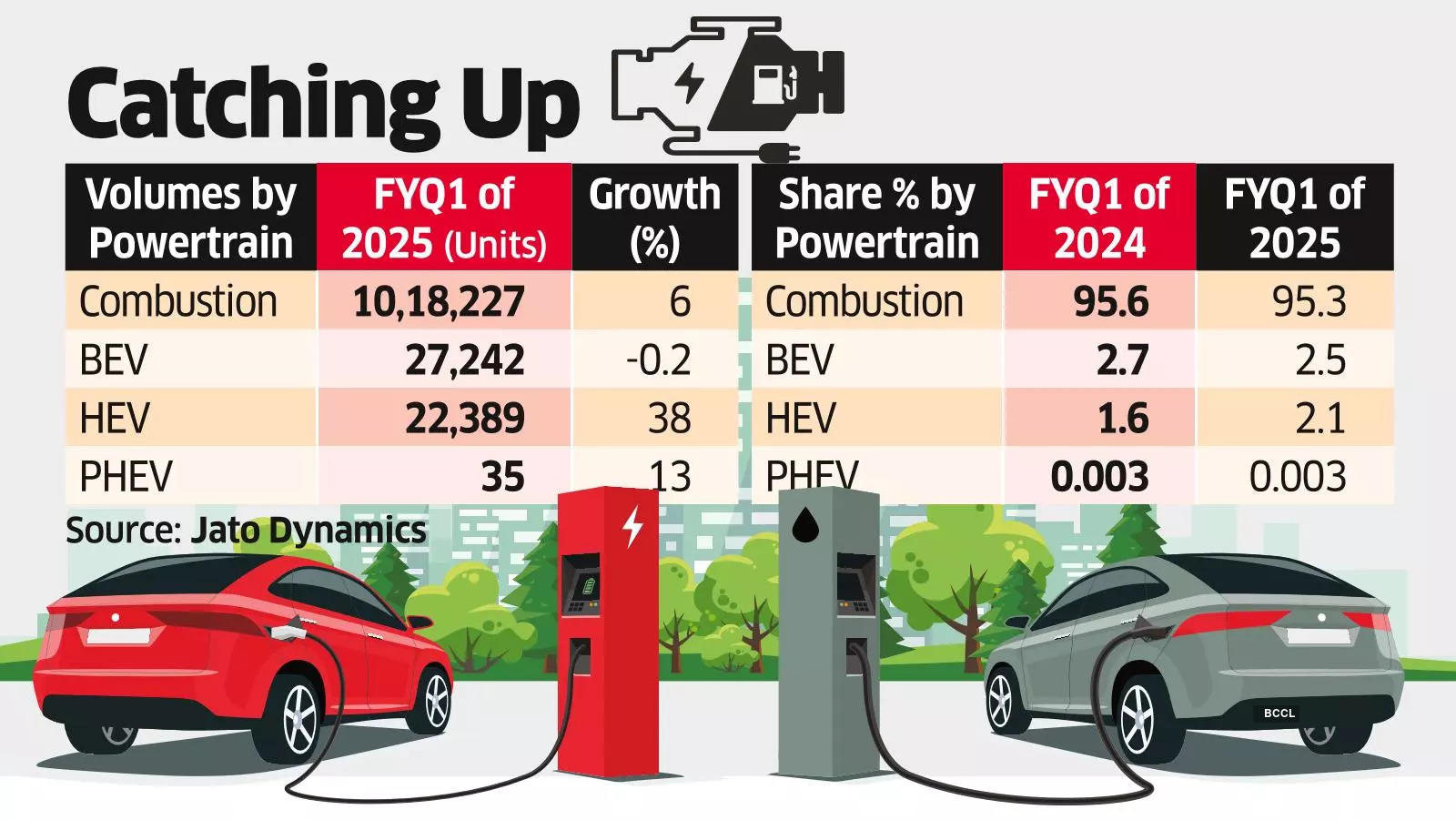

Sales of hybrid cars and SUVs have grown at a faster pace, narrowing the market-share gap with electric vehicles (EVs). Hybrid electric vehicles (HEVs) are expected to see a 38% growth at 22,389 units, capturing a market share of 2.1% compared to EVs, which will see a slight decline of 0.2% to 27,242 units. Plug-in hybrids will grow by 13%, from a small base to 35 units, according to fiscal Q1 estimates by Jato Dynamics.

Globally too, sales of HEVs and PHEVs have been accelerating amid the slowdown in EVs. In the US, growth has outpaced EVs over the past several months. As a result, global HEV sales could exceed the outlook by 1-2 million vehicles, according to a recent Goldman Sachs report.

Despite EVs’ critical role in long-term climate goals, hybrids present an immediate, cost-effective solution. The combination of fuel efficiency, lower operating costs, and reduced emissions make hybrids an attractive option for consumers, say experts.

Toyota believes that HEV is one such technology that can help to lower the dependence on fossil fuels, along with reducing carbon footprint. Toyota has all the electrified vehicle technologies and believes in introducing these based on each market requirements and context to minimise fossil fuel usage and achieve carbon reduction in the fastest possible time, said Vikram Gulati, EVP, Toyota Kirloskar.

The self-charging HEV technology has the capability to run on either electric mode or internal combustion engine mode, or both combined. Thus, providing 40-50% better fuel efficiency, lowering operating cost and reducing carbon emissions, said Gulati.

Tata Motors, on the other hand, through its multi-powertrain strategy, has become the top electric PV player. By the end of this decade, Tata Motors will strengthen its CNG and EV market share through new launches like iCNG Nexon, it said at its recent investor meet. The company plans to launch 10 new EVs by FY 26 under its plan to ‘mainstream EVs in India’.

Industry experts suggest that the hybrid segment, buoyed by upcoming launches from Hyundai and Kia, could surpass EV sales this fiscal year. Toyota continues to lead the hybrid market along with Marut Suzuki with its self-charging technology, providing a practical solution for emission reductions without the need for extensive charging networks.

Demand for EVs is expected to grow gradually, amid the pursuit of carbon neutrality. As global demand for battery-powered cars slows, automakers are increasingly betting on hybrids, which offer higher profit margins and meet stringent emission standards, said Ravi Bhatia, regional director, Jato Dynamics.

The growing acceptance of BEVs, HEVs, PHEVs, and CNG vehicles, reflects the market gradually leaning towards greener, sustainable alternative fuel technologies. This shift is crucial for reducing emissions and enhancing energy security in India’s automotive future, adds Bhatia.

Hybrids are not heavy in terms of acquisition costs, despite electric enjoying a tax benefit, said a senior official of a leading car company. While the government currently levies a 5% GST rate on electric vehicles, hybrids attract a GST rate of 43%. Because of the policy thrust on EVs, most automakers except for Japanese companies are relying solely on fully electric vehicles to attain the carbon-reduction goals.