Currently, it’s ‘A for ADAS’ in the passenger vehicle industry. ADAS would qualify to be the hottest technology trend of 2023, and is likely to be so in 2024 too. “Such a technology trend can take quantum jumps. ADAS will become more mainstream in the coming year,” says Gaurav Gupta, Deputy MD, MG Motor India, an OEM which has CASE (Connected, Autonomous, Shared, Electrification) as its “platform” to build its story in the domestic market.Hyundai, the country’s second largest carmaker, is bullish about the ADAS trend, and plans to offer ADAS features in more models. Currently, Ioniq 5 EV, Tucson, Verna, Venue, and Venue N-Line are the ones offering ADAS features. “Encouragingly, over 32% of Verna customers have opted for the ADAS-enabled variant, reflecting a positive trend in the acceptance of this advanced technology. Our ambitious plan aims to extend ADAS coverage to 60% of our portfolio by 2024,” says Tarun Garg, COO, Hyundai Motor India

A billion-dollar ADAS market

Given Indian consumers’ appetite for technology, reflected quite well in the smartphone industry, the domestic market for ADAS is expected to be around USD 1 billion by 2027-28, according to a study by research and rating firm CRISIL’s Market Intelligence and Analysis wing. The market size in FY 23 stood at around USD169 million.

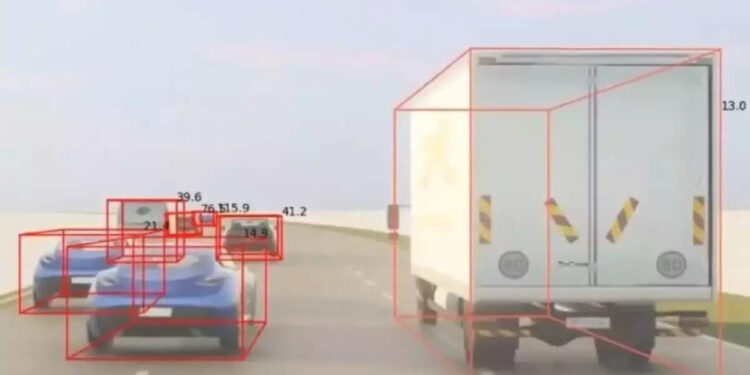

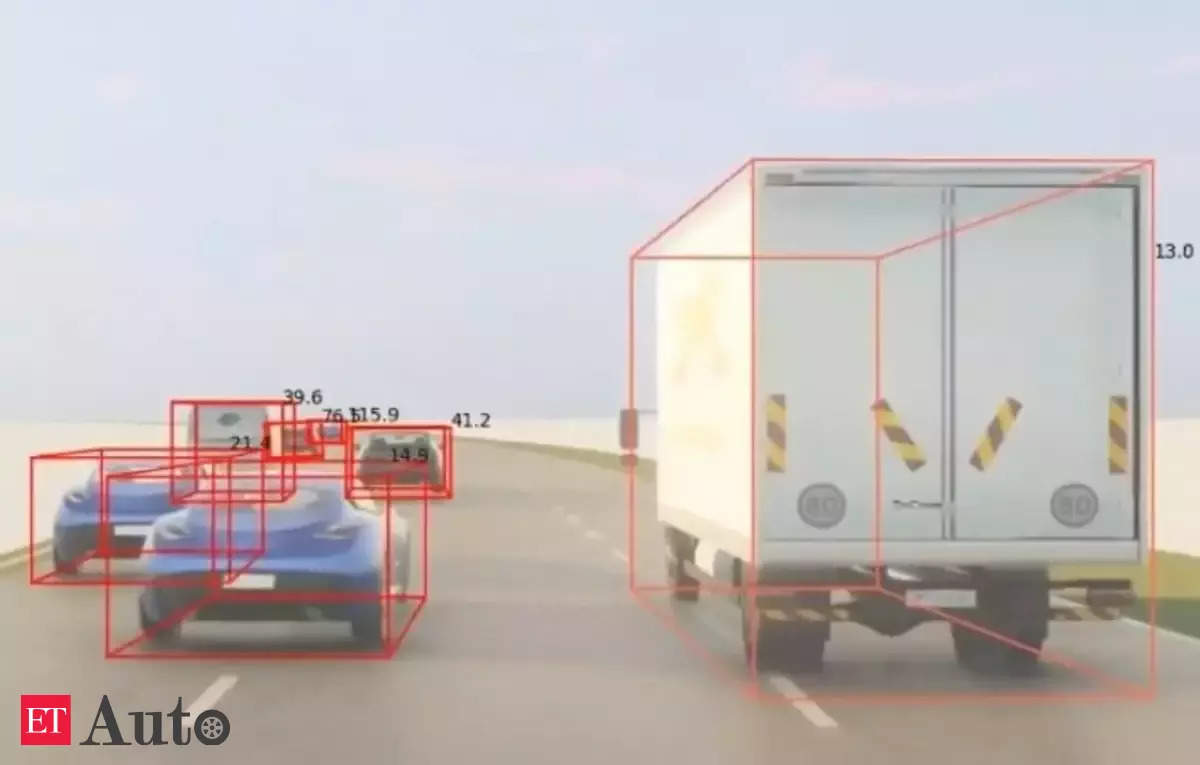

ADAS is a set of features that assist the driver by doing manoeuvres like steering, braking, parking, and also alerting the driver in certain potentially dangerous situations. Components used for ADAS functions are camera, radar, and sensor.

Mahindra & Mahindra, with its XUV700, and MG Motor India, with the Astor and Gloster SUVs, lead the pack in terms of ADAS-equipped vehicles in the volume domestic passenger vehicle market. The ADAS trend has also taken some by surprise. It is learnt that at M&M the top 2 variants of the XUV700, equipped with ADAS features, were initially expected to contribute around 17%. The contribution from these variants in the marketplace far outstripped expectation, with a share of over 70% in the model’s overall sales.

According to the study cited earlier, M&M has a 40%-50% share in the ADAS-equipped vehicle market, followed by MG at 30%-40%, and Honda with a share of 10%-15%. Tata, Hyundai, and Toyota are the others. Midsize SUVs and sedans are driving the ADAS penetration in the marketplace.

Customers, now with a heightened awareness of car safety, increasingly choosing to go for longer drives, makes Hyundai “anticipate a continued surge in the adoption of ADAS-powered vehicles”. It pledges to “introduce more products infused with ADAS technology”.

Technology that trickles down

Usually automotive technology trickles down from the luxury vehicle segment to the volume passenger vehicle market. That’s happening in the case of ADAS too, with little or no lag in some cases. According to automotive business intelligence firm Jato Dynamics, the ADAS penetration in the luxury segment grew from 43% in 2021, to 53% during Jan-Nov 2023.

In the mass market, it grew from 8%, to 12% in the same period.

“While all Mercedes-Benz vehicles feature Level 1 ADAS features as standard, for the first time in India Mercedes-Benz offered Level 2 Autonomous Driving Features in the form of ‘Evasive Steering Assist’ and Active Brake Assist with ‘cross traffic function’ in the S-Class Maybach,” says Santosh Iyer, MD and CEO, Mercedes-Benz India.

He added that Mercedes-Benz pioneered Level 1 ADAS features like Adaptive Cruise Control, Lane Keep Assist, Active Blind Spot Assist, Distronic Plus, Attention Assist etc.

Mercedes-Benz is building its own operating system MB.OS through which it wants to offer an “outstanding customer experience comprising driving assistance, navigation and entertainment and even integrated charging”.

“We will be the first automaker to build our own branded navigation experience based on new in-car data and navigation capabilities from the Google Maps Platform, embedded into MB.OS. We are working towards introducing MB.OS-enabled vehicles in India in the foreseeable future,” says Iyer.

There are 5 levels of assisted or automated driving. Most OEMs have reached L1 and L2 with their features. There’s a pilot project or two involving L3. China’s IM Motors, a joint venture among MG Motor India’s parent SAIC, Alibaba, and ZhangJiang Hi-tech, has recently sought government approval to introduce L3 autonomous vehicles. Mercedes-Benz is the first carmaker in the world to introduce L3 autonomous driving in a standard production vehicle in the US.

Jato Dynamics’ research shows that L2 features have seen a faster adoption rate than L1 in India. The penetration level moved from 0.94% in 2021, to 3.43% till November 2023, compared to 0.28%, to 2.60% for L1 during the same period.

Big opportunity for Tier-Ones

As the ADAS trend progresses, Tier-1 suppliers are also drawing up strategies, and ramping up capabilities to tap new growth opportunities. Uno Minda, one of the top 3 Tier-1 suppliers in India, is one such player. It has formed a business division for ADAS. The reverse parking alert regulation in 2018 was the trigger.

With additions like cameras, suppliers like Uno Minda offer a more valuable park assist system. “When we move to other functions, at low speed, and high speed, blind spot detection, front collision warning, which are very safety critical, and adaptive cruise control, are the other three functions (of ADAS) that we see will have more takers in India,” says Kartikeya Joshi, VP – Engineering, Uno Minda.

The Tier-1 major has invested in a “full-fledged ADAS lab” in its central technical centre in Pune. Over 40 people are part of the ADAS team.

Need for India-specific ADAS solutions

India is increasingly adopting advanced technologies, but everything may not work with a plug-and-play approach. Some of them may have to be tweaked to suit certain scenarios unique to India.

“If I put all the ADAS functions together in a bucket, and do the accident analysis and identify, only 46% of the accidents in India can be addressed by all the ADAS functions across the world,” says Girikumar Kumaresh, Principal Advisor, Road Safety, Future Mobility and Expert Accident Research. This, he says, should be seen as an opportunity “to dig deeper into this 54% and identify what are the real needs of the local accident scenarios, identify the situations, and build the right products for the country, and save lives”.

Joshi feels that AEB (Automatic Emergency Braking), an ADAS feature, should be made mandatory like in Europe, as it will help in reducing the number of road fatalities. However, there’s also a viewpoint that given the traffic congestion scenario, common in many Indian cities, it is more often a bane than a boon. And, in some cases, the AEB equipped vehicle may get hit by another vehicle from behind in a case of sudden braking, if the vehicle behind is also not AEB-equipped.

Gupta argues that travelling in an AEB-equipped vehicle will always be safer, as it will never collide into another vehicle in the front, and also the law will protect in the event of a rear-ending as in such cases the vehicle behind may be found to be at fault for not maintaining the recommended gap.

Largely the argument is in favour of ADAS as the features contribute to safer and more convenient mobility and transportation. The trend is gradually percolating into the commercial vehicle segment too. Tata Motors has recently introduced ADAS features like Collision Mitigation System, Lane Departure Warning System and Driver Monitoring System in select in its HCV Prima range.

“Inside the cabin, driver drowsiness detection will also see adoption both in passenger and commercial vehicles,” says Joshi.

While the debate whether fully autonomous vehicles will become commonplace continues, partial automation and assistance in the form of ADAS can play a significant role in safer transportation. Though a unique and populous market India may demand solutions suited to local conditions and environment.