If you read any industry story on battery fires in electric vehicles, chances are the photograph accompanying the story would be that of 20 electric scooters ablaze in a truck. The incident that happened on April 9 near Nashik based Jitendra EV’s 24,000 unit per annum factory has in a way become the symbol of a problem that has engulfed the entire industry in the last 6 months.

It is not difficult to see why. Fires have affected even better known companies like Ola, Okinawa or Pure EV but in those cases only a single scooter caught fire at a time. In this instance, 20 were on fire at the same time magnifying the drama multifold. The only catch however was that the batteries in the scooters never caught fire in the first place.

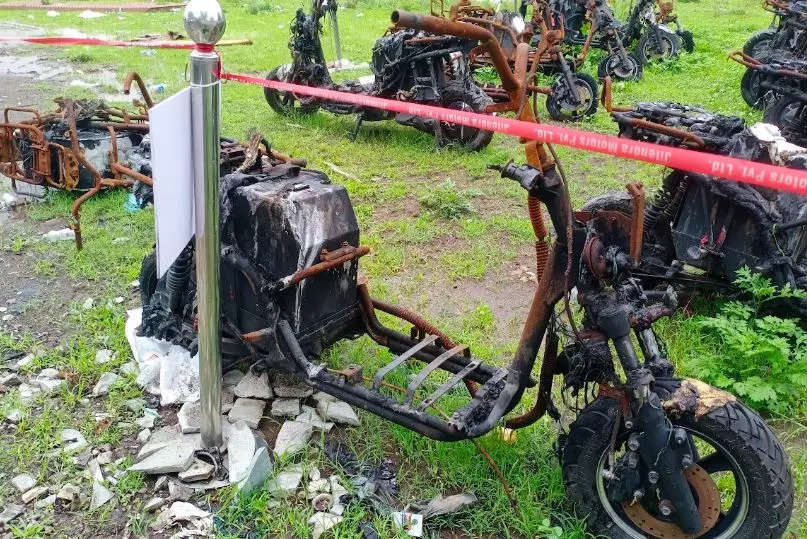

After a detailed investigation, Defence Research and Development Organization (DRDO) that was tasked by the government to look into each of the fire instances during the summer, gave a clean chit to the company stating that the cause of the fire was external to the batteries while noting that most of them were found to be intact. The company also invited ETAuto to the site of the incident where the charred remains of the 20 scooters show no evidence of an explosion in any of the batteries. (see picture)

“It was just bad luck. We have been in this business since 2016 and there has been not one untoward incident. This happened when there were similar instances in other companies so everybody jumped to the obvious conclusion,” said Jitendra Shah, co-founder, Jitendra New EV Tech. “The scooters were prototypes as we were testing new fast charging batteries (with Lithium Titanium Oxide) by Log9 Materials (a Bengaluru based startup). We knew that the batteries were not at fault and would be launching them soon.”

While that infamous picture that continues to pop up in media from time to time, still haunts them, the Shah family has been in the automotive business for decades–they have dealerships for Mahindra, HeroMoto Corp and MG Motor in Nashik, are eager to move on. With its range of scooters the company largely targets the rural markets and fortunately sales haven’t been impacted too much by the incident.

“We are not among the top 5 in the business but are always on a steady trajectory unlike others who are up and down,” said Shah’s son Samkit who is also a co-founder in the company. “The market for electric scooters is exploding right now and we intend to be in the top 10 in the long term.”

With average sales of about 1000 units a month, it received a shot in the arm recently when Bangalore based startup FAE bikes placed an order for 12,000 scooters. With this the company is close to achieving its full capacity at the current factory and has identified land for a new unit.

For a company with humble origins, the aim is big. So far it has invested about INR 100 crore in the business but over the next 5 years, it has plans to invest INR 1000 crore to set up a 2 million unit facility. It will also expand its retail presence from 170 today to 300 by next year and 700 by 2027. Aided by new products including motorcycles, it expects to hit sales volume of 1 million units by then.

“So far, we are a bootstrapped company but are planning to raise INR 300 crore for the next round of expansion,” said Samkit Shah. “The established players in the market are still not aggressive in the EV space which provides us with ample space to grow. By 2030, we believe 80% of India’s two wheeler sales would be electric. Our window of opportunity will be open only over the next few years so we have to make it count.”

There is one big problem though. The company doesn’t really have expertise in technology and relies on the prowess of its vendors. In an industry where companies are spending billions of dollars in acquiring technical know-how, Jitendra EV’s R&D set-up comprises just 15 people. Most of the real development work is done by 32 outsourced scientists.

“Are they the best in the industry? Absolutely not. Are they the worst? Not really. But when the consolidation in the industry happens, it is companies like Jitendra EV that will struggle. They will be lucky if they get bought over, else they will perish,” said an industry veteran.

Unlike in the current combustion engine era, in the EV world, technology is believed to be the differentiator between good and bad firms. Those that do not have robust in-house R&D and rely on third party vendors, could be particularly vulnerable. For Jitendra EV, it may be bad luck that the April 9 incident happened at an inopportune time and got blown out of proportion but it may also be their good luck that no real incident has happened in all these years.

In the end, it all evens out and everybody gets what they deserve. At least that’s what the scriptures say.