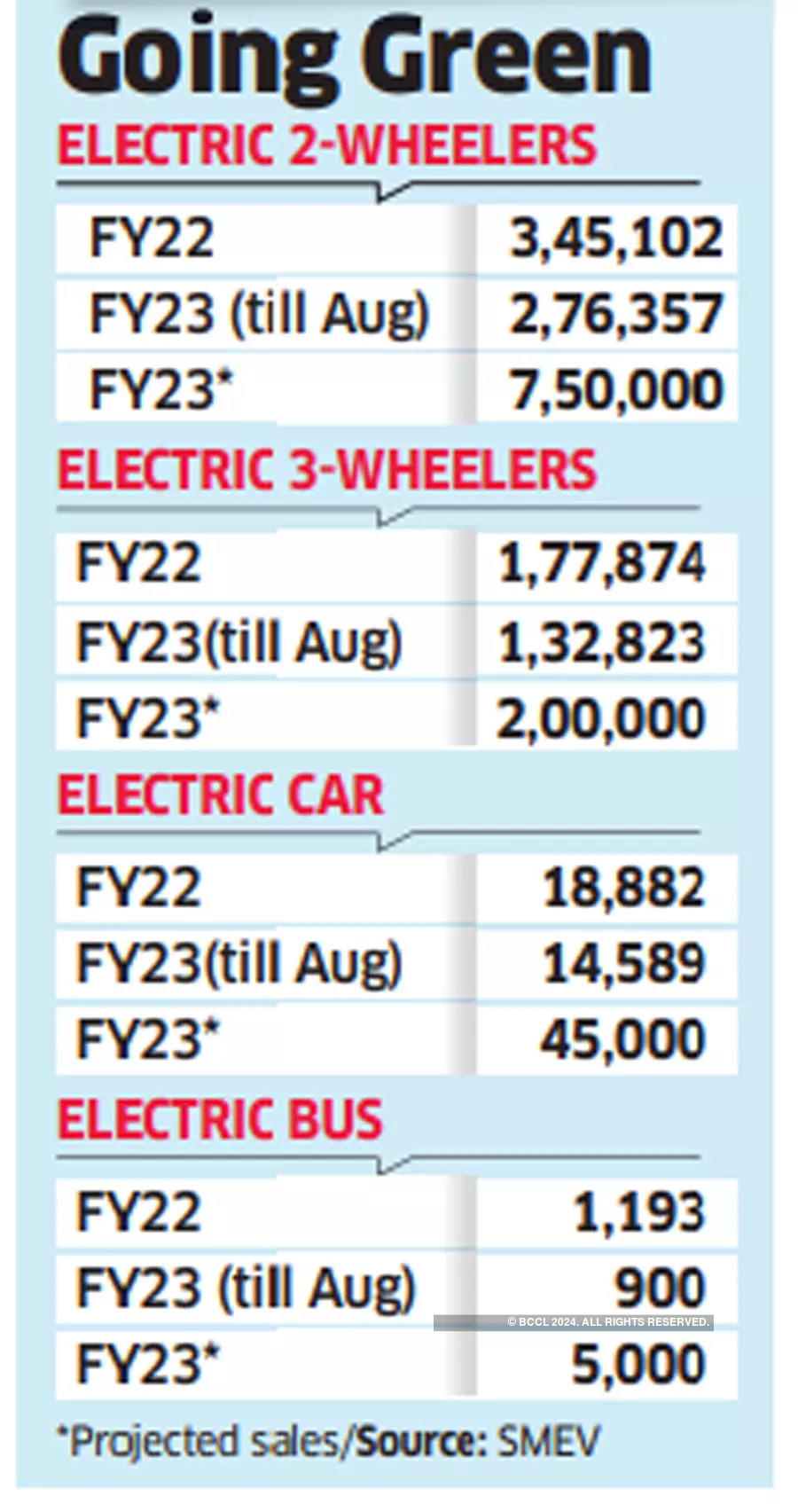

The current fiscal year is set to be a watershed for India’s electric vehicle industry. If the past five months are an indicator, EV sales will cross a million units in FY23, up 84% over last year.

Leading the race are electric two-wheelers, poised to rise 117% to 750,000 units, followed by three-wheelers at 12% to 200,000 units. Electric passenger vehicles, a segment with a small base but two major players in Tata Motors and MG Motors, is set to surge 138% to 45,000 units. The e-buses category, which is seeing sales traction from state transport corporations, is expected to reach 5,000 units in FY23. All segments, in the first five months of the current fiscal, have almost equalled FY22’s total sales, according to the Society of Electric Vehicle Manufacturers (SMEV).

Against global markets, India has a long way to go in electrification. While it is showing growth, penetration is still low, said Ravi Bhatia, president of Jato Dynamics. In India, e-two wheelers still account for just 3% of total ICE two-wheelers, and when it comes to passenger cars, EV contribution is just 1%.

In contrast, pure battery-operated electric vehicles account for 50% of the Chinese two-wheeler market, and 26% of its passenger cars. In Europe and the US, electric cars account for 11% and 5%, respectively of the total market, Jato Dynamics estimates.

However, experts see India taking to electric vehicles in a big way. At a recent event, Prime Minister Narendra Modi said that it was likely that the EV sector would fast track growth of the entire auto ecosystem.

The recent exponential growth – from just 5,900 units in FY21 for passenger cars – has been spurred by a favourable policy environment, positive word of mouth from existing customers, practical product options with better ride and handling vis-a-vis ICE cars, increasing awareness of home charging and availability of public charging.

“We have been receiving over 1,000 month-on-month bookings for our ZS EV, which encouraged us to develop another EV priced between ₹12 and 16 lakh,” said Rajeev Chaba, MD, MG Motor India. The company expects 25% of its total sales for the FY23 to come from the existing ZS EV and another vehicle set to launch.

Tata Motors is also bullish, with plans to launch 10 new models, targeting a contribution of 25% in five years.

Low Hanging Fruit

“As on YTD we hold 88% market share driven by strong response to Tigor EV, Nexon EV Prime and Nexon EV Max,” said Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Electric Mobility.But the real driver of India’s electrification will be 2- and 3-wheelers, said Sulajja Firodia Motwani, chief executive of Kinetic Green Energy & Power Solutions. “Electric scooters and three wheelers are the ‘low hanging fruits’, as these are used by the masses for last-mile connectivity for its low cost of operations,” she said.

Sohinder Gill, CEO, Hero Electric, and director general of industry lobby group SMEV, expects that in the next two years, there will be more electric 2-wheeler product launches, at competitive price points which will improve penetration.In the first half of 2022, sales of electric cars in China grew by 94%. Europe saw a growth of 30%, USA at 48%. E-passenger cars in India in the first 5 months grew by 322%, according to JATO estimates.

Since India is a market of small and affordable cars, electrification will take longer, say experts, since a majority of the consumers are more price sensitive than their counterparts in Europe or USA. In these markets the average price of e-cars is Rs 37-45 lakh. At the same time, governments have actively worked on providing high incentives to boost the electric vehicle demand, said Bhatia.With EV penetration expected to go up, the battery manufacturing segment remains a critical cog in the overall EV ecosystem. Achieving economies of scale in battery manufacturing will remain critical in lowering the cost of an EV and helping achieve pricing parity with ICE vehicles, today the biggest deterrent. ICRA estimates investments in cell manufacturing will exceed $9 billion.

At present, battery cells are not manufactured in India, and thus most OEMs rely on imports, and manufacturing operations in India are limited to the assembly of battery packs, said Shamsher Dewan, Senior Vice President & Group Head – Corporate Ratings, ICRA. China dominates battery manufacturing at almost 80%.