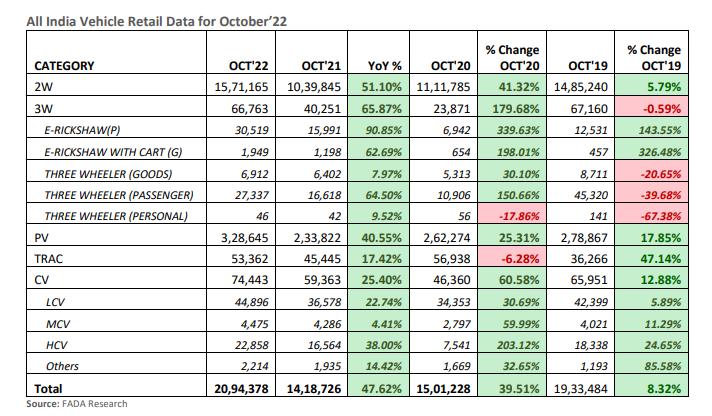

New Delhi: Automobile retail sales were up 48% to 20,94,378 units in October 2022. The industry reported sales of 14,18,726 units during the year-ago period, according to the latest data shared by the Federation of Automobile Dealers Association (FADA) on Monday.

Retail sales were in green across the segments. Passenger vehicle segment grew 40.55% year-on-year to 3,28,645 units, as against 2,33,822 units in October 2021, the industry body report said.

Manish Raj Singhania, President, FADA, said that with most of October being under festive period, the sentiments were extremely positive across all categories of dealership outlets.

Even when compared to the pre-Covid month of 2019, overall retails for the first time closed in green by growing 8%. Except 3Ws, which saw a marginal dip of -0.6%, all the other categories like 2W, PV, Tractor and CV grew by 6%, 18%, 47% and 13% respectively, he said.

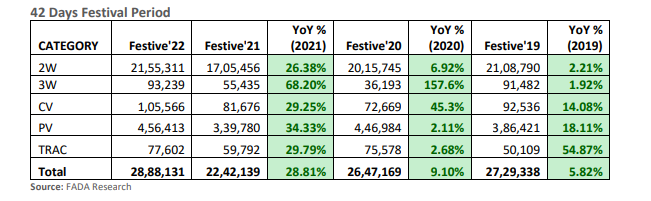

During the 42-day festive period, the industry saw retail sales growing 29% to 28,88,131 units compared to 22,42,139 units in the same period last year.

Festive 2022 brought cheers to the auto industry as for the first time customers of every category came out in good numbers and took part in festive purchases thus making it the best in the last 4 years. As anticipated, the PV segment saw the best year in a decade by outgrowing 2020 numbers by 2%. When compared to pre-covid festive period of 2019, overall retails were up by 6%. All the categories were in green with 2W, 3W, CV, PV and Tractor growing by 2%, 2%, 14%, 18% and 55% respectively, said the FADA President.

The 2W segment showed a huge growth of 51% YoY and for the first time, 6% compared to October 2019, a pre-covid year. With both Navratri and Deepavali majorly falling in a single month, the month of October saw double foot fall at Dealerships. Dealers say that sentiments have also started improving at the rural level but the same needs to sustain for at least next 3-4 months. Apart from this, new launches and good customer schemes also played a pivotal role in helping revival in demand.

The 3W segment showed a massive growth of 66% YoY but was marginally below the red line in 2019 by de-growing -0.6%. The sub-category figures clearly show that shift is happening towards EV adoption while ICE vehicles are no more favourites. In few pockets due to permit issues, new vehicle sales have taken a hit during the month.

The PV segment showed a growth of 41% YoY and 18% when compared to 2019. PV segment continues to see extremely high demand especially in SUV and Compact SUV segments including higher variants in most of the product categories. With better vehicle availability coupled with new launches, the segment also witnessed the best Festive Period in a decade by surpassing 2020 festival sales by 2%.

“The CV segment continues to come back on track by growing 25% YoY and 13% compared to 2019. Festivities ignited better fleet sales. With Mining and Infrastructure projects increasing in various regions, demand has been keeping well and is also coming back on track,” Singhania said.

With festivities ending, the FADA President said that the immediate next month generally witnesses a certain amount of softness in sales. While farmers will start receiving their crop realizations, the overall sentiment continues to show some headwinds especially in the 2W rural segment. For auto retails to show strength, the 2W segment will have to grow for at least 3-4 months over pre-covid months to come out of the woods.

The CV segment is anticipated to have continued demand due to rising infra projects and government spending. While the PV segment continues to outperform, demand in the entry level segment continues to show some softness. Most of the OEMs will now start migrating towards manufacturing OBD-2 norms vehicles. This will definitely see a steep price increase across all categories of vehicles when they hit the market.

With the year drawing to a close, many customers wait for vehicles manufactured in the New Year. FADA said it remains cautious as the year end is approaching.

Also Read: