New Delhi: As a newcomer in the promising yet highly competitive Indian passenger vehicle industry, Citroën knows it won’t be a cakewalk in the conventional internal combustion engine (ICE) vehicle market here, even with its 100+ year legacy. While it is making efforts to enhance its presence in the conventional market segment, where it is set to launch the C3 Aircross in October, the French carmaker sees better chances for itself to get a blogger share in the emerging EV market. That explains why the carmaker entered the electric vehicle (EV) segment with the e-C3 in February, just 6 months after launching its first locally produced model, the C3.

With close to 3,000 e-C3s delivered, Citroën India claims it is at the 3rd position of the domestic electric passenger vehicle market, with Tata Motors leading by a huge margin and MG Motor India following up on the second spot. “We are sold out for the next five and a half to six months. Whatever we are producing on the line is booked,” Saurabh Vatsa, Head, Citroën India, told ETAuto.

Vatsa didn’t quantify the production numbers except for saying it is “significant stuff”. However, there are some production restrictions due to “constraints” in the supply of certain imported contents.

Launched at a starting price of INR 11.5 lakh (ex-showroom) in February this year, the e-C3 is powered by a 29.2 kWh battery pack, which Citroen claims can be fast charged throughout its life without any significant deterioration usually caused by DC charging. The ARAI-certified driving range for the vehicle is 320 km.

Demand in contrast to sales strategy

The real world driving range seen by B2B operators is around 240 kms, according to Vatsa. “So that is telling them that on a single charge they can run throughout the day,” he said. With an EV’s inherent advantage of low running cost and total cost of ownership (TCO), Citroën bets on the B2B segment to help it gain the volumes and a fair market share.

The carmaker’s original plan was to make its mark in the fleet segment first with the e-C3 as the volume driver. Its India engineering team also took feedback from fleet customers while developing the EV model. However, six months down the line, the customers had other plans. The market response so far has turned out to be quite contrasting to the planned strategy. 90% of the sales so far have come from the B2C or personal vehicle segment.

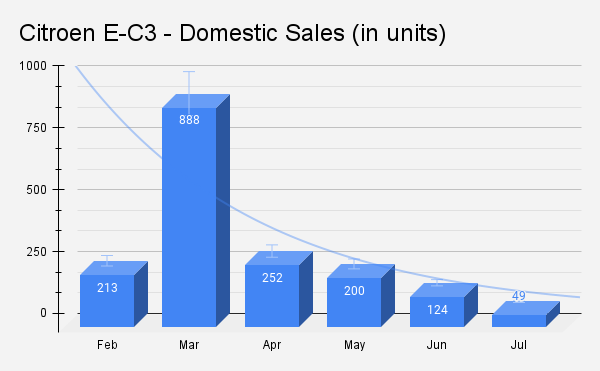

3,000 units since its launch in end February translates to an average monthly sales of 600 till July. The B2B segment still attracts focus. “The demand for the B2B segment is significant, and we are trying to ramp up the volumes to cater to this demand,” said Vatsa. He added that the e-C3 has found B2B buyers in Mumbai, Bengaluru, Delhi, Hyderabad and Kolkata.

Another contender in the hatchback segment is the Tata Tiago, introduced on World EV Day in September last year. Launched at a starting price of INR 8.69 lakh (ex-showroom), the company has sold over 19,000 units of the Tiago EV since the commencement of deliveries in January this year.

It may be noted that Tata Motors introduced its first electric sedan for the commercial fleet customers – the XPres-T EV, at a starting price of INR 9.54 lakh (ex-showroom) – in 2021. This was based on the carmaker’s Tigor (priced at INR 12.49 lakh ex-showroom) and was reserved only for fleet models.

Going forward, Citroen plans to ramp up its 44 sales outlets to 60 by the time the C3 Aircross is launched, and to 75 by the end of the year. The plan is to have a total of 150 outlets in 2024.

With less than 1% share in the Indian passenger vehicle market, Citroen clocked sales of about 9,000 units in 2022-23. With an early move in the EV segment with the e-C3, which is expected to be followed by an electrified C3 Aircross SUV, Citroën India may have a better chance of a larger share in the domestic EV space than in the ICE vehicle market.

| Citroen India | Domestic Sales (in units) |

| FY 2021-22 | 775 |

| FY 2022-23 | 9062 |

In January 2021, Stellantis was formed with the merger of FCA (Fiat Chrysler Automobiles) and France’s PSA Group. Jeep took over from the Fiat brand in India and Citroen from Peugeot. The Amsterdam-based auto major Stellantis has a portfolio of 14 automotive brands globally, including Jeep, Peugeot, Opel and Maserati.

The automaker’s Citroen brand forayed into the domestic market with its C5 Aircross SUV in April 2021. The C3 compact car was introduced in the petrol version in July 2022 and it entered into the EV space with the electric version of C3 in February 2023.