New Delhi: Betting big on its SUV portfolio, country’s second largest carmaker Hyundai Motor India has on Monday launched the sub-4 meter SUV Exter to fill the white space in its portfolio for this segment.

With the new launch, the automaker will have an SUV for every customer in every category. With this, it has become a full-range SUV maker in the country, said Unsoo Kim, MD and CEO, Hyundai Motor India at the launch event.

Kim noted that Hyundai has invested INR 950 crore on the development of Exter, which is the company’s eighth model in the SUV segment. Others include Creta, Venue, Venue N Line, Tucson and Alcazar in the ICE range, and the Kona Electric and Ioniq 5 in the EV range.

“Our focus is on setting new benchmarks. With Exter, the industry should clock about 20,000-22,000 unit sales per month in this segment,” Tarun Garg, COO, Hyundai Motor India, told ETAuto.

“A lot of hatchback customers will enter the entry-level SUV segment. The consumers in this segment want a SUV body- style vehicle at a similar price range,” he added.

Exter is launched at introductory prices starting at INR 5.99 lakh and going up to INR 9.31 lakh (ex-showroom). It will directly compete with the rival Tata Motors’ Punch, which was launched in October 2021 and also comes at a starting price of INR 6 lakh.

The entry-level SUV segment which clocks an average of 11,000 unit sales a month, also includes the Citroen C3 which sells marginal numbers. It was introduced in the market in July 2022.

While Hyundai has no plans to re-enter the hatchback segment, Garg said that the segment cannot be ignored as it still contributes to a significant portion of PV sales. However, he also believes that most customers are not willing to compromise on features, because they have started to believe in the YOLO philosophy. The sub 5-lakh market will only go down over time and thus the segment with Exter and Punch will become the entry-level benchmark for most SUV consumers.

In May, the South Korean automaker signed an agreement with the Tamil Nadu government for an investment of INR 20,000 crore to be spent over 10 years. The proposed investment is to be spent in establishing an EV battery pack assembly unit, which the company is hoping to begin from next year.

Further, the investment will contribute to the development of new vehicle platforms and new models (ICEs and EVs), and the ramp up of production capacity. Hyundai said it is looking to increase its capacity from 7.5 lakh units per annum to 8.50 lakh at its manufacturing plant near Chennai.

Growing SUV share

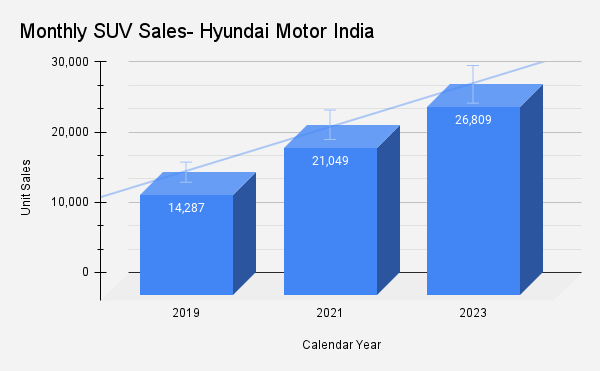

In 2019, SUVs contributed to about 26% of passenger vehicle sales. This increased to 38% in 2021 and 46% in 2023.

Hyundai, which took a lead in the SUV segment during the past decade, now sells 8 models in this segment. In CY 2023, SUVs contributed to 54% of the company’s sales. In CY 2021, the contribution stood at 50% and in CY 2019, it was at 34%.

Hyundai’s 2nd-gen Creta launched in March 2020 is the market leader in SUVs and currently occupies a share of 17.5% in the segment. In H1 2023, the model managed to retain its No 1 position with sales of 82,566 units in the January-June 2023 period.

Creta, a mid-size SUV, competes with the likes of Kia Seltos, Maruti Suzuki Grand Vitara, Toyota Urban Cruiser Hyryder, MG Hector, Skoda Kushaq, amongst others.

With an increasing demand for technology and features, Hyundai said about 45%-50% of its overall sales come from models with sunroof as an option.

On the industry outlook, Garg stated that high interest rates could be a dampener ahead but, in the mid term, the auto industry has strong prospects in the country.