New Delhi: Maruti Suzuki’s Japanese parent Suzuki Motor Corporation (SMC) is working on developing affordable hybrid technology for India. Currently, the automaker sells two strong hybrid models in the country– Grand Vitara and Invicto– as part of the global Toyota-Suzuki alliance.

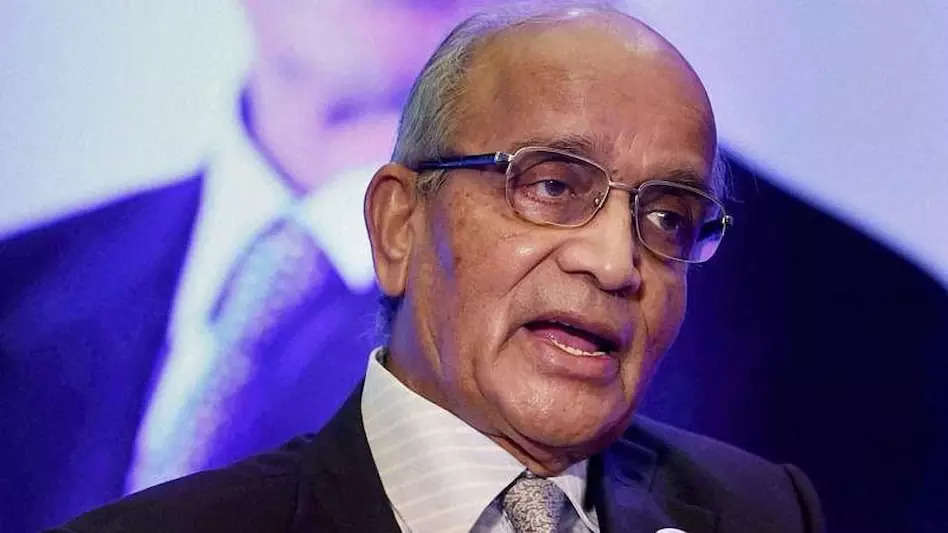

“The costs of today’s technology which goes into the Toyota hybrids is still quite high. And that is why the cost of the car becomes high,” RC Bhargava, Chairman, Maruti Suzuki, said while speaking to the reporters post the company’s Q4-earnings on Friday.

“A lot of work is going on in Suzuki Japan to evolve better technology which will enable smaller cars to take advantage of the principles of hybridization to improve fuel economies at a much more affordable cost. If this is aligned with lower GST, I think you can look forward to small cars with much better mileage than we have today,” Bhargava said, sharing the company’s intent to bring a cost-effective hybrid car.

In India, electric vehicles (EV) are taxed at just 5%, while the levy on hybrids is as high as 43%, just below the 48% imposed on petrol cars. Recently, Union Minister Nitin Gadkari stated that the proposal to reduce GST on hybrid vehicles to 5% and to 12% for flex engines has been sent to the Finance Ministry which is considering the requisition.

“The market for hybrids, to an extent, is determined by their price. We don’t know what the ultimate view of the GST Council will be. We will know once elections are over, let’s wait for a few months. I think that will then determine how far and quickly the expansion of hybrids and EVs will take place,” the Chairman noted.

Responding to a question about bringing plug-in hybrids (PHEVs) to India, Hisashi Takeuchi, Managing Director & CEO, Maruti Suzuki said, “We don’t have an immediate plan of bringing this technology into India but it is a very interesting proposition and I think we must consider this.”

Last month, ETAuto reported about JSW MG Motor’s plan to bring its first PHEV in India next year.

Maruti Suzuki will start the production of its first EV for the Indian market in the current financial year. However, with a commitment to export the first lot to Europe, it is expected to hit the domestic market in FY 2025-26.

By FY 2030-31, the carmaker expects internal combustion engine (ICE) vehicles including CNG, biogas, flex fuel vehicles, ethanol and blended fuel to take up a share of 60% in its sales. This will be followed by 25% hybrid electric vehicles and 15% battery electric vehicles (BEVs).

For the ongoing financial year, its target is to clock 6 lakh units for CNG cars. In FY 2023-24, it sold 4.5 lakh units of CNG models. It is also working on using the CNG to generate electricity to run its manufacturing plants.

Q4 Earnings

On Friday, the carmaker reported a growth of 47% in its consolidated net profit of INR 3,952 crore in January-March 2024 quarter. The company had reported a net profit of INR 2,688 crore in the corresponding period of last year.

Total revenue from operations during the fourth quarter stood at INR 38,471 crore, when compared to INR 32,213.5 crore during Q4 FY23.

“This comes on account of higher sales volume, favorable commodity prices, cost reduction efforts and higher non-operating income,” said the maker of Fronx and Jimny.

In the quarter, the sales volume in the domestic market stood at 5.05 lakh units, up by 12.2% over that in Q4 FY23. The sales volume in the export market was at 78,740 units, a growth of 21.7% over exports of 64,719 units in the same period last year.

It surpassed the annual total sales milestone of 2 million units in FY24 for the first time in a fiscal year. Its exports account for about 42% of the total passenger vehicle exports from India.

“We have finished the last financial year with a good result. There may be some challenges ahead of us, but we would like to maintain this momentum,” the MD said.

Maruti Suzuki’s Board of Directors have recommended the highest-ever dividend of INR 125 per share (face value of INR 5 per share) compared to INR 90 per share in FY 2022-23.

Market Share Growth

During the last few years, Maruti Suzuki’s market share has gone down significantly. For FY 2023-24, it occupied 42% of the passenger vehicle market in India.

The Chairman reiterated that in the last 2-3 years when the market was shifting to relatively bigger cars, Maruti had limited capacity for manufacturing them. They did not anticipate such a big increase in the costs happening there and that it would have a big impact on the market.

“So, our production capacity got somewhat out of tune with the market requirements and it took us time. But we have adjusted to a large extent and as we increase capacity we will be able to increase our volumes,” he said.

Bhargava expects SUVs to continue to garner majority interest from the consumers. The rebound of the small car market is “not going to happen this year, and maybe not even next year”.

During the last year, the carmaker had 100,000 units capacity at its Manesar plant. Next year, it will start production at the first unit with 2.5 lakh capacity in the Kharkhoda plant. In FY 2025-26 it will increase that capacity and by 2026 end, Maruti is confident of having the SMC’s Gujarat plant.

Last year, Maruti Suzuki unveiled its 3.0 strategy with a focus on new models and capacity enhancement.

Outlook

The Chairman remains optimistic about its performance in FY 2024-25. “The car industry can look forward to a year which is pretty good in all aspects.”

According to him, on a high base of last year the car industry is not looking at double digit growth this year. But the inflation is expected to be under control and that will possibly lead to a reduction in interest rates in the second half of the year.

However, there are uncertainties regarding the impact of the Red Sea crisis and uncertainty on policies after the elections when the government is formed.

For FY25, Maruti Suzuki’s export target is over INR 3 lakh units.