By Khalid Wani

The automotive industry is embracing new technologies and investing heavily on applications for safety, connectivity, and entertainment. The applications like high-definition 3D maps, advanced driver-assist systems (ADAS), autonomous computers, enhanced infotainment, over-the-air (OTA) updates, and vehicle-to-everything communication (V2X) are transforming the industry. These applications also require onboard data storage which should keep pace with the changes in the automotive industry.

Today’s consumers demand very sophisticated and increasingly connected vehicles and the connected-car market is growing very fast. In 2019, the global connected-car market was valued at USD 63.03 billion, according to Allied Market Research. By 2027, the value is expected to exceed USD 225 billion.

Cars are also becoming intelligent with applications like dashboard cameras, digital clusters, V2X communications, safety sensors for ADAS, and even AI-based technology. Most of these technologies, once available only in high-end vehicles, are mainstream now. Thus they make cars fast growing data centres requiring about 1TB storage.

For a fleet, the storage requirement will exceed 1TB, as these vehicles will collect more data to increase efficiency and to help businesses gain insight into the fleet’s operation. Because of these, cars are also referred to as data centers on wheels.

Data requirements for diverse applications will be different, and the duration of the data requirement also will vary. For example, some data may be needed for a few seconds, while the rest might have to be retained for days, months or even years for analytical or regulatory requirements. As a result, different kinds of storage solutions will be needed to match the unique needs of each use case.

On the road, in the cloud

Storage embedded in a car is not enough anymore. As autonomous vehicles increasingly exchange information outside of the car, they will rely on actual data centres. These will not be traditional data centers, but Edge data centers, located along the road to allow computation of raw-sensor data. (Edge data centers are small data centers that are located close to the edge of a network). Therefore, the infrastructure outside of the vehicle also plays a critical role. Cloud computing brings a supporting infrastructure to Edge data centers that can deliver much faster response times. As vehicles advance from Level 0-5 autonomy, increasing amounts of storage will be required to support ADAS.

5G drives the need for data storage

Vehicles will be able to function as infotainment centres when 5G is rolled out. This will allow quick streaming and downloading of videos to the vehicle. Cars with 5G will be able to do more interactive browsing or play games. Because 4K and 8K videos are becoming more popular, and because 5G coverage will be patchy for the next three to five years, most vehicles will continue to add onboard storage to accommodate downloaded content. Similarly, individualized usage, in which each passenger watches his/her own stream, will increase storage requirements.

5G will also have an impact on safety. Vehicle-to-everything (V2X) connections between vehicles, pedestrians, and roadside infrastructure have been updated. The communication will supplement onboard safety systems, allowing drivers to avoid collisions and improve their driving experience. If vehicles detect risks on the road (via driver interaction or otherwise), that information can be sent in real-time via 5G to the Edge and cloud, where it may be processed and pushed out as over-the-air updates (OTA) to all other local vehicles, pedestrians, and infrastructure. Similarly, if maps are found to be dated, or new threats or conditions are uncovered, 5G can be used to quickly relay such information. For such huge amounts of data, storage will be required.

The future

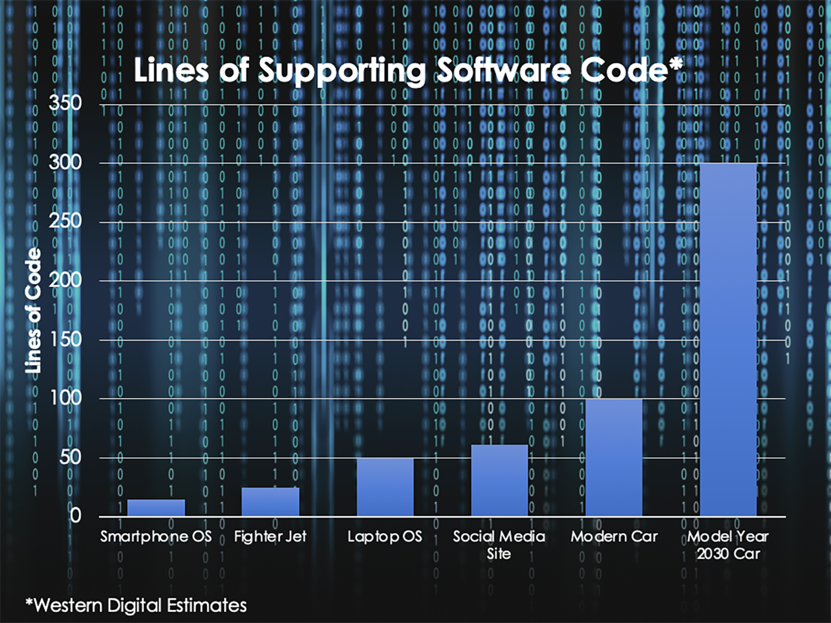

Western Digital estimates that more lines of software code exist in automobiles today than in fighter jets. Today, automakers see themselves as innovators of technology and leaders of technology from a high-performance perspective. Considering long design cycles due to qualifications, certifications, and regulations that vary across borders, automakers need to plan storage many years before a new application becomes available. The storage industry must continue to innovate to offer solutions to meet the changing requirements of the automotive industry

(Disclaimer: Khalid Wani is Senior Director- Sales, India, Western Digital. Views are personal.)