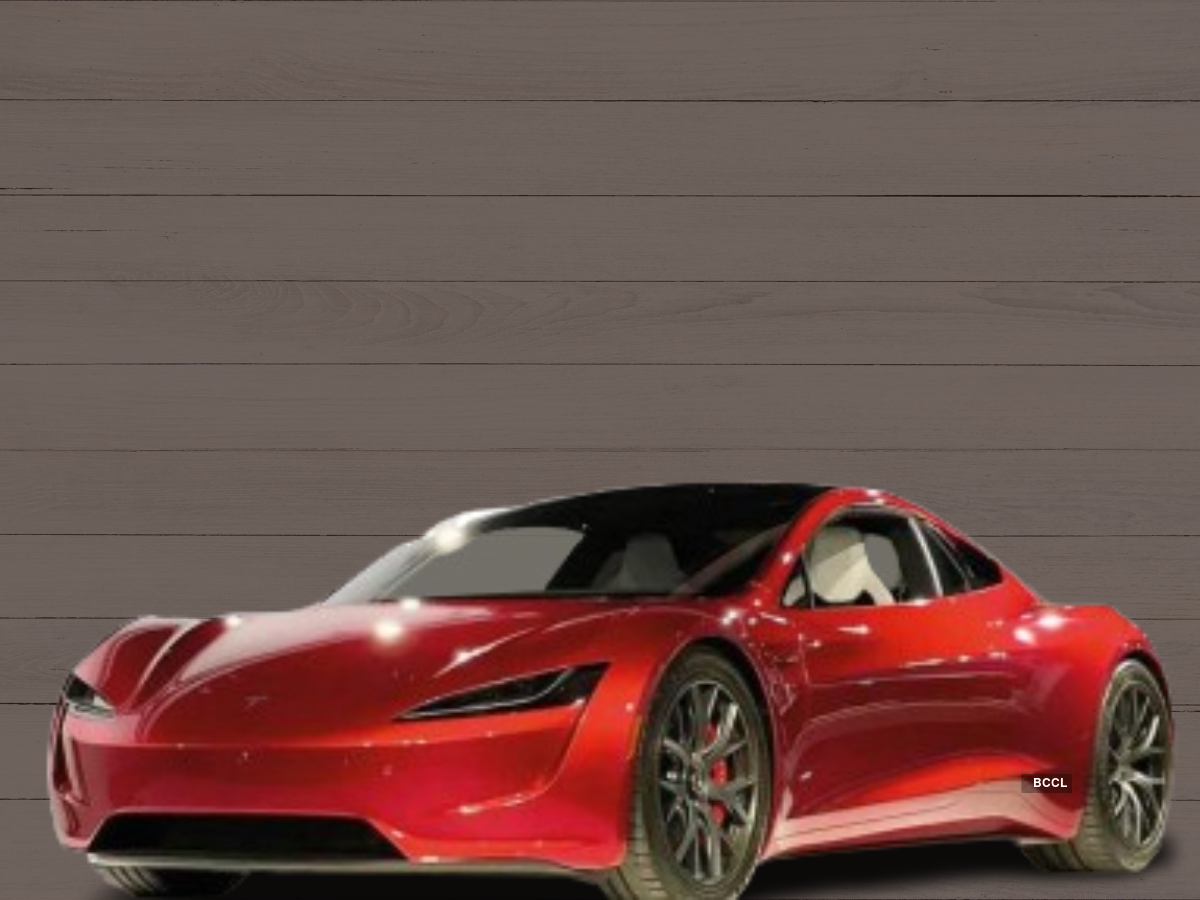

Elon Musk’s recent cryptic comments on the next Tesla Roadster, with ‘space-inspired attributes’, and an incredibly high speed of 0-60 mph (0-97 kmph) in less than a second has ignited speculation within the automotive industry globally.

What specific features could embody these premium attributes in an electric car, and how might they influence India’s burgeoning electric luxury car market?

While the next-generation Roadster with record-setting acceleration, range and performance might offer a glimpse into the future, US-based Tesla, Vietnam’s Vinfast, China’s BYD and many other global luxury car makers may bet on premium feature-led electric models for the Indian market.

Recent policy changes have allowed automakers to import electric vehicles (EVs) priced at USD 35,000 or higher at a reduced import duty of 15%. This would, however, be contingent on automakers committing to invest USD 500 million within three years to establish manufacturing plants in India.

This policy, with a ‘floor but no ceiling’, throws open the door for imports of luxury electric vehicles as completely built-up (CBU) units.

Most of the luxury EV makers in India have been pursuing a CBU-led strategy so far, which attracts more than 100% import duty. For instance, Mercedes-Benz sells three electric cars in India, out of which only one is assembled locally. In the case of BMW, all five electric models are CBUs. Several other luxury car makers such as Audi, Volvo, JLR are present in the Indian EV market.

Luxury EVs had about 7% share of the total luxury car market last fiscal, a figure which is expected to grow in double digits over the next 2-3 years.

Tesla, Lamborghini, Vinfast, JLR and BYD declined to comment.

Chinese smartphone maker Xiaomi has also signalled its entry into EVs.

Xiaomi’s entry, likely in the SUV segment, could further intensify competition in the luxury EV market, especially in light of the recent policy changes.

It remains to be seen how Xiaomi’s pricing strategy and technological advancements will compare to established players, said Ravi Bhatia, president, Jato Dynamics, a consultancy firm.

Industry watchers say rising luxury electric car sales coincide with an expanding base of affluent Indians. With 271 billionaires, India currently ranks third globally in billionaire count, according to the latest Hurun Global Rich List 2024. While China maintained its lead with 814 billionaires, India added nearly 100 new billionaires last year, said the report.

Luxury car companies are increasingly drawing inspiration from aerospace technology. Fly-by-wire systems, once exclusive to airplanes, are now finding their way into high-performance automobiles, offering enhanced precision and control. This trend is expected to shape the future of luxury EVs in the country.

“The future of car design seems to be hurtling towards a world of autonomous vehicles, potentially featuring no steering wheels, blistering acceleration, and cockpit-like interiors,” said Bhatia. These cars will rely heavily on software not just for basic functionalities but also for advanced features like driver-assistance systems and, ultimately, autonomous driving. This software-centric approach is fundamentally changing the car ownership experience.

“Imagine a car that constantly evolves and gets smarter over time, eliminating the need for frequent service centre visits,” said a senior official at a luxury car company.

Mercedes-Benz has made significant progress in the domain of Level 3 automated driving with ‘drive pilot’ — the world’s only SAE Level 3 system using a multitude of sensors.

Typically, target customers are high-end buyers who will pay extra for safety and convenience. Automakers see these as long-term investments in their core customer base to protect market share.

“We see increasing adoption of features like in-car digital offerings such as seamless e-commerce and entertainment, advanced hazard warnings, high-end 3D map visualisation, integrated in-vehicle e-commerce and immersive in-car, multi-player gaming experience and in-car personal assistant,” said Vasudha Madhavan, founder and CEO, Ostara Advisors, an electric mobility-focused investment bank.

Most luxury carmakers in the country have an aggressive EV road map.

This year, “we will be doubling our electric portfolio with three new BEVs, further deepening our BEV penetration, which currently is at 4-5% of our annual sales”, said Santosh Iyer, managing director, Mercedes-Benz India, which retails the EQB, the EQE SUV and the EQS luxury sedan, priced from Rs 80 lakh to Rs 1.62 crore.

Although the market is still at a nascent stage in terms of sales volume, “we see a fast rate of EV adoption, especially in the luxury segment. The key deciding factors will be continuation of taxation incentives and availability of a well-spread charging infrastructure”, said Vikram Pawah, president, BMW India.

BMW, with its product portfolio priced between Rs 52.5 lakh and Rs 2.13 crore (ex-showroom), expects EV contribution to rise to 25% of total sales from the current 10%, Pawah said.

There is a high cost associated with developing and producing luxury EVs compared to fossil-fuel powered vehicles. Luxury carmakers often rely on specialized parts and advanced technologies sourced from global suppliers. To make EVs more accessible to Indian consumers, luxury automakers are exploring local assembly or manufacturing options.

Building the EV ecosystem, including fast chargers, creating a pool of future-ready BEV workforce, introducing long-range EVs, and lowering entry price barriers will accelerate the pace of luxury EV adoption. However, this transition is more likely to be a long-haul marathon than a sprint dash, said Iyer.

Despite the current obstacles, industry experts believe India’s luxury EV market holds immense potential in the long run. The advent of breakthrough technologies, such as solid-state batteries that offer increased driving range and faster charging, coupled with growing consumer demand for sustainable mobility, could catalyse the adoption of luxury EVs in the country, say experts.