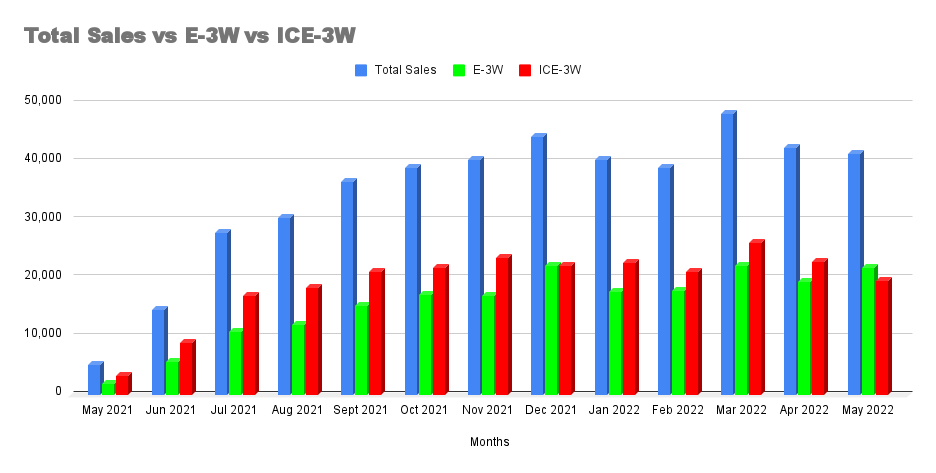

New Delhi: The three-wheeler industry took a serious hit in the past two years as COVID -19 pandemic triggered a crisis for public transit and shared mobility services. However, there has been a slight but uneven recovery in retail sales of three-wheelers in the past 12 months as consumers are gradually returning to shared mobility. From 5,215 units in May 2021, the segment’s retail sales have jumped by almost eight times to 41,508 units in May 2022 on the back of steady pick-up in last-mile connectivity demand and cargo requirements.

Meanwhile electric mobility also has been making rapid strides in the three-wheeler segment mainly owing to the pressure on businesses to go green and the government incentives.

Transition to electric

After crashing 37% in FY21, electric-three-wheelers made a strong comeback in FY22 by registering 101% growth at 1,77,874 units on the back of massive push from the e-commerce segment and government support. Even in the first two months of FY23, this vertical is performing well above market expectations.

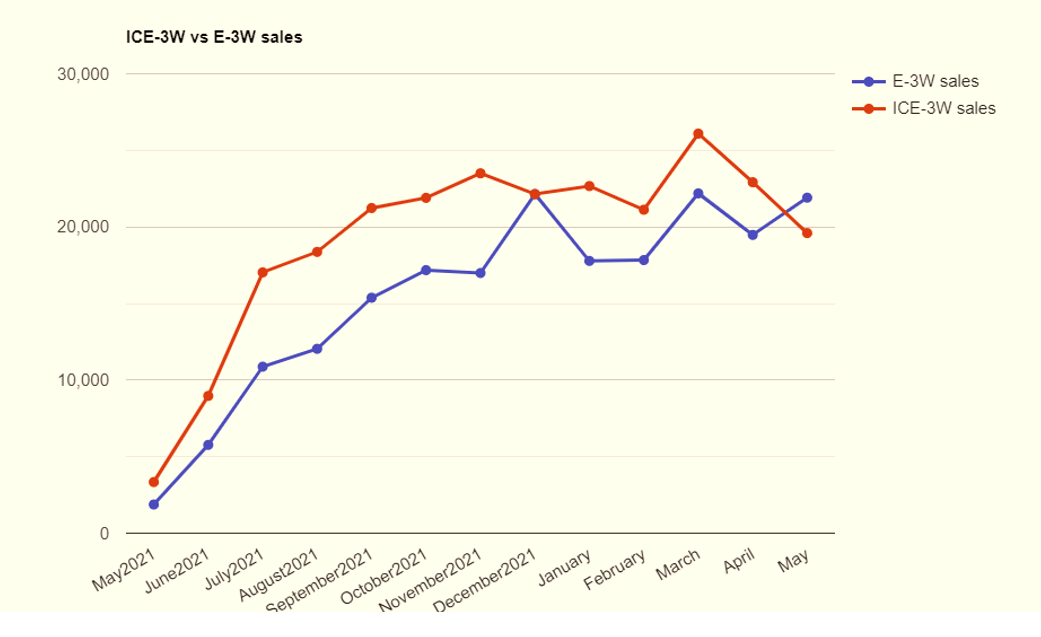

For the first time ever, electric three-wheeler retail sales surpassed the conventional ICE three-wheeler in May 2022. The electric segment sold 21,911 units last month as compared to ICE counterpart’s 19,597 units and its market size surged from 45% to 53% sequentially.

It simply means that the electrification megatrend has surpassed the inflection point in the three-wheeler in a less timeframe than the cars and two-wheelers. This happened primarily as the market recognised the segment as a low hanging fruit for clean mobility in the country, based on market readiness, cost-competitiveness, ease of charging, and emission reduction potential.

Beating the dominant diesel, CNG and LPG offerings, electric three-wheeler sales currently account for more than 45% of the overall domestic three-wheeler market, which is one of the largest in the world. From freight loaders to garbage disposal vans, going electric helps this segment save on the running cost of the vehicles. Unlike four-wheelers, three-wheelers offer easy options of replacing discharged batteries with charged ones, helping save on the time taken to charge.

“Both the cargo and passenger segments of three-wheelers are ripe for electrification. The electric models fulfil the need of high uptime and low upfront costs,” Shrisharan Tiwari, Head of Research, PDL Capital, said. However, charging infrastructure continues to remain a problem as not enough land is available to set up such stations.

E-commerce going the EV way

The hefty burst in e-commerce and logistics requirements has brought with it a change in transportation management and supply chain analytics. Marred by high fuel costs during delivery of consignments, e-commerce sectors are seriously examining the possibility of going the EV way.

“The cargo segment is the main driver where e-commerce companies have embraced electrification in a very big way, plus there are a lot of logistics players who are having completely electrified fleets for the first and last mile,” Suman Mishra, CEO of Mahindra Electric, said at one of ETAuto events in March.

A report by the World Business Council for Sustainable Development (WBCSD) and Flipkart reveals that the e-commerce market in India currently deploys one million EVs as part of its fleet spread across two and three-wheelers, small and medium commercial vehicle segments. This includes last mile delivery vehicles with a daily utilization of 100-150 km, long haul transport (from factories to warehouses or regional fulfilment centres), it added.

Manufacturers have also realized that in order to maintain market dominance it is important for them to expand their electric portfolio. Seeing the influx of demand, Piaggio made its entry into the electric cargo segment with Ape E-Xtra FX range in February last year. Piaggio India, which is the second largest three-wheeler player, currently has five electric models in this domain.

Bajaj auto, the one with largest market share of 48%, is also set to launch its first electric auto rickshaw by the end of this month. Apart from the passenger three-wheeler, the Mumbai-based company also plans to progressively cover the cargo, small passenger, and large passenger segments with electric versions.

“I actually see a big new segment opening up for the e-three wheelers, so it is not a new used case but it certainly is a new catchment area of an existing used case,” Rakesh Sharma, Executive Director, Bajaj Auto, said in an analyst call last month.

Why ICE three-wheelers facing hard times

The three-wheeler segment witnessed massive shrinkage in market size due to permit issues, educational institutions being closed and work from home phenomenon. At its peak, three-wheeler sales reached close to 7,98,000 units and were 3% of the domestic automobile sales. That was in the financial year 2018-2019. These days, three-wheeler sales accounts for less than 2% of the total market, with total sales hitting 3,88,093 in FY12, as per government’s Vahan dashboard by Federation of Automotive Dealers Association (FADA).

With the feat of infection waning off, many corporate firms and schools have started operating from January that pushed the majority of the sales. Market stats suggest that demand is nearing pre-COVID levels as traffic had almost touched normalcy at 92% to 95% last month. Despite the segment recovering from the trough, the retail sales are still 51% lower than the peak of FY19.

Within the segment, the share of ICE three-wheelers has seen massive contraction in the past one year, as the majority of the fleet and individual requirements are gravitating towards sub 1 tonne light commercial vehicles (LCV). Industries have started recognising LCVs as preffered mode of intracity transportation of goods, as they offer relatively better load carrying capacity. This is largely impacting the cargo three-wheelers, which currently holds 38% of the overall three-wheeler market size.

Some pain points persist

Despite gradual recovery in demand, there isn’t much respite on the financing side for both the electric and the traditional three-wheelers. As per analysts, the fear of infection has killed the scope of steady earnings of three-wheeler auto drivers. They believe that the non-performing assets in the three-wheeler category are still the highest, compared with other categories such as car and two-wheeler loans as many drivers are not capable of paying the EMIs.

With the perception of high delinquency levels, financing companies are in turn have become extremely cautious in three-wheeler financing which is also impacting the demand. Passenger three-wheelers have started seeing a return of some stress with the sudden spike in cases in the past one week.

Moreover, the 2% price revision done by the manufacturers in the last five months to overcome the commodity price inflation has also killed the prospects of the individual buyers. “The spiralling fuel cost and price hikes by the companies shot up the cost of ownership in the diesel segment by about INR 40,000-INR 50,000. As a result, EMI payments of buyers have suddenly increased to INR 9000 from INR 6000 which is leading to postponement of purchase,” a Piggio dealer from the north region said on condition of anonymity.

However, as economic activities gain pace, he believes that financing issues or cash flow constraints will be ironed out in the coming quarters.

“On the cargo side the traffic has almost reached the pre-COVID levels. And with re-opening of offices and schools the passenger vehicle will soon see turnaround in usage that will ultimately mean more earnings for the drivers. If the pace of infection remains under control, we are expecting to see good volumes by the end of September quarter,” he added.