New Delhi: As vehicles are becoming an extended IoT device driven by software, German Tier-I major Continental believes that in the coming years, software integration coupled with AI-driven technologies will become even more prevalent in vehicles to make them more efficient, convenient, and safer.

“In the last 3 years, the content per vehicle has increased upwards of 30%. For Continental, India is a very important market. We can expect the content per vehicle to grow significantly for at least the next five years. As a company, we have been growing higher than the market (growth) in India, and we are ambitious about our good performance,” Prashanth Doreswamy, president and CEO, Continental India, told ETAuto in an exclusive interaction.

The next set of growth areas, he said, will be in body electronics and vehicle architecture which will include high performing computers (HPCs), telematics, and control unit gateways. Parallely, the assisted functions on the ADAS side will become essential for convenience.

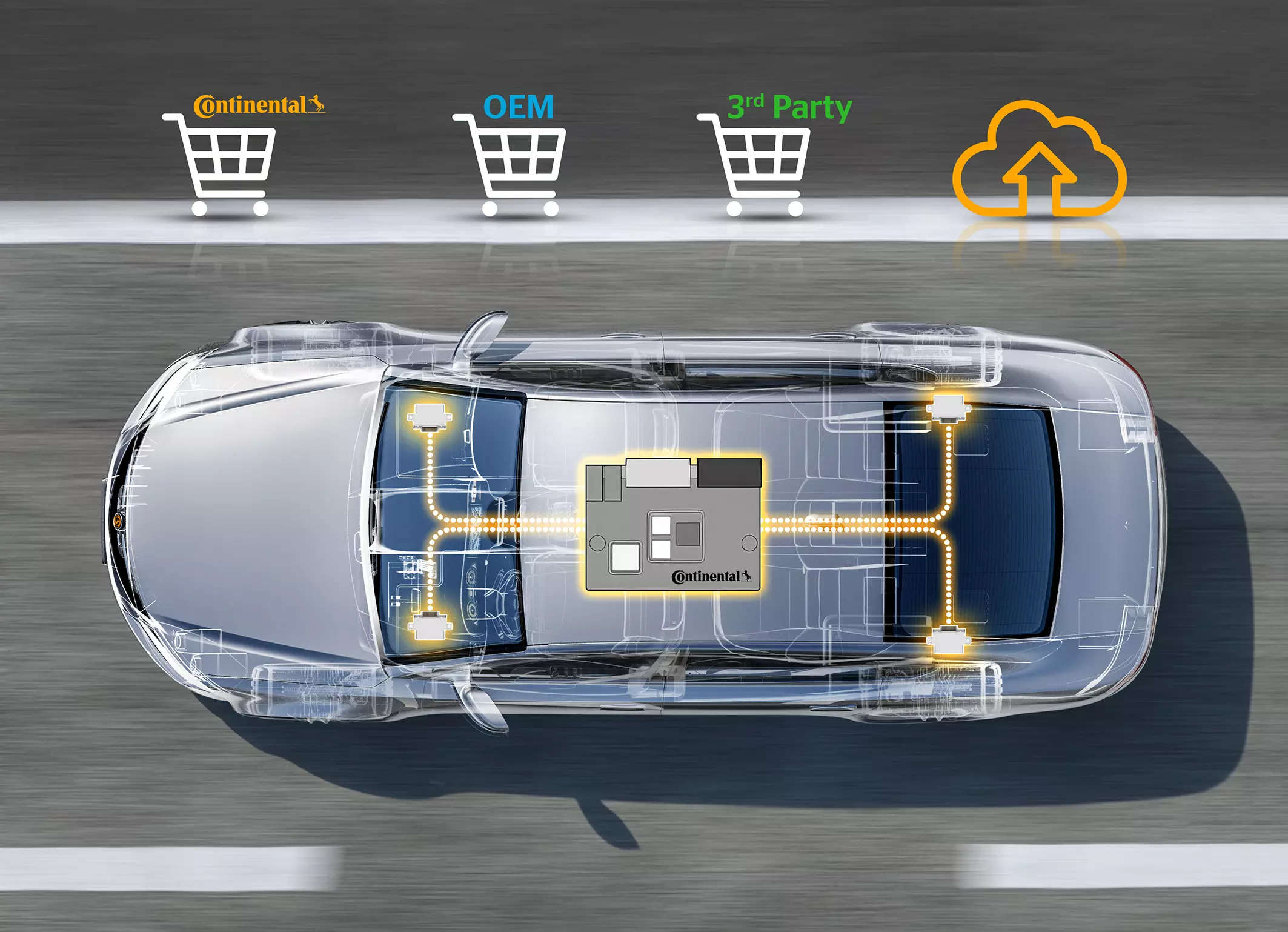

The electronics architecture of the modern generation of vehicles is undergoing a profound transformation, moving away from the many individual electronic control units (ECUs) of current cars, which are about 80 to 100 ECUs, towards a small number of HPCs. In 2019, Continental was the first supplier worldwide to offer interior HPCs for Volkswagen ID.3, which had about 20 million lines of code.

Doreswamy noted that HPCs are an essential feature of interconnected vehicles. The powerful computer controls and safeguards the wireless exchange of data and, in the future, will have the capability to support and secure over-the-air (OTA) updates.

Currently, vehicles in India do not come with HPCs. However, almost all the OEMs are working on this. In the next few years, we expect that new vehicle launches in India will feature HPCs, more prominently for body controls and interiors, he said.

Going forward, cars may come with four HPCs – for interiors, body electronics, vehicle dynamics and chassis controls, and for powertrain.

Doreswamy said that in the long term, it is expected that the four HPCs could be integrated into one single computer, which will be able to drive the entire car. So OEMs may even consider moving to deploying operating systems.

Connectivity and ADAS for India

The automotive industry is broadly transforming in four directions- Connectivity, safety, electrification, and automation and ADAS.

Doresswamy believes that while connectivity and ADAS is revolutionary and is driven by consumers who want convenience and comfort, safety and electrification is evolutionary in nature and is driven by the governments.

ADAS can be split into assisted, automated and autonomous. Assisted functions are more of safety functions. Automated and autonomous are more convenient functions– takes the work from you and does it on its own. Automation makes you more efficient in a way that it frees you from concentrating on the road, you can do something different. It also provides convenience with a lot of other technologies in terms of connectivity.

Assisted is L1, which offers safety related functions. Then automated includes L3, L4 along with L2, and autonomous is Level 5.

“We see a huge growth of L1 and L2 functions in India in the next 3-4 years. But L3, L4 are too early for India. The technology can be made available but the entire ecosystem also needs to be available. We also believe that at least 40 percent of the new cars will come with some kind of assisted function by 2026. The telematics fitment rate is also increasing because we see a lot of connected features- even the displays are becoming more digital than analogue,” Doreswamy said.

He stated that the electronic stability control feature (ESC) is a must for bringing in ADAS features. ESC may be classified into sense, plan and act. ABS has its own purpose in terms of vehicle safety, but a lot of inputs for the ADAS is taken in terms of the vehicle dynamics from the ECUs.

Continental has about 40,000 R&D engineers globally with 6000 of them based in India. For autonomous mobility, India is the company’s biggest center for the world markets, with over 2000 engineers. Last year, the technology company opened a INR-200-crore Greenfield facility in Pune, and INR 1000 crore on a new campus for its Technical Center India (TCI) in Bengaluru.

The automotive parts major also partnered with Japan’s Nisshinbo Holdings last year, to localise machining for valve block meant for the company’s Electronic Brake Systems (EBS) portfolio in India, which includes Electronic Stability Control (ESC) for passenger cars and Anti-lock Brake Systems (ABS) for passenger cars and two-wheelers.

Talking about the challenge of initial cost of the software defined vehicles (SDVs), Doreswamy stated that over the next few years it is expected that some of the connected features could be available on the cloud as a subscription, where consumers can choose to opt for select features.