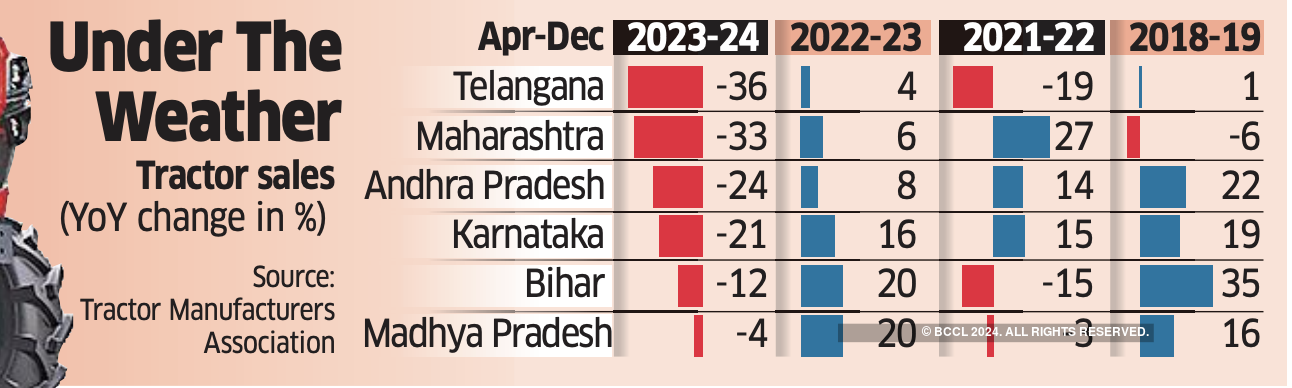

Tractor sales in India, a proxy for rural economic health, have seen a steep decline in key states in the west and south in the first 9 months of the fiscal year, dragging overall sales down 4% in the world’s largest market for the equipment. This follows record growth in FY23.

Maharashtra saw a 33% drop in tractor sales, while they fell 21% in Karnataka and 36% in Telangana. This is the sharpest decline ever in these states. A 4% decline in Madhya Pradesh, the second largest market after Uttar Pradesh in volume terms, also pulled down the average. However, the overall numbers were shored up by the 6% increase in Uttar Pradesh tractor sales.

Erratic weather conditions, an uneven monsoon due to El Nino and inadequate rain hurt agricultural output and thereby farm income, causing tractor purchase plans to be deferred or scrapped. Lower reservoir levels also weighed on sentiment. They’re down 18% compared with last year and 5% below the decadal average, according to the Central Water Commission’s report on 150 important reservoirs.

Agriculture accounts for about three-fourths of tractor demand and is led by farmer sentiment, which is primarily influenced by the monsoon and rural income. The remaining demand comes from commercial segments such as infrastructure and mining.State Incentives:

The rise in Uttar Pradesh, the country’s largest tractor market by volume, could not compensate for the drop in seven states that account for over 40% of total volume, according to data from the Tractor Manufacturers Association. The seven are Maharashtra, Karnataka, Telangana, Kerala, Bihar, Tamil Nadu and Andhra Pradesh.

The slowdown was on account of the tapering of agricultural activities, said Hemant Sikka, president, farm equipment sector, Mahindra & Mahindra, the country’s largest tractor maker. He expects a revival in the next season.

“Rabi crop output is expected to be good with prevailing cold conditions helping the key crop of wheat,” Sikka said. “Government announcement of a good estimate in terms of horticulture production, with continued government support, is expected to boost the rural economy, which will aid positive sentiments and support tractor demand in the coming months.” Mahindra’s inventory is currently slightly higher than the norm but he’s expecting this to get corrected over the next few months.

Tractor Junction, a demand aggregator platform for new and used tractors, has seen a dip in monthly traffic, reflecting overall sluggishness.

“Typically, we get 5 million visitors on our platform every month. This has reduced by (500,000) in recent months,” said Tractor Junction founder Rajat Gupta. He expects the tractor market to regain momentum once the new crop cycle kicks in and a government is formed after the general election, expected in April-May.

In addition to the factors cited above that eroded demand, the discontinuation of certain incentives in some states also sapped purchasing power, said tractor dealers. Till March last year, farmers in Maharashtra, for instance, were getting a subsidy of `1.25 lakh for tractor purchase, which took care of the down payment.

“They haven’t been getting it for the past six to seven months,” said a Yavatmal, Maharashtra-based TAFE dealer, who sells the company’s Massey Ferguson tractors. Additionally, a drop in the prices of cotton and soya bean has squeezed purchasing power, he said.

Similarly, the end of the Dalit Bandhu Scheme in Telangana, under which those eligible got a grant of `10 lakh, has hit tractor sales, said an Ibrahimpatnam, Telangana-based multi-brand tractor dealer.

Forthe full year that ends in March, tractor sales are estimated to decline 4-5% year-on-year. This will be on the back of a record volume of 945,000 units, up 12% year-on-year in FY23, having just recovered from a 6% drop in FY22. Successive years of normal monsoon over the 2021-23 fiscal years have led to a positive rural income, resulting in a compound annual growth rate (CAGR) of 10% in tractor sales against the long-term average growth rate of 6% in the past decade, Crisil Ratings said in a release on Thursday

It expects that domestic tractor volume will recover to clock modest growth of 3-5% in FY25, driven by the expectation of a normal monsoon supporting rural sentiment, higher farm incomes and good replacement demand, it said.