central levels to ensure the deployment of charging infrastructure in the past few years.

Today, EVs’ share in overall domestic market sales stands at 0.7% and is estimated to touch 3.8% by FY27. OEMs providing increased range and new models that will be launched in the future will drive EV growth in the passenger vehicle segment.

Also Read: ETAuto Forecast 2022: Is India’s 5 million PV sales dream dashed forever?

Key trend—Technology

With the rise of automatic transmissions (AT) in the Indian passenger vehicle industry, from just 4.8% in FY14, automatic gearbox cars today make up about 20%-22% of the industry passenger vehicle sales. The reasons for this incremental change include affordability, traffic congestion, and consumers choosing comfort features such as an automatic gearbox over other accessories. Increased preference for automatic cars is seen among women and senior citizens. Automatic transmission will gain a 28%-30% market share by FY27 due to changing consumer preferences for convenience and driver comfort in city traffic. Frost & Sullivan expects more OEMs to provide automatic transmission options across vehicle segments.

Connectivity has become a unique selling proposition (USP) for OEMs; most OEMs launched connected services in 2020, offering 50 or more features in their vehicles. Fully digital instrument clusters, larger advanced infotainment systems, head-up displays (HUDs), and improved voice recognition will be the key focus areas for carmakers in India during the next 3-5 years.

Currently, the adoption of advanced driver assistance systems (ADAS) is limited in India. However, the country is becoming a global hub for ADAS software development. Manufacturers in India, both global and Indian, already have plans to introduce ADAS technologies in India, but poor infrastructure, especially outside the cities and across highways, is still a major constraint. Apart from vehicle manufacturers, the component manufacturers are working on ADAS at their Global Technical Centres in India for Indian and global markets. However, in the short term, manufacturers will provide ADAS as an option and be limited to their top variants; it will not be offered across the range of variants as the cost is a major constraint.

Key Challenges for the PV Industry

- ·Rising fuel prices: A major challenge for the Indian passenger vehicle industry is the continuous rise in fuel prices and the closing gap between petrol and diesel prices. India is a highly price-sensitive market, and higher fuel prices will affect customer vehicle buying patterns.

- ·Rise in raw material and production costs: The prices of raw materials of key components such as metals have grown significantly. Market players have responded to the rising raw material prices by optimizing their manufacturing process, budgeting their advertising and marketing costs, and passing them on to consumers through price hikes.

- ·Growth of public transport in metros and major cities: To avoid traffic and save time in metros and major cities, people may prefer to travel by public transport rather than their own vehicle. This is likely to negatively affect passenger vehicle market sales in the future.

- ·Upcoming BSVI phase II regulations: The move toward stringent emission norms is a challenge for OEMs. Meeting new emission standards, optimum fuel efficiency, and low costs are opposite poles. Furthermore, the increased use of electronics will increase car prices, affecting car demand.

- ·Adoption of EVs: Range anxiety, lack of charging infrastructure, a wide gap between EV and internal combustion engine (ICE) vehicle prices, and a lack of assurance about a satisfactory resale value are the customer concerns in the short to medium term.

Conclusion

Tier-II cities and the rural segment will play a key role in fuelling demand for passenger vehicles. SUVs are becoming popular in India and have created new opportunities for vehicle manufacturers. Compact SUVs will continue to shine in the next 3-5 years and help the passenger vehicle industry gain momentum.

Growing customer safety requirements, increasing awareness about car safety ratings, driving assistance, and parking functionalities will be key focus areas for Indian OEMs in the next 2-5 years. The widespread popularity of infotainment services has fuelled growth in the deployment of smartphone and embedded systems integration to offer a wide range of in-vehicle features.

Consumer preference for a comfortable ride in city traffic has increased the demand for multiple transmission options like Automated Manual Transmission (AMT), Continuously Variable Transmission (CVT), torque converter, and dual-clutch. Rising fuel prices are leading the customer shift toward CNG.

With the growing demand for compact SUVs and MPVs, many OEMs plan to introduce CNG options for their models in this segment.

In the current situation, it is difficult to predict the future. There is uncertainty due to the ongoing Russia-Ukraine crisis and rising Covid cases in India and globally. As the supply of electronic components continues to be unpredictable, it might also impact the production volume in FY23.

(Disclaimer: Naynish Kulkarn is Director, Mobility Practice, Frost & Sullivan. Views are personal.)

Also Read: