New Delhi: In the Indian car market, Maruti controls a little over 40% (down from over half the market 3 years ago) and Hyundai has been comfortably in second place for over a good decade or two now. Its reign though is now being threatened by a company that a few years ago no one would have given even a second chance at attempting this feat. This company which was known for unexciting products with iffy quality at both product and service levels, ranked No 6 in 2015, 5 in 2016, 4 in 2018, and has been at No 3 since 2020. This company is Tata Motors and the percentage market share difference between the two in 2022 and 2023 has been, hold your breath, less than or around 1%.In the past 12 months Tata Motors has beaten Hyundai by ranking No 2 in May and December 2022, and also in December 2021. The main volume driver for Tata Motors has been the very successful foray into EVs (based on their recent celebrations of the Nexon EV selling 50k numbers.) The Tata group does not publish their EV numbers separately for any of their models where they have been electrifying at least 1 or 2 of their current ICE cars in the portfolio, each year. 2019 saw the advent of the Nexon EV and ever since they have worked on their other models such as the Tigor and the Tiago and brought out their EV versions.

More is expected in the months to come with the likes of Altroz and the Punch being spoken about as well as born EVs such as the CURVV, Sierra and Avinya. The other great ICE (Internal Combustion Engine) volume drivers for Tata Motors have been the Nexon SUV, the brilliant Punch, the Altroz and the Tiago/Tigor twins. Their foray into the large SUV markets heralded by the Harrier and the Safari have by and large been a lukewarm success.Hyundai on the other hand has seen very steady overall volumes of a little over half a million annually for the past 7 years running with a market share of around 15-17% and under pressure since the advent of the Tata juggernaut. Though Hyundai has taken over the mid-sized SUV segment with the Creta being in the lead and defining the segment, they have all but given up on the lower end (sub INR 10 lakh price point) of the market where Maruti and Tata Motors rule with almost 85% of market share.

Overall market Share of Hyundai and Tata over the past decade

Overall market Share of Hyundai and Tata over the past 36 months. It shows what a tight fight is going on between these 2 for the crown of being India’s No 2

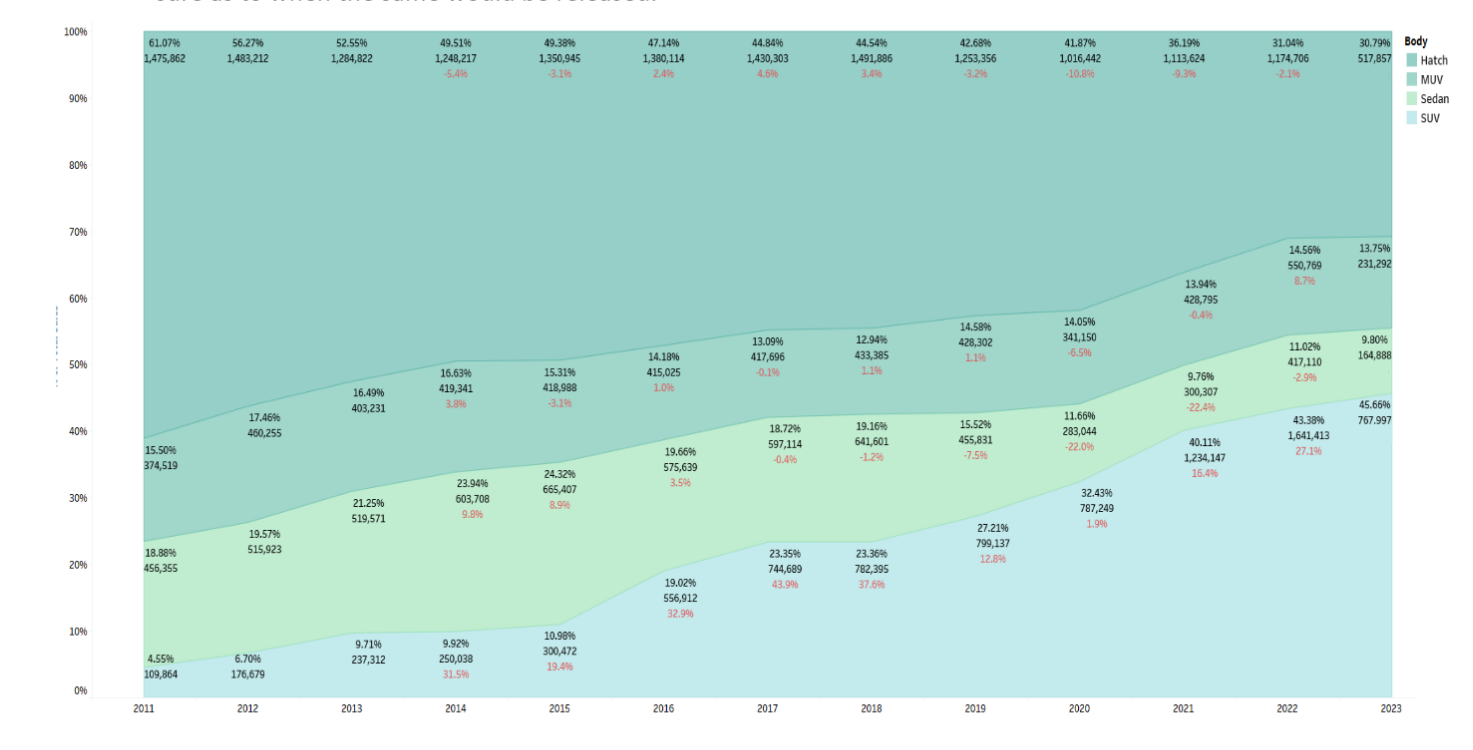

The fastest growing segments and sub segments of the Indian Car Market

All growth numbers given below are a 3-year CAGR (Compounded Annual Growth Rate) calculated.

The SUV segment overall is growing at 27% compared to around 9% for the overall domestic car market. In the SUV segment, the mini-SUV segment characterized by the likes of the Maruti Ignis, and the Tata Punch have grown 95% thanks mainly to the Punch whose volumes have been averaging at over 10k monthly last year with no let up this year either. The segment itself was created by Maruti with its launch of the Ignis in 2017 but has been on a roller coaster ride with no steady sales performance over the years, though last year was an all-time high.

The Tata Punch has no class leading engines or automatics, and its success can be attributed mainly to its design, looks, road presence and the legendary Tata ride quality which have been a matter of praise across industry aficionados. “The Punch has a stronger appeal than Ignis. Rough and tough look is very purposeful. Ignis was more for city use. Product image plays a very crucial role in determining product success” says Yogesh Diwakar, who has worked over 25 years in the auto industry with companies like Toyota and Volvo.

“The Ignis, while being very capable, suffers from two critical weaknesses – fuzzy positioning of whether a lifestyle hatch or a mini-SUV and the classic Maruti Suzuki paradox of having too many vehicles to sell” says Avik Chattopadhyay of Expereal India. Hyundai is now releasing the Exter this month which will face off against the Tata Punch. “The Hyundai Exter will further edge the Ignis out of contention. Along with the Kwid and Punch, it will also turn the heat on the traditional hatchbacks and provide the much-needed excitement in the sub-8.00 lakh band” adds Avik Chattopadhyay.

The other 3 sub-segments of the SUV market that are making waves are the mid-sized SUVs growing at 29%, the 4-meter SUVs growing at 27% and the large SUVs growing at 34%

CAGR Tables

See the section on CAGR tables below to understand the fastest growing and slowest growing segments of the Indian car market over a period of 7 years.

It is surprising to note that the Tatas known for their SUV focus (two-thirds of their cars are SUVs) have completely ignored the mid-sized SUV market and have no products to feature here to compete with the likes of the Hyundai Creta or the Kia Seltos. Though we do hear of Nexon Coupe oft and on, we are not sure as to when the same would be released.

All growth numbers given are a 3-year CAGR (Compounded Annual Growth Rate)

The Mini SUV story

The two players in this segment have been the Maruti Ignis and the Tata Punch. The above graph shows sales and the impact of the Punch on the Ignis .

The above graph shows the impact of the Tata Punch on the mini-SUVs as a segment and how it has grown overall in the SUV super segment. (Please note that EV numbers are only based on what OEMs have reported explicitly like the EC3 for example). In any period, the total of all the various segments adds up to 100%. This graph is solely representative of the SUV segment.

Since Oct 21 when the Tata Punch was released the share of the Mini SUVs as a percentage of the overall SUV market has shot up from less than a percent to around the 10%-mark straightaway (Legend in RED)

Portfolio Analysis and Comparison between Hyundai and Tata

One of the industry standard templates to understand the product portfolio of a company is the BCG (Boston Consultancy Group) Matrix Analysis. The BCG matrix is essentially a bubble chart where every product is plotted against the specific segment Market Growth Rate on the X axis and Market Share within that segment on the Y axis. The size of the bubble is governed by a metric known as the Relative Market Share that is calculated as a ratio of the market share of the product to the market share of the strongest competitor in the segment. The chart is then divided into 4 quadrants which are explained below.

Cash Cows: Products having a very high share of the market in a segment that is showing slow or even negative growth are termed Cash Cows. Companies know that the market is not growing but given that they control a huge portion of it, would continue the product so that the same keeps generating cash for the company.

Stars: Products having a very high share of the market in a segment that is showing high growth are termed Stars. These are the products that bring in great profits as well as the promise of higher growth for companies.

Question Marks: These are products that have a very low market share in a segment that is doing brilliantly. Usually, money earned from cash cows are invested in question mark products with the hope of converting them into Stars!

Dogs are products that have a very low market share in segments that themselves are growing either slowly or negatively. Smart companies usually pull the plug on such products.

The Tata portfolio is governed by the Tiago and the Altroz as its Cash Cows, the Nexon, Harrier and the Punch as its Stars, the Safari as its Question Mark and the Tigor as the potential Dog. The numbers in terms of its EV offerings are not published separately and the company would know the contours of that market segment (Sedan EVs). Sedans overall are doing poorly as a segment and hence the reason for the Tigor to get slotted in that quadrant. The Maruti Dzire is the market leader in that segment with a share of over 50%

The overall portfolio of Tata Motors both from a segment (the top part of the chart) and sub segment (the bottom half of the chart) perspective. 66% is SUV, 26% is hatch and 8% sedan. 25% is the Punch! 32% is the Nexon and the Tiago is a good 15%

The Hyundai portfolio is governed by the Aura, the i20 Elite, the Grand i10 and the Verna as its Cash Cows, the Venue and Creta as its Stars, and the Alcazar and the Tucson as its Question Mark. Models with very low volumes such as the Kona is excluded as its impact on the overall analysis would be minimal.

Overall portfolio of Hyundai Motors both from a segment and sub segment perspective. 53% is SUV, 33% hatch and 13% sedans. 32% is the Creta, 21% is the Venue and the i20 and i10 make up hatches.

Competing Segments/Models between Hyundai and Tata

All market share numbers are specific to these two OEMs and will not add up to 100%. The remaining players in the segments specified will account for the remainder.

Final Notes.

The juicy mini-SUV segment that the Tatas have very successfully tapped into, will in the days to come attract a lot of competition. Hyundai is at serious risk of losing the No 2 crown in the Indian car market and Tata has been snapping at its heels for over a year now. The strategy the Tatas are using is in the high volume SUV market at the lower end. The two major gaps in the product portfolios of these two companies are the Mini SUV segment for Hyundai which it will plug in using the Exter and the midsize SUV segment for the Tatas which they will hopefully plug in with the Nexon Coupe.

Will the Exter land the proverbial “Punch” to unsettle the Tatas and jettison their plans to wear the silver crown? The segment is governed by factors such as butch and tough looks, comfort, pricing and other hygiene factors such as serviceability and cheap, easily available spares. Engine power and refinement, and automatic gearbox technologies have so far not proven to be impediments to success. An average 1.2 liter naturally aspirated engine like that of the Tata Punch (this engine has never been seen as class leading by any serious car reviewer) coupled to a bare-bones technology automatic such as the AMT, seems to be doing a great job. The Exter will have a better engine with its 1.2-liter Naturally Aspirated Kappa unit (seen by most aficionados as second best only to Maruti’s 1.2-liter K12C petrol unit) and that still does duty in the many versions of the Venue, the i10 and the i20, coupled to an AMT that many in the industry see as the best in the business. Would the Exter have the SUV personality and road presence that the Punch so wonderfully eschews is a matter for us to wait and see the car in the flesh when it is released in a weeks’ time.

Yogesh Diwakar also feels that a moot point to mull over will also be whether to gain market share, the two are now focusing more on lower end sub 10 lakh cars where margins are much smaller if not wafer thin.

Hyundai has very rightly focused all this while on the mid-sized and 4-meter SUV market which is known to be amongst the more profitable segments in the non-premium (Read Mercedes, BMW, and Audi) end of the Indian car market.

Tata Motors have run into heavy headwinds in their more profitable large SUV business heralded by the Harrier and the Safari, with Mahindra releasing the much sought after XUV700. The only way for them to grow volume-wise is to focus on mass market segments such as the lower end SUVs, which as explained earlier are growing at a frenetic pace. Is the lure of maintaining the No 2 crown in the Indian automobile sector so strong for Hyundai that it would reinvest in the lower ends of the market that it had slowly slithered away from in the last decade. So far, the Exter story seems to be suggesting that they do value their ranking!