By Kaushik Narayan

The pre-owned segment in the automotive industry was ripe for transformation as the pandemic hit home in India. Challenges faced by customers included:

·Uniqueness: Each asset for sale or purchase was unique. The combination of vehicle features, fuel type, colour, tyre type and tread wear, mileage covered and body condition was unique for each asset available for sale

·Location: It was difficult to know which seller had what assets available for sale. Prior to digitalisation, buyers had to visit multiple used car outlets to understand what was available for sale

·Assessing vehicle quality: Vehicles were assessed using offline inspection reports that were not standardised or available for the buyer to review

·Pricing the asset: Asset pricing was not available publicly

·Seller trust: There were no means to understand if sellers could be trusted other than word of mouth or going by market reputation

·Emergence of platforms for listing: The advent of platforms like Cars24, Cardekho, OLX and Leaptrucks has made listing and searching assets very simple and easy for customers. Sellers can list their vehicles in a short period of time and buyers can locate vehicles they are interested in very easily also

·Realtime inspection report availability: Detailed inspection reports are now made available to customers for vehicles that match their requirements. These reports may include detailed information about the vehicle, the aggregate, battery and tyre condition and details regarding any damage to the body of the vehicle.

·Use of AI for detecting vehicle quality: The advent of Artificial Intelligence supports more accurate estimation of vehicle condition and quality. This in turn helps improve pricing estimates for vehicles

·Emergence of pricing engines: Multiple pricing engines are currently available that provide a range of prices for assets based on their manufacturer, age, features, specifications and location. This has brought about transparency in pricing assets.

·Seller ratings: Online ratings on Google and Justdial complement word of mouth and referrals and help add a layer of trust for sellers

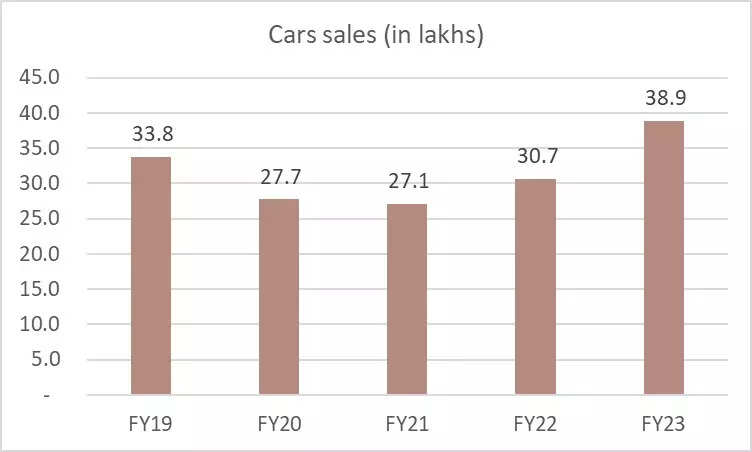

These changes have helped accelerate transformation in the pre-owned industry. This in turn help organise this segment and in turn drive industry growth. This in turn has contributed to robust growth in new car sales in 2022-23. A study in the US indicated that Used car buyers spent over 30% more time on research as opposed to new car buyers prior to making a purchase. Digitalisation has provided these buyers access to better quality information which has helped them make informed decisions.

“Pre-owned cars have become an important driver of growth in the new car sales segment, as more and more customers are looking to upgrade their vehicles. At Kia India, we have seen the benefits of this trend first-hand, as many of our customers have chosen to trade in their old cars for a new Kia. This has helped us to penetrate the Indian market quickly and establish ourselves as a fast-growing and trusted brand in the automotive industry,” Hardeep Brar, VP and Head, Marketing & Sales, Kia India, said.

Used car dealers and platforms also believe that the trust in vehicles sold can be further increased with access to service data from Original Equipment Manufacturers (OEMs). The availability of detailed vehicle service history, insurance claims and accident information will simultaneously improve both the accuracy of vehicle pricing as well as the confidence of the buyer in the vehicle assessment.

The digitalisation trend in the pre-owned car segment continues to stay ahead of the 2-wheeler, 3-wheeler and commercial vehicle segments. However, the advent of platforms like Leaptrucks and emergence of more demanding customers who are digitally savvy and look for transparency will help accelerate the transition to digitalisation in the other segments.

( Disclaimer:Kaushik Narayan is the CEO of Leaptrucks, a Bengaluru-based online marketplace for assisted buying or selling of used trucks, buses or construction machinery. Views are personal)